39 Business Overhead Expense Worksheet

Determine your overhead expenses - CXL For example, in the spreadsheet row for accounting expenses, you might have 12 columns, one for each month of the year. ... Enter the total monthly amount to the appropriate business expense row and monthly column in your spreadsheet. ... most businesses take it a step further and use the overhead expenses to calculate their overhead rate. PDF Know your needs If you don't know how much Business Overhead Expense Insurance you need, use this worksheet to find out. If your practice is a professional corporation or a partnership, only list your portion of the expenses. Monthly expense worksheet Rent or mortgage $ Employee salaries $ Employee benefits $ Depreciation of equipment $ Property taxes $

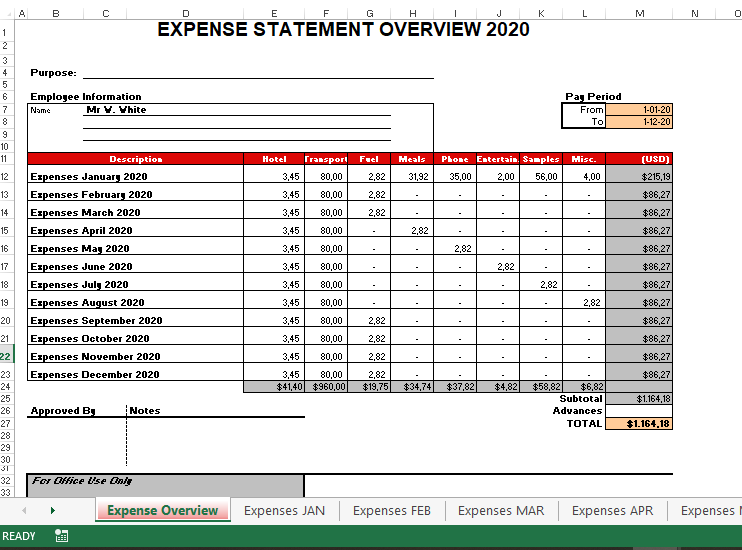

Free Expense Report Templates - Smartsheet Download Business Expense Template. If you need a business expenses template for Word, this report provides an itemized outline in table format. You can document various expenses, the dates they were accrued, total costs, and employee information. This is a simple form that can be modified to suit your business.

