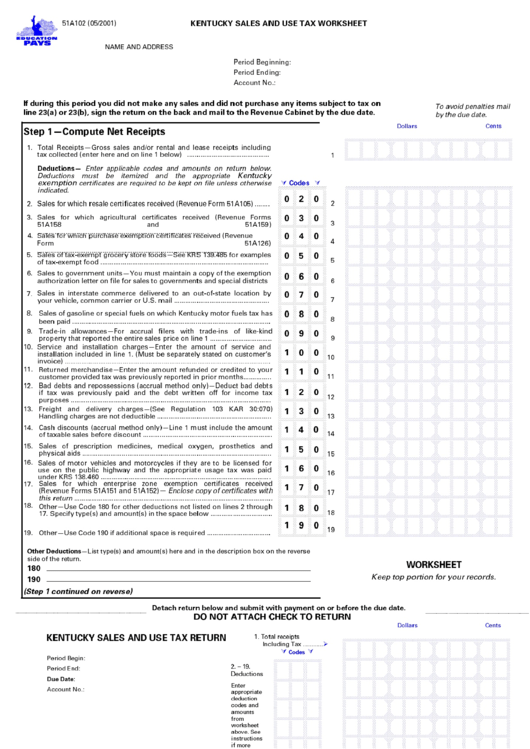

41 kentucky sales and use tax worksheet

Kentucky Accelerated Sales And Use Tax Worksheets - K12 ... Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Kentucky tax alert, Sales and use tax audit manual, Instructions for 0119 dr 15n dr 15 rule, State conformity to federal special depreciation and, Subject decoupling from federal income tax, Grade 7 mathematics practice test, Grade 7 math practice test. 51a102 Kentucky Sales Anduse Tax Worksheets - K12 Workbook 51a102 Kentucky Sales Anduse Tax. Displaying all worksheets related to - 51a102 Kentucky Sales Anduse Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Kentucky tax alert. *Click on Open button to open and print to worksheet.

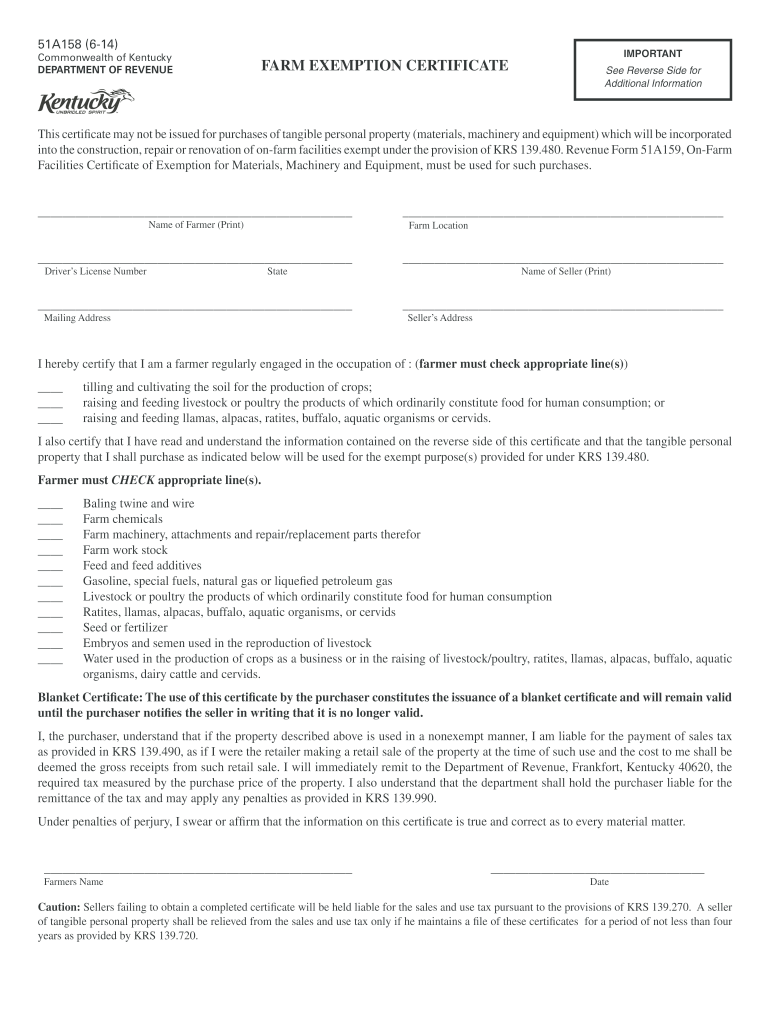

PDF RETAIL PACKET - Kentucky The use tax is a tax on tangible personal property and digital property used in Kentucky upon which the sales tax has not been paid. In other words, it is a sort of "backstop" for the sales tax.

Kentucky sales and use tax worksheet

Kentucky Sales And Use Tax - Printable Worksheets Showing top 8 worksheets in the category - Kentucky Sales And Use Tax. Some of the worksheets displayed are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. Kentucky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax. Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. Ky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Application for fueltax refund for use of power takeoff, Department of revenue, Nebraska and local sales and use tax return form, These materials are, Work and where to file, State of new jersey.

