39 self employed expenses worksheet

Self-employed business expenses: all you need to know | QuickBooks... If preparing you self employed business expenses for Self Assessment still feels a bit daunting, you could get expert advice from a QuickBooks certified accountant listed in our ProAdvisor Directory. Found this article about self-employed business expenses useful? Using software like QuickBooks... Self Employment Expenses Worksheet - Escolagersonalvesgui Self employment expenses worksheet. My first year of side hustling i did a good job tracking my income but not so much on expenses. Read about 15 tax deductions and benefits that are available to the self employed worker.

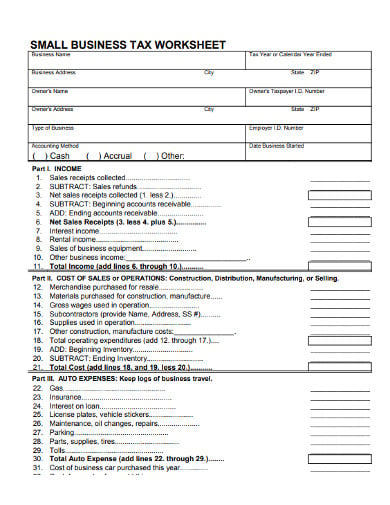

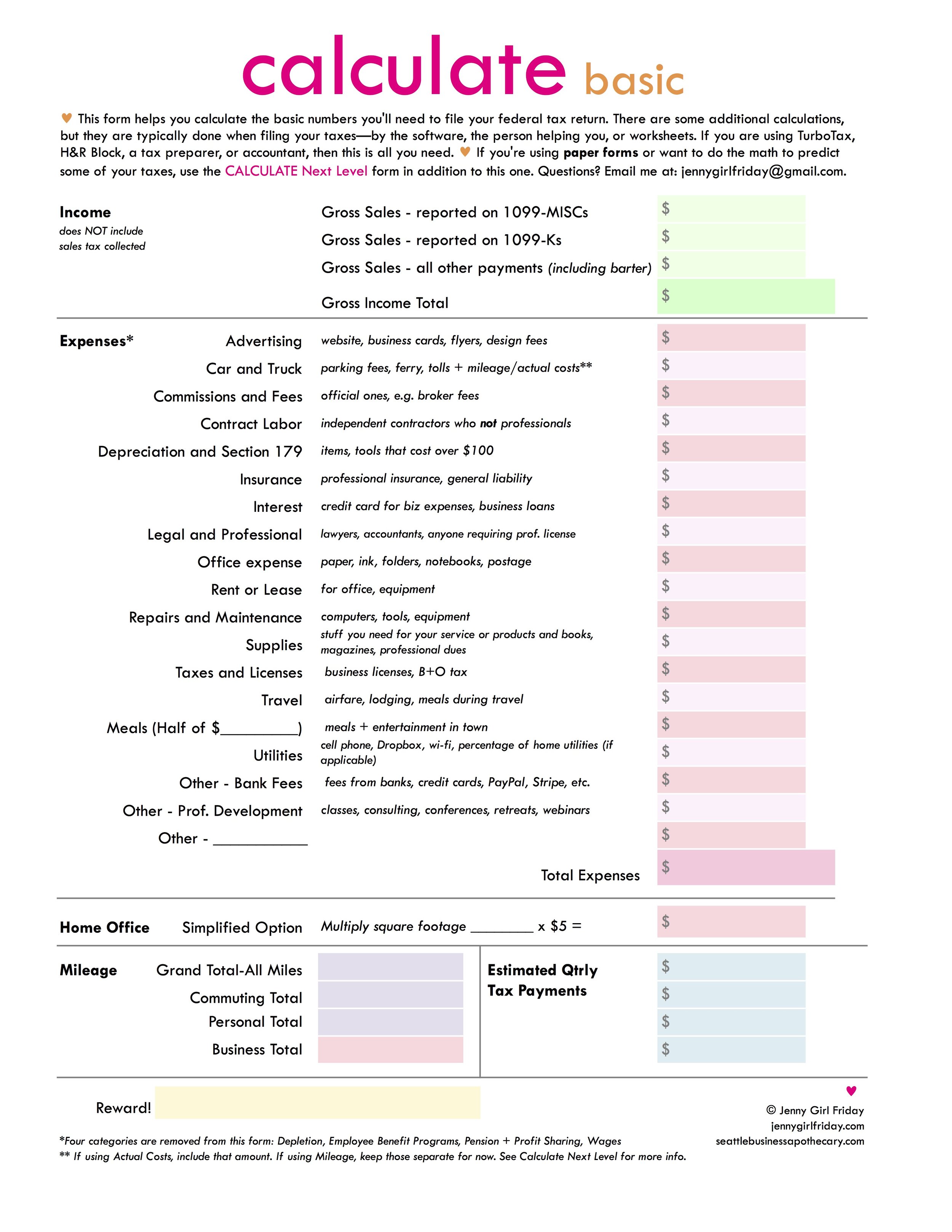

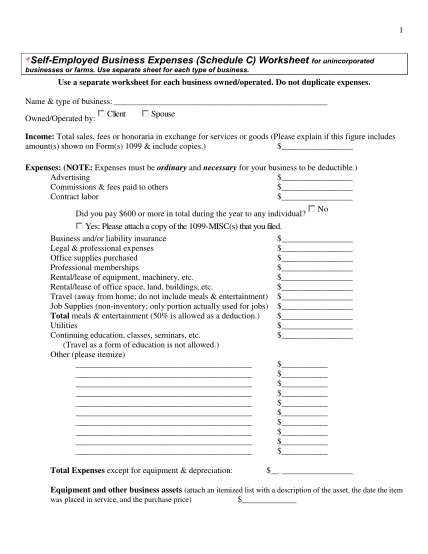

Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

Self employed expenses worksheet

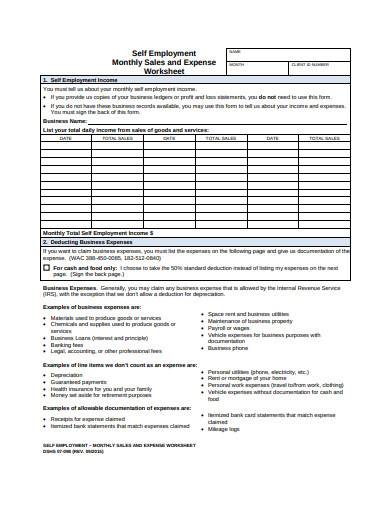

