39 self employment expenses worksheet

PDF Employment/Commission Expense Worksheet Employment/Commission Expense Worksheet. GUIDELINES/INSTRUCTIONS: If you were eligible to deduct employment expenses as an employee/commissioned salesperson, please provide us with the following information to assist in preparing your tax returns PDF Self-employment Worksheet SELF-EMPLOYMENT WORKSHEET. Please provide 3 months of all self-employment gross monthly income and expenses: Applicant Name (First & Last Name). Date of Birth.

Self Employment Expenses List Economic There self employment expenses worksheet. › Verified 3 days ago. Details: Beyond economic resilience, self-employment also helps workers cope with unexpected expenses. Using special access to individual bank data, JP Morgan Chase found that workers with income from.

Self employment expenses worksheet

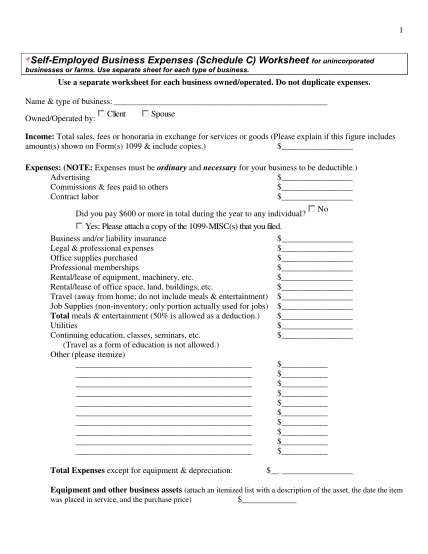

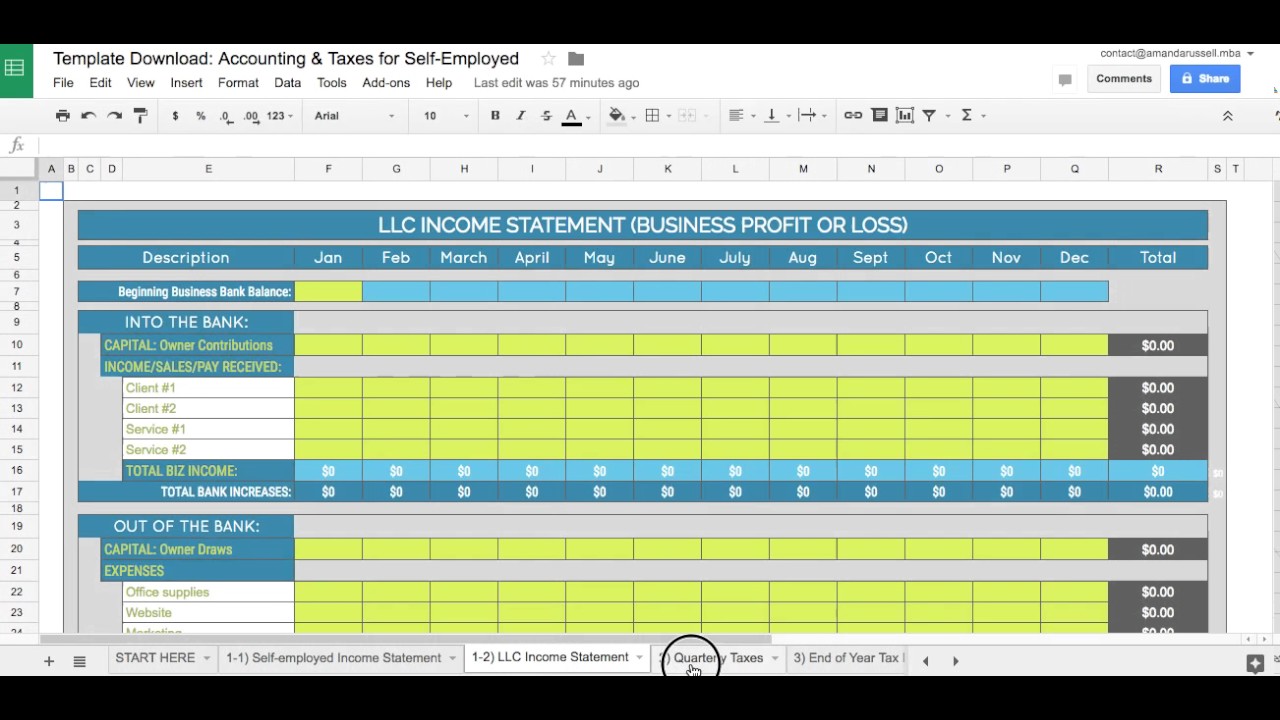

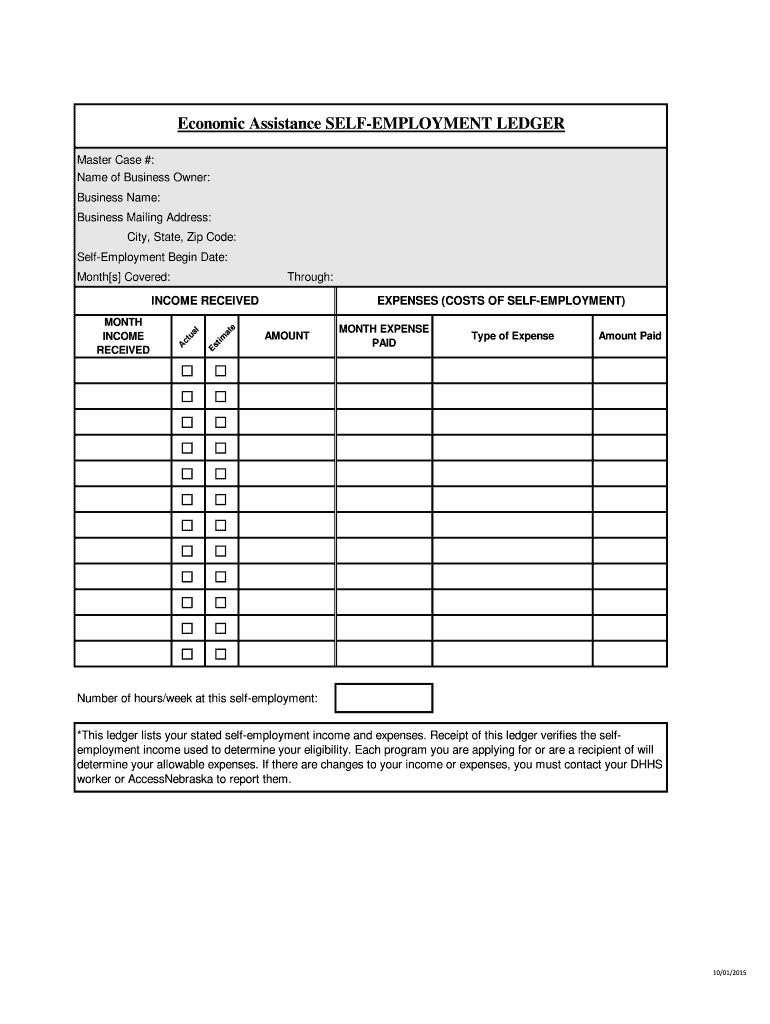