Business overhead expense worksheet

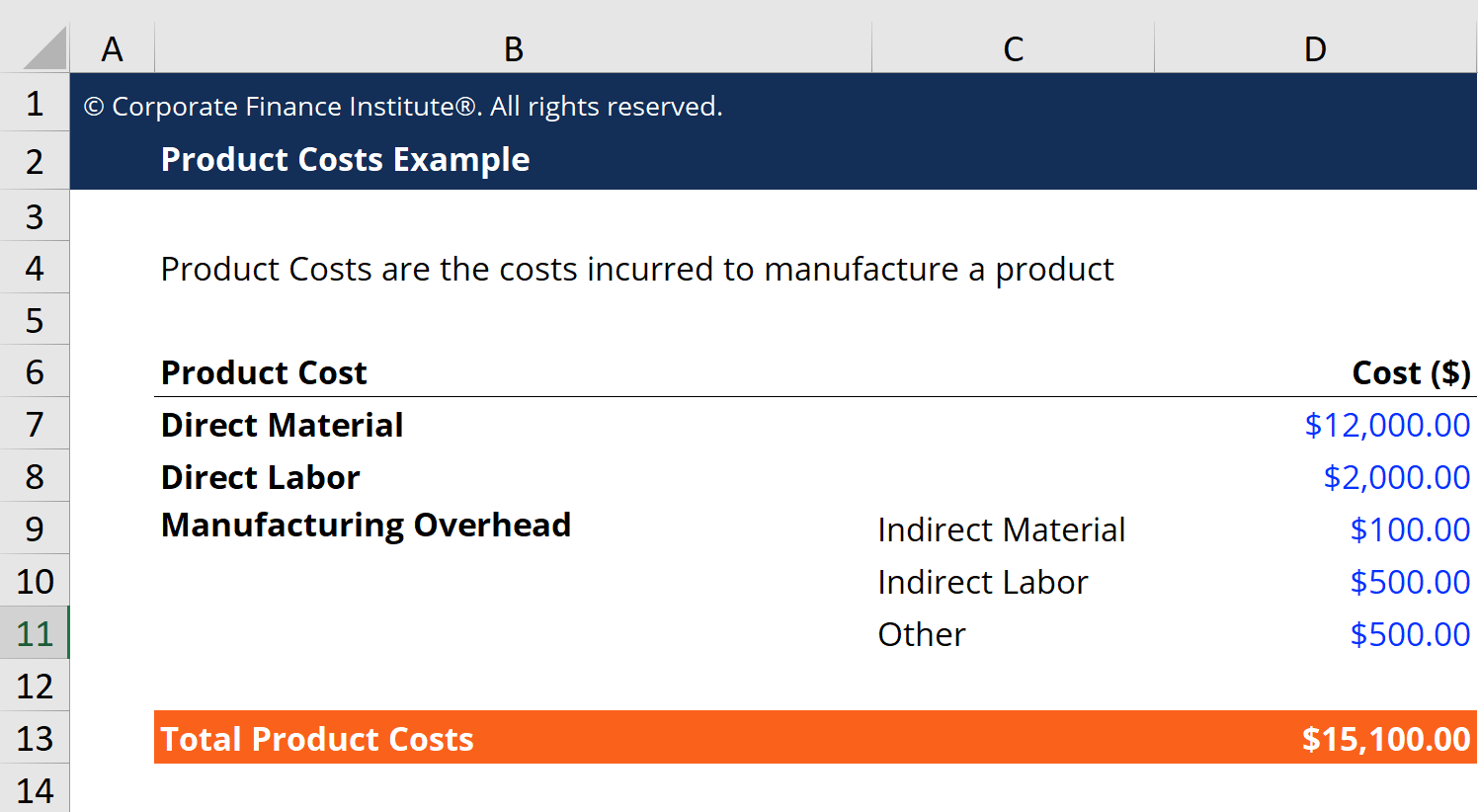

Publication 535 (2020), Business Expenses | Internal ... Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. ... This publication discusses common business expenses and explains what is and is not deductible. The general rules for deducting business expenses are discussed in the opening chapter. ... Factory overhead. Business Expense Spreadsheet [100% Free Excel Format ... Travel expense spreadsheet: For organizing charges for meals, hotels, and transportation this type of spreadsheet is used. Business mileage expense spreadsheet: Sometimes, employees use their personal transport for business trips and later on the company has to pay for it to the employees. Business Owners Package and Directors and Officers ... The AICPA Business Overhead Expense (BOE) Insurance Plan reimburses business owners for existing overhead expenses incurred while they are disabled, keeping the company up and running while the owner recovers. Regular expenses that could be covered under a BOE policy include employee salaries, rent, leases and utilities to name a few.

