42 worksheet for figuring net earnings loss from self employment

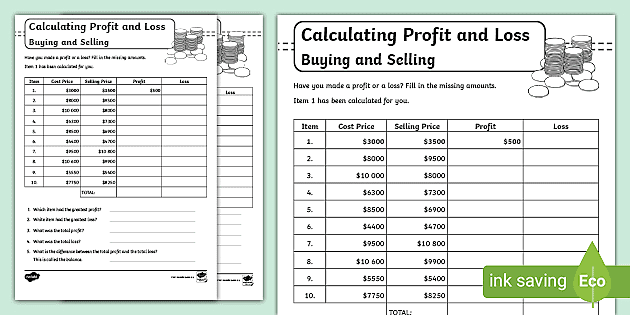

Net Earnings from Self-Employment - SocialSecurityHop.com To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A). PDF F-16036 (06/2019) Self-employment Income Worksheet ... Complete all the fields on this worksheet. If a line on the Schedule K-1 (Form 1065) or Form 1065 is left blank, enter a zero on this worksheet. If a statement is provided for line 20 of Form 1065 that does not specify an expense listed on this worksheet, enter a zero on this worksheet. Indicate percentages as a decimal to the ten thousandth place. Do

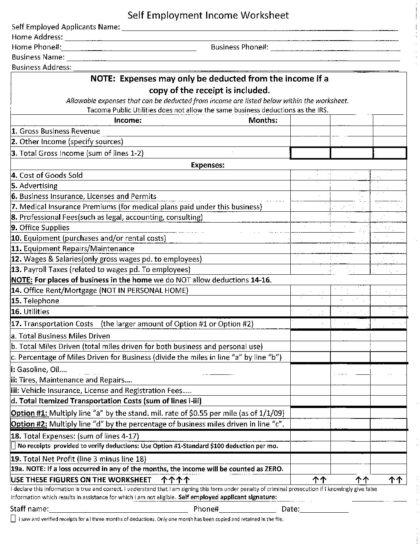

PDF SELF EMPLOYMENT INCOME WORKSHEET - caclmt.org - Net Losses (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value.) > Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). -Income Taxes (federal, state, and local) EXPENSES: 2. Other Income (specify sources): 3. Total Gross Income

