43 income tax worksheet excel

If the taxable income was $50,000, we would like Excel to perform the following math. It needs to multiply all $50,000 by 10% because all $50,000 is taxed by at least 10%. To that, we need Excel to add 5% of 40,925 (50,000-9,075), because the differential rate of the next bracket is 5% (15%-10%). Tax Assistant for Excel is a custom application written for Microsoft Excel and requires Microsoft Excel 2007/2010/2013. It simplifies your Federal Income Tax preparation by providing Excel...

To calculate total income tax based on multiple tax brackets, you can use VLOOKUP and a rate table structured as shown in the example. The formula in G5 is: = VLOOKUP( inc, rates,3,1) + ( inc - VLOOKUP( inc, rates,1,1)) * VLOOKUP( inc, rates,2,1) where "inc" (G4) and "rates" (B5:D11) are named ranges, and column D is a helper column that ...

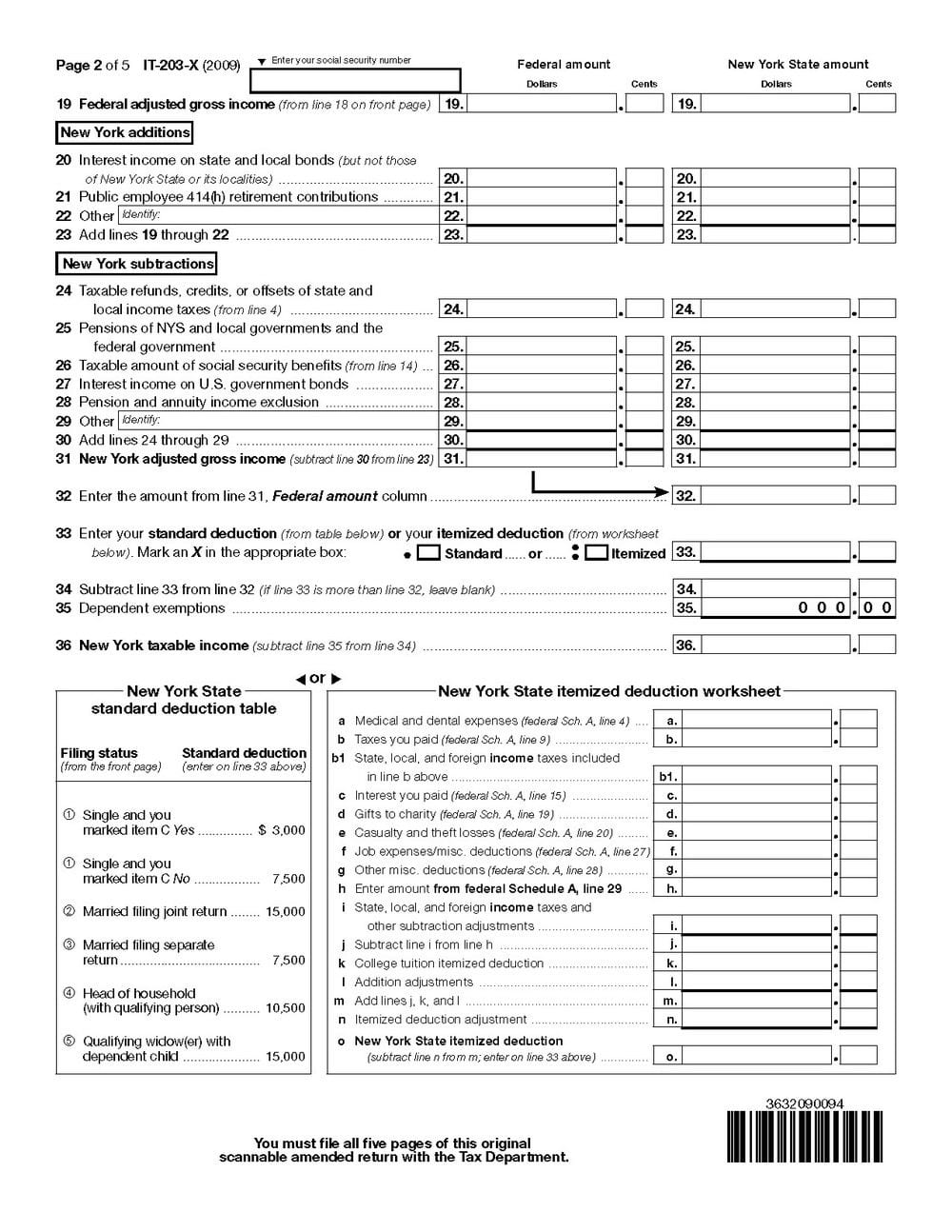

Income tax worksheet excel

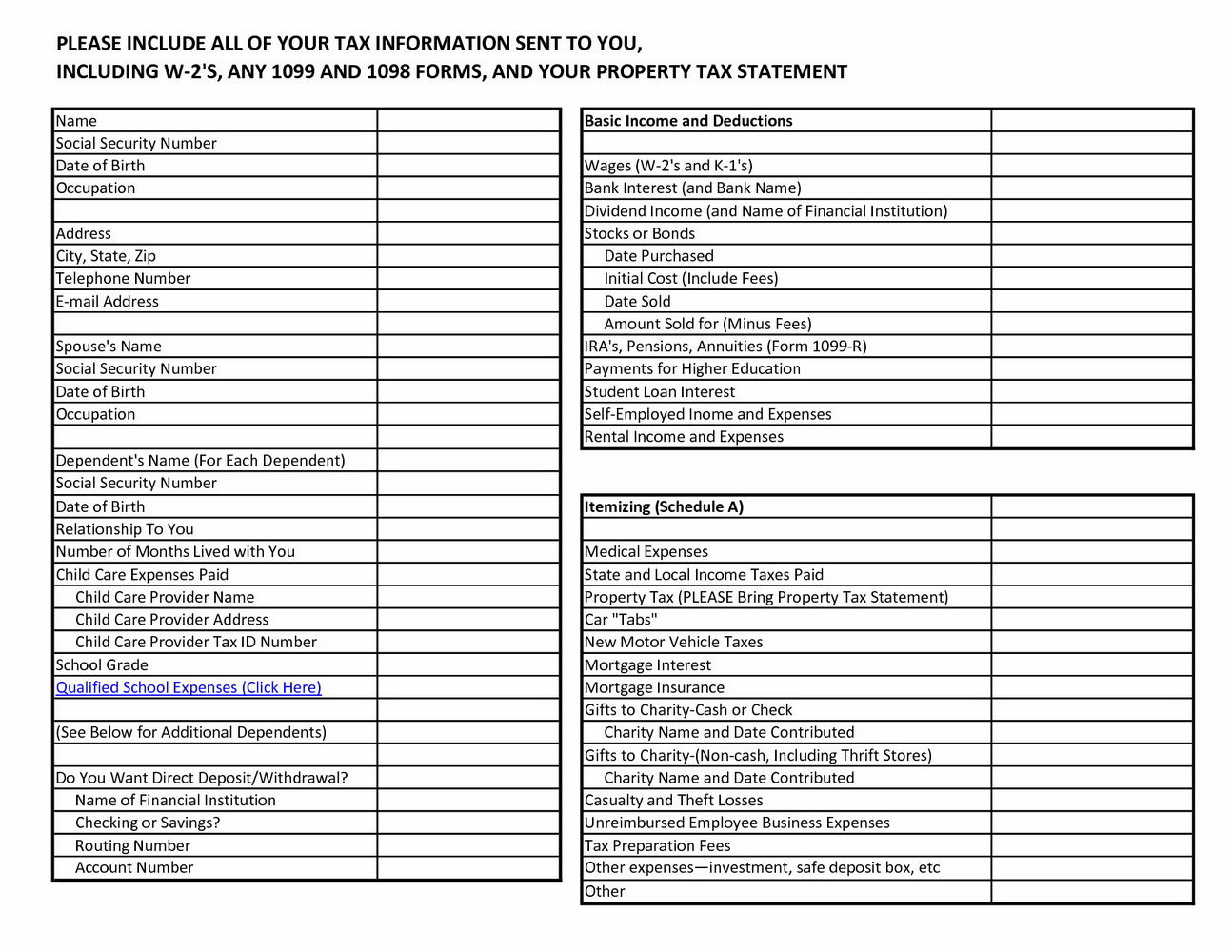

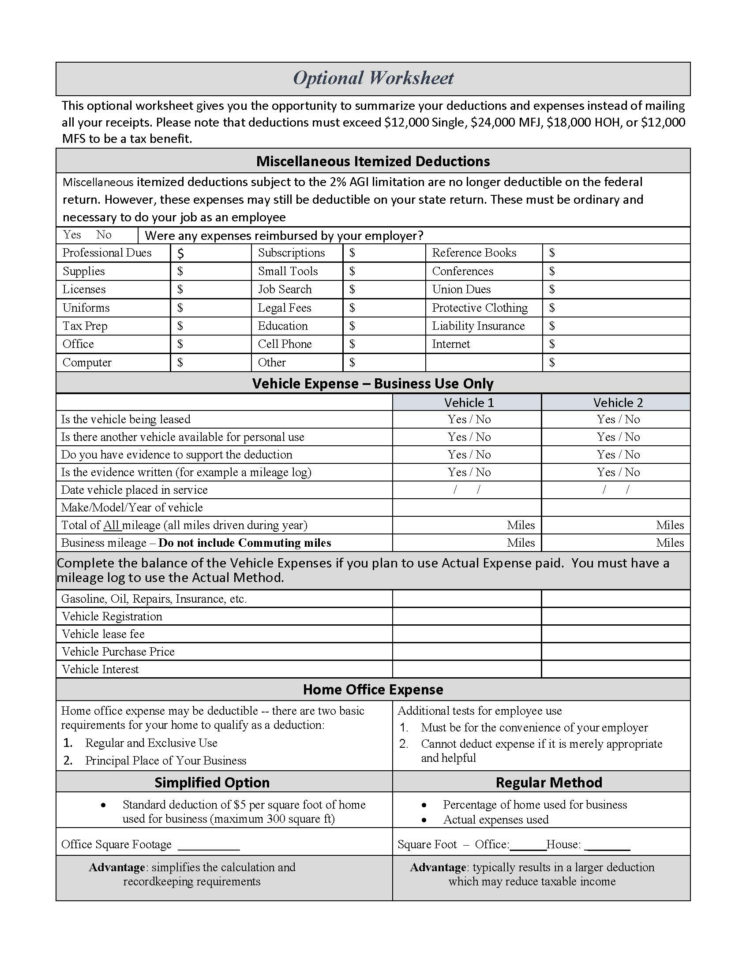

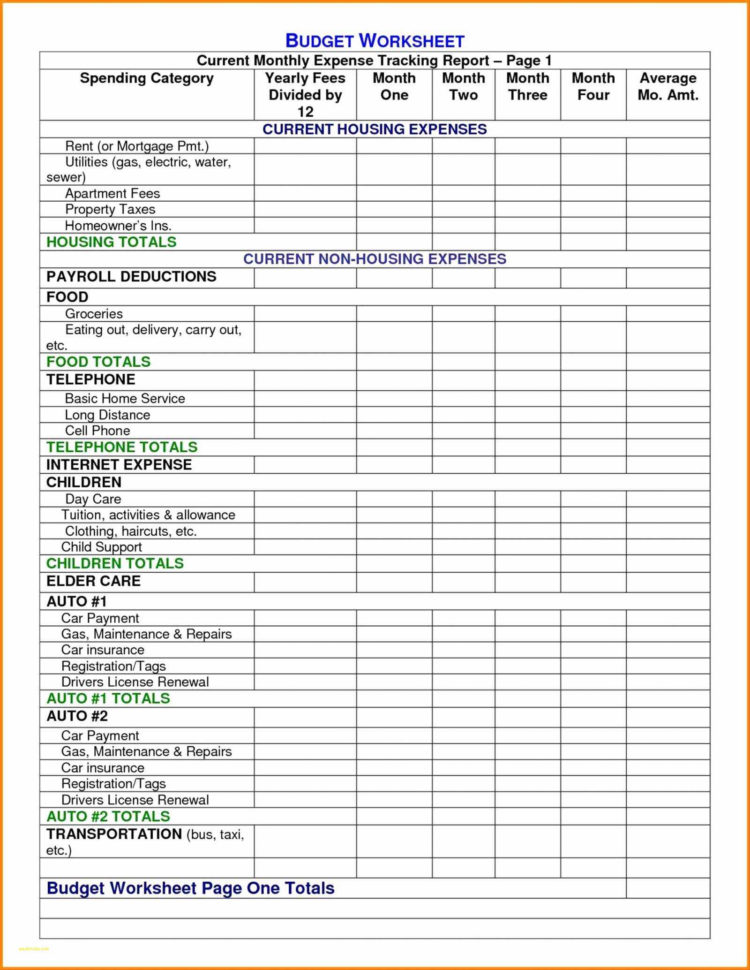

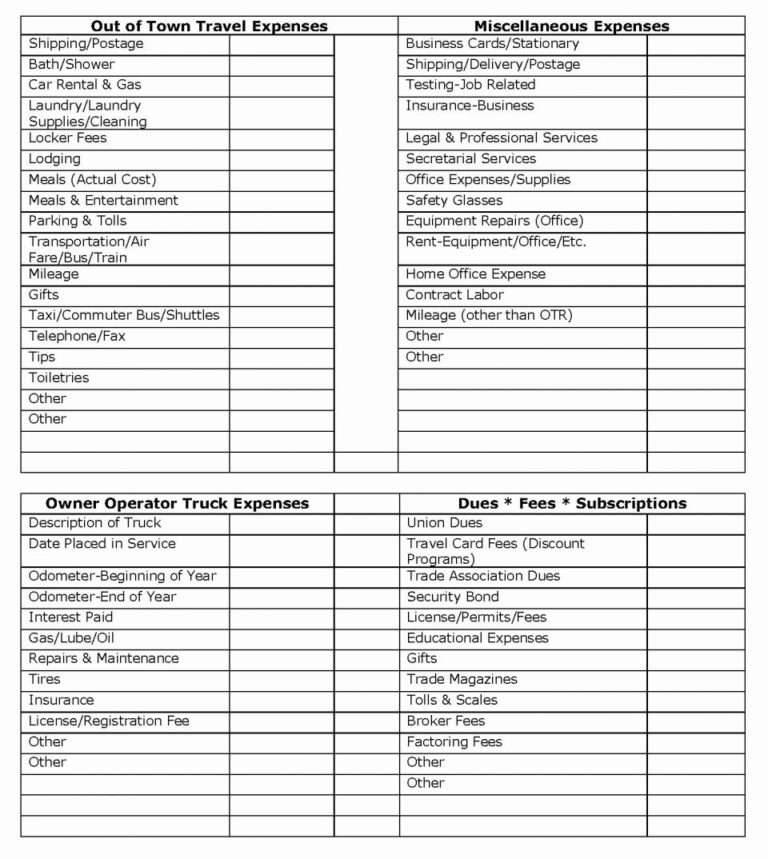

Tax expense journal. Track your tax expenses with this accessible tax organizer template. Utilize this tax expense spreadsheet to keep a running total as you go. Take the stress out of filing taxes with this easy-to-use tax deduction spreadsheet. Prepare your Federal Income Tax Return with the help of these free to download and ready to use ready to use Federal Income Tax Excel Templates. These templates include Simple Tax Estimator, Itemized Deduction Calculator, Schedule B Calculator, Section 179 Deduction Calculator and much more. All excel templates are free to download and use. The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

