41 form 886 a worksheet

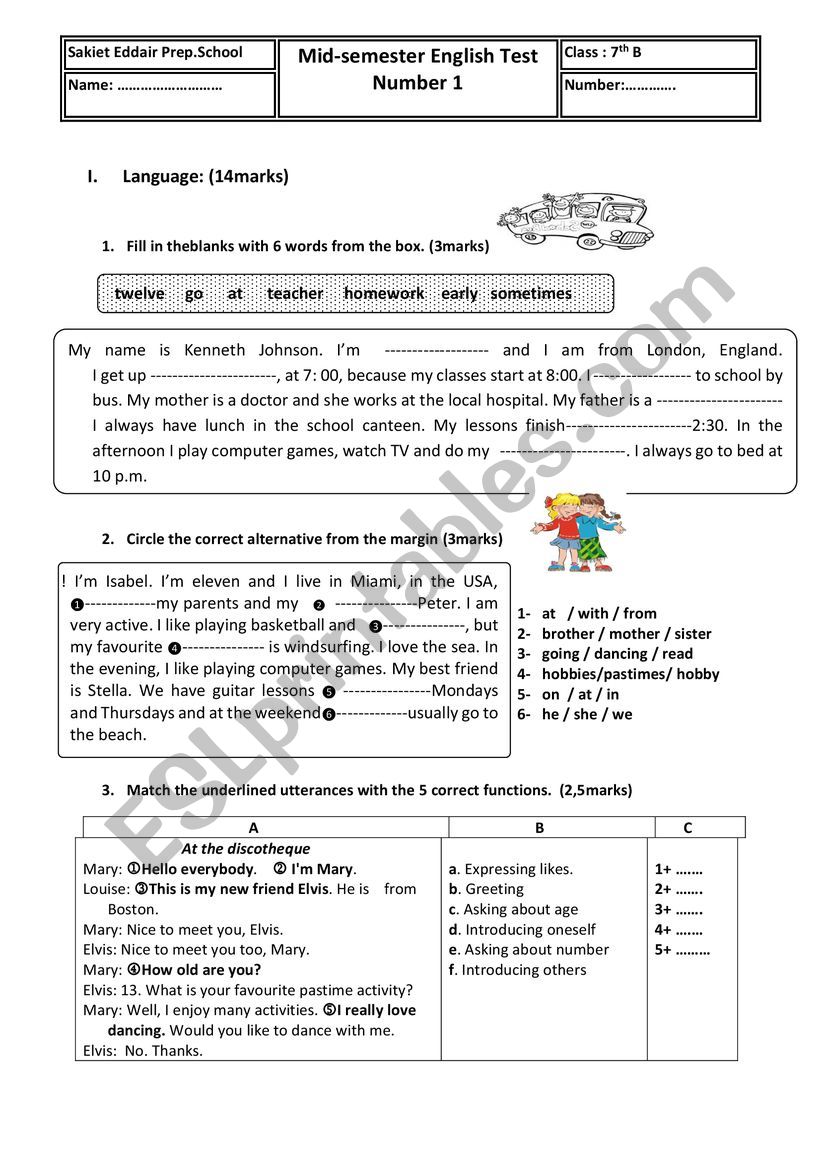

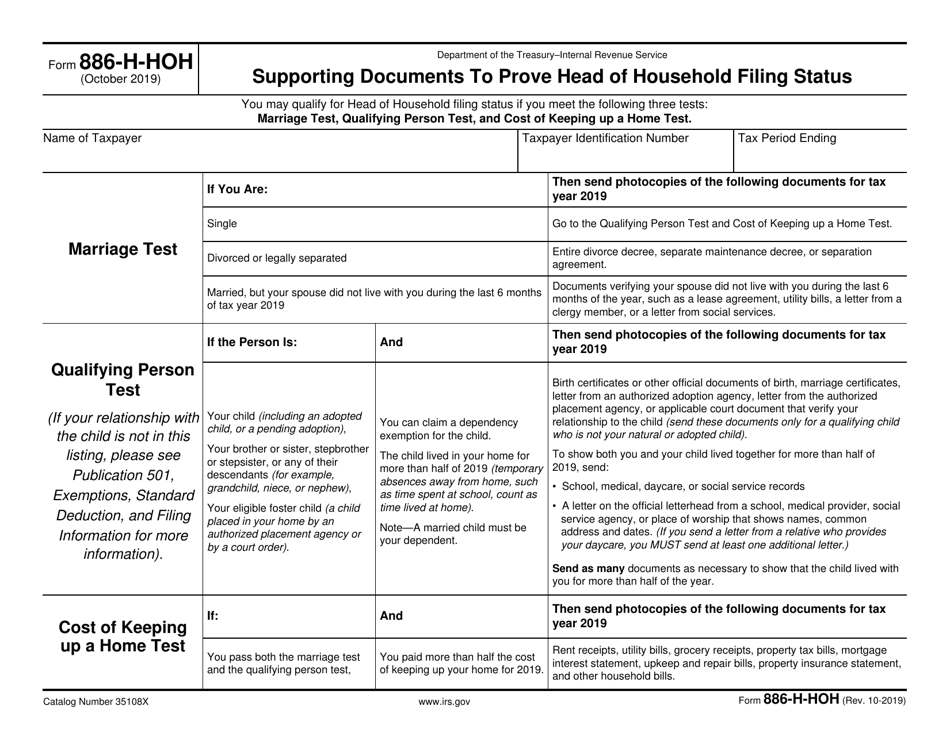

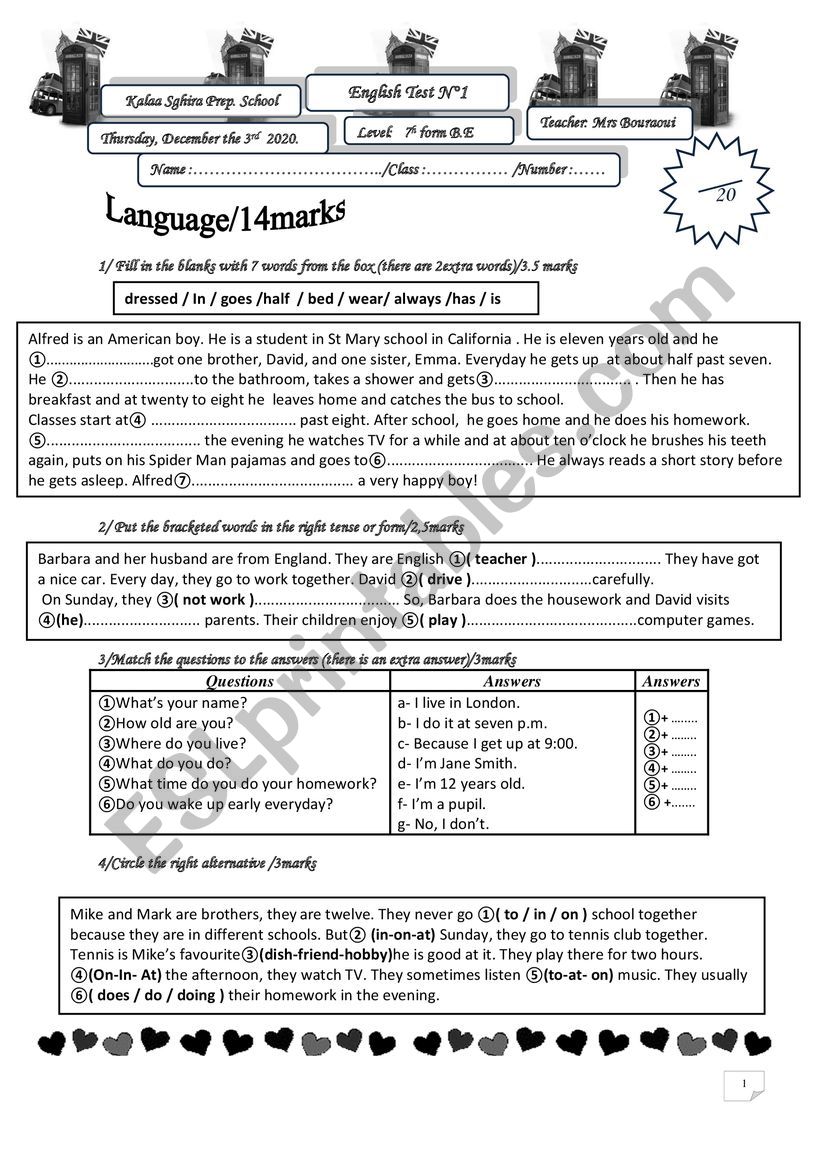

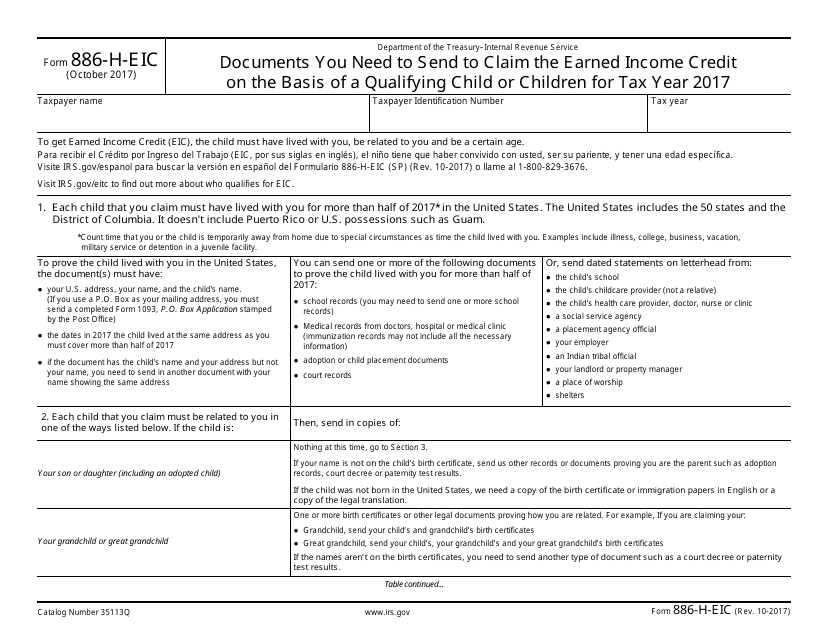

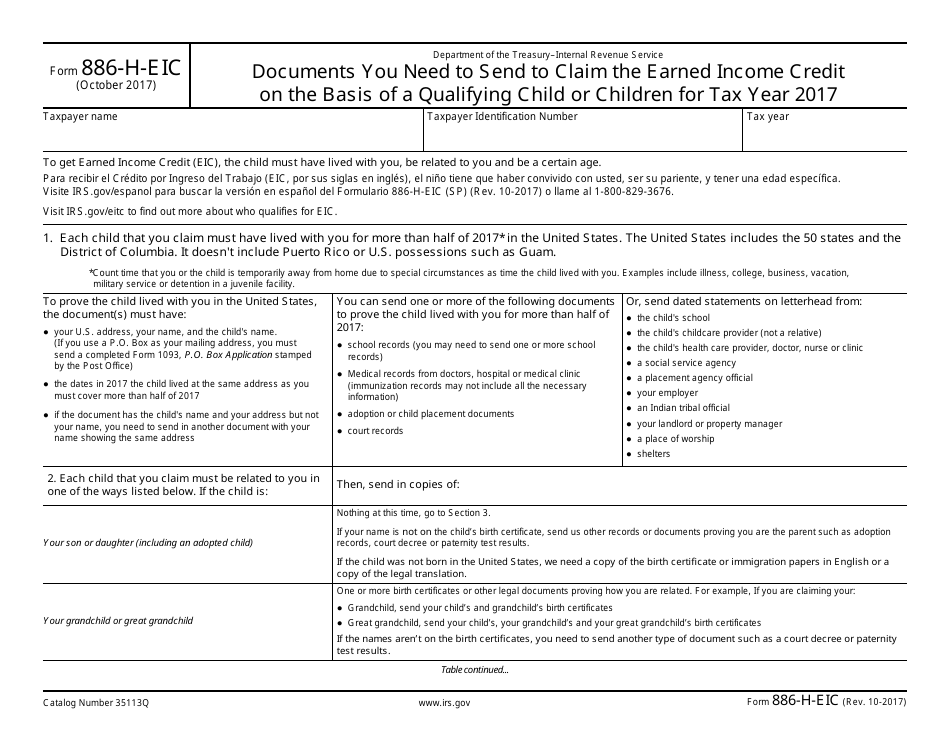

PDF Are You Claiming Hoh, Eitc, Ctc or Aotc? Form 886-H-EIC Toolkit. Document