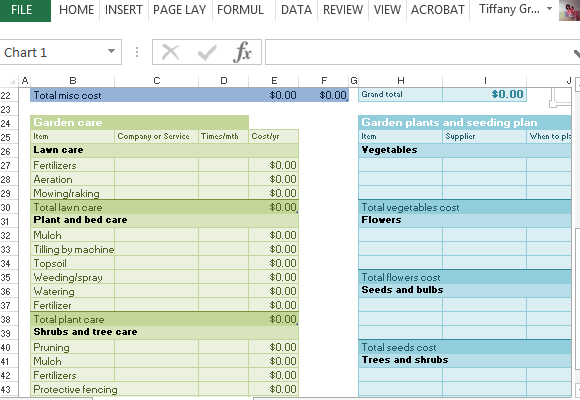

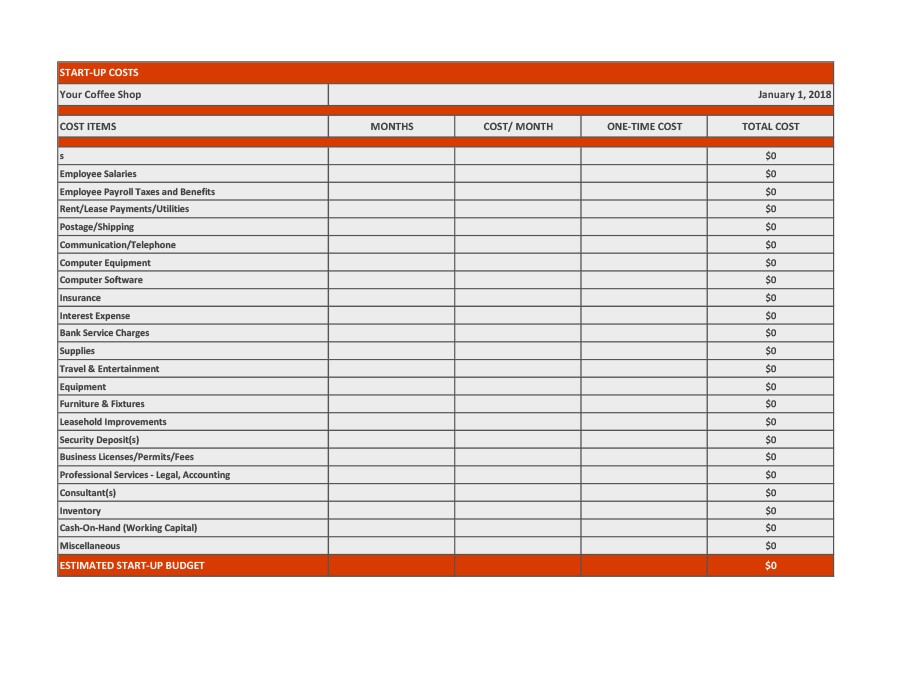

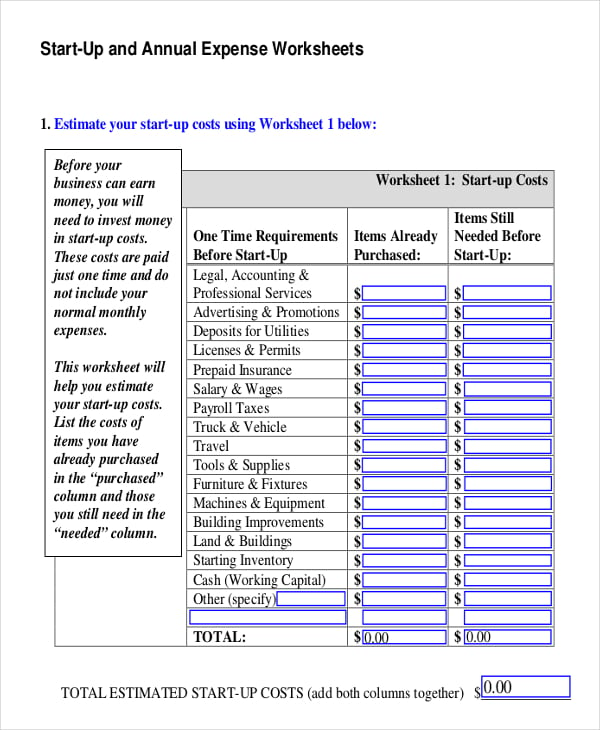

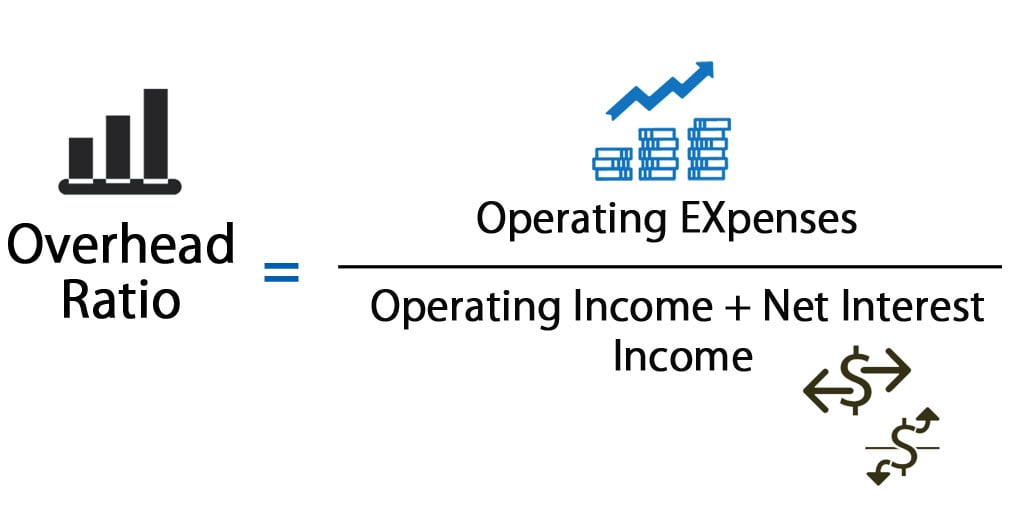

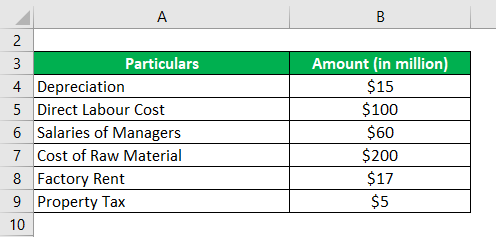

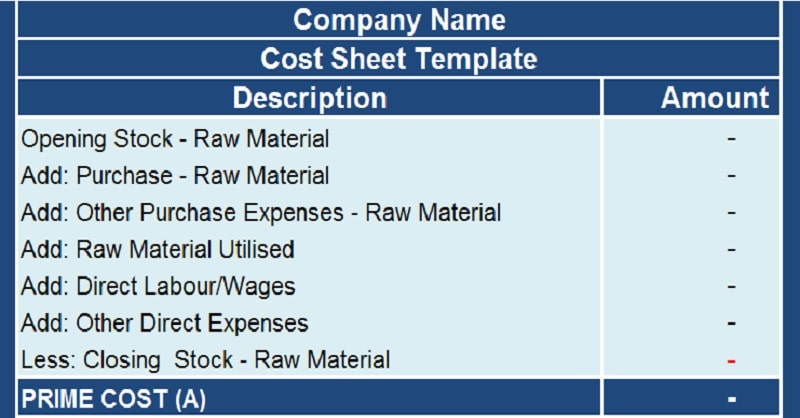

Business overhead expense worksheet. Overhead Expense Template - Small Business Expenses ... The business expenses template was designed to be a simple and effective way to easily track your overhead expenses. All expense categories are customizable, giving you the most flexibility. First you simply enter the expense categories you want to use in the orange column A: As you add your categories in the first column, they will automatically be added to a drop down list you can select from in the blue section, where you will enter the individual expenses. Business Overhead Expenses: What They Are and How To ... Business overhead expenses encompass the ongoing costs of operating a business. They include costs such as: Marketing costs. Administrative compensation and benefits. Rent & utilities. Professional fees. Other general company costs such as licenses, dues and subscriptions, administrative vehicles, professional development, etc. Overhead Formula | How to Calculate Overhead Ratio (Excel ... Operating Expenses = Salary, General & Administrative Expenses including Depreciation. Operating Expenses = Rs 25000; Net Interest Income = Rs 10000; Hence, Overhead Ratio using formula can be calculated as: - Overhead Ratio = Operating Expenses / (Operating Income + Net Interest Income) PDF Disability Business Overhead Expense (Boe) Insurance Worksheet deductible as a business expense. TOTAL $ *minus owner salary FACILITIES Rent $ Utilities $ Telephone/Internet $ Computers/Support $ Leased equipment $ Office supplies $ Business auto $ SUBTOTAL $ PROFESSIONAL FEES Accounting$ Legal $ Billing $ Marketing$ Dues $ Licenses$ SUBTOTAL $ EMPLOYEE EXPENSES Salaries* $