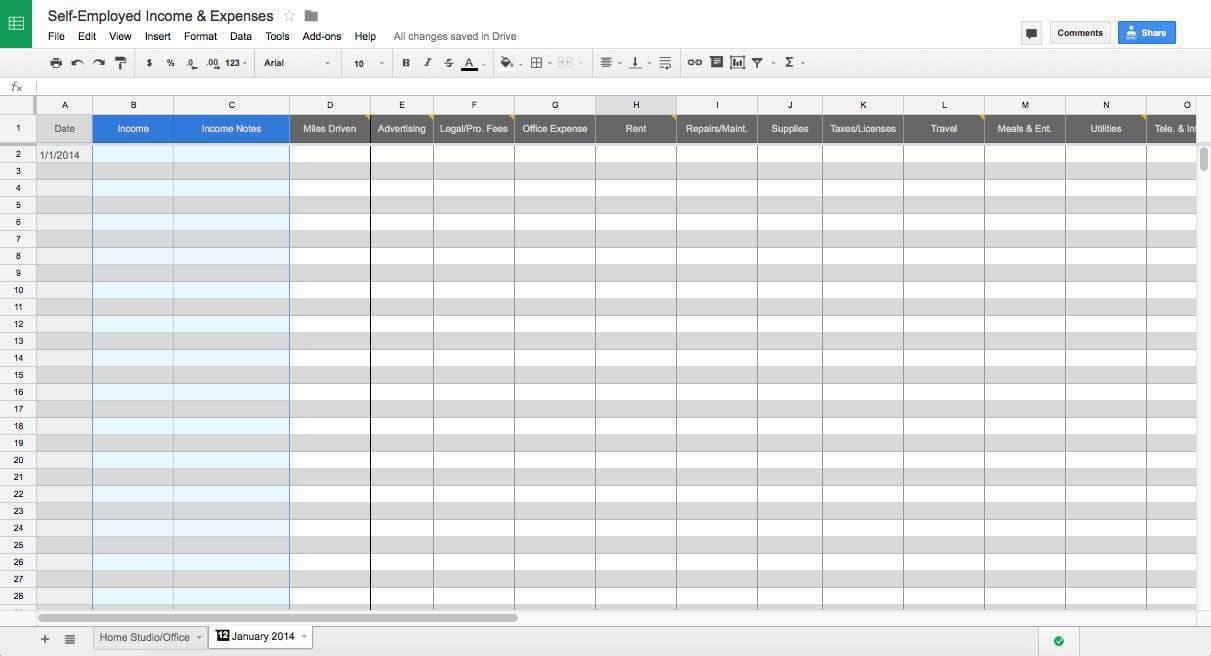

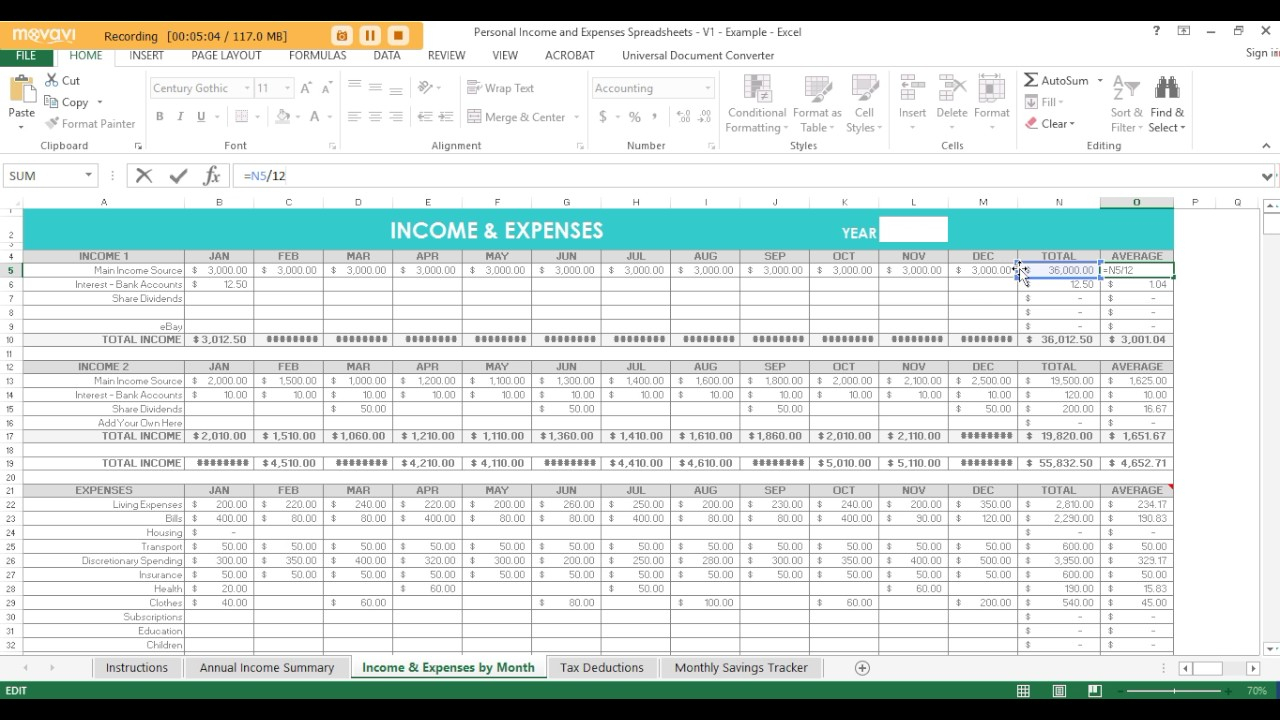

Income tax worksheet excel. Now the spreadsheet can calculate your effective tax rate based on the estimated amount of income you expect to make. The tax rates calculated depend on the tax tables on the right side of the sheet, which define the income tax brackets. You'll need to update the data in yellow each year for the new brackets and for your filing status. Income Tax Organizer Worksheet. All the information needed printed on one user-friendly 8 1/2 x 11" sheet. Simple & easy for clients. Download Now. Want printed copies? Let us do your printing for you. Call 612-722-3552 for a quote. Active subscribers get 20% off of our competitive rates. Imprints and custom orders are available too. If you did not have Excel, you can download OpenOffice for free. Remember, for items costing $200 or more, keep the receipts separate and fill out the worksheet under "Major Purchase" . *** If your program tells you it's in "Read-Only" mode, then save the spreadsheet to your computer, close the program, and open the saved spreadsheet. You can add up all of your income and expenses in one place and be well prepared to drop your final numbers into your tax prep software. While a basic budget spreadsheet is great, it is a rather manual process to prepare. Either you are adding multiple numbers in one cell and triple checking you keyed them in correctly, or you are creating a ...

This site makes available, for free, a spreadsheet that may be used to complete your U.S. Federal Income Tax Return. Download - Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator This downloadable file contains worksheets for, wages and pensions, IRA distributions, interest and dividends, Miscellaneous income (tax refunds, social security, unemployment, other income). Don't forget to attach W-2's and 1099 forms to you worksheets. SP. 90% of estimated total tax ( 66 2/3% for farmers and fishermen) 0. Enter 100% of 2020 's income tax ( Check if 2020 's AGI was > $ 150 K) Choose which to use... Smaller of above or ... Use 100 % of 2020 's amount from the line above. Use 100% of the 2021 estimated total tax. How to estimate your taxes using Excel Excel Formula to Calculate Tax Federal Tax: =VLOOKUP (TaxableIncome,FederalTaxTable,4) + (TaxableIncome - VLOOKUP (TaxableIncome,FederalTaxTable,1)) * VLOOKUP (TaxableIncome,FederalTaxTable,3)