from a court or an agency showing you are the brother or sister and the child is your niece or nephew . I have documents listed under . Stepbrother or Stepsister. Social service records showing you are the brother or sister and the child is your niece or nephew PDF Head of Household Worksheet You must complete the Dependent/Child Tax/Education Credit Worksheet and provide a copy of the Divorce/Separation/Child support agreement. You affirm you have reviewed Form 886-H-HOH Supporting Documents to Prove Head-of-Household status

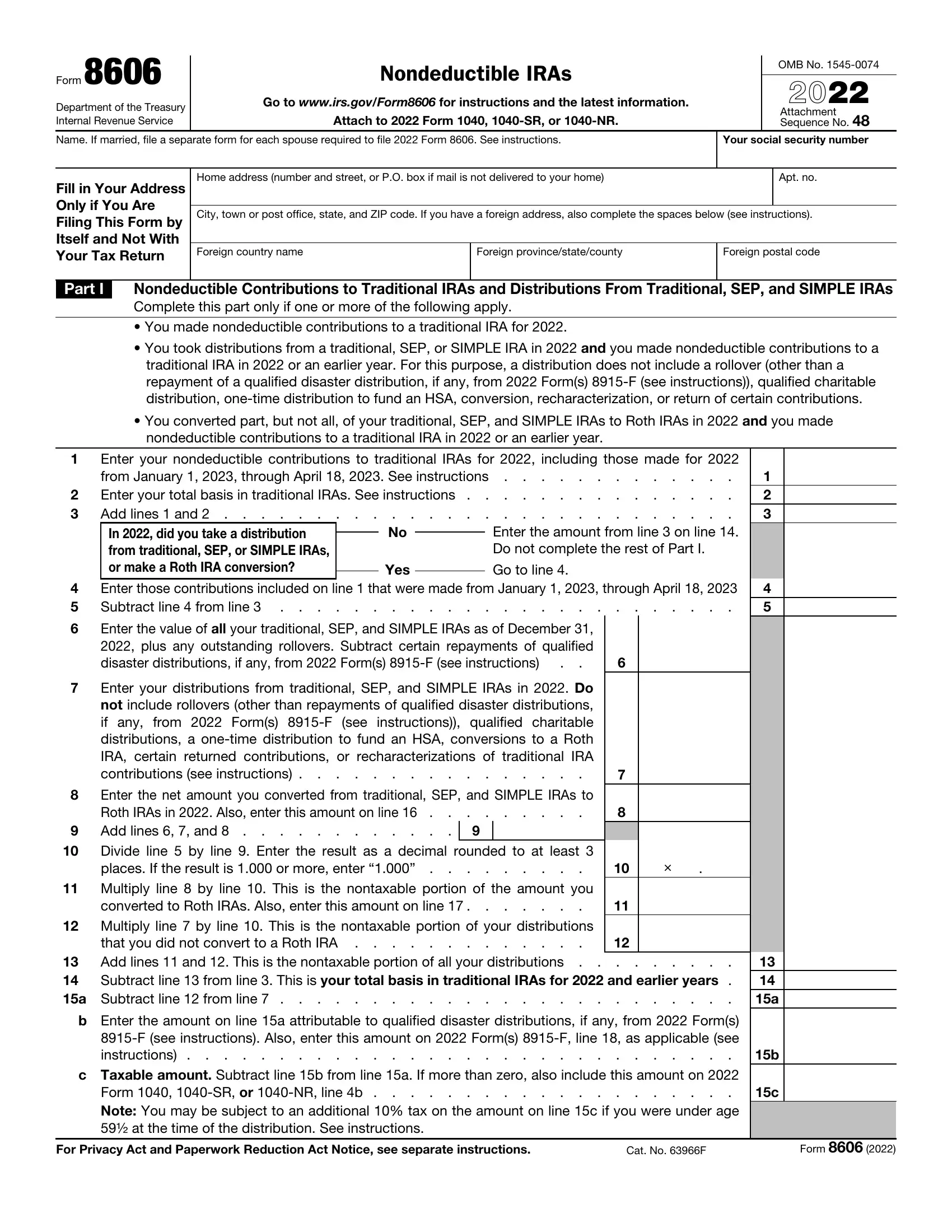

Fill - Free fillable IRS PDF forms Third-Party Sick Pay Recap Form 8922. IRS e-file Signature Authorization for an Exempt Organization Form 8879-E0. Installment Sale Income Form 6252. Request for Public Inspection or Copy of Exempt or Political Organization IRS Form 4506-A. Payment Card and Third Party Network Transactions Form 1099-K.

