41 1040ez worksheet for line 5

1040ez Worksheet For Line 5 Instructions - Worksheet ... 1040ez Worksheet For Line 5 Instructions Jerry May 24, 2020. Share This Post: Facebook Pinterest Twitter Google+. 21 Posts Related to 1040ez Worksheet For Line 5 Instructions. What Is 1040ez Worksheet Line F. 1040ez Line F Of Worksheet. Tax Form 1040ez Worksheet Line F. 1040ez Worksheet Line F 2014. Screen FAFSA - Federal Student Aid Application Information ... Enter the exemptions from Form 1040 line 6d or 1040A line 6d. For 1040EZ, if no boxes are checked on line 5, enter 1 if the taxpayer is single, 2 if the taxpayer is married. If either box on line 5 is checked, use 1040EZ worksheet line F to determine the number of exemptions.

What is line 11a on Form 1040? - Pursuantmedia.com IRS Form 1040A - Use Line: 6d. IRS Form 1040EZ, and didn't check either box on line 5, enter 01 if they are not married, or 02 if they are married. IRS Form 1040EZ, and checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($4,050 equals one exemption).

1040ez worksheet for line 5

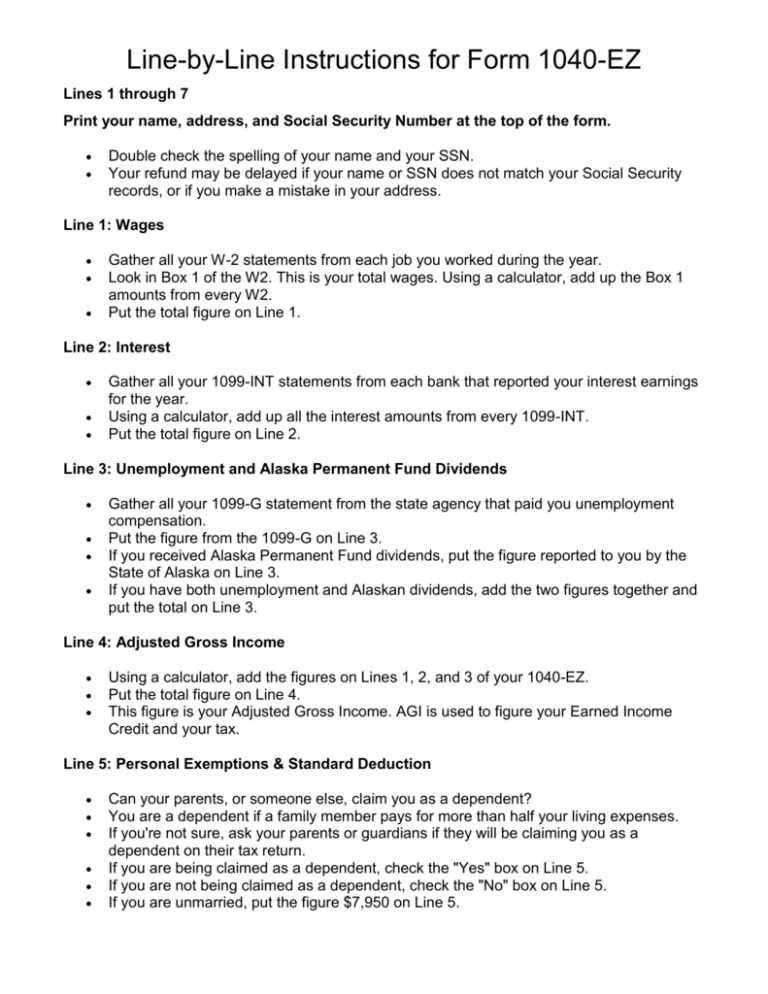

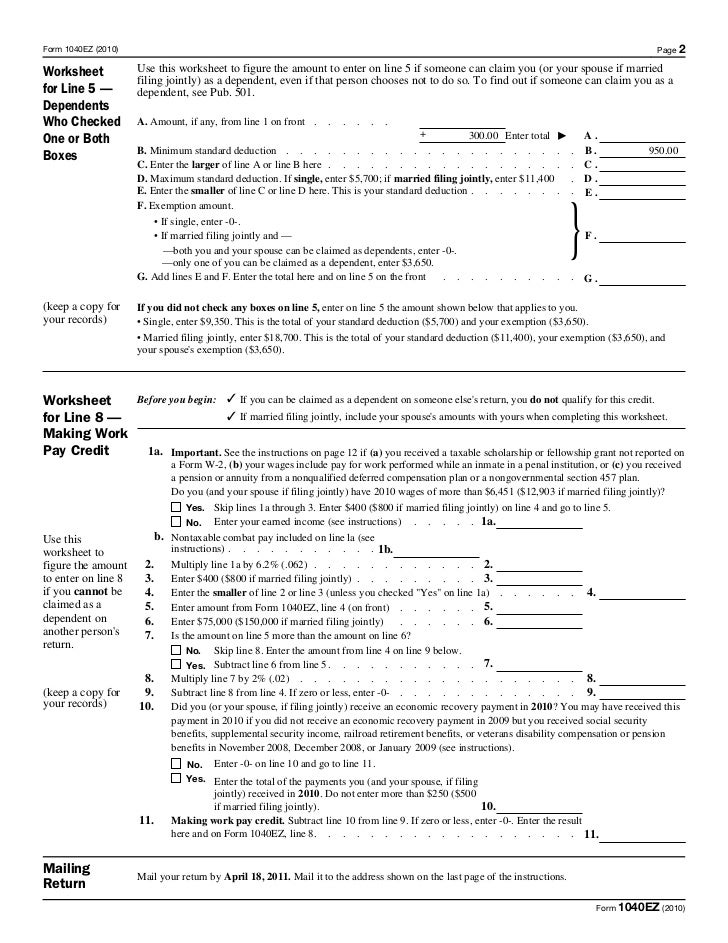

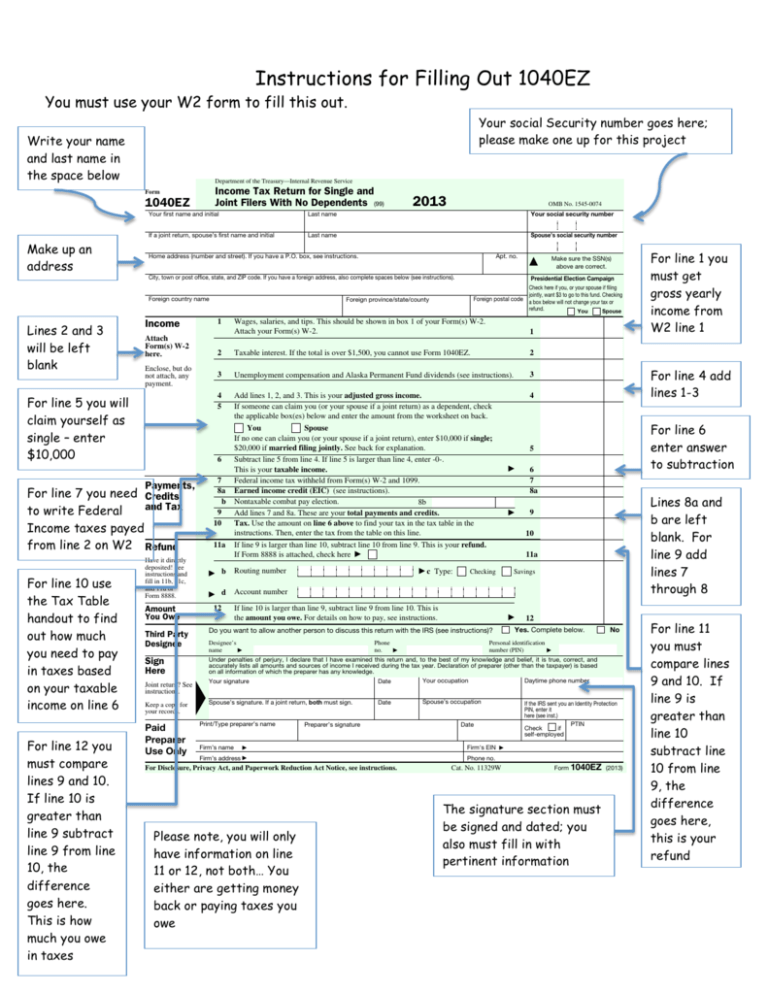

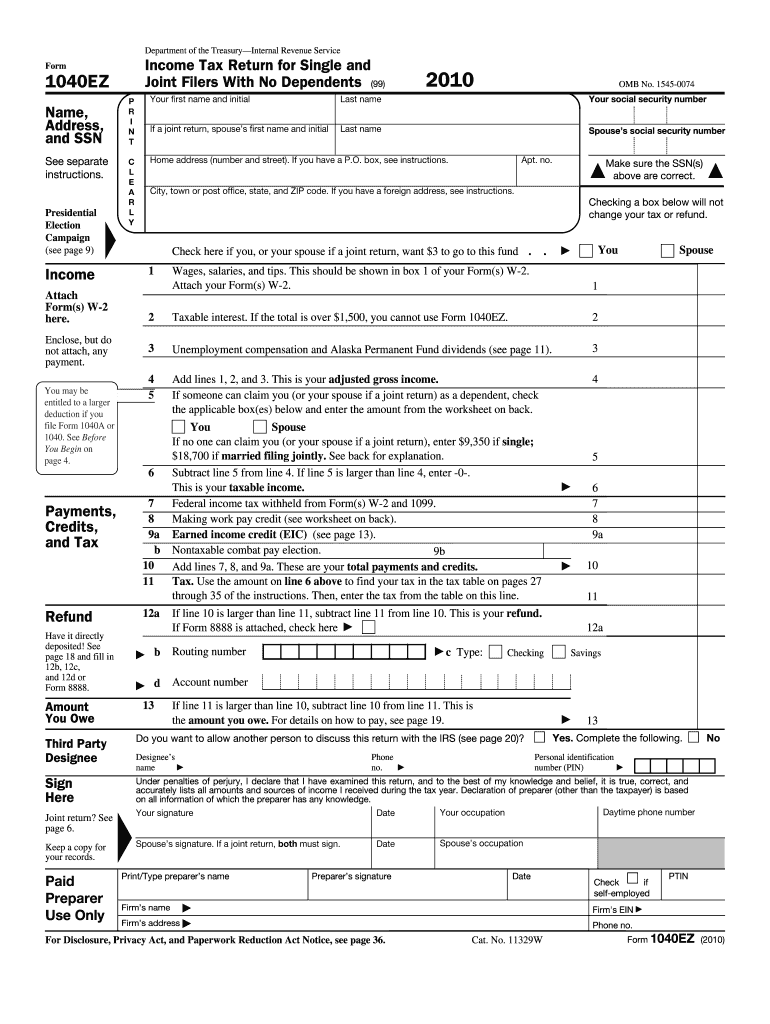

PDF 1040EZ 2016 Income Tax Return for Single and Joint Filers ... the applicable box(es) below and enter the amount from the worksheet on page 2. If no one can claim you (or your spouse if a joint return), enter $10,350 if single; $20,700 if married filing jointly. See page 2 for explanation. Subtract line 5 from line 4. If line 5 is larger than line 4, enter -0-. This is your taxable income. Line by Line Instructions Free File Fillable Forms ... The bottom of Worksheet 3 totals columns a, b and c and transfers the figures to Page 1, line 3a, 3b and 3c. Worksheet 4 has 5 rows. Columns a, b, and c are manual entry. Column d calculates the difference of column a minus column c. There is a total row that calculates the sum of columns a, c and d. Internal Revenue Service - 1040EZ | Genius Worksheet for Line 5 — Dependents Who Checked One or Both Boxes Keep a copy for your records Use this worksheet to figure the amount to enter on line 5 if someone can claim you (or your spouse if...