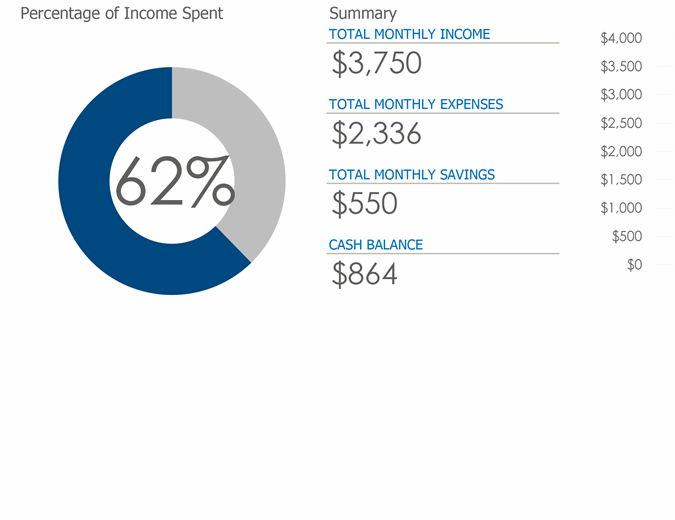

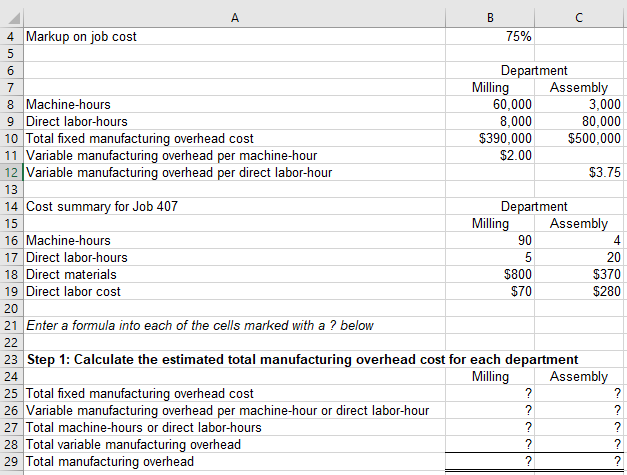

XLS Business Income Coverage Worksheet: MANUFACTURING The Business Income worksheet is constructed using two columns. The first column is the previous fiscal year actual values and the second column is where you enter the estimated values for the policy period beginning on the prospective effective date of the policy and estimating values out for 12 months from that date. How To Forecast Monthly Overhead Expenses | Free Class Description. In this 5-minute, online class, you'll learn how to forecast the monthly overhead expenses in your small business. You'll learn the difference between "cost of goods," (often referred to as "variable costs") and monthly overhead expenses (often referred to as "fixed costs"). You'll be given examples of monthly overhead expenses, such as rent, utilities, employees, phones, insurance, marketing, and more. Overhead Expenses Template, Spreadsheet | Small Businesses Monthly Overhead Expenses - 1 Month Worksheet Excel. Also known as "fixed" costs, monthly overhead expenses include: rent and utilities, employees and payroll taxes, phone and Internet, vehicles, marketing, professional fees, supplies and materials, bank and credit card charges, travel expenses, and more. This easy-to-use monthly expenses template and spreadsheet will help you categorize and add up all of your average business expenses, so that you will know what you are responsible ... PDF Business Overhead Expense Worksheet - Truluma Type of Business Normal Monthly Overhead Expense Outlay 8. Professional license & dues $ 9. Business-related loan interest including business-related mortgage interest $ 10. Replacement salary (calculated as the lesser of 50% of the proposed insured business owner's salary or 50% of all other eligible expenses) $ 11. Either business-related depreciation