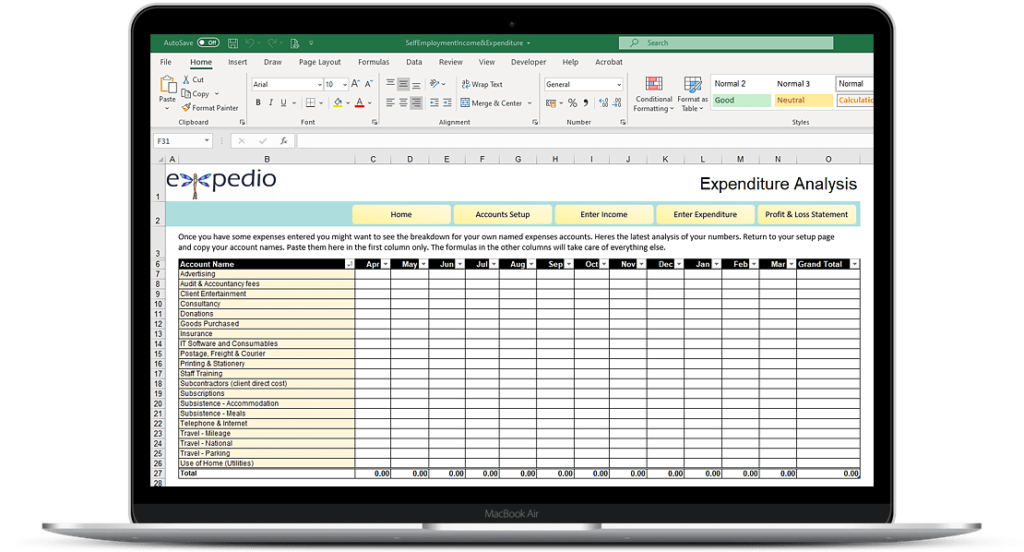

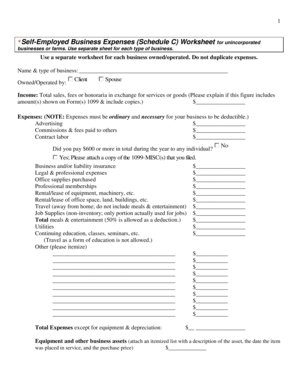

15 Tax Deductions and Benefits for the Self-Employed Self-Employment Tax. Self Employed Contributions Act (SECA). Tax Deductions and Benefits. In addition to the office space itself, the expenses that you can deduct for your home office include the business percentage of deductible mortgage interest, home depreciation, utilities, homeowners... Self Employment Expense Template, Jobs EcityWorks 7 Self-employment Ledger Templates A person who is self-employed is entitled to pay self-employment taxes and must be in possession of a self-employment ledger. (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Self Employed Expense Sheet Self Employed Expense Sheet! study focus room education degrees, courses structure, learning courses. Education. 3 days ago Self Employed Tax Deductions Worksheet. Fill out, securely sign, print or email your self employment income expense tracking worksheet form instantly with SignNow.