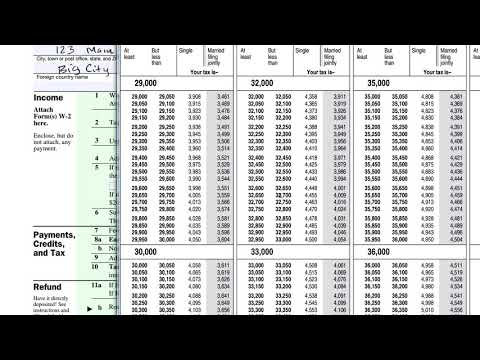

1040ez worksheet for line 5. 1040ez Line F Of Worksheet - Worksheet : Resume Examples # ... 1040ez Worksheet Line F 2014. 1040ez Tax Form Line 5. 1040ez Tax Form Line 11. Line 2 1040ez Tax Form. Line 8a On 1040ez Tax Form. Tax Form 1040ez Line 10. Tax Form 1040ez Line F. Worksheet For Number Line. Tax Worksheet 1040 Line 44. Awesome 1040ez Line 5 Worksheet - The Blackness Project 1040ez Line 5 Worksheet Example. Some of the worksheets for this concept are 2017 form 1040ez 2014 form 1040ez 2017 form 1040ez Step 5 standard deduction dependent exemptions 1040ez 2014 income tax return for single and joint filers Standard deduction and tax. 1040EZ 2016 from 1040Ez Worksheet Line F sourceirsgov. Whats A 1040ez Tax Form. › pub › irs-prior2016 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,350 if . single; $20,700 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ... Amazing Line 5 1040ez Worksheet - Goal keeping intelligence 1040ez Worksheet For Line 5. When you start to complete your 201617 application you will be asked if you want the information from the 2015 fafsa to pre fill the new application. 4 Foot Letter Stencils. 1040ez Worksheet For Line F. 1040ez Worksheet Line 5. For Dependents Who Checked One Or Both Boxes On Line 5. Tax Form 1040ez Line F.

PDF 2002 Form 1040EZ - Money Instructor Use this worksheet to figure the amount to enter on line 5 if someone can claim you (or your spouse if married) as a dependent, even if that person chooses not to do so. To find out if someone can claim you as a dependent, use TeleTax topic 354 (see page 8). Worksheet for dependents who checked "Yes " on line 5 PDF 2017 Form 1040EZ - IRS tax forms 5 . If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You. SpouseIf no one can claim you (or your spouse if a joint return), enter $10,400 if . single; $20,800 if . married filing jointly. See back for explanation. 5 . 6 . Subtract line ... tax.ohio.gov › static › formsINSTRUCTIONS ONLY • NO RETURNS • If you have any questions or need assistance with your return, you can contact our Taxpayer Assistance line at 1-800-282- 1780, or click on ‘Contact Us’ at tax.ohio.gov . Best wishes, 6+ Creative Ez Worksheet Line F - Mate Template Design What Is 1040ez Worksheet Line F. Free Printable Easy and Simple Worksheets for Kindergarten. This far-from-exhaustive list of angle worksheets is pivotal in math curriculum. Enter the total here and on line 5 on the front. Line graph worksheets have ample practice skills to analyze interpret and compare the data from the graphs.