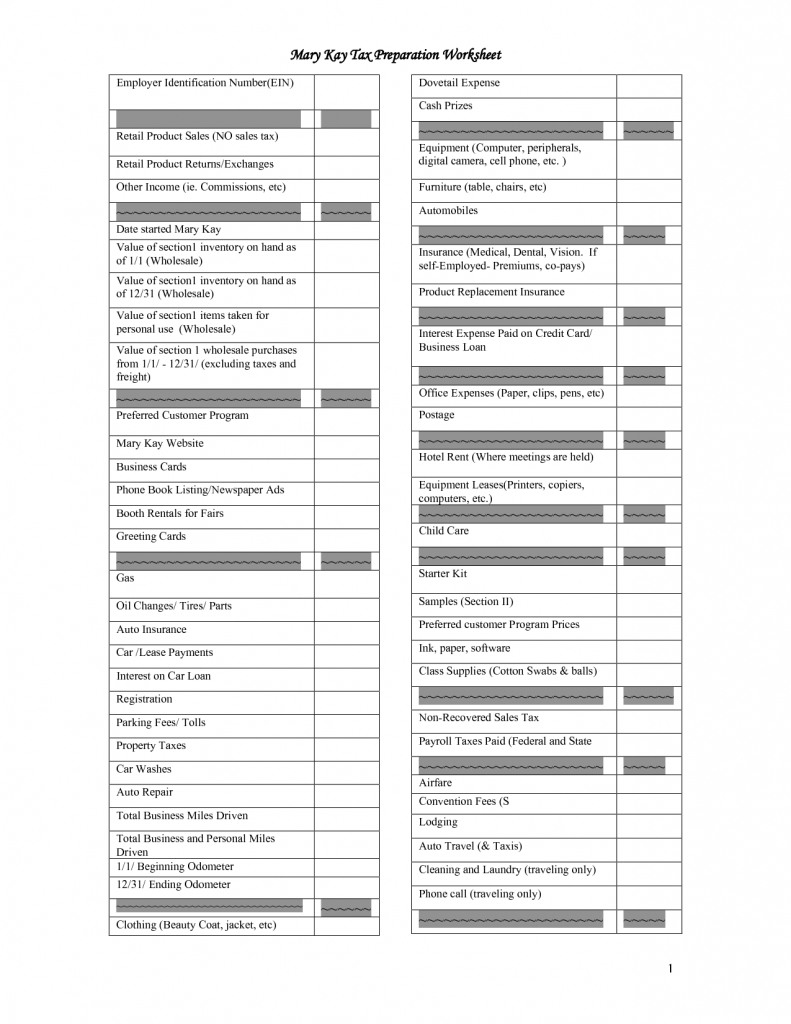

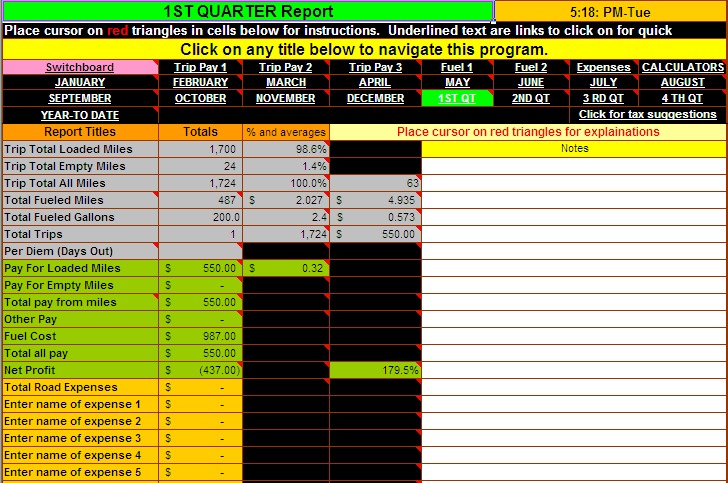

For high income taxpayers in the AMT, the likely effect of this phase-out of the phase-out is nil because the tax burden will simply shift from normal income tax to AMT. Version 1.0, 12/31/2007, includes spreadsheets for California, Ohio, and Federal Only. Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate. Income Tax Changes in Union Budget 2021. There was No major changes in income tax in Budget 2021. The only change was the interest earned on contribution of more than Rs 2.5 Lakh in a year through EPF or VPF would be added to the income and taxed at marginal tax rate. Download Excel file to Calculate and compare Taxable Income and Income Tax Liability as per the Existing and New Regimes (Tax Provisions & Tax Rates) for AY 2021-22 (FY 2020-21). Save your calculations on your computer for future reference. Download Income Tax Calculator AY 2021-22 | 2022-23 in Excel