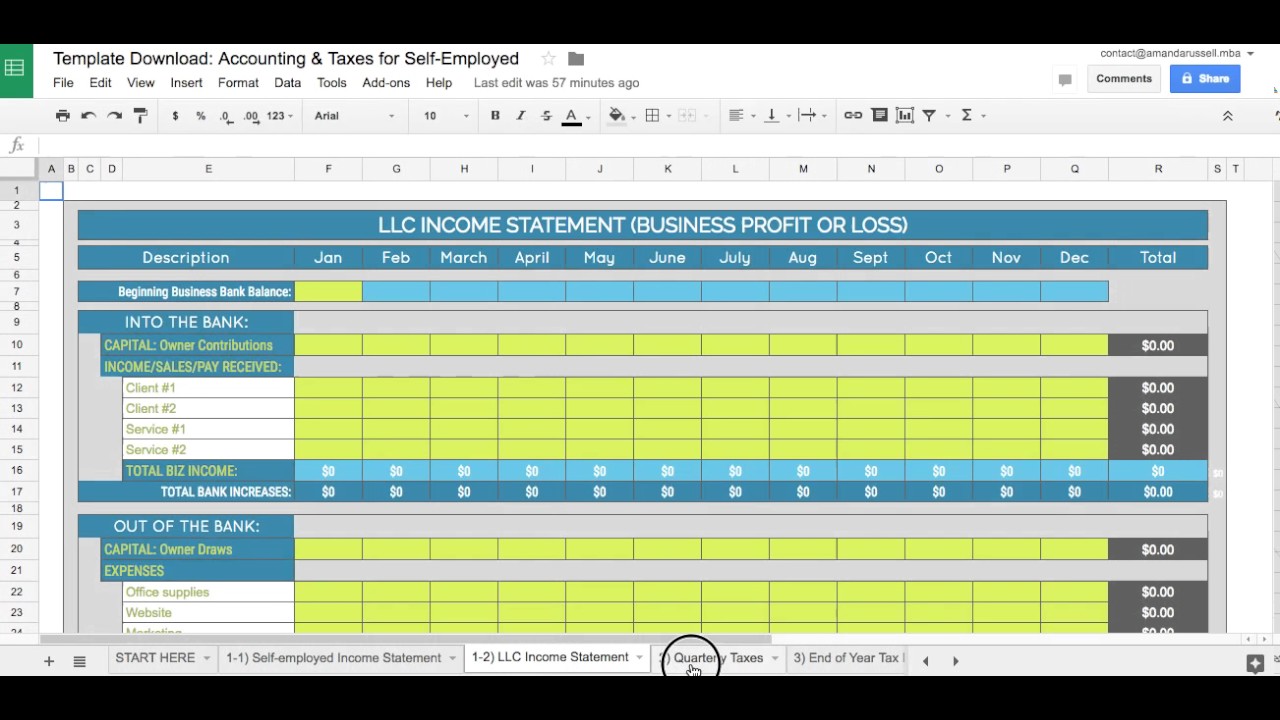

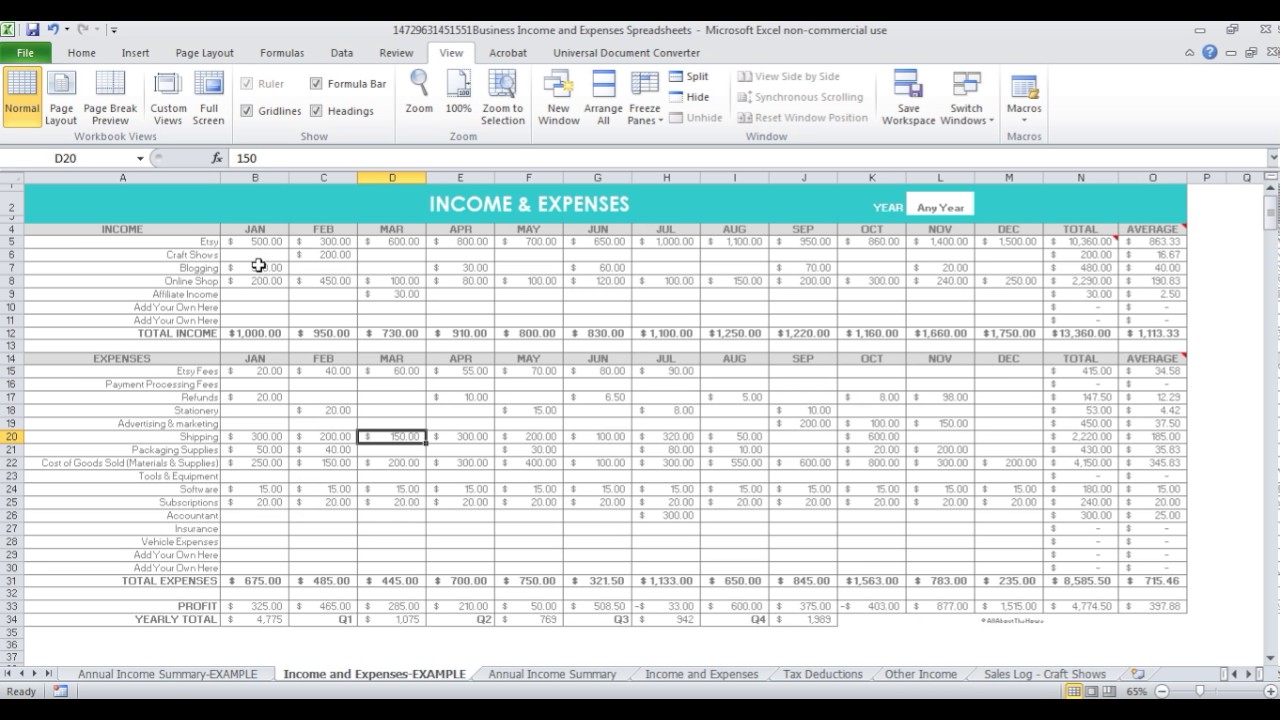

Self-Employed Individuals – Calculating Your Own ... Nov 05, 2021 · If you are self-employed (a sole proprietor or a working partner in a partnership or limited liability company), you must use a special rule to calculate retirement plan contributions for yourself.. Retirement plan contributions are often calculated based on participant compensation. For example, you might decide to contribute 10% of each participant's compensation to your … 5. Self Employment Monthly Sales and Expense Worksheet 4. Self-Employed Business Expenses Worksheet. 5. Self Employment Monthly Sales and Expense Worksheet. 8. Employee Business Expenses Worksheet Template. 9. Small Business Tax Worksheet Sample. Self Employed Expense Sheet Excel Details: (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Schedule C Expense Excel Template. Self Employed Expenses Spreadsheet Free and Independent Contractor Deductions List.