16 Best Images of Federal 941 Worksheet - 2013 1040EZ ... Encouraging your creative skills by stacking the typography of different weight for a stylish effect. Apply color to your image as a block of color in your design for consistency. Use letter spacing to fill the dead space, align text, or abbreviate words that take up too much space. 2013 1040EZ Worksheet Line 5 via 2013 Federal Income Tax Forms via 1ez Worksheet Line 1 - worksheets.thegreenerleithsocial.org Form 1-EZ Income Tax Return for Single and Joint Filers With No Intended For 1040ez Worksheet Line 5 It is ready after unadjusted trial balance is extracted from the ledgers' balances. Major function of the worksheet is to include changes to the closed accounts in a structured method following a certain format. Step 5 — Standard deduction, dependent exemptions, If you filed federal Form 1040EZ, enter 0 on line 23. If you filed federal Form 1040A or 1040, complete this worksheet. a. Enter the number of exemptions claimed on federal Form 1040A or 1040, line 6d ..... a. b. See Line b instructions below..... b. c. Add lines a and b..... c. d. Enter the total number of boxes checked on federal Form 1040A or 1040, line 6a and line 6b ... d. … › statistics › soi-tax-stats-individualSOI Tax Stats – Individual Income Tax ... - IRS tax forms Contains complete individual income tax data. The statistics are based on a sample of individual income tax returns, selected before audit, which represents a population of Forms 1040, 1040A, and 1040EZ, including electronic returns.

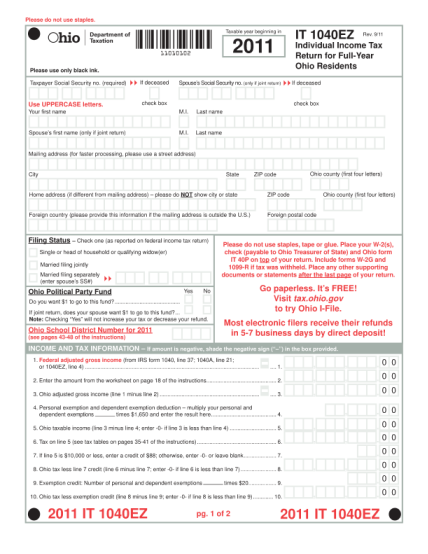

2021 Ohio IT 1040 hio Department of Taxation Use only ... Enter here and on Ohio ScheduleAdjustments, of line 11 ..... 11. Part 3 – Taxable Business Income Note: If Ohio IT 1040, line 5 is zero, do . not. complete Part 3. 12. Line 9 minus line 11 ..... 12. 13. Taxable business income (enter the lesser of …

PDF NAME SID - Green River College For IRS Form 1040EZ, if box on line 5 is unchecked, enter 1 for unmarried and 2 for married; if box on line 5 is checked, use 1040EZ worksheet line F. This information will be used only to determine or verify eligibility for the TRIO Student Success Services program at South Seattle College.

IRS Form 1040EZ - See 2020 Eligibility & Instructions ... 07/01/2022 · On Line 5, indicate whether someone can claim you (or your spouse if you’re filing a joint return) as a dependent. If so, check the applicable box(es) and enter the amount from the worksheet on the back of Form 1040EZ. If no one can claim you (or your spouse if you’re filing a joint return), enter the dollar amount indicated on the form, which will be different depending on …

PDF 2017 Form 1040EZ Worksheet for Line 5 — Dependents Who Checked One or Both Boxes (keep a copy for your records) Use this worksheet to figure the amount to enter on line 5 if someone can claim you (or your spouse if married filing jointly) as a dependent, even if that person chooses not to do so. To find out if someone can claim you as a dependent, see Pub. 501. A.

1040ez Line 5 Worksheet - worksheet 1040ez tax form line 5. Worksheet for line 5 dependents who checked one or both boxes keep a copy for your records use this worksheet to figure the amount to enter on line 5 if someone can claim you or your spouse if married filing jointly as a dependent even if that person chooses not to do so.