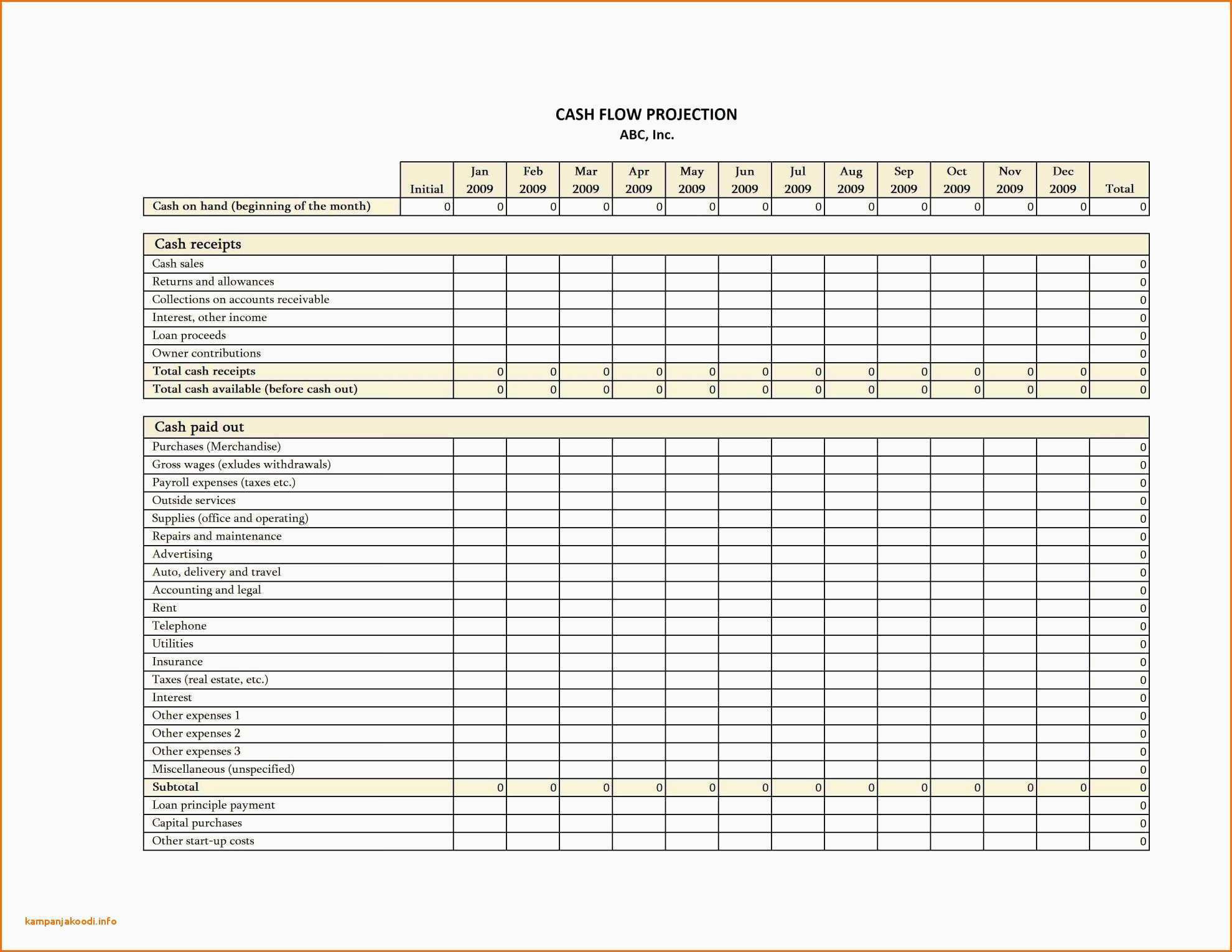

To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Example: if income is 39000, tax equals 3572 + 0.325 * (39000 - 37000) = 3572 + 650 = $4222. To automatically calculate the tax on an income, execute the following steps. 1. On the second sheet, create the named range Rates. 2.

Excel Income Tax Spreadsheet. Here are a number of highest rated Excel Income Tax Spreadsheet pictures on internet. We identified it from obedient source. Its submitted by direction in the best field. We take this nice of Excel Income Tax Spreadsheet graphic could possibly be the most trending subject when we allocation it in google plus or ...

Frequently, you can get the tax table with cumulative tax for each tax bracket. In this condition, you can apply the Vlookup function to calculate the income tax for a certain income in Excel.. Select the cell you will place the calculated result at, enter the formula =VLOOKUP(C1,A5:D12,4,TRUE)+(C1-VLOOKUP(C1,A5:D12,1,TRUE))*VLOOKUP(C1,A5:D12,3,TRUE) into it, and press the Enter key.

Worksheet 3 - Calculating quarterly instalment payments for 2021. Use Worksheet 3 to determine your quarterly instalments (if you are eligible).. After you have calculated the taxes you owe in worksheet 1 (under Parts I, VI, VI.1, and XIII.1 of the Income Tax Act, and your provincial and territorial tax), enter the amounts in the appropriate lines in options 1, 2, and 3.

