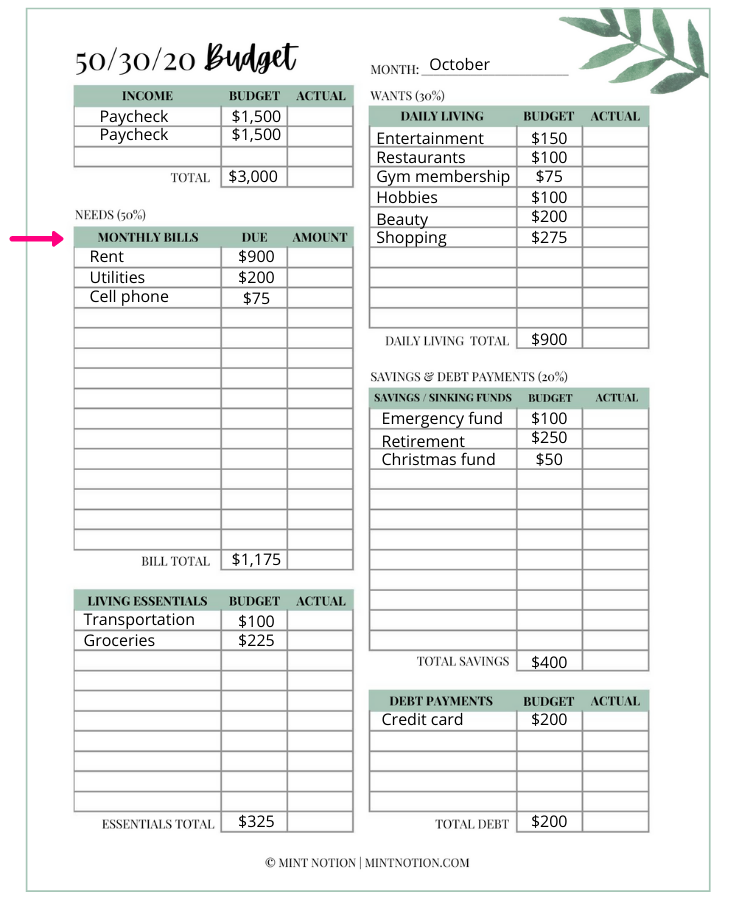

41 50/20/30 rule worksheet

The 50-20-30 rule is a way of organizing the categories of your spending into three percentages. If you are a beginner at budgeting, don't let this overwhelm you! A 50-20-30 budget rule is a great tool! Please know that this is a gentle starting point. When you are figuring out your budget, make sure to use your after-tax income.

The 50-20-30 rule is intended to help individuals manage their after-tax income, primarily to have funds on hand for emergencies and savings for retirement. Every household should prioritize...

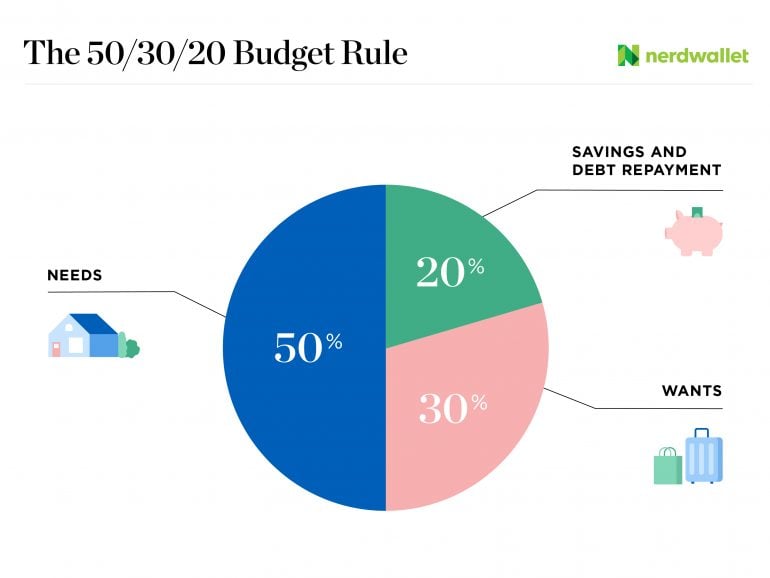

"Use the 50/20/30 rule to manage spending—apply 50 percent of your take-home pay to needs, 20 percent to savings and debt payments, and no more than 30 percent to your wants." Sometimes it's hard to apply advice you hear in articles or books—or even from friends and family—to your own circumstances. Don't feel discouraged. You