Form 886 a worksheet

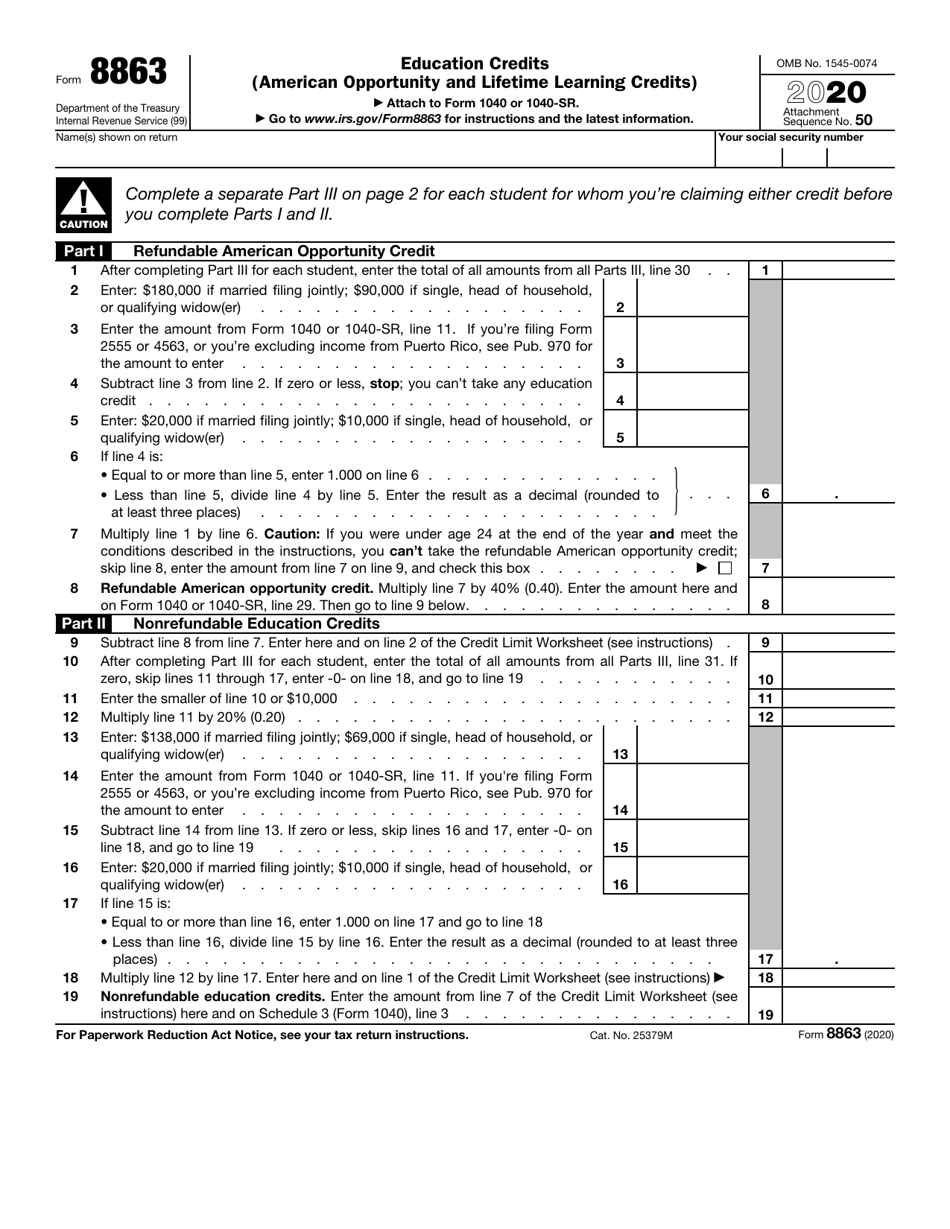

Form 886 A - Fill Out and Sign Printable PDF Template | signNow Follow the step-by-step instructions below to eSign your 886 a: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. After that, your 886 a is ready. PDF Mortgage Deduction Limit Worksheet Mortgage Deduction Limit Worksheet Part I Qualified Loan Limit 1) Enter the average balance of all grandfathered debt..... 1) 2) Enter the average balance of all home acquisition debt incurred prior to December 16, 2017 ... (Form 1040)..... 12) 13) Enter the total amount of interest paid ... Form 8867 - Paid Preparer's Due Diligence Checklist - Support Form 8867, Paid Preparer's Due Diligence Checklist, must be filed with the tax return for any taxpayer claiming EIC, the CTC/ACTC, and/or the AOTC. obtain appropriate and sufficient information to determine the correct reporting of income, claiming of tax benefits (such as deductions and credits), and compliance with the tax laws.

Form 886 a worksheet. DOC Limiting Reagents Worksheet - New Paltz Middle School The amount of product produced is 0.886 mole NO2. The depletion of ozone (O3) in the stratosphere has been a matter of great concern among scientists in recent years. It is believed that ozone can react with nitric oxide (NO) that is discharged from high altitude planes. The reaction is. O3 + NO ( O2 + NO2. If 7.40 g of O3 reacts with 0.670 g ... Form 886 A Worksheet Fillable - Fill and Sign Printable ... Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details. Form 886 H Dep - Online PDF Template Put an digital signature on your form 886 h DEP printable with the assistance of Sign Tool. Once the form is completed, click Done. Distribute the prepared form by way of electronic mail or fax, print it out or download on your device. PDF editor enables you to make improvements in your form 886 h DEP Fill Online from any internet connected ... PDF Deduction Interest Mortgage - IRS tax forms You file Form 1040 or 1040-SR and item-ize deductions on Schedule A (Form 1040). • The mortgage is a secured debt on a quali-fied home in which you have an ownership interest. Secured Debt and Qualified Home are explained later. Both you and the lender must intend that the loan be repaid. Note. Interest on home equity loans and