Worksheet for figuring net earnings loss from self employment

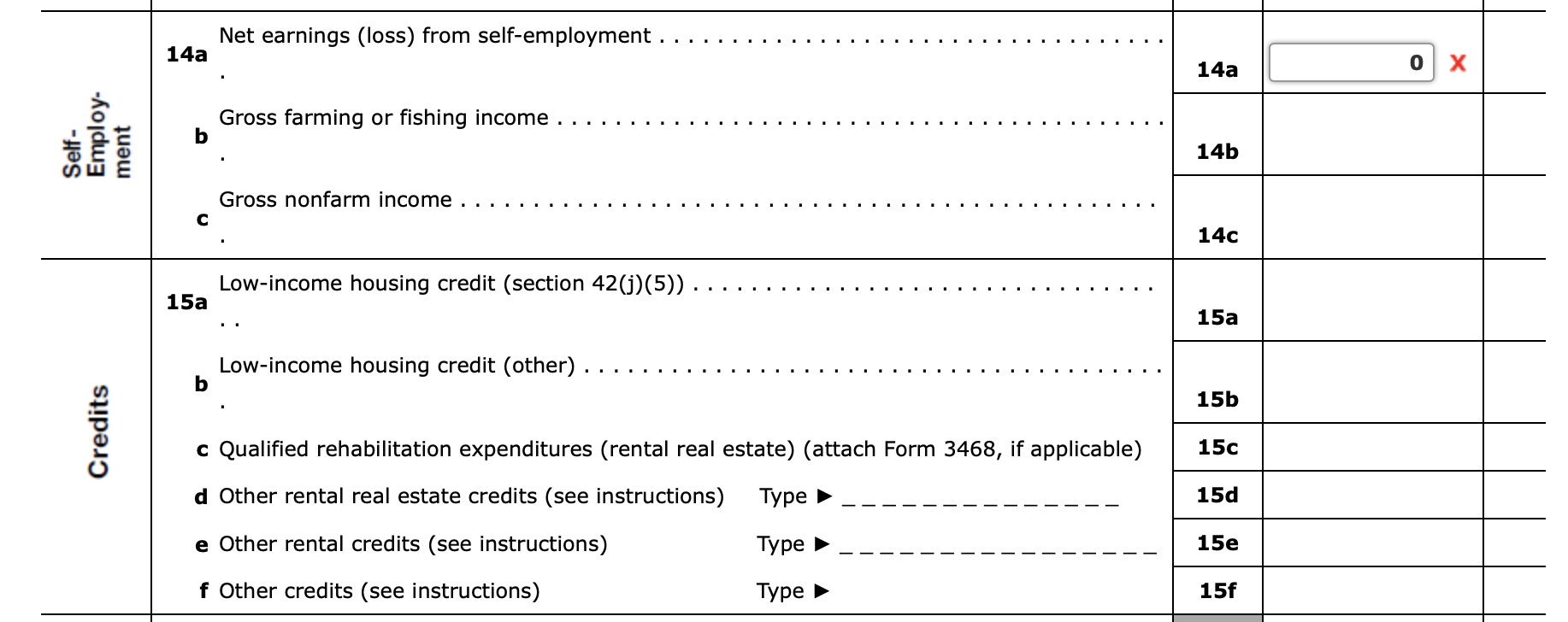

Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss ... To enter Self-Employment Earnings (loss) from tax form Schedule K-1 (Form 1065) in TaxSlayer Pro from the Main Menu of the Tax Return (Form 1040) select: Income Menu; Rents, Royalties, Entities (Sch E, K-1, 4835, 8582) K-1 Input and select 'New' and double-click on Form 1065 K-1 Partnership which will take you to the K-1 Heading Information Entry Menu. If the initial K-1 entry was previously keyed in, double click on the entry in the K-1 pick list. Self-Employed Individuals - Calculating Your Own ... To calculate your plan compensation, you reduce your net earnings from self-employment by: the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and; the amount of your own (not your employees') retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans. › main › OLTFreeOLT Supported Federal Forms - OLT.COM Student Loan Interest Deduction Worksheet: Worksheet Form 6251-Schedule 2, Line 1: Exemption Worksheet for Form 6251 line 5: State and Local General Sales Tax Deduction Worksheet: Mortgage Insurance Premiums Deduction Worksheet: Business use of your home (Simplified Method Worksheet) Capital Loss Carryover Worksheet: 28% Rate Gain Worksheet

Worksheet for figuring net earnings loss from self employment. PDF Self-employment Income Worksheet - Wshfc Self-Employment Income Worksheet | Rev. January 2014 tonbar SELF-EMPLOYMENT INCOME WORKSHEET . Property Name: Unit: Applicant/Resident Name: To Calculate Income from Schedule C Profit or Loss From Business: Line 31: Net profit or (loss) Add PDF FNMA Self-Employed Income - Mortgage Grader FNMA Self-Employed Income Calculations ... Depreciation related to income (or loss) from rentals must be added back to net gain (or loss). Farm Income or Loss (from Schedule F): This is the profit or loss from farming. Any depreciation shown on ... *Mortgage, notes, bonds payable in less than one year: This figure, which is found on the ... PDF Income Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. 2021 Instructions for Schedule SE (2021) | Internal ... If you are the only spouse who carried on the business, you must include on Schedule SE, line 3, the net profit or (loss) reported on the other spouse's Schedule C or F (except in those cases described later under Income and Losses Not Included in Net Earnings From Self-Employment). Enter on the dotted line to the left of Schedule SE, line 3, "Community income taxed to spouse" and the amount of any net profit or (loss) allocated to your spouse as community income.