PDF 2004-2005 FAFSA on the Web Pre-Application Worksheet Exemptions are on IRS Form 1040-line 6d or 1040A-line 6d. For Form 1040EZ, if a person answered "Yes" on line 5, use EZ worksheet line F to determine the number of exemptions ($3,050 equals one exemption). If a person answered "No" on line 5, enter 01 if he or she is single, or 02 if he or she is married. For Form Telefile,

PDF 1040EZ • Federal Form • Federal Form 13 Tax Computation Worksheet (Keep this worksheet for your records.) A Taxable Income: Print the amount from Form IT-540B, Line 11. A 00 B First Bracket: If Line A is greater than $12,500 ($25,000 if filing status is 2 or 5), print $12,500 ($25,000 if fil- ing status is 2 or 5). If Line A is less than $12,500 ($25,000 if filing status is 2 or 5), enter amount from Line A.

Ohio Form IT 1040EZ (Ohio Individual Income Tax EZ Return ... Taxable business income (enter the lesser of line 12 above or Ohio IT 1040, line 5). .Enter here and on Ohio IT 1040, line 6.....13. 14. Business income tax liability – multiply line 13 by 3% (.03). Enter here and on Ohio IT 1040, line 8b.....14. Do not write in this area; for department use only. Schedule IT BUS – page 1 of 2 2021 Ohio Schedule IT BUS Business Income Primary …

PDF DRAFT AS OF - IRS tax forms 5 If someone can claim you (or your spouse if a joint return) as a dependent, check the applicable box(es) below and enter the amount from the worksheet on back. You Spouse If no one can claim you (or your spouse if a joint return), enter $10,150 if single; $20,300 if married filing jointly. See back for explanation. 5 6 Subtract line 5 from ...

How to Calculate Capital Gains Tax - H&R Block Price for Federal 1040EZ may vary at certain locations. See local office for pricing. Type of federal return filed is based on taxpayer's personal situation and IRS rules/regulations. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, taxable ...

1040-EZ Form Printable 📝 Get IRS Form 1040EZ: Tax Form ... Using 1040ez-form-gov.com, you can apply all our form-filling instruments to file the form as fast as possible. Our website lets you print the complete or a blank form, or send it via e-mail directly to the IRS. The printable 1040-EZ can be sent by mail to the nearest IRS office in your region. We provide all the versions of the Form 1040-EZ to ...

Note We calculate line 16 if you completed the MINI ... Note: We calculate line 16 if you completed the MINI-WORKSHEET FOR LINE 5. See the FAQ to the left to learn what is considered support. * If YES, this person is your Qualifying Relative and we'll make this person your dependent. * If NO, this person is not your Qualifying Relative or your dependent. Not for Filing

Diy 1040ez Worksheet Line 5 - The Blackness Project 1040Ez Worksheet For Line 5 free print and download for learning and education. Grades K-2 3-5 6-8 9-12. 1040ez tax form line 5. Tion is the amount on line E of the Worksheet for Line 5. Worksheet for line 5 dependents who checked one or both boxes keep a copy for. Write this number here.

› tax-center › filingClaiming A Charitable Donation Without A Receipt | H&R Block Offer valid for returns filed 5/1/2020 - 5/31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

2021 Form 1040 - IRS tax forms Form 1040 U.S. Individual Income Tax Return 2021 Department of the Treasury—Internal Revenue Service (99) OMB No. 1545-0074. IRS Use Only—Do not write or staple in this space.

Federal Income Tax 1040EZ Taxes Worksheet, Lesson Plan This worksheet contains a random information required for filling the the simple tax form, the 1040EZ. Students should use the information to fill out the form. Print out both the worksheet as well as the form below. NOTICE: This is a historical document for archival purposes. For Tax Years 2018 and later, FORM 1040EZ is no longer used.

PDF NJ Alternative Financial Aid Application - HESAA On the 1040EZ, if a person didn't check either box on line 5, enter 01 if he or she is single, or 02 if he or she is married. If a person checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($3,950 equals one exemption).

43 1040ez worksheet for line 5 - Worksheet Master PDF 2014 2015 WASFA Student Information Worksheet Instructions the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($3,700 equals one exemption). If a person didn't check either box on line 5, enter 01 if he or she is single, or 02 if he or she is married.