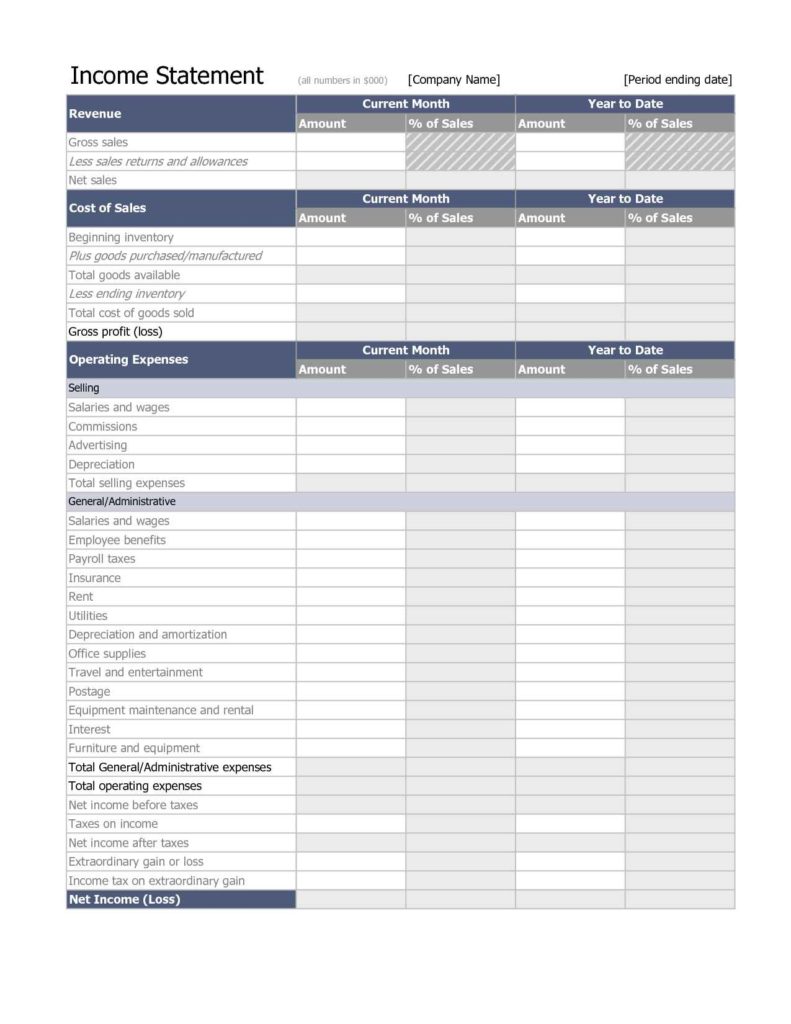

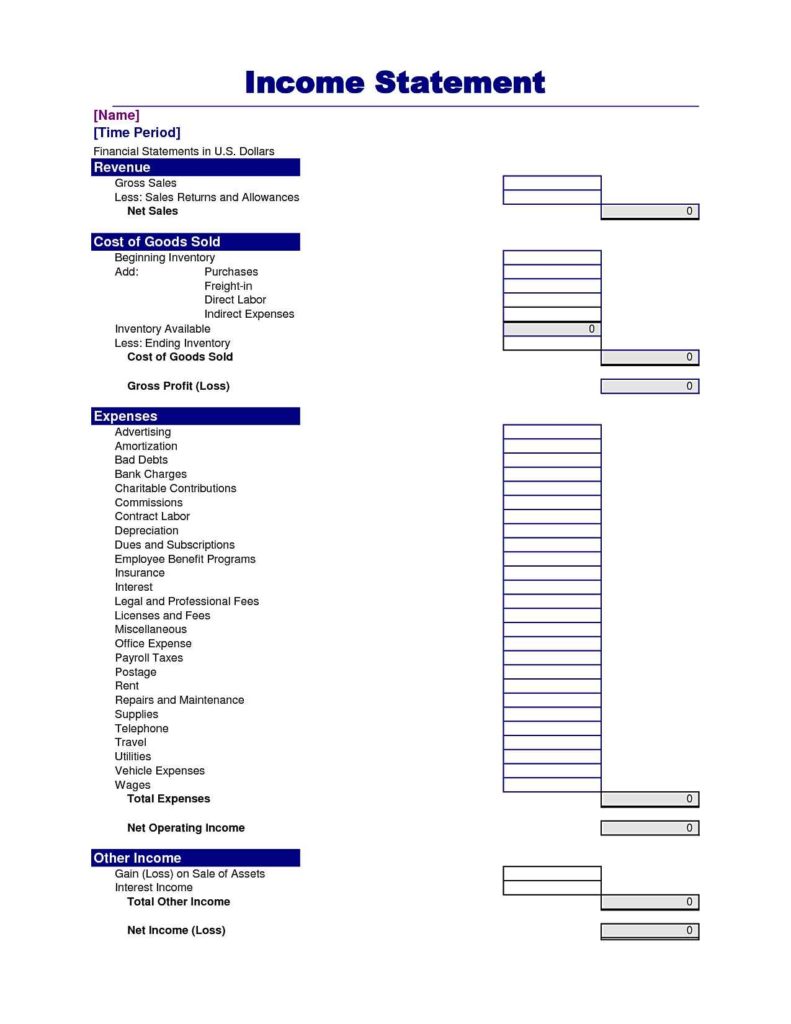

The first is a simple single-step income statement with all revenues and expenses lumped together. The second worksheet, shown on the right, is a multi-step income statement that calculates Gross Profit and Operating Income. Income Statement Essentials Net Income = Total Revenue - Total Expenses Revenues

Section 8a: Net Rental Income - Tax Return method Definition: Derived from the Schedule of Real Estate Owned on page 3 of the application. Must be supported by a current lease on the property or copies of the past two year's tax returns. You can also refer to PMI's Income Analysis Worksheet when calculating rental

Download Income Tax Calculator FY 2020-21 (AY 2021-22) in Excel Format. This calculator is designed to work with both old and new tax slab rates released in the budget 2020. You can calculate your tax liabilities as per old and new tax slab. It will help you to make an informed decision to opt for a suitable tax structure.

How to use this 1099 Excel template. Keeper Tax is an amazing tool that can help freelancers or small business owners like you stay organized and take the terrible-ness out of taxes! ... At the end of the year they can compile all of your data onto a worksheet that looks like this: ... If you have any further questions about your Federal Income ...

Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you.

The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees' wages. It will help you as you transition to the new Form W-4 for 2020 and later.

The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

Prepare your Federal Income Tax Return with the help of these free to download and ready to use ready to use Federal Income Tax Excel Templates. These templates include Simple Tax Estimator, Itemized Deduction Calculator, Schedule B Calculator, Section 179 Deduction Calculator and much more. All excel templates are free to download and use.

Tax expense journal. Track your tax expenses with this accessible tax organizer template. Utilize this tax expense spreadsheet to keep a running total as you go. Take the stress out of filing taxes with this easy-to-use tax deduction spreadsheet.

0 Response to "43 income tax worksheet excel"

Post a Comment