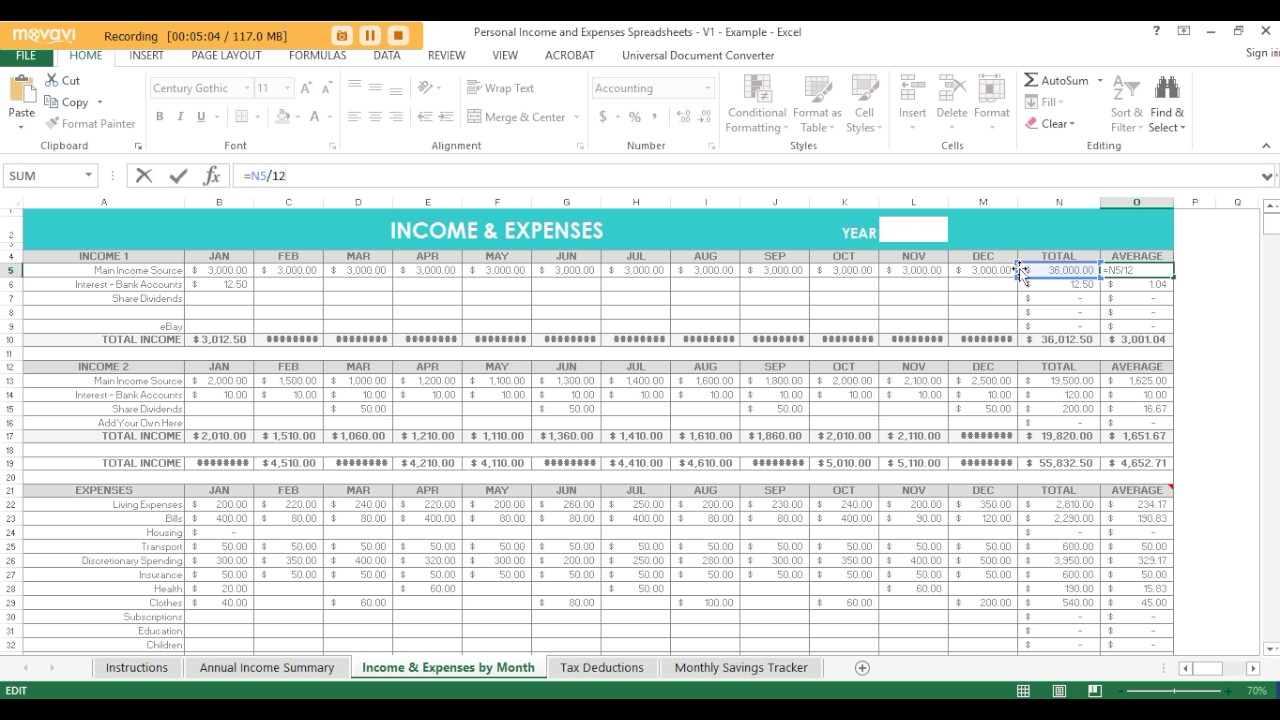

Self employment expenses worksheet. PDF Self-employment expense worksheet Self-employment expense worksheet. Applicant's name: _Name of self-employed person: _ Name of business... PDF Use our SETO (Self-Employed Tax Use this worksheet to record your monthly income and expenses from self-employment. Self-employment taxed is calculated on net income. For more elaborate tracking of income and expenses, try one of these free budgeting apps: Mint, Wave, or Outright (which features a Schedule... 15 Best Images of Self -Employment Expense Worksheet - Tax... While we talk about Self -Employment Expense Worksheet, scroll the page to see particular related images to add more info. tax deduction worksheet, tax itemized deduction worksheet and cleaning schedule log template are three of main things we will show you based on the post title. 16 amazing tax deductions for independent contractors | NEXT Feb 15, 2022 · 14. Self-employment tax deduction. When filling out your tax form as a self-employed worker, self-employment taxes can be something of a shock. That’s because you're paying both the employer and employee sides of Social Security tax and Medicare taxes—that’s a tax rate of 15.3% of net earnings.

Income Calculations - Freddie Mac for self-employed Borrowers as described in Chapters 5304 and 5305. I. Income Calculations from IRS Form 1040 IRS Form 1040 Federal Individual Income Tax Return Year: Year: 1. W-2 Income from self-employment (reported on IRS Forms 1040 and 1120 or 1120S) Name of business: _____ Self Employment Expenses Worksheet - Escolagersonalvesgui Self employment expenses worksheet. My first year of side hustling i did a good job tracking my income but not so much on expenses. Self employment monthly sales and expense. Running your own business has both personal and financial perks but also poses a large degree of risk. PDF Worksheet for employment expenses EMPLOYMENT EXPENSES T2200 If you are employed and your employer has given you a T2200 Conditions of Employment, you may be able to deduct the following expenses. Please fill in the amounts listed on this form and attach your T2200. 