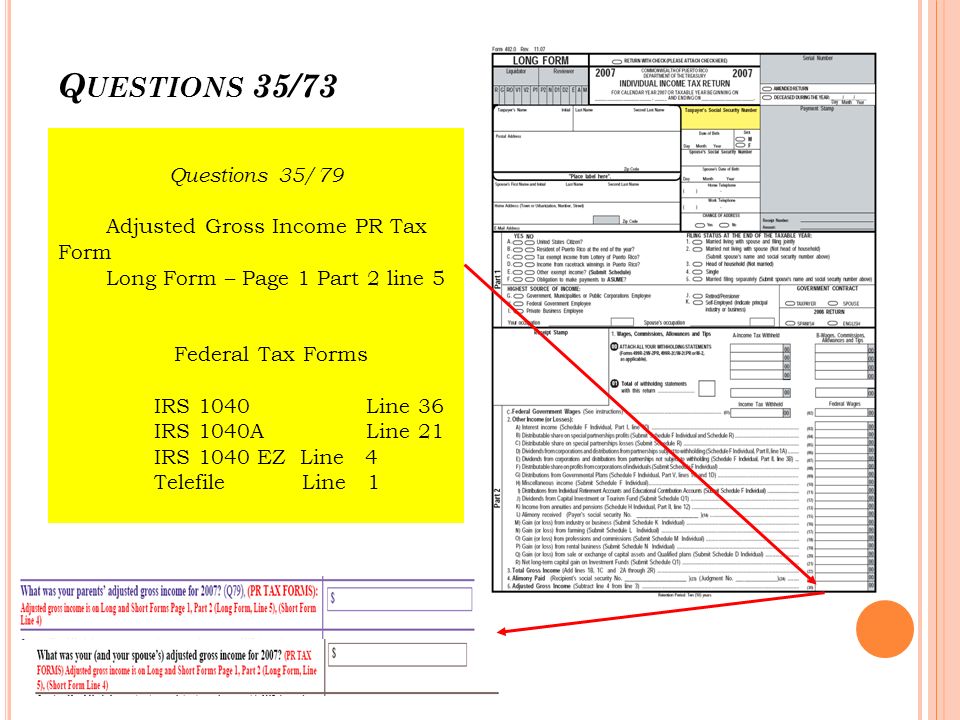

PDF 2014 2015 WASFA Student Information Worksheet Instructions the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($3,700 equals one exemption). If a person didn't check either box on line 5, enter 01 if he or she is single, or 02 if he or she is married. Adjusted Gross Income - 2013 (Ref. 3c):* Enter 2013 adjusted gross income from: IRS Form 1040 line ...

PDF Sample - Do not submit On the 1040EZ, if a person checked either the "you" or "spouse" box on line 5, use 1040EZ worksheet line F to determine the number of exemptions ($3,500 equals one exemption). If a person didn't check either box on line 5, enter 01 if he or she is single, or 02 if he or she is married. Notes for questions 42 and 43 (page 4) and 92 and 93 (page 7)

Internal Revenue Service - 1040EZ | Genius Worksheet for Line 5 — Dependents Who Checked One or Both Boxes Keep a copy for your records Use this worksheet to figure the amount to enter on line 5 if someone can claim you (or your spouse if...

Line by Line Instructions Free File Fillable Forms ... The bottom of Worksheet 3 totals columns a, b and c and transfers the figures to Page 1, line 3a, 3b and 3c. Worksheet 4 has 5 rows. Columns a, b, and c are manual entry. Column d calculates the difference of column a minus column c. There is a total row that calculates the sum of columns a, c and d.

PDF 1040EZ 2016 Income Tax Return for Single and Joint Filers ... the applicable box(es) below and enter the amount from the worksheet on page 2. If no one can claim you (or your spouse if a joint return), enter $10,350 if single; $20,700 if married filing jointly. See page 2 for explanation. Subtract line 5 from line 4. If line 5 is larger than line 4, enter -0-. This is your taxable income.

0 Response to "41 1040ez worksheet for line 5"

Post a Comment