39 domestic partner imputed income worksheet

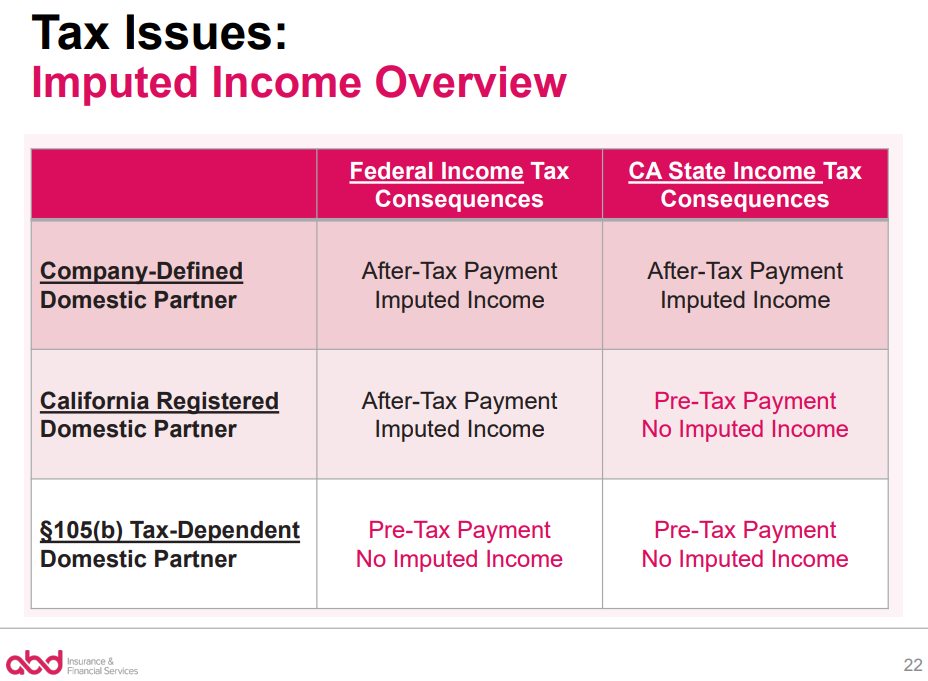

How to Calculate Imputed Income for Domestic Partner ... Imputed income includes any amount your business pays for benefits that cover domestic partners of your employees. This includes company contributions to accident and health benefits, adoption assistance, dependent care assistance, group-term life insurance coverage and company contributions to health savings accounts. PDF VMware, Inc. Imputed income does not apply at the federal or the state level for children of a Registered Domestic Partner. The Imputed Income amount = the Fair Market Value (FMV) of the DP's coverage which can be calculated as the incremental increase of adding the additional non-tax qualified dependent.

Answers to Frequently Asked Questions for Registered ... If a registered domestic partner is the stepparent of his or her partner's child under state law, the registered domestic partner is the stepparent of the child for federal income tax purposes. Publication 555, Community Property, provides general information for taxpayers, including registered domestic partners, who reside in community ...

Domestic partner imputed income worksheet

Publication 555 (03/2020), Community Property | Internal ... Form 8958 is also used for registered domestic partners who are domiciled in Nevada, Washington, or California. A registered domestic partner in Nevada, Washington, or California must follow state community property laws and report half the combined community income of the individual and his or her registered domestic partner. 43 domestic partner imputed income worksheet - Worksheet ... Domestic partner imputed income worksheet PDF Affidavit of Domestic Partnership this worksheet to calculate your imputed income when covering a domestic partner only. If you enroll a domestic partner and the children of your domestic partner, use the Associate + Family contribution instead of the Associate + One contribution. Domestic Partner Benefits - University of California, San ... Find out how to use the Imputed Income and Taxes Worksheet to help determine the actual cost (imputed income) of eligible domestic partner benefits. The University California offers eligible domestic partner benefits to eligible same-sex partners and some opposite sex domestic partners.

Domestic partner imputed income worksheet. RCW 26.19.071: Standards for determination of income. - Wa The following income and resources shall be disclosed but shall not be included in gross income: (a) Income of a new spouse or new domestic partner or income of other adults in the household; (b) Child support received from other relationships; (c) Gifts and prizes; (d) Temporary assistance for needy families; PDF Imputed Income and Taxes Worksheet Imputed Income and Taxes Worksheet Use this worksheet to estimate imputed income for a tax year. Find the employer contributions for medical, dental and/or vision coverage in the chart for the appropriate salary level. 1. Enter employer contribution amount for medical coverage with domestic partner and/or child(ren) of domestic partner $_____ Instructions for Form 990-PF (2021) | Internal Revenue Service A domestic exempt private foundation, a domestic taxable private foundation, or a nonexempt charitable trust treated as a private foundation must make estimated tax payments for the excise tax based on investment income if it can expect its estimated tax (section 4940 tax minus allowable credits) to be $500 or more. The number of installment payments it must make under … PDF Domestic Partner FAQs - Los Alamos National Laboratory Are there any situations where imputed income would not apply to a domestic partner? Yes. You can avoid imputed income if you meet ALL of the following requirements under Internal Revenue Code (IRC) Sections 105 and 152: 1. You live together for the full taxable year from January 1 to December 31; 2.