Understanding Schedule K-1 self-employment income for ... The program creates a worksheet to show the calculation of net earnings from self-employment. Follow these steps to view the Self-Employment Worksheet: Go to the Forms tab. Select Worksheets from the left-side Form window. Select Self-Emp. Worksheet from the left-side Page window. How do I enter adjustments or overrides for self-employment income? PDF Based on the calculations shown on his worksheet, Manuel's ... 12 Self-employment tax. Add lines 10 and 11. Enter here and in Part I, line 3 . . . . . . . . . 12 Part VI Optional Methods To Figure Net Earnings— See instructions for limitations. Note: If you are filing a joint return and both you and your spouse choose to use an optional method to figure net earnings, you must each complete and attach a ... PDF U.S. Department of Housing and Urban Development Office of ... Net Income/Loss 12 Type Definition Net Income Profits or net earnings of a company determined by gross income less deductible expenses and depreciation. Net Earnings Certain income is not considered in net earnings for income tax purposes including dividend income, interest from loans, income from a limited partnership. Eligible Self-Employed ... Income Analysis Worksheet | Essent Guaranty YTD P&L and Business Statement Analysis. Use our flow chart to guide you in applying temporary COVID-19 agency guidelines and determining a stable monthly income. Download Worksheet (PDF) Ask 2. Save 10. Handout. Here are two simple questions to ask self-employed borrowers, so you can save 10. Download Worksheet (PDF)

Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. Worksheet For Figuring Net Earnings Loss From Self ... Self employment income worksheet. Net operating losses from other years. Enter on line 14a the amount from line 5 of the worksheet. Self employment earnings loss line 14a net earnings loss from self employment amounts reported in box 14 code a represent the amount of net earnings from self employment. 1065-US: Calculating Schedule K, line 14a - Net earnings ... Question. How does UltraTax CS calculate Schedule K, line 14a - Net earnings from self-employment? Answer. UltraTax CS calculates self-employment earnings (SE) per activity for partners in the Partner's Self-Employment Worksheet based on the type of partner selected in the Partner tab in the Partner Information window in View > Partner Information. Self-employed borrower cash flow worksheets | MGIC Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrower's income. Our editable, auto-calculating worksheets help you to analyze: Cash flow and YTD profit and loss (P&L) Comparative income; Liquidity ratios; Rental income; For employment and other types of income, check out our Income Analysis worksheet.

› document › 45363441IRS Publication 4012 Volunteer Resource Guide | PDF | Irs Tax ... 3. You had net earnings from self-employment of at least $400. 4. You had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from employer social security and Medicare taxes. 1. You had income tax withheld from your pay. 2.

› taxtopics › tc554Topic No. 554 Self-Employment Tax | Internal Revenue Service Feb 18, 2022 · If you had a loss or small amount of income from your self-employment, it may be to your benefit to use one of the two optional methods to compute your net earnings from self-employment. Refer to the Instructions for Schedule SE (Form 1040) PDF to see if you qualify to use an optional method.

1065-US: Calculating Schedule K, line 14a - Net earnings ... Use the Ptr Alloc button to allocate this amount to the appropriate partners. LLC Member (No SE) will not calculate self-employment earnings. Note: Enter an amount in the Net earnings (loss) from self-employment (Force) field in Screen SepK to override the self-employment income UltraTax CS calculates. Use the Ptr Alloc button to allocate this amount to the appropriate partners.

Genworth Self Employed Income Worksheet - Math Worksheets ... Monthly qualifying rental income or loss. 5 days ago genworth rental income worksheet How to create an e-signature for the fannie mae self employed income worksheet The self - employed persons FICA tax rate for 2019 January 1 through December 31 2019 is 153 on the first 132900 of net income plus 29 on.

How to Calculate Lost Earnings If You're Self Employed in ... Maryland law is clear that when a victim of negligence is in business for herself, loss of profits is the same thing as loss of earnings from personal services. So lost profit is the key to and calculating damages for an injury claim. If you are a small business owner, documenting self-employment income to compute lost earnings can be complicated.

PDF FHA Self-Employment Income Calculation Worksheet Job Aid The FHA Self-Employment Income Calculation Worksheet, which is located at . wholesale.franklinamerican.com. under Forms > FHA, is a tool to be used for FHA loans when any borrower is self -employed. • The worksheet is to be used for evaluation of only one self -employment business per borrower. • A new worksheet will need to be used for additional borrowers and self -employment, even if there are multiple borrowers who share ownership in a business.

