40 1040 qualified dividends worksheet

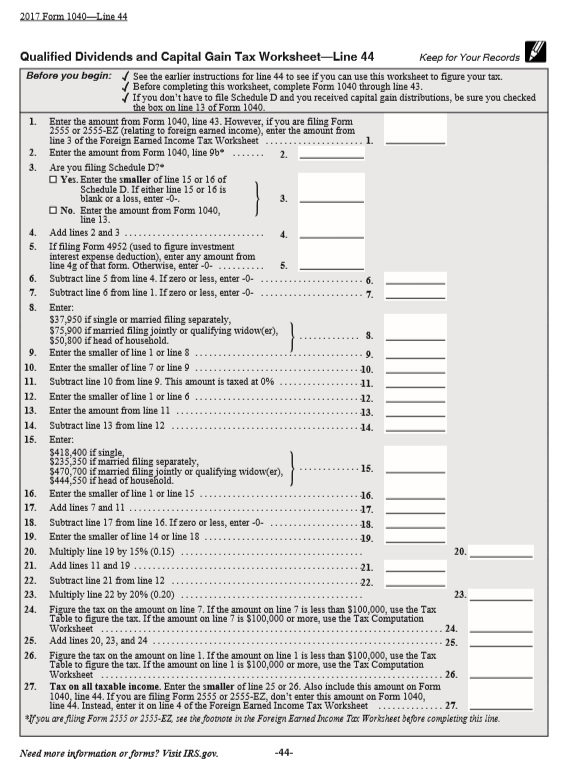

40 capital gain worksheet 2015 - Worksheet Live Capital Gain Tax Worksheet - 2015 Form 1040Line 44 ... 2015 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. What Are Qualified Dividends On 1040? - TheMoneyFarm Qualified dividends are taxed at preferred tax rates if they are calculated using a worksheet included in instructions for Form 1040. How do I know if my dividends are qualified? The 121-day period begins 60 days before to the ex-dividend date, therefore you must have held the shares for at least 60 days to qualify.