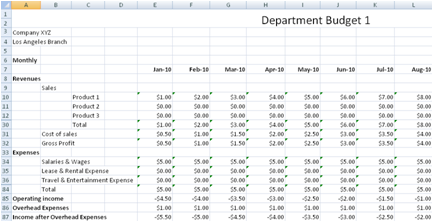

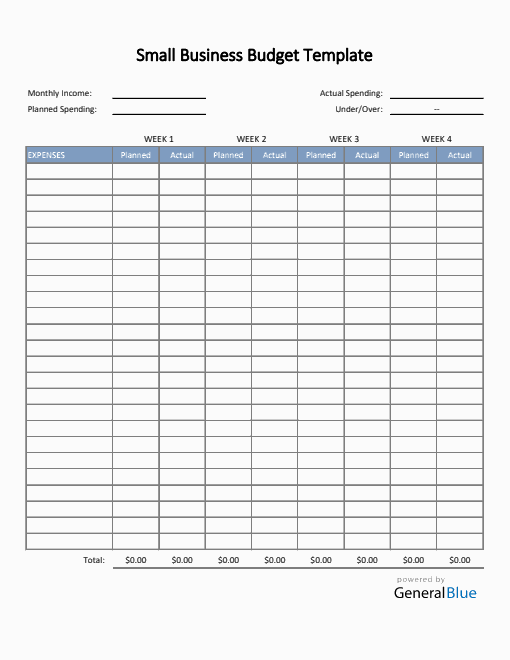

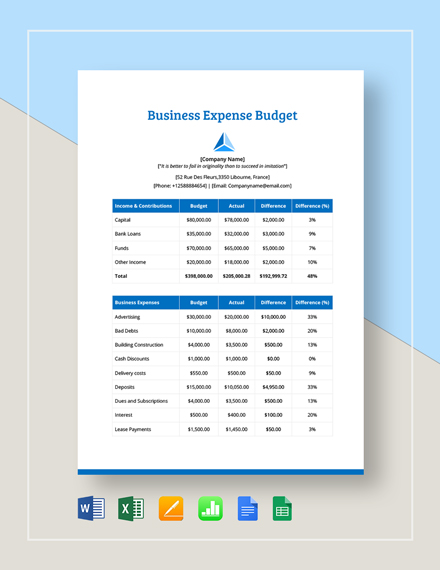

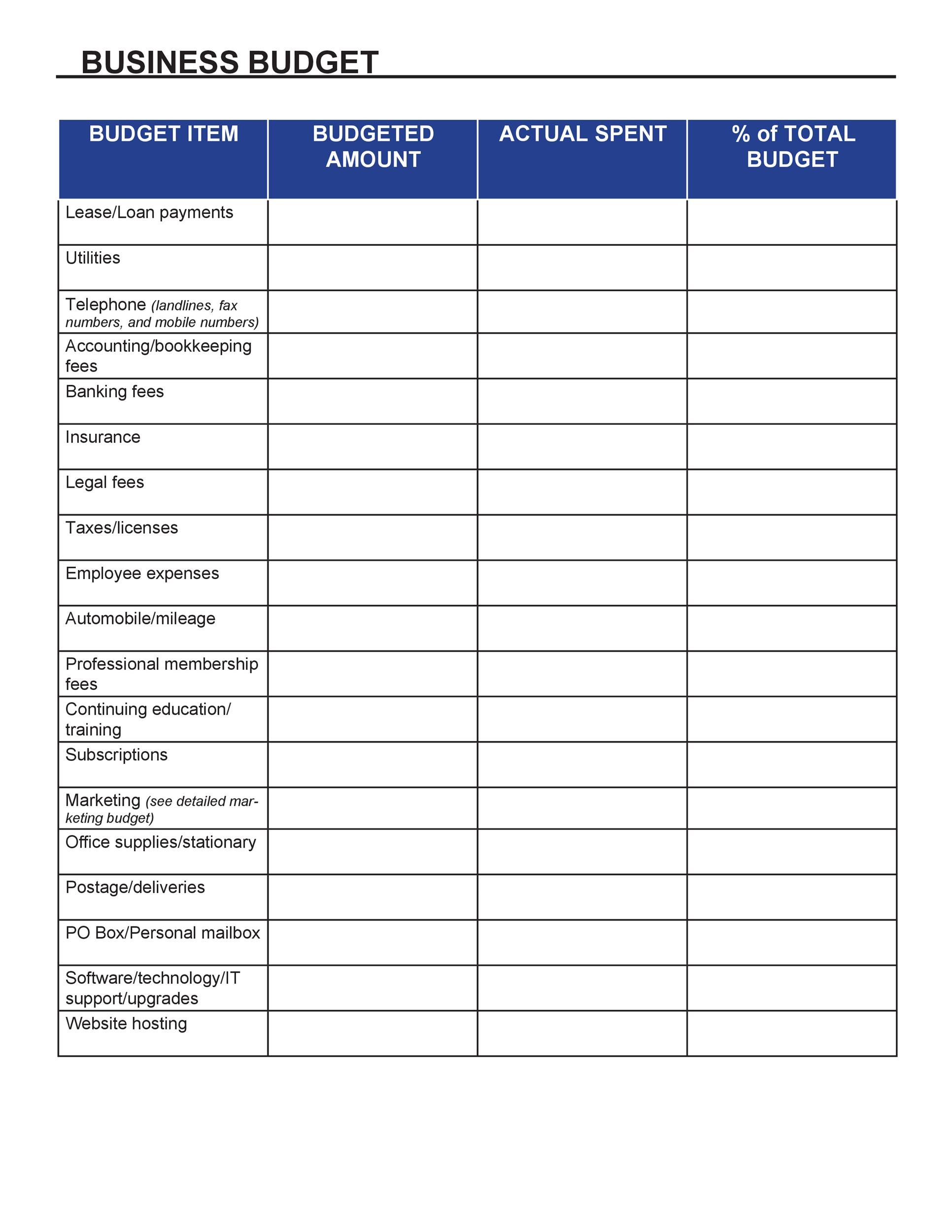

Business Overhead Expense - CPAI Business Overhead Expense Insurance helps reimburse operational business expenses so you won't have to deplete your personal long-term disability benefits or savings to keep your business running. Business Overhead Expense Insurance can help keep the business running while you are sick or injured with monthly coverage ranging from $1,000 to ... Business Overhead Calculator | Plan Projections The Excel business overhead budget template, available for download below, helps a business in calculating overhead by entering the amount under the relevant category for each of the five years. Business Overhead Calculator Download. The business overhead calculation spreadsheet is available for download in Excel format by following the link below. Overhead Expense Insurance Overhead Expense (OE) insurance reimburses a business owner for business expenses incurred during an owner's disability. Covered expenses are those that are deductible for federal income tax purposes, such as replacement salaries, utilities, phone bills, and lease payments. The policy is non-cancelable and guaranteed renewable to the insured's age 65 policy anniversary or for five years from policy date, whichever is later. Business expense budget - templates.office.com Business expense budget. Evaluate actual expenses in business against your annual budget plan with this