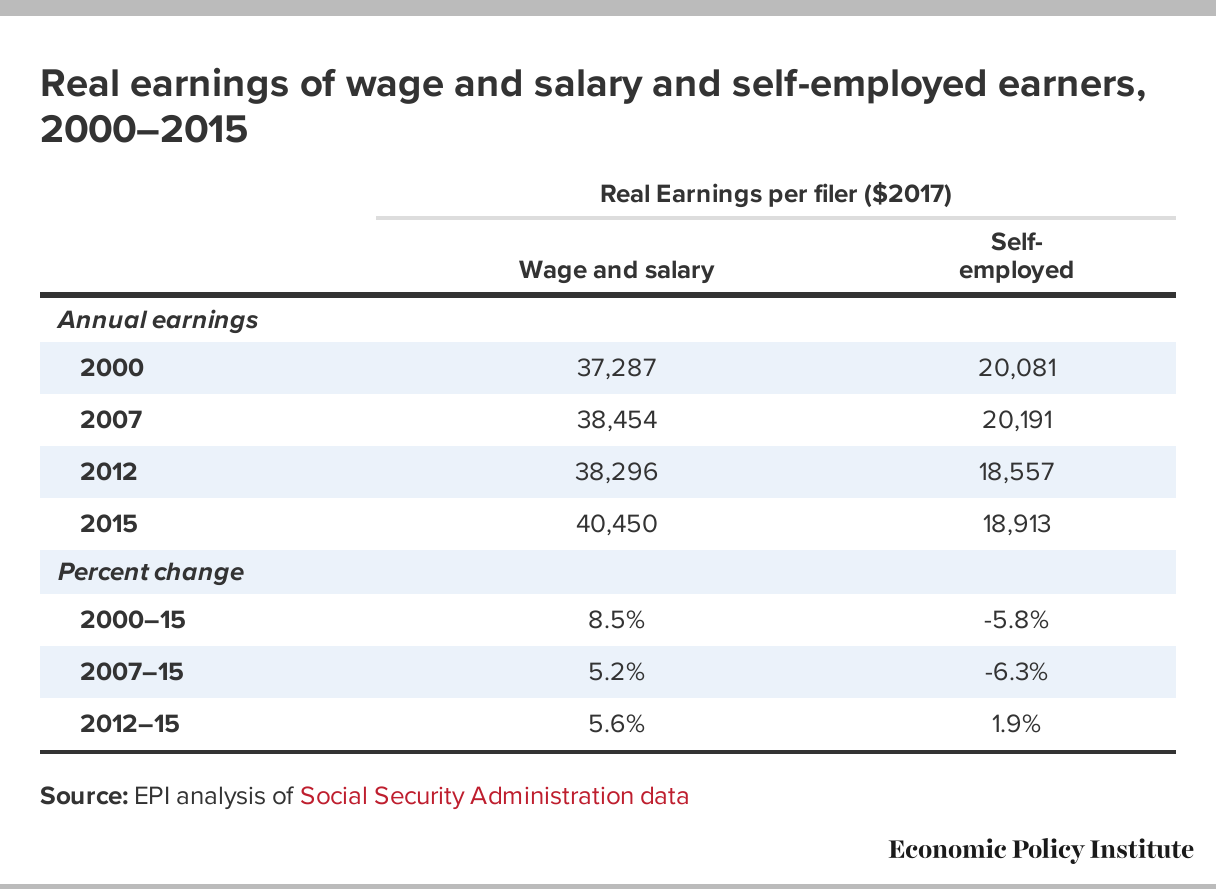

How To Calculate Self Employment Income for a Mortgage | 2021 For example, say year one the business income is $80,000 and year two $83,000. The income used for qualifying purposes is $80,000 + $83,000 = $163,000 then divided by 24 = $6,791 per month. Declining Self-Employed Income: But the lender also looks at something else when reviewing years one and two: consistency.

Cash Flow Analysis (Form 1084) - Fannie Mae Line 3a - Net Profit or Loss: Record the net profit or (loss) reported on Schedule C. Line 3b - Nonrecurring Other (Income) Loss/ Expense: Other income reported on Schedule C represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required.