8+ Income & Expense Worksheet... | Free & Premium Templates / 8+ Income & Expense Worksheet Templates. You need to be able to budget your income and your expenses. That is why it is best to make use of income and expense worksheets, and this article features some great sheet examples you can use.You may also see budget planner template.

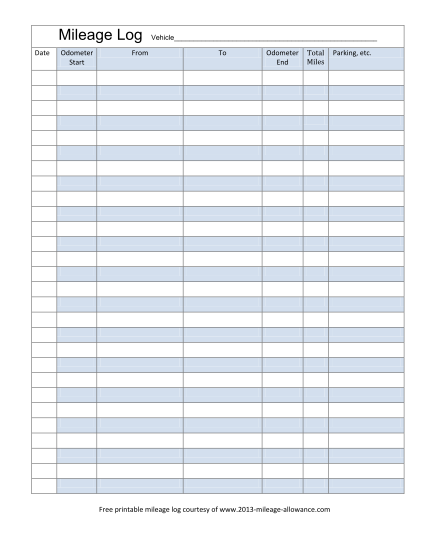

PDF Employment Expenses Worksheet Employment Expenses Worksheet -. Salaried & Commission Based Employees. For the year: 20 __. Parking Supplies Telephone Salaries paid to an assistant Office Rent (if required as a condition of employment) Home Office Expenses (To be summarized in the following table) Vehicle Expenses... 1040-SS U.S. Self-Employment Tax Return - IRS tax forms U.S. Self-Employment Tax Return (Including the Refundable Child Tax Credit for Bona Fide Residents of Puerto Rico) Department of the Treasury Internal Revenue Service U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of the Northern Mariana Islands, or Puerto Rico. OMB No. 1545-0090 35 Self Employment Expenses Worksheet - support worksheet Self Employed Worksheet - When it comes to you wanting to arranged goals for yourself presently there are several ways in which this could be Self employment expenses worksheet. Pdf Writing Off Business Expenses Writing Pdf Pdfprof Com. Free Excel Templates For Small Business Owners. Are Medical Expenses Tax Deductible? - TurboTax Feb 17, 2022 · Pays for itself (TurboTax Self-Employed): Estimates based on deductible business expenses calculated at the self-employment tax income rate (15.3%) for tax year 2020. Actual results will vary based on your tax situation.