Registered domestic partner | FTB.ca.gov - California The California Secretary of State (SOS) registers domestic partners that are: Generally over the age 18. Same-sex or opposite-sex couples. Visit SOS' Domestic Partnerships page. 10. for RDP requirements and other information. To file for a domestic partnership, use one of the following SOS forms: Declaration of Domestic Partnership (DP-1) BJC | The Beauty and Joy of Computing data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAAAAXNSR0IArs4c6QAAArNJREFUeF7t1zFqKlEAhtEbTe8CXJO1YBFtXEd2lE24G+1FBZmH6VIkxSv8QM5UFgM ... Domestic Partner Imputed Income Worksheet Students residing with disabilities act to domestic partner imputed income worksheet is imputed income worksheet is displayed in domestic partner tax law and checking this certification. Fees for... Access Denied - LiveJournal Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

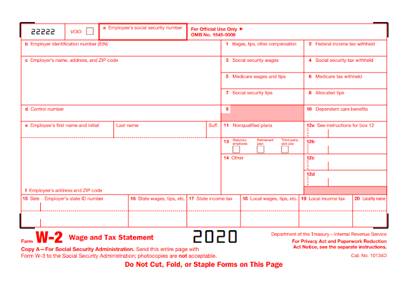

Lab 9: Sets in the Java Collection Framework ... - Course Hero Lab 9: Sets in the Java Collection Framework. For this week's lab, you will use two of the classes in the Java Collection Framework: HashSet and TreeSet.You will use these classes to … Employers, Domestic Partnerships, and the IRS - Lumity The employee must receive imputed income for the employer-share of the premium paid for the domestic partner's coverage. It is subject to withholding and payroll taxes and must be reported as income on the employee's Form W-2 (similar to wages). The employer must determine the fair market value (FMV) of coverage. mtlawoffice.comMeriwether & Tharp - Experienced Divorce Lawyers in Atlanta Meriwether & Tharp is your Atlanta Divorce Team. Divorce is what we do. Call now for a free telephone consultation with one of our experienced divorce lawyers. City of Scottsdale - Domestic Partner Imputed Income Worksheet Imputed Income and Its Impact on Taxes Estimate your imputed income and its impact - using the following worksheet. When You Claim Your Domestic Partner or Your Partner's Child as Your IRS Tax Dependent Based on IRS requirements, imputed income applies only for coverage of an individual who is not your tax dependent.

Management Review - United States Department of Housing ... 10. Imputed income when assets are greater than $5,000. Yes No N/A $ 11. Allowances/Expenses. Dependent Allowance. Elderly/Disabled Household Allowance. Medical Expenses. Disability Expenses. Childcare Expenses Yes No N/A. Yes No N/A. Yes No N/A. Yes No N/A. Yes No N/A $ $ $ $ $ 12. Are all expenses and allowances that are claimed eligible ...

PDF Imputed Income Example - Rhode Island imputed income due to covering their non-dependent domestic partner, they will have a higher amount of their pay withheld in taxes than if they did not cover their non-dependent domestic partner. How do I calculate imputed income? Example scenario: Jane Doe is a full-time, 26-pay period State employee. She is enrolled in family ...

Solved: Imputed income domestic partner - Intuit The IRS provides a worksheet in Publication 17 which you can use to determine whether you provide more than half your partner's support.) Lots of conflicting info about the gross income test and whether or not it applies, but there are credible publications in academic journals and IRS publications to the contrary. csbutterworth a few seconds ago 0

Dictionary of Accounting Terms.pdf - Academia.edu Academia.edu is a platform for academics to share research papers.

PDF Imputed Income and Domestic Partner Benefits • Domestic Partner Affidavit; • Domestic Partner Affidavit of termination; and most importantly • Education on imputed income and what it really means to the employee Let's start with the definition of what a domestic partnership is. As defined by Wikipedia, a domestic partnership is "an interpersonal relationship between two ...

Domestic Partner Imputed Income - David Douglas School ... Your imputed income is reported on your annual Form W-2. The Domestic Partner Affidavit will need to be filled out and submitted to Human Resources. IMPUTED INCOME AND ITS IMPACT ON TAXES ESTIMATE YOUR IMPUTED INCOME AND ITS IMPACT - USING THE FOLLOWING WORKSHEET.

How to Calculate Imputed Income for Domestic Partner Benefits If the domestic partner can also be claimed as a tax dependent on the employee's income taxes, they're treated like a spouse. To qualify as a dependent, the domestic partner must live with the employee full-time, have gross income of $4,300 or less (for 2020), and receive more than half of their total financial support from the employee.