Knowledge Base Solution - How can I get page 2 of the ... NOTE: Self employment entered in the return will automatically produce Schedule SE if net earnings above $400. Business Income: Go to the C-1 - Schedule C-Income.; In box 80 - Gross Receipts or sales, enter an amount.; Partnership Passthrough: Go to K-1 - K-1 General, Income, Deductions, Investment Interest and SE Information. In box 161 - Self-employment earnings (loss), if box 30 - K-1 ...

Knowledge Base Solution - How do I generate Schedule SE ... Self employment income entered will automatically produce Schedule SE if earnings are above $400. Business Income: Go to the Income/Deductions > Business worksheet. Select section 2 - Income and Cost of Goods Sold.. Enter line 1 - Gross Receipts or sales.; Partnership Passthrough:. Go to the Income/Deductions > Partnership Passthrough worksheet. Select section 1 - General.

46c47fef8fd0ce49ad0c46fe7ac2204e ... - Course Hero Worksheet for Figuring Net Earnings (Loss) From Self-Employment 1a Ordinary business income (loss) (Schedule K, line 1) 1a b Net income (loss) from certain rental real estate activities (see instructions) 1b c Other net rental income (loss) (Schedule K, line 3c) 1c d Net loss from Form 4797, Part II, line 17, included on line 1a, above.

1200. Net Earnings from Self-Employment To calculate the net earnings from self-employment, follow the steps below: Add up your total gross income as calculated under the income tax law. Include income from all your trades and businesses. Subtract all the deductions, including the allowances for depreciation that you are allowed when you calculate your income tax from the result in (A).

› publications › p560Publication 560 (2021), Retirement Plans for Small Business ... Distributions of other income or loss to limited partners aren't net earnings from self-employment. For SIMPLE plans, net earnings from self-employment are the amount on line 4 Schedule SE (Form 1040), Self-Employment Tax, before subtracting any contributions made to the SIMPLE plan for yourself.

achieverstudent.comAchiever Student: We always make sure that writers follow all your instructions precisely. You can choose your academic level: high school, college/university, master's or pHD, and we will assign you a writer who can satisfactorily meet your professor's expectations.

Self-Employed Borrower Tools by Enact MI Self-Employed Borrower Tools by Enact MI. We get it, mental math is hard. That's why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrower's average monthly income and expenses. Please note that these tools offer suggested guidance, they don't replace instructions or ...

Schedule K Line 14a (Form 1065) Calculating Self ... Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From Self-Employmentfrom page 41 of the 1065 form instructions. To generate Lacerte's version of the Self-Employment worksheet: Click on Settings. Click on Options. Select the Tax Returntab. Scroll down to the Federal Tax Options section.

5 Look at the Worksheet for Figuring Net Earnings Loss ... 5 Look at the Worksheet for Figuring Net Earnings Loss from Self Employment p 35 from ACC 645 at University of Miami

› main › OLTFreeOLT Supported Federal Forms - OLT.COM Student Loan Interest Deduction Worksheet: Worksheet Form 6251-Schedule 2, Line 1: Exemption Worksheet for Form 6251 line 5: State and Local General Sales Tax Deduction Worksheet: Mortgage Insurance Premiums Deduction Worksheet: Business use of your home (Simplified Method Worksheet) Capital Loss Carryover Worksheet: 28% Rate Gain Worksheet

Self-Employed Individuals - Calculating Your Own ... To calculate your plan compensation, you reduce your net earnings from self-employment by: the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and; the amount of your own (not your employees') retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss ... To enter Self-Employment Earnings (loss) from tax form Schedule K-1 (Form 1065) in TaxSlayer Pro from the Main Menu of the Tax Return (Form 1040) select: Income Menu; Rents, Royalties, Entities (Sch E, K-1, 4835, 8582) K-1 Input and select 'New' and double-click on Form 1065 K-1 Partnership which will take you to the K-1 Heading Information Entry Menu. If the initial K-1 entry was previously keyed in, double click on the entry in the K-1 pick list.

.png)

0 Response to "42 worksheet for figuring net earnings loss from self employment"

Post a Comment