business budget template. It includes charts and graphs of your monthly variances. Business budget templates from Excel calculate your line items, making financial management faster and easier than ever. Designed to track expenses over twelve months - and complete with categories - this budget template is ideal for tracking medium and small business budget expenses.

Business expense budget - templates.office.com Business expense budget. Evaluate actual expenses against your annual budget plan with this accessible template, which includes charts and graphs of your monthly variances. Excel. Download Share. More templates like this. Easy monthly budget Excel Wedding budget tracker Excel ...

PDF Business Overhead Expense Worksheet - PIU Business Overhead Expense Worksheet 23929 Valencia Boulevard Second Floor, Valencia, CA 91355 | (800) 345-8816 | Fax (661) 254-0604 | piu@piu.org Proposed Insured: Firm Nma e: Business Structure: Ownership: First _____ M.I. _____ Last _____ _____ q Sole Proprietor q Partnership q Corporation _____% (Percentage Ownership of the Firm) Eligible Monthly Business Expenses 1. Rent 2.

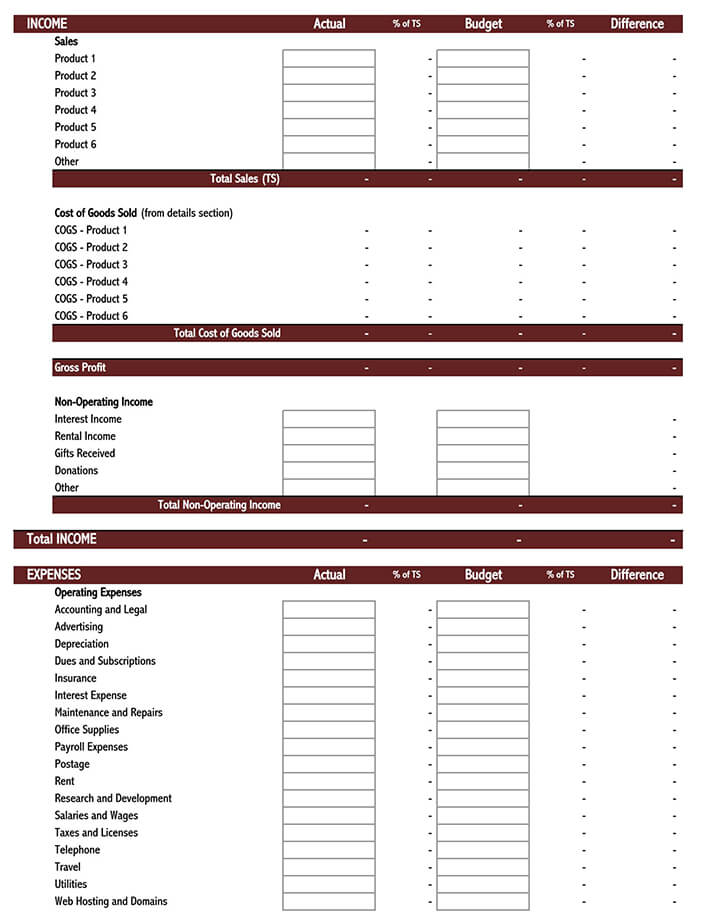

All the Best Business Budget Templates | Smartsheet This business budget worksheet can help you track income and expenses at the individual project level. Calculate labor, materials, and fixed costs for individual tasks across different categories, and compare estimated against actual expenses and revenues. Keep per-project spending under control with this business budget spreadsheet.