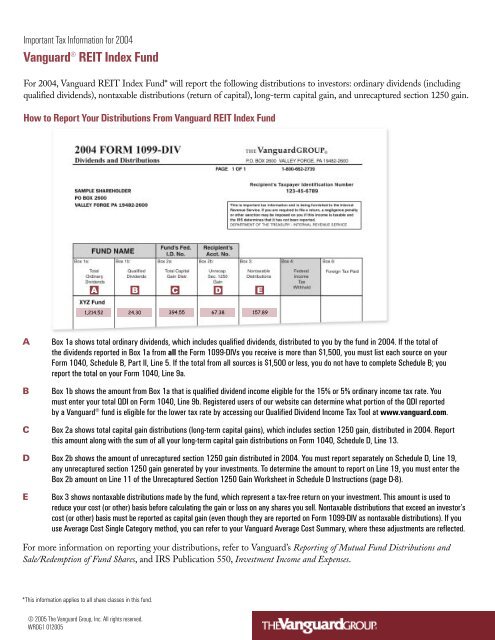

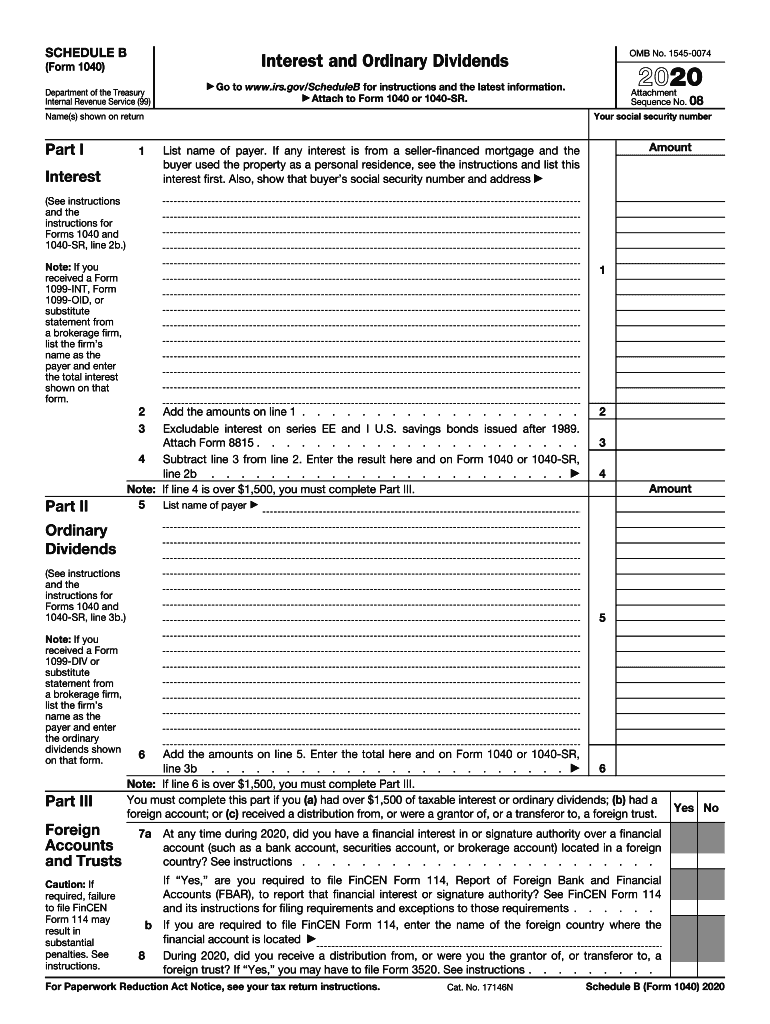

About Schedule B (Form 1040), Interest and Ordinary Dividends About Schedule B (Form 1040), Interest and Ordinary Dividends. Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

1040 qualified dividends worksheet

When To Use Qualified Dividends And Capital Gain Tax ... How are qualified dividends reported on tax return? Qualified dividends are taxed at preferred tax rates if they are calculated using a worksheet included in instructions for Form 1040. What is the difference between qualified and nonqualified dividends? As of November 12, 2020, this blog has been revised for accuracy and comprehensiveness' sake. Qualified Dividends and Capital Gain Tax Worksheet: An ... rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during 2003 and to include the dividend tax break. Schedule D will be much shorter for 2004, when one set of rates will apply for the whole year. Worksheet Alternative How to Figure the Qualified Dividends on a Tax Return ... Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

1040 qualified dividends worksheet. How To Report Ordinary And Qualified Dividends On 1040 ... Line 9b of Form 1040 or 1040A is where you report your qualifying dividends. To calculate your total tax amount, use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a. To calculate your tax, use the Schedule D spreadsheet. Where Is The Qualified Dividends And Capital Gain Tax ... Calculate the desired tax rates on qualifying dividends using the Qualified Dividends and Capital Gains Tax Worksheet included in the Form 1040 instructions. Where can I find Schedule D? For the most up-to-date information, visit . Lines 1b, 2b, 3b, 8b, 9, and 10 of Form 8949 can be used to list your transactions. Federal Taxation of Qualified Dividends - The Balance Ordinary dividends are reported on Line 3b of your Form 1040. Qualified dividends are reported on Line 3a of your Form 1040. You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. 7. Home Instructions 1040 (2021) - Internal Revenue Service Qualified Dividends. Enter your total qualified dividends on line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV.

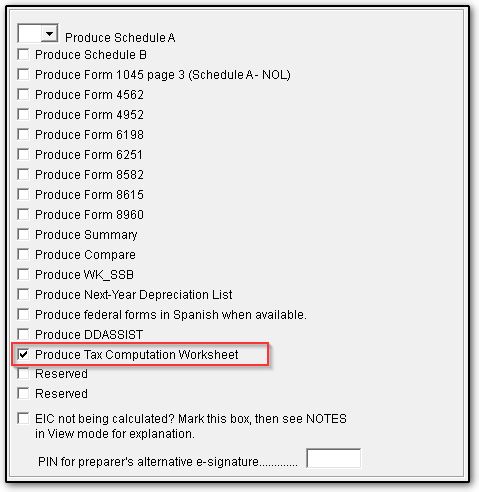

What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D. 2021 Instructions for Schedule D (2021) | Internal Revenue ... (However, if you are filing Form 2555 (relating to foreign earned income), enter instead the amount from line 3 of the Foreign Earned Income Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16) 1. _____ 2. Enter your qualified dividends from Form 1040, 1040-SR, or 1040-NR, line 3a: 2. _____ 3. How Your Tax Is Calculated: Qualified Dividends and Capital ... Instead, 1040 Line 16 "Tax" asks you to "see instructions." In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do. Qualified Dividends and Capital Gain Tax Worksheet ... - 1040.com Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040) Line 28 (Form 1040A) 2016 Before you begin: 1. 1. 2. 2. 3.