50/20/30 rule worksheet

"Use the 50/20/30 rule to manage spending—apply 50 percent of your take-home pay to needs, 20 percent to savings and debt payments, and no more than 30 percent to your wants." Consumers have told us that they sometimes find common financial rules of thumb—like "spend no more than 30% of your take-home pay on your

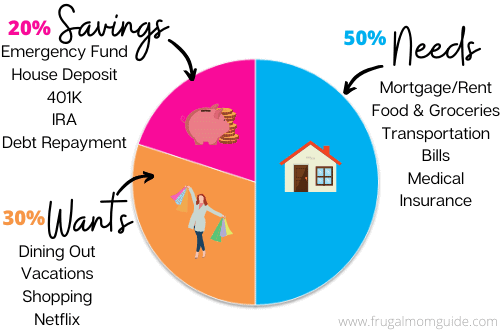

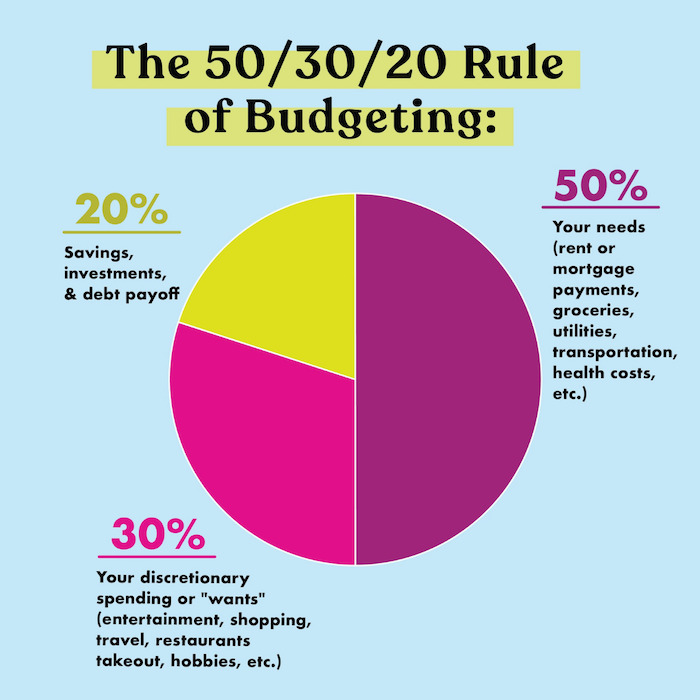

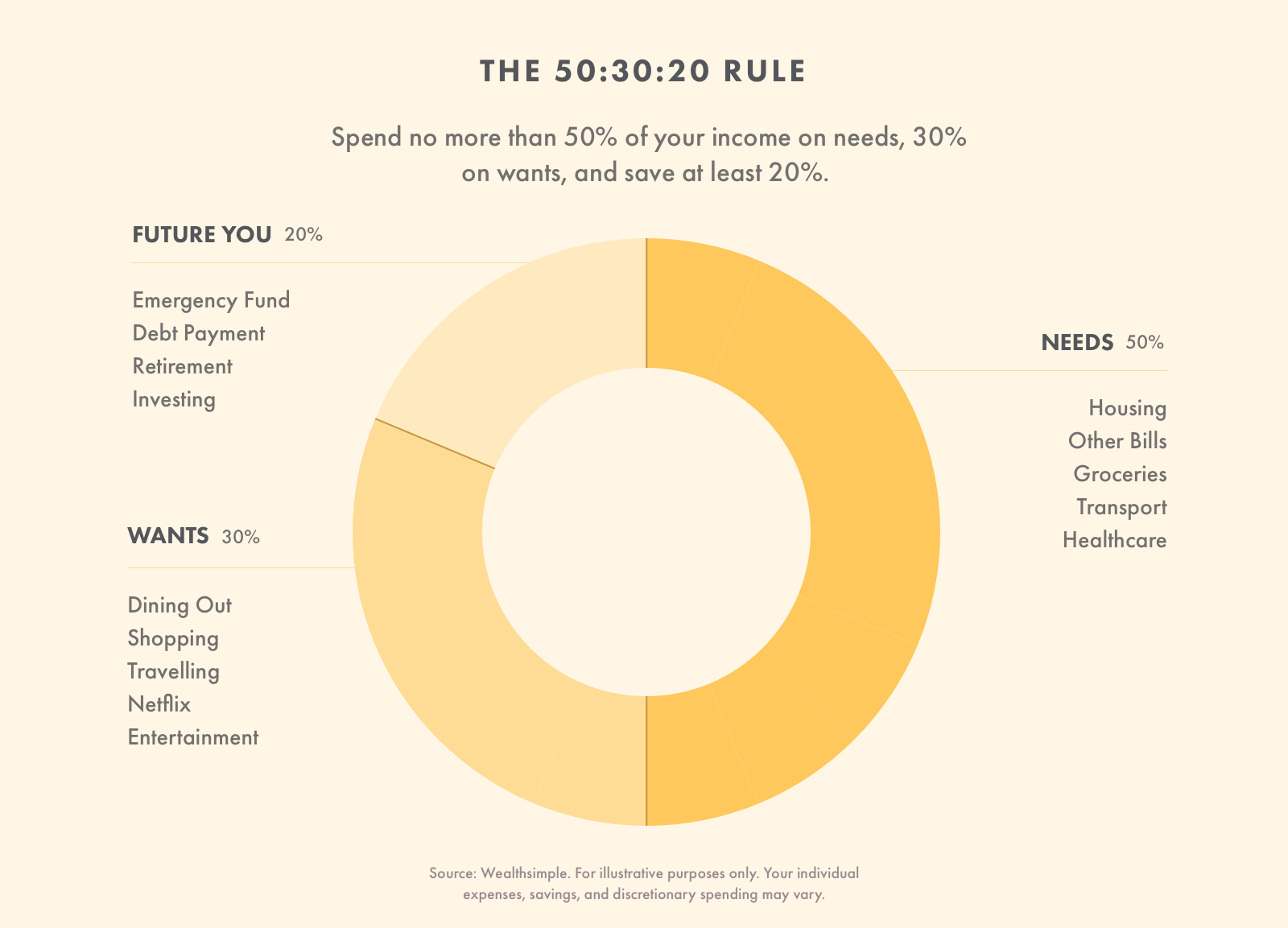

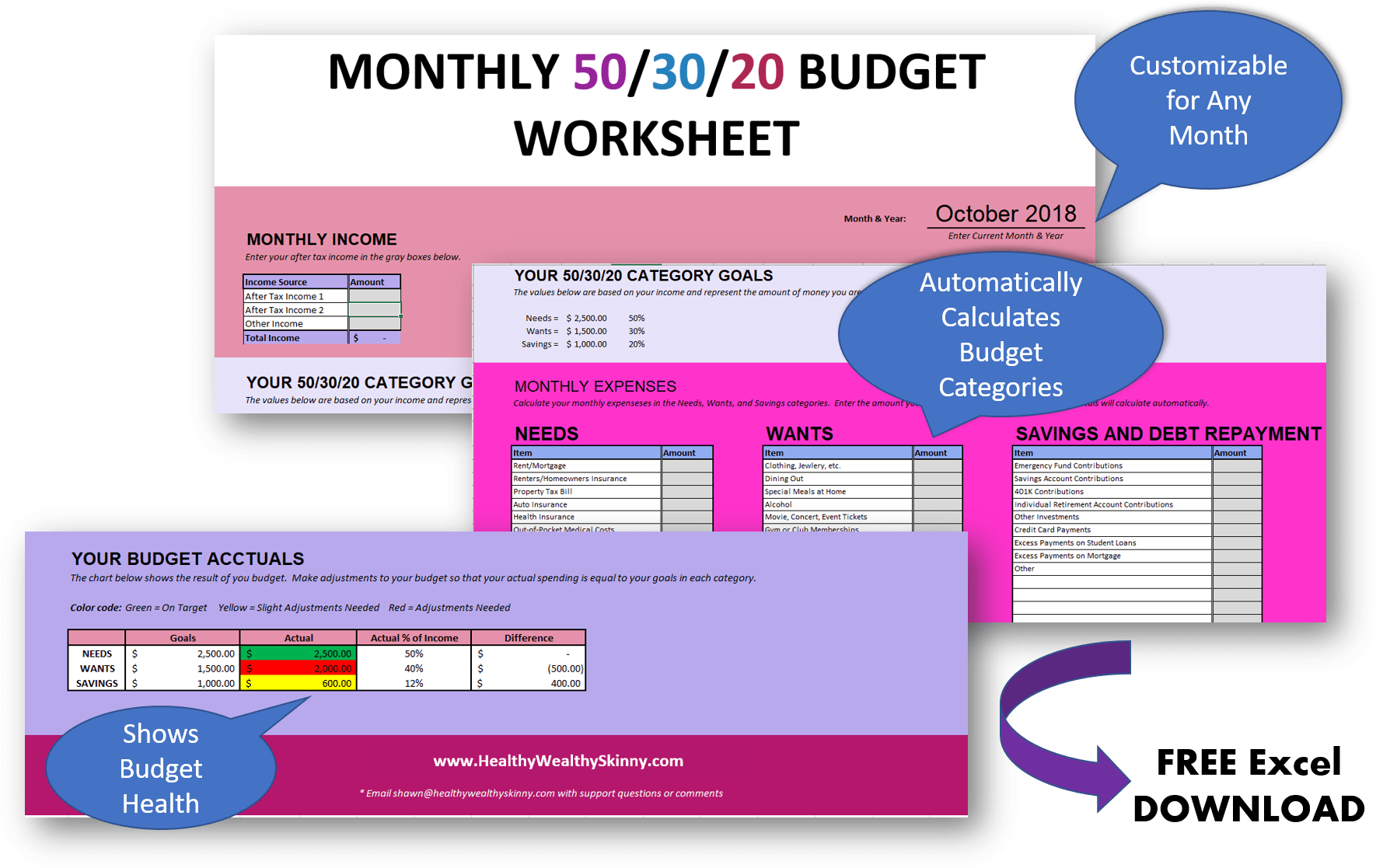

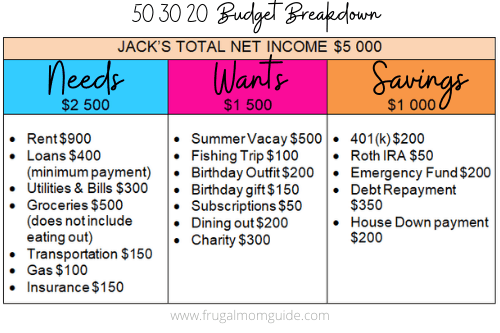

A 50/30/20 budget is a simple, easy way to organize your money, cover your expenses, and set yourself up to make long-term financial progress. It's all about dividing your monthly income into three buckets - Needs(50%), Wants(30%), and Goals(20%).

The 50/30/20 Budget Explained. The 50/30/20 Budget is one that was made popular by the book "All Your Worth: The Ulitmate Lifetime Money Plan", written by Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi.The intention of this book is to help the reader master their finances by allocating a set percentage to three categories of money:

50/20/30 rule worksheet.

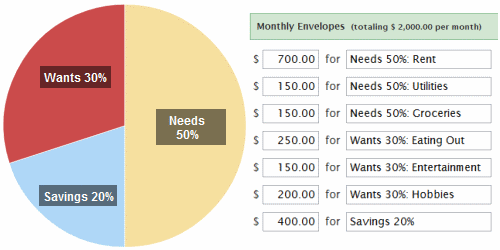