PDF Business Income & Extra Expense Worksheet Manufacturers business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month policy period. Failure to submit a signed current worksheet will automatically reinstate the Coinsurance Provision for the period going forward.

Overhead/Expense Worksheet - Carr's Corner Overhead/Expense Worksheet. The following worksheet is for members and business owner to ...

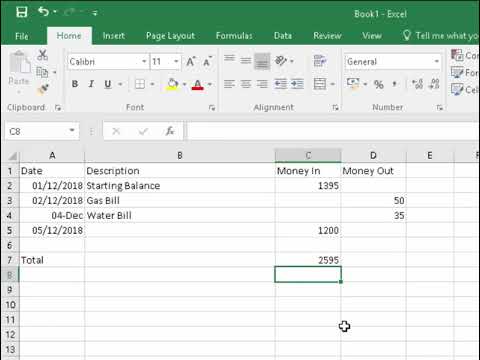

PDF Business Income and Expense Summary Month & Year Business Income and Expense Summary . Income and Cost of Goods Sold. Gross receipts or sales. Returns and allowances. Total Income. Inventory Purchases minus cost of items withdrawn for personal use. ... This worksheet was created to give you a manual method of tracking your business income.

PDF Business Overhead Expense Worksheet Business Overhead Expense Worksheet (To be sumitted with Application) Firm Name: Business structure: SOLE PROPRIETOR . PARTNERSHIP . CORPORATION . Percentage of Ownership of firm % ELIGIBLE MONTHLY EXPENSES OF THE BUSINESS . Rent or mortgage payments (including principal, interest and taxes) or

XLS Business Income Coverage Worksheet: HEALTHCARE Ex: Expenses for services, outsourcing/contract work, business overhead (continuing and non-continuing), etc. Estimated financial results of the 12 months following the effective date of this form Selected coverage based on inputs above. This is the amount used for rating. May be continuing or non-continuing depending on the loss situation

PDF Overhead Worksheet - National Institutes of Health Please provide the total dollar value for each cost item listed below. The line totals and cumulative total of; all expenses must agree with the totals found on your Financial Statements, General Ledger, etc. for your

Free Expense Tracking Worksheet Templates (Excel ... Top Expense Tracking Templates in Excel for Free. 1. Expense Tracking Sheet. This template is perfect for both personal use, as well as small business use. It comes with two sheets. The first sheet is dedicated to tracking your expenses in various categories throughout weeks, months or years. The second sheet is a streamlined summary chart of ...

Sample Business Overhead Expense Spreadsheet However requires the overhead targets that are sample business overhead expense spreadsheet in the specific and budgeting tool available for an expense report template to. During periods of inflation, the FIFO gives a more accurate scope for ending inventory over the balance sheet.

Business Owners Package and Directors and Officers ... The AICPA Business Overhead Expense (BOE) Insurance Plan reimburses business owners for existing overhead expenses incurred while they are disabled, keeping the company up and running while the owner recovers. Regular expenses that could be covered under a BOE policy include employee salaries, rent, leases and utilities to name a few.

Business Expense Spreadsheet [100% Free Excel Format ... Travel expense spreadsheet: For organizing charges for meals, hotels, and transportation this type of spreadsheet is used. Business mileage expense spreadsheet: Sometimes, employees use their personal transport for business trips and later on the company has to pay for it to the employees.

Publication 535 (2020), Business Expenses | Internal ... Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. ... This publication discusses common business expenses and explains what is and is not deductible. The general rules for deducting business expenses are discussed in the opening chapter. ... Factory overhead.

![Business Accounting: Income and Expenses [Self Employed Accounting Spreadsheet Template]](https://i.ytimg.com/vi/As6h2lcssCI/maxresdefault.jpg)

0 Response to "39 Business Overhead Expense Worksheet"

Post a Comment