Clarification of Worksheet Line References in the 2020 ... Jan 24, 2022 — ... to line 23 of the Qualified Dividends and Capital Gain Tax Worksheet in the ... which is located in the 2020 Instructions for Form 1040. How To Report Qualified Dividends On Tax Return ... How are qualified dividends reported on tax return? To calculate the tax on qualifying dividends at the preferred tax rates, use the Qualified Dividends and Capital Gain Tax Worksheet contained in the instructions for Form 1040. Are qualified dividends included in taxable income? Qualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain ... Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

PDF Qualified Dividends and Capital Gain Tax Worksheet - Line ... • Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. • If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 7. Enter the amount from Form 1040 or 1040-SR, line 15. However, if you are filing Form 2555 (relating to foreign ...

Form 1040, 1040-SR, or 1040-NR, line 3a, Qualified dividends ... Apr 09, 2021 · Don't enter an amount less than zero on line 3a (qualified dividends) of Form 1040, 1040-SR, or 1040-NR. Page Last Reviewed or Updated: 09-Apr-2021 Share. Facebook

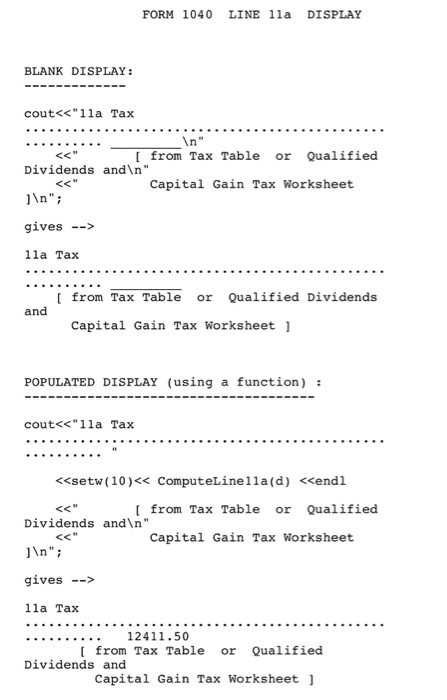

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

PDF SCHEDULE D Capital Gains and Losses - IRS tax forms Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the : Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040) 2021:

Where Do Qualified Dividends Go On 1040? - TheMoneyFarm Use the Qualifying Dividends and Capital Gains Tax Worksheet provided in the instructions for Form 1040 to calculate the tax on qualified dividends at the selected tax rate. Where do qualified dividends go on the Schedule B? On a Schedule B, dividends that are not qualified are taxed. Your taxable income includes the dividends.

How to Figure the Qualified Dividends on a Tax Return ... Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Qualified Dividends and Capital Gain Tax Worksheet: An ... rates to qualified dividends received after 2002 and before 2009. The IRS added several lines to Schedule D, Capital Gains and Losses, to capture the different rates that apply during 2003 and to include the dividend tax break. Schedule D will be much shorter for 2004, when one set of rates will apply for the whole year. Worksheet Alternative

When To Use Qualified Dividends And Capital Gain Tax ... How are qualified dividends reported on tax return? Qualified dividends are taxed at preferred tax rates if they are calculated using a worksheet included in instructions for Form 1040. What is the difference between qualified and nonqualified dividends? As of November 12, 2020, this blog has been revised for accuracy and comprehensiveness' sake.

![Solved] Skylar and Walter Black have been married for 25 ...](https://s3.amazonaws.com/si.experts.images/questions/2021/07/60ea435668138_ScreenShot20210710at8.53.37PM.png)

0 Response to "40 1040 qualified dividends worksheet"

Post a Comment