The 50/30/20 budget method is a simple method of creating a budget that focuses on three main categories. Needs, Wants, and Savings Your after-tax income is divided into these three categories based on certain percentages. NEEDS = 50% WANTS = 30% SAVINGS = 20% At this point, it is clear to see how the 50/30/20 Budget Method got its name.

Remember to keep reading to the bottom for the 50-30-20 rule spreadsheet! 50% - needs on a $48,000 annual salary So as you can see, at $48,000 per year as a single person, paying something like $1,300 for a high-priced home or rental is going to be tough.

The 50/20/30 rule splits up take-home pay into three large spending categories — fixed costs, financial goals, and flexible spending. Here's a list of what each contains. Fixed Costs (50%) - These are the expenses most vital to your survival, which don't vary from month to month: mortgage or rent, vehicle payments, and utilities.

The place to see your 50-30-20 percentages is under the "Reports" tab. You can look at your monthly spending, and see how close you are to the 50% NEEDS, 30% WANTS, 20% SAVINGS rule.

The 50-30-20 rule gives a good ballpark of where your finances should be to stay on track financially. The following is an updated article where we walk you through how to create a 50-30-20 budget in 4 easy steps along with a downloadable budget template for you to create your own budget based around needs, wants, and savings.

The 50-20-30 rule is a money management technique that divides your paycheck into three categories: 50% for the essentials, 20% for savings and 30% for everything else. If the 50-20-30 budget doesn't fit your lifestyle, try one of these instead. While it might be easy to remember, the rule isn't always easy to live by.

The 50/30/20 guideline doesn't add-up for most Americans where many people live paycheck to paycheck. There's a growing lack of financial stability and security across the country and different family situations. It's hard to build a nest egg when you can barely afford the nest. Explore more situations or 50/30/20 budgeting worksheet

Your 50/30/20 Monthly Budget Guide Create your 50/30/20 budget in four easy steps: 1 Calculate Your Total Monthly Income Your after-tax income is the amount you have after all taxes—local, state, federal, Medicare and Social Security—are taken out of your paycheck.