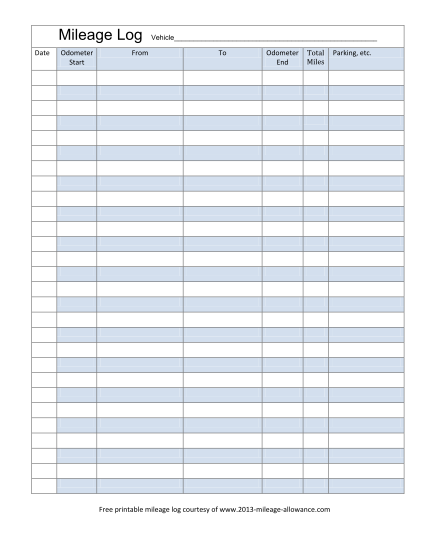

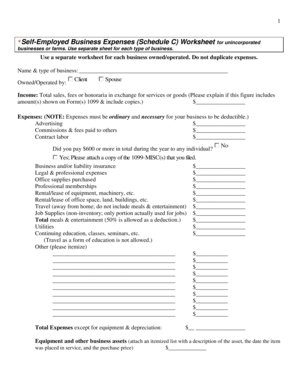

Self employed expenses worksheet. Schedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date … PDF Self employed expenses worksheet Self-employment offers a lot in the way of tax perks and personal gratification, but it doesn't allow you to deduct commuting expenses. Given the Internal Revenue Service's definition of commuting, however, you can still claim some helpful deductions for your business-related driving and miles. PDF Microsoft Word - Monthly_Expenses_Worksheet.doc Monthly Expenses Worksheet. How do you typically spend your money? Other. If self-employed, business expense. Calculate Your Total Monthly Expense: Total from Column A Self-Employed Borrower Tools by Enact MI We get it, mental math is hard. That’s why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrower’s average monthly income and expenses. Please note that these tools offer suggested guidance, they don’t replace instructions or applicable guidelines from the GSEs.

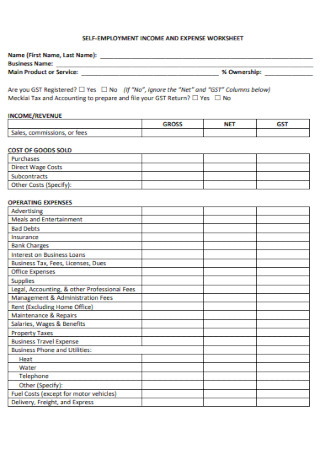

Self Employed Business Expenses Worksheet Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c's business name (if any). Expenses related to entire home including business portion (indirect). 12+ Business Expenses Worksheet in... | Free & Premium Templates self-employed business expenses worksheet. The management of the income and the expenses that are to be managed and kept records of in the Then add on the formulas in the worksheet of the business expenses so that you might keep the record for it. Step 4: Comparing Income to the... (Schedule C) Self-Employed Business Expenses Worksheet for .. Mar 09, 2018 · (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. SELF EMPLOYMENT INCOME WORKSHEET Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). - Income Taxes (federal, state, and local ). EXPENSES:.2 pages