Self Employed Expense Sheet Excel › Get more: Self employed monthly expense worksheetShow All. (Schedule C) Self-Employed Business Expenses Worksheet for. Excel. Details: Self Employed Business Expenses Worksheet. Fill out, securely sign, print or email your self employment income expense tracking worksheet form...

PDF Employment expenses worksheet Then open with a PDF reader such as Adobe to activate the SAVE capabilities. Employment expenses worksheet. Provide a copy of the T2200 declaration of conditions of employment completed and signed by your employer - we cannot file your...

Self Employment Expense Template - Free Catalogs A to Z Category: Self employment income worksheet template Show details. Self-Employment Ledger: 40 FREE Templates & Examples. 6 hours ago Self Employment Income and Expense Statement free download and preview, download free printable template samples in PDF, Word and Excel formats.

(Schedule C) Self-Employed Business Expenses Worksheet for .. (Self-employed individuals should use the Self Employment Worksheet instead.) Educator Expenses : For teachers, aides, instructors, counselors, or principals. You must be employed at a grade school or high school, work at least 900 hours during the school year, and have unreimbursed expenses for...

The ultimate guide to tax deductions for the self-employed - Article Finally, self-employed individuals deduct business expenses on Schedule C of Form 1040. These expenses include advertising, utilities and other One of your biggest costs may be for health insurance coverage. Self-employment health insurance deduction. Most full-time employees receive...

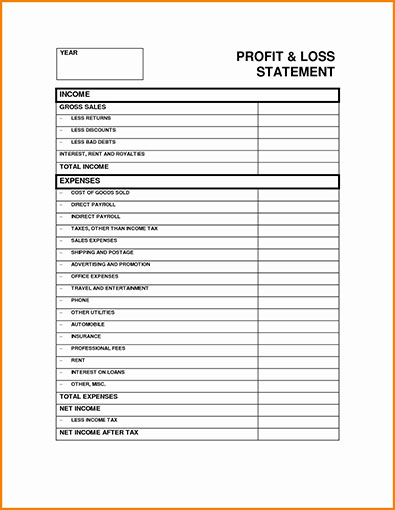

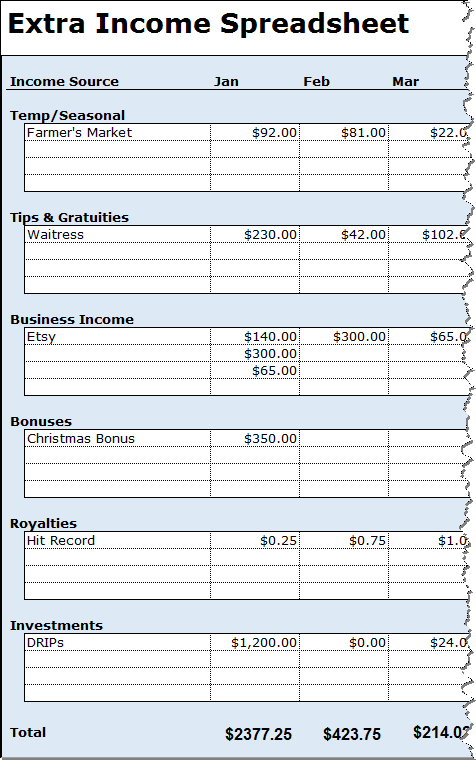

4. Self-Employed Business Expenses Worksheet 4. Self-Employed Business Expenses Worksheet. 5. Self Employment Monthly Sales and Expense Worksheet. Fill out the given components which include Self Employment Income, Deducting Business Expenses, Expenses, Business Mileage.

Self Employed Tax Preparation Printables - Instant Download - Small Business Expense Tracking - Accounting

Self Employment Expense Template Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes.

PDF Excel Spreadsheet For Self Employed Expenses Self-Employment some Cash Accounting Worksheet. If you treat new haven having a blog or any purpose-employed business hold may. Many working performers are considered self-employed regarding filing their taxes. Self Employed Monthly Expense Template Excel.