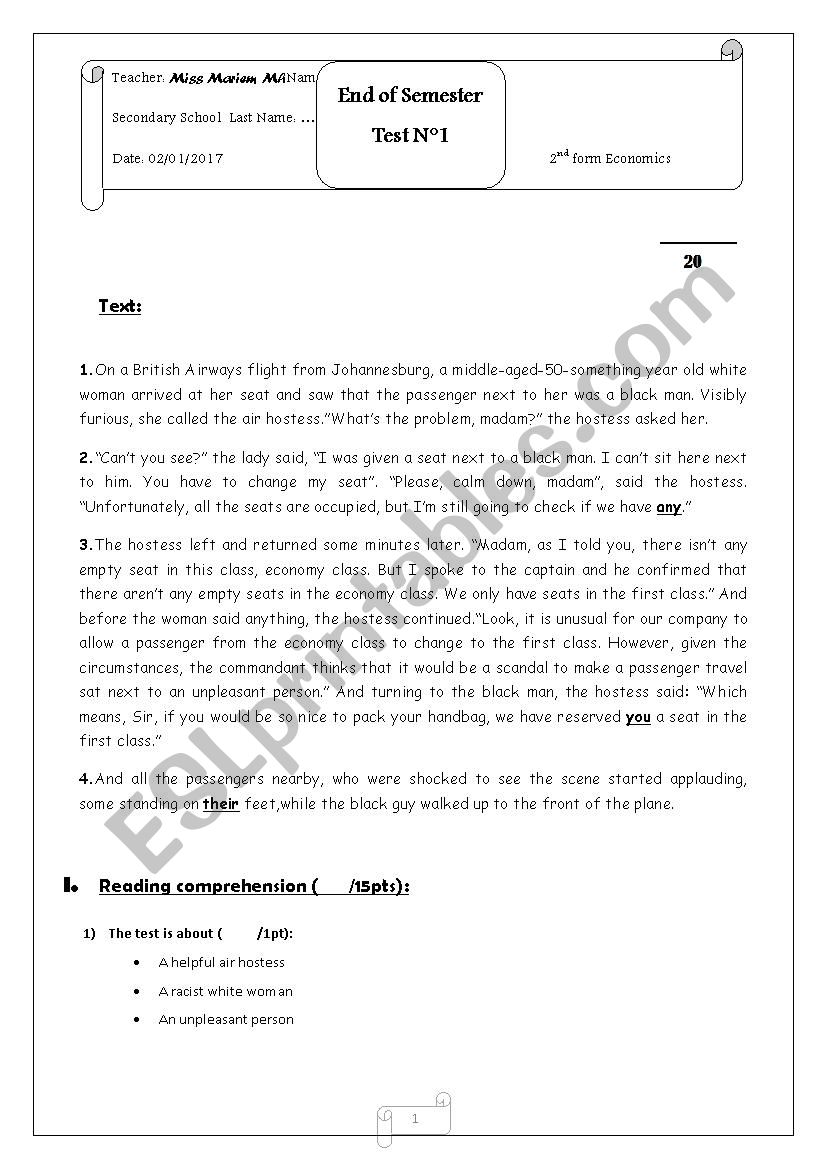

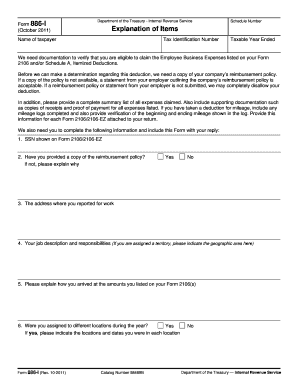

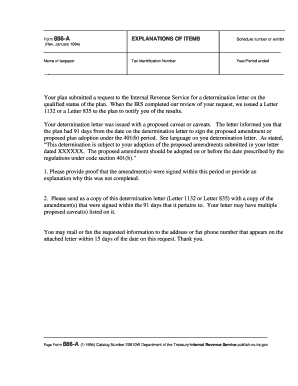

Tax Dictionary - Form 886A, Explanation of Items | H&R Block IRS Definition Form 886A, Explanation of Items explains specific changes to your return and why the IRS didn't accept your documentation. In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted. irs form 886-a may 2022 - Fill Online, Printable, Fillable ... irs form 886-a may 2022. Reap the benefits of a digital solution to create, edit and sign documents in PDF or Word format on the web. Convert them into templates for multiple use, incorporate fillable fields to gather recipients? data, put and request legally-binding digital signatures. Do the job from any device and share docs by email or fax. What is a form 886 EIC? - Pursuantmedia.com What is a form 886 EIC? (October 2019) Department of the Treasury-Internal Revenue Service. Documents You Need to Send to Claim the Earned Income Credit. on the Basis of a Qualifying Child or Children for Tax Year 2019. What is a CP75 from the IRS? The CP75 is an audit notice regarding the tax return on which an Earned Income Credit was claimed. Form 886 A Worksheet - Fill Online, Printable, Fillable ... Get the free form 886 a worksheet. Description of form 886 a worksheet. 1 2 3 4 Linda Franklin Tax Counsel III Board of Equalization, Appeals Division 450 N Street, MIC:85 P.O. Box 942879 Sacramento CA 95814 Tel: (916) 323-3087 Fax: (916) 324-2618 5 6 Attorneys for the. Fill & Sign Online, Print, Email, Fax, or Download.

Head of Household Filing Status - Support There is a HOH worksheet built into the program that can help you determine HOH eligibility. From the Main Menu of TaxSlayer Pro select: Configuration. Advanced Configuration (Macros) Use Head of Household Worksheet. With this option set to YES, when you create a new return and select HOH as the taxpayer's filing status, you will be prompted ... Form 886-A - IRS tax forms Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended __ Your plan submitted a request to the Internal Revenue Service for a determination letter on the qualified status of the plan. Rec'd a Form 886-A worksheet pre Qualified Loan limit and ... Recd a Form 886-A worksheet re Qualified Loan limit and Ded. I'm trying to do my daughters taxes. She made $25000, I'm trying to do my daughters taxes. She made $25000, purchased a mftg home, has the form indicating interest paid and points on the loan, paid … read more. Is there a downloadable/fillable version of Schedule C-7 ... The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit. They often request more information than what they really need but you also have a duty to supply sufficient evidence to win your case. Income Issues: The IRS has reviewed and has noticed a discrepancy in the items reported.