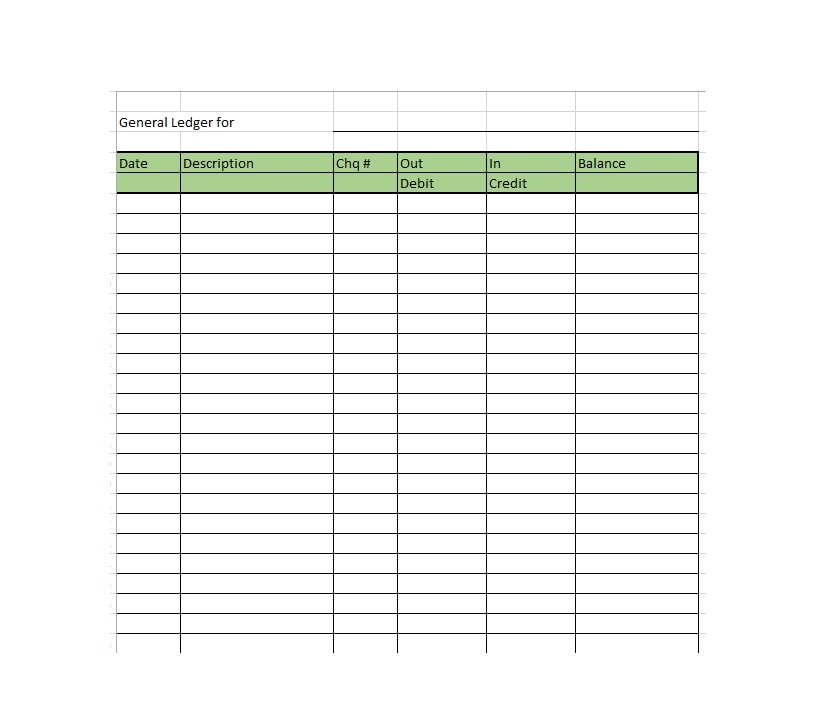

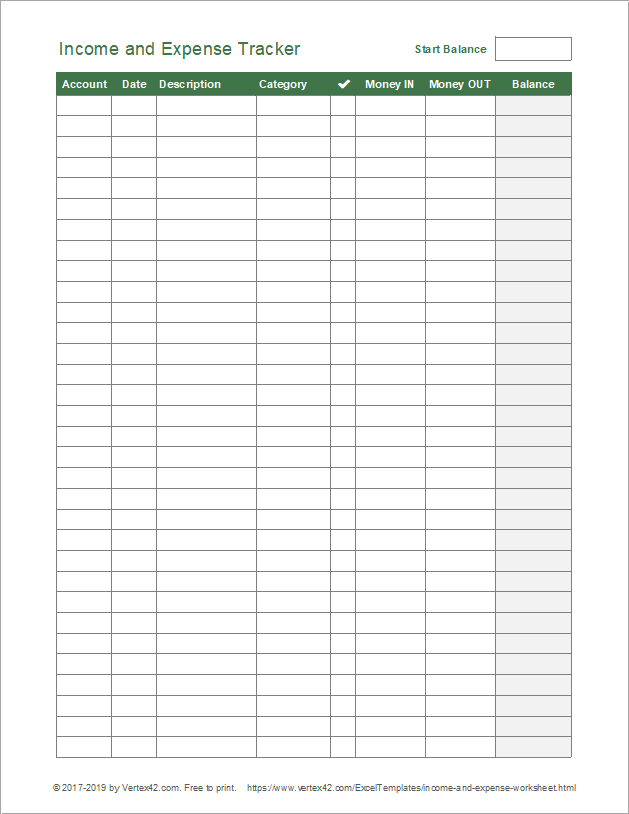

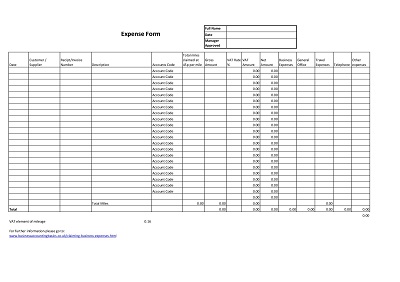

Self-employed health insurance deduction - healthinsurance.org Dec 16, 2021 · Key takeaways. For the self-employed, health insurance premiums became 100% deductible in 2003. The deduction that allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.; If you have an S-corp, you should be aware of a 2015 notice regarding reimbursement for health … 39 self employed expenses worksheet - Worksheet Resource Fill self employed expense spreadsheet: Try Risk Free ... Get, Create, Make and Sign excel spreadsheet for self employed expenses. Get Form. Self Employed Expense Worksheet - Promotiontablecovers. Title pretty much says it. Free Excel Bookkeeping Templates | 3. Expense Form Template 3. Expense Form Template. This excel bookkeeping template is a cash book specifically for tracking income and expenses off a credit card. We tell you how to calculate that and include it in the template so that the total claimable is automatically worked out. Income And Expense Worksheet For Self Employed All posts tagged in: income and expense worksheet for self employed. About Complete Income and Expense Tracker System using .. June 25, 2021.