The 50/30/20 rule is a popular budgeting method that splits your monthly income between three main categories. Here's how it breaks down: Monthly after-tax income. This figure is your income after ...

50/30/20 budgeting worksheet Look at your spending for one month, and record your data on this page. 1. Then continue to step 2 on the next page. Track and visualize your income and spending for an average month to see how it compares to an ideal budget. If you don't normally keep track of your spending,

The 50/30/20 rule budget is a simple way to budget that doesn't involve detailed budgeting categories. Instead, you spend 50% of your after-tax pay on needs, 30% on wants, and 20% on savings or paying off debt. Editorial Note: Credit Karma receives compensation from third-party advertisers, but that doesn't affect our editors' opinions.

Tips for Budgeting Success With the 50/20/30 Rule. Let's start with the biggest chunk. That 50% number you should put toward necessities is a maximum. Yes, that's right. A maximum. If your monthly bills are higher than 50% of your monthly income, you need to make some adjustments.

The 50/30/20 Rule vs. the Zero-Based Budget and the Baby Steps. So, if I don't think you should use the 50/30/20 rule, what budgeting method do I recommend? The zero-based budget. When you use the zero-based budget alongside the Baby Steps, you'll be so focused on your goals and progress that nothing will stop you.

Key Takeaways The 50/30/20 rule of thumb is a guideline for allocating your budget accordingly: 50% to "needs," 30% to "wants," and 20% to your financial goals. It was popularized by Elizabeth Warren and her daughter, Amelia Warren Tyagi. Your percentages may need to be adjusted based on your personal circumstances.

Nov 8, 2016 - Explore Trillann Minor's board "50 20 30 Rule" on Pinterest. See more ideas about budgeting, budgeting tips, budgeting finances.

50/30/20 Rule. The 50/30/20 rule is a simple budgeting technique that helps you pay your bills, work toward your financial goals, and splurge a little on yourself. If you don't like the thought of budgeting, this technique is for you. Investing and saving are an essential part of a balanced budget.

Step 5: Analyze and Compare. In Step 5 you will be comparing what you actually spent on Needs, Wants, Savings and Debts vs what you should have spent using the 50/30/20 Rule. To Compare Your Actual Budget vs an Ideal 50/30/20 Budget: Divide your total income calculated in Step 1 into dollar values of 50%, 30%, and 20%.

The 50/30/20 budget rule helps you establish the right spending proportions. Specifically, it uses percentages to determine what percentage of your after-tax income will be allocated to each group. One group will get 50% of the money, a second group will get 30% of the money, and the last group will get 20% of the money.

What are the basics of the 50/30/20 budget rule? Spend no more than 50% of your monthly take-home pay on needs. Things like rent, utilities, insurance, groceries and minimum debt payments. Spend about 30% on your wants. Things like dining out, entertainment, ride-sharing services and shopping on luxury items. Add at least 20% to your savings.

The 50/30/20 rule (also referred to as the 50/20/30 rule) is one method of budgeting that can help you keep your spending in alignment with your savings goals. Budgets should be about more than just paying your bills on time—the right budget can help you determine how much you should be spending, and on what.

A 30 B 25 C 20 D 10 E 5 Total 90 Species A and B are dominants according to step (3) above, because together their sum (30 + 25 = 55) is more than 50 % of the total (50% of 90 = 45). Species C is also a dominant according to step (4), because its coverage (20) is 20 % or more

This Calculator by MoneyFit.org is based upon the 50-30-20 Rule and can provide you the simplest approach to your monthly personal and household budgeting. Recommended percentages are adjustable. How the 50/30/20 Budget Works. The lean and easy-to-understand 50-30-20 budget calculator has been around since at least the early 2000s.

Now split that three ways according to the 50-30-20 rule. 50% of $2,400 is $1,200. 30% is $720. 20% is $480. If 50% does not cover your living expenses, which is unfortunately the case for many people, then you can take some from your "wants" money, or even your savings, if necessary. The main point of this rule is that it should be ...

![The 50 30 20 Budget Rule Explained [Ultimate Guide] - Arrest ...](https://arrestyourdebt.com/wp-content/uploads/2020/08/50-30-20-Budget-JPG-scaled.jpg)

/the-50-30-20-rule-of-thumb-453922-final-5b61ec23c9e77c007be919e1-5ecfc51b09864e289b0ee3fa0d52422f.png)

0 Response to "41 50/20/30 rule worksheet"

Post a Comment