Form 886-A Schedule C-5 is asking for a log of business ... Form 886-A Schedule C-5... Form 886-A Schedule C -5 is asking for a log of business mileage which i can provide, but it also asks for two receipts/documents showing mileage at the beginning and at the end of the year for each vehicle.

IRS Form 886A | Tax Lawyer Shows What to do in Response ... Since the purpose of Form 886A is to "explain" something, the IRS uses it for many various reasons. Most often, Form 886A is used to request information from you during an audit or explain proposed adjustments in an audit. This form is extremely important because the IRS will want their questions answered by you! Audit Procedure

Forms 886 Can Assist You | Earned Income Tax Credit Forms 886 Can Assist You Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the due diligence knowledge requirement. Consider using the forms IRS uses to request documentation during audits. Tell your clients here's what you need to support your claim if you are audited by IRS.

PDF Form 886-I Explanation of Items - ncpe Fellowship Form 886-I (October 2011) Catalog Number 58489B Explanation of Items Department of the Treasury - Internal Revenue Service Schedule Number . Name of taxpayer Tax Identification Number . Taxable Year Ended We need documentation to verify that you are eligible to claim the Employee Business Expenses listed on your Form

Form 886 A Worksheet - Fill Online, Printable, Fillable ... Form 886 A Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller. Fill Form 886 A Worksheet, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. Try Now!

Worksheet Student - Page 886 of 925 - Good Worksheets ... Expanded Form Worksheets For Grade 2. by Amanda on May 14, 2021. May 14, 2021 Leave a Comment on Expanded Form Worksheets For Grade 2. This is a suitable resource page for third graders teachers and parents. Free math worksheets from K5 Learnings online reading and math program.

42 form 886 a worksheet - Worksheet Master Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details.

Form 886 A Worksheet - Fill and Sign Printable Template ... Click the orange Get Form option to begin filling out. Turn on the Wizard mode on the top toolbar to get more recommendations. Fill in every fillable area. Make sure the information you add to the Form 886 A Worksheet is up-to-date and accurate. Add the date to the document using the Date tool. Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one.

PDF 886-H-HOH (October 2020) Supporting Documents to Prove ... 886-H-HOH (Rev. 10-2020) Form . 886-H-HOH (October 2020) Department of the Treasury - Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests:

Forms and Publications (PDF) - IRS tax forms Form 886-H-DEP: Supporting Documents for Dependency Exemptions 1019 07/31/2020 Form 886-H-DEP (SP) Supporting Documents for Dependency Exemptions (Spanish Version) 1019 07/31/2020 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children ...

PDF Form 886-H-DEP Supporting Documents for Dependency Exemptions Form 886-H-DEP (Rev. 10-2016) Catalog Number 35111U publish.no.irs.gov . Department of the Treasury - Internal Revenue Service. Form . 886-H-DEP (October 2016) Department of the Treasury-Internal Revenue Service . Supporting Documents for Dependency Exemptions. Taxpayer Name Taxpayer Identification Number Tax Year. If You Are:

Form 8867 - Paid Preparer's Due Diligence Checklist - Support Form 8867, Paid Preparer's Due Diligence Checklist, must be filed with the tax return for any taxpayer claiming EIC, the CTC/ACTC, and/or the AOTC. obtain appropriate and sufficient information to determine the correct reporting of income, claiming of tax benefits (such as deductions and credits), and compliance with the tax laws.

PDF Mortgage Deduction Limit Worksheet Mortgage Deduction Limit Worksheet Part I Qualified Loan Limit 1) Enter the average balance of all grandfathered debt..... 1) 2) Enter the average balance of all home acquisition debt incurred prior to December 16, 2017 ... (Form 1040)..... 12) 13) Enter the total amount of interest paid ...

Form 886 A - Fill Out and Sign Printable PDF Template | signNow Follow the step-by-step instructions below to eSign your 886 a: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. After that, your 886 a is ready.

0 Response to "41 form 886 a worksheet"

Post a Comment