Self Employed Expense Sheet Drivers › Get more: Self employed expenses pdfDetail Drivers. Complete List of Self-Employed Expenses and Tax … Details: (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business.

Simplified Option for Home Office Deduction | Internal ... May 11, 2021 · Actual expenses determined and records maintained: Home-related itemized deductions claimed in full on Schedule A: Home-related itemized deductions apportioned between Schedule A and business schedule (Sch. C or Sch. F) No depreciation deduction: Depreciation deduction for portion of home used for business: No recapture of depreciation upon ...

(Schedule C) Self-Employed Business Expenses Worksheet … Mar 09, 2018 · (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ...

Claiming the Self-Employment Health Insurance Tax Deduction Dec 30, 2019 · How to Claim the Deduction If You're Self-Employed . If you have self-employment income, you can take the deduction for health insurance expenses incurred for yourself, your spouse, and your dependents. Self-employment income is reported on Schedule F if you're a farmer or Schedule C for other sole proprietors.

Use this worksheet to record your monthly income and ... Use this worksheet to record your monthly income and expenses from self-employment. Track gas and vehicle expenses for your budget, but business mileage will be needed for your taxes. Use our SETO (Self-Employed Tax Organizer) to calculate the annual totals (including business mileage)...

Self Employed Expense Worksheet - Nidecmege Self Employed Expense Worksheet. Written By Tri Margareta Tuesday, April 23, 2019 Add Comment Edit. A lender may use fannie mae rental income Free Income And Expense Report Template Self Employed Spreadsheet. If you made the deduction on schedule c or made and deducted more than...

50+ SAMPLE Expense Worksheets in PDF | MS Word 50+ Sample Expense WorksheetsWhat Is an Expense Worksheet?Who Can Use Expense Worksheets? Self-employed people also need to pay for manpower and wages. And almost all businesses need a reliable and steady flow of supplies.

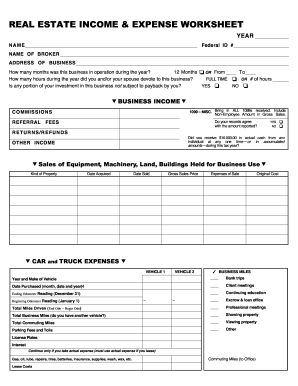

› uploads › 2015SELF-EMPLOYED INCOME AND EXPENSE WORKSHEET self-employed income and expense worksheet taxpayer name ssn principal business or profession business name employer id number business address business entity (circle one) individual spouse joint business city, state, zip code income expenses $ gross receipts or sales $ advertising $ returns & allowances auto & travel $ $

Use Of Home As An Office | Claiming Home Office Expenses If you are self-employed and use the home as an office, you can claim expenses. There are two methods of calculating your claim. Our home office deduction worksheet in Excel is an easy to use template. The download is available at the bottom of this page.

Self employed expenses: what can I claim on tax returns? Self-employed expenses calculator. You need to rely on your tax records when calculating your allowable expenses - the figures will be unique to your business. It's a case of adding up your expenses from your bills and receipts, so it's important that you keep them all, otherwise you might...

PDF Common Unreimbursed Business Expenses Worksheet BusinessExpensesWorksheetTY19. IRS Codes. Common Unreimbursed Business Expenses Worksheet for Self-employed, Landlords, Employees Number of Personal Use Days. Employees With Business Expenses. The Miscellaneous Itemized deductions subject to 2% floor has been...