PDF FoxTax-Organizers-2020-R3-01 | 1099-MISC / SELF-EMPLOYMENT EXPENSES. 1099-MISC / SELF-EMPLOYMENT. W2. Advertising: Promo, Website costs, etc. (Anything for promotion of business). See per diem worksheet. Wages Paid to Others (Provide details on payroll and payroll taxes). Bank and Credit Card Charges (On business accounts).

Self Employment Expense Worksheet | Printable Worksheets and... Self Employment Expense Worksheet If you don t have a previous tax return to use or you think you may be eligible for medicaid this worksheet can don t forget to deduct self employment expenses it is important to be Examples wages salaries commissions self employment income such as educator...

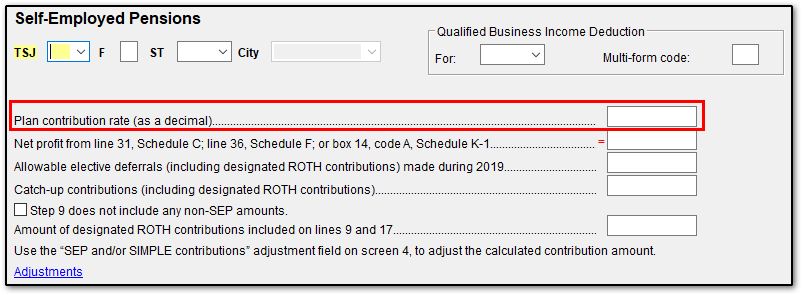

Self-Employed Individuals Tax Center | Internal Revenue Service Self-employed individuals generally must pay self-employment tax (SE tax) as well as income tax. SE tax is a Social Security and Medicare tax You do this by subtracting your business expenses from your business income. If your expenses are less than your income, the difference is net profit and...

PDF 2021 Worksheet - Self-Employment & Auto Expense 2021 Worksheet - Rental Income & Expense. 2021 Worksheet - Self-Employment & Auto Expense. Property Address

Self-Employed Expense Worksheet Self-Employed Expense Worksheet. Small Business Tax Deductions Worksheet | Small business ... self employed expense sheet employment tax expenses spreadsheet worksheets excel regarding sample db.

Self-employed mortgage borrower? Here are the rules Jan 21, 2022 · For self–employed borrowers, FHA also requires a two–year self–employment history – or one year of self–employment, plus two years in a related role with similar income.

Publication 535 (2021), Business Expenses | Internal Revenue ... Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. Other coverage. Effect on itemized deductions. Effect on self-employment tax. How to figure the deduction. Health coverage tax credit. More than one health plan and business. Nondeductible Premiums; Capitalized Premiums. Uniform ...

PDF Self-Employment Worksheet Instructions Self-Employment Worksheet Instructions. 1) Write your name and your business name at the top of the worksheet. 2) Please provide a bank statement Self-Employment Expense Worksheet. Business income MUST be verified with a business bank statement, receipts, or other documentation.

PDF Self Employment Monthly Sales and Expense Worksheet Monthly Total Self Employment Income $. 2. Deducting Business Expenses. • Itemized bank card statements that match expense claimed. • Mileage logs. Self employment - monthly sales and expense worksheet dshs 07-098 (rev.

Self Employment Expense Form › Get more: Self employment expenses worksheetDetails Post. Self employed income/expense sheet. › Get more: Self employed monthly expense worksheetDetails Post. (Schedule C) Self-Employed Business Expenses Worksheet for.

Self Employed Expense Sheet Self Employed Expense Sheet! study focus room education degrees, courses structure, learning courses. Education. 3 days ago Self Employed Tax Deductions Worksheet. Fill out, securely sign, print or email your self employment income expense tracking worksheet form instantly with SignNow.

Self Employment Expense Template, Jobs EcityWorks 7 Self-employment Ledger Templates A person who is self-employed is entitled to pay self-employment taxes and must be in possession of a self-employment ledger. (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors.

15 Tax Deductions and Benefits for the Self-Employed Self-Employment Tax. Self Employed Contributions Act (SECA). Tax Deductions and Benefits. In addition to the office space itself, the expenses that you can deduct for your home office include the business percentage of deductible mortgage interest, home depreciation, utilities, homeowners...

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1)

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

![Free Household Budget Worksheet [Excel, Word, PDF] - Best ...](https://www.bestcollections.org/wp-content/uploads/2021/04/household-budget-worksheet-for-wisconsin-works.jpg)

0 Response to "39 self employment expenses worksheet"

Post a Comment