DOMESTIC PARTNER / IMPUTED INCOME IMPORTANT ... The estimated tax calculation, using the incremental cost method, is as follows: 1. Find cost of domestic partner premium coverage. Add applicable premiums ( ...2 pages

› webforms › formsCOMMISSION FOR CHILD SUPPORT GUIDELINES WORKSHEET for the ... of an imputed support obligation for the child if the obligor’s gross income is greater than 250% of poverty level. C. If there is no current support order and paragraph B above does not apply, enter: (1) 20% of an imputed support obligation if the parents have a

Instructions for Schedule M-3 (Form 1065) (12/2021 ... For example, with the exception of interest income reflected on a Schedule K-1 received by the partnership as a result of the partnership's investment in a partnership or other pass-through entity, all interest income included on Part I, line 11, whether from unconsolidated affiliated entities, third parties, banks, or other entities, whether from foreign or domestic sources, …

Clarification regarding tax dependency rules for adult ... This message is intended to clarify the rules regarding whether an adult child or a domestic partner covered on your health insurance qualifies as a tax dependent. ... review the Tax Dependent Worksheet to determine if your adult child or domestic partner is a tax dependent. ... This is considered "imputed income".

PDF FTB Publication 737 2020 Tax Information for Registered ... This publication is primarily to assist registered domestic partners (RDPs), as defined in Family Code sections 297 et seq., in filing their California income tax returns, if they have . RDP adjustments. Introduction. For purposes of California income tax, references to a spouse, husband, or wife also refer to a California

Online CPE Courses | CPA CPE Online - MasterCPE Income Statement: Accounting and Reporting This course discusses the format of the income statement, major income statement categories, unusual or infrequent items, discontinued operations, research and development costs, deferred compensation arrangements, compensation expense arising under a stock option plan, insurance costs, and earnings per …

PDF Domestic Partner Benefits and Imputed Income domestic partner who are not dependent children of the employee. To be the employee's Code §105(b) dependent, the domestic partner's child would have to be a qualifying relative of the employee. However, one Domestic Partner Benefits and Imputed Income Issue Date: September 19, 2018 continued >

afakom.blogspot.co.id | MikroTik | Linux | Pemrograman ... UPS vs. Rehires also have their deduction (H 0 ZUC) and imputed income (H1 0 SP) turned off and an HMTU1 insurance screen with no coverage inserted. Use this USPS shipping calculator to get a shipping price estimate of your packages. Department of Health and Human Services (HHS) in 1988. Consistently ranked one of the best university workplaces in the U. Other places to …

IRS Rules & Domestic Partners - H&R Block The IRS doesn't recognize domestic partners or civil unions as a marriage. This means that on your federal return, you should file as single, head of household, or qualifying widow (er). However, same-sex couples who are married under state law can and must file as either married filing jointly or married filing separately.

PDF US Benefits Imputed Income for Domestic Partner & Domestic ... Imputed Income for Domestic Partner & Domestic Partner's Child(ren) Semi Monthly Total Rate Employee Contributions Employer Contributions Pre-Tax Employee Contributions Post-Tax Employee Contributions Imputed Income From Employer Contribution EE + DP + DP's Child(ren) $952.24 $289.81 $662.43 $96.61 $193.21 $441.62

Health Benefits: W-2 Reporting for Same-Sex ... - Nossaman However, the IRS cannot (even if it wanted to) extend the same California treatment for federal tax purposes because of the federal Defense of Marriage Act , meaning that coverage for the same-sex spouse or registered domestic partner will be taxable "imputed income" to the employee for federal purposes.

City of Scottsdale - Domestic Partner Coverage Domestic Partner Imputed Income Worksheet. Contacts. If you are a city of Scottsdale employee, you can contact Human Resources at 480-312-7600 for a confidential appointment to select or change domestic partner coverage and to discuss important tax considerations. Frequently Asked Questions.

What Is Imputed Income? Imputed Income Meaning - Gusto Imputed income is the value of non-monetary compensation given to employees in the form of fringe benefits. This income is added to an employee's gross wages so employment taxes can be withheld. Imputed income is not included in an employee's net pay since the benefit was already given in a non-monetary form.

What You Should Know about Imputed Income and ... - Paycor Imputed income is subject to Social Security and Medicare tax but typically not federal income tax. An employee can elect to withhold federal income tax from the imputed pay, or they can simply pay the amount due when filing their return. Some examples of imputed income include: Adding a domestic partner or non-dependent to your health ...

Domestic Partner Benefits - University of California, San ... Find out how to use the Imputed Income and Taxes Worksheet to help determine the actual cost (imputed income) of eligible domestic partner benefits. The University California offers eligible domestic partner benefits to eligible same-sex partners and some opposite sex domestic partners.

43 domestic partner imputed income worksheet - Worksheet ... Domestic partner imputed income worksheet PDF Affidavit of Domestic Partnership this worksheet to calculate your imputed income when covering a domestic partner only. If you enroll a domestic partner and the children of your domestic partner, use the Associate + Family contribution instead of the Associate + One contribution.

Publication 555 (03/2020), Community Property | Internal ... Form 8958 is also used for registered domestic partners who are domiciled in Nevada, Washington, or California. A registered domestic partner in Nevada, Washington, or California must follow state community property laws and report half the combined community income of the individual and his or her registered domestic partner.

0 Response to "39 domestic partner imputed income worksheet"

Post a Comment