› sites › defaultSelf Employment Monthly Sales and Expense Worksheet SELF EMPLOYMENT – MONTHLY SALES AND EXPENSE WORKSHEET DSHS 07-098 (REV. 09/2015) Worksheet Self Employment Monthly Sales and Expense NAME MONTH CLIENT ID NUMBER 1. Self Employment Income You must tell us about your monthly self employment income. • If you provide us copies of your business ledgers or profit and loss statements, you do not

IRS Business Expense Categories List [+Free Worksheet] 11. Self-employed health insurance: If you are self-employed, payments made for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents are deductible. The premiums are not deductible on Schedule C like other business expenses, but rather Form 1040...

Self-Employed Expense Worksheet self employed expense sheet employment tax expenses spreadsheet worksheets excel regarding sample db. Restaurant Expenses Spreadsheet regarding Self Employed ... Self-Employed Expense Worksheet Mobile DJ.

Self-Employed Tax Deductions Worksheet (Download FREE) If you are concerned with how much you'll owe, don't worry. The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

15 Tax Deductions and Benefits for the Self-Employed Self-Employment Tax. Self Employed Contributions Act (SECA). Tax Deductions and Benefits. The self-employment tax refers to the Medicare and Social Security taxes that self-employed people In addition to the office space itself, the expenses that you can deduct for your home office include the...

Self Employed Business Expenses Worksheet - Worksheet List For self employed individuals these are expenses that are seen as ordinary and necessary for conducting business. Expense Log Template Self Employed Tax Deductions Worksheet. Expense Worksheet Template Spreadsheet Business Income And Templ.

Top 5 Self Employed Expenses Spreadsheet Templates free to... Self-employed Business Expenses (schedule C) Worksheet For For Unincorporated Businesses Or Farms. Self Employed Revenues And Expenses List Template - Rogerdeanmaidment.

SELF-EMPLOYMENT WORKSHEET Deductible Expense: Advertising. Car/Truck Expenses. Commissions/Fees. Contract Labor. Depletion. Depreciation. Employee Benefit Programs. Insurance.1 page

tax year 2020 Part 1: Business Income and Expenses Schedule C Worksheet for Self-Employed Filers and Contractors – tax year 2020. This document will list and explain the information and documentation that we ...6 pages

Free expenses spreadsheet for self-employed Get a free self-employed expenses spreadsheet or use Bonsai to track your expenses for free. We've built it to help you get peace of mind and get on with your work. You can also use Bonsai for free to automatically keep track of all your expenses online and be prepared for tax season.

Which Receipts for Self Employed Expenses Should You Save for... 1. What Are Self-Employed Expenses? Before you can start saving receipts and tracking However, many self-employed workers mistakenly believe they have a home office because they work from The easiest way to track business expenses is to use a receipt tracker or an expenses worksheet.

Deductions: employee and self-employed expenses | Quizlet self-employment persons must pay BOTH employer and employee portions of FICA and unemployment taxes. expenses while "away from tax home" at least OVERNIGHT on business. includes transportation, lodging, meals, and miscellaneous expenses. "tax home" generally means...

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The ... A self-employed borrower’s share of Partnership or S Corporation earnings can only be considered if the lender obtains ... Deduct the expenses related to royalty income used in qualifying the borrower.

Self Employed Expense Sheet Excel Details: (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Schedule C Expense Excel Template. Self Employed Expenses Spreadsheet Free and Independent Contractor Deductions List.

5. Self Employment Monthly Sales and Expense Worksheet 4. Self-Employed Business Expenses Worksheet. 5. Self Employment Monthly Sales and Expense Worksheet. 8. Employee Business Expenses Worksheet Template. 9. Small Business Tax Worksheet Sample.

Self-Employed Individuals – Calculating Your Own ... Nov 05, 2021 · If you are self-employed (a sole proprietor or a working partner in a partnership or limited liability company), you must use a special rule to calculate retirement plan contributions for yourself.. Retirement plan contributions are often calculated based on participant compensation. For example, you might decide to contribute 10% of each participant's compensation to your …

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b30151dff905f0198f6a_1099-template-excel.png)

![Business Accounting: Income and Expenses [Self Employed Accounting Spreadsheet Template]](https://i.ytimg.com/vi/As6h2lcssCI/maxresdefault.jpg)

0 Response to "39 self employed expenses worksheet"

Post a Comment