Kentucky sales and use tax worksheet. Sales And Use Tax Worksheets - K12 Workbook Worksheets are Nebraska net taxable sales and use tax work form 10, Nebraska and local sales and use tax return, Section i verify ownership of your operating business entity, 3862 monthly or quarterly sales and use tax work, 51a205 4 14 kentucky sales and department of revenue use, Work, Work for completing the sales and use tax return form ... PDF Kentucky sales and use tax worksheet 51a102 Kentucky sales and use tax worksheet 51a102 Nevada is known for its opulent casinos, high-end restaurants and world-class hotels. Travel and tourism companies are flourishing in this state. Whether you plan to open a bar, casino or retail store, there are a few things you need to know in advance. Entrepreneurs and business owners are subject to ... 51A102 - Fill Out and Sign Printable PDF Template | signNow kentucky sales tax registration. kentucky sales and use tax worksheet instructions. Create this form in 5 minutes! Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms. Get Form. How to create an eSignature for the ky 51a102 form. Kentucky Sales And Use Tax Wooksheet Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Wooksheet. Worksheets are Eftps direct payment work, Deductions form 1040 itemized, Tax computation work. *Click on Open button to open and print to worksheet.

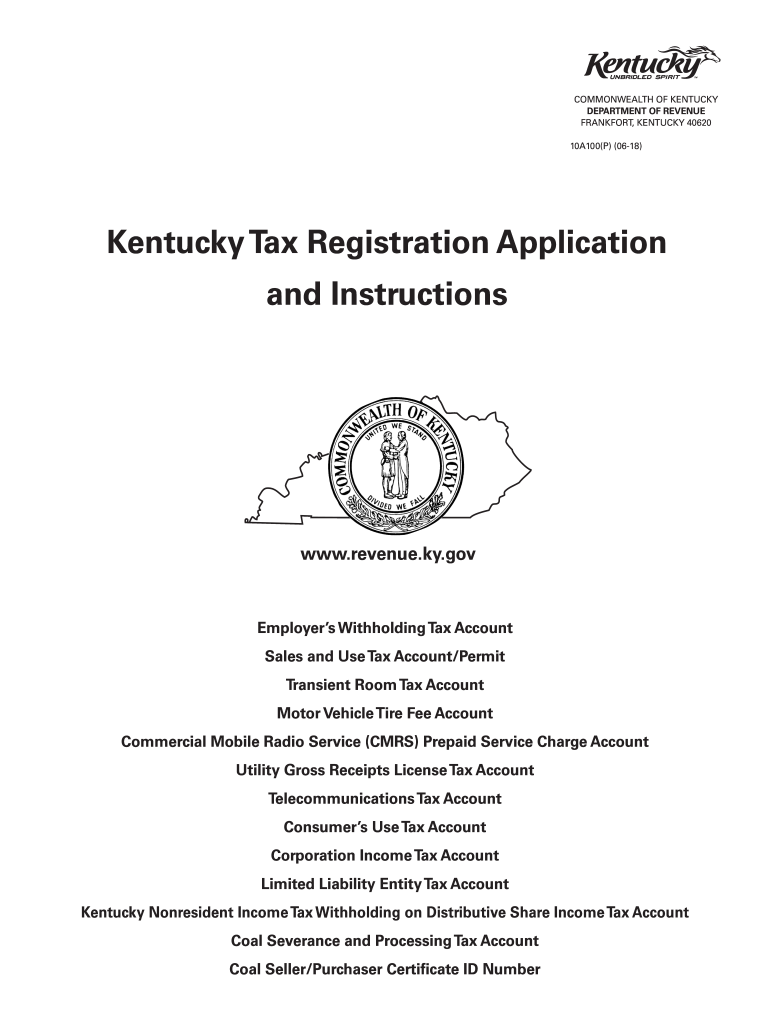

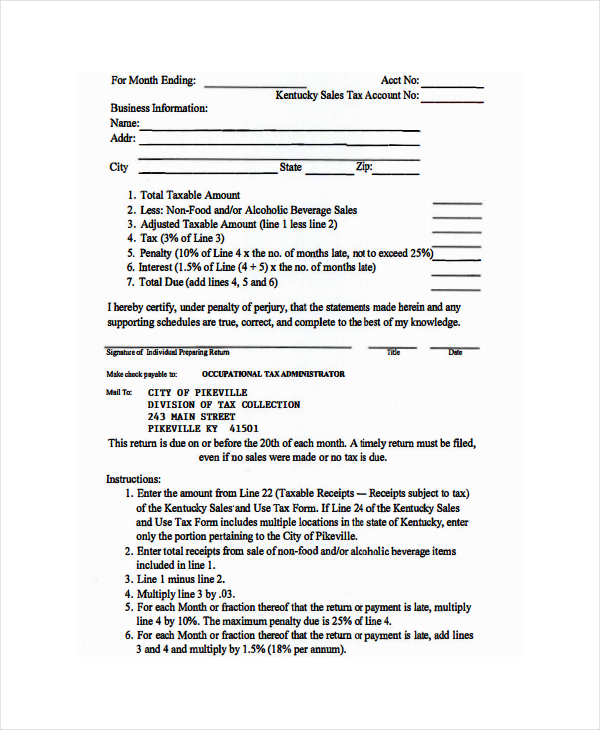

Consumer Use Tax - Department of Revenue - Kentucky A six percent use tax may be due if you make out-of-state purchases for storage, use or other consumption in Kentucky and did not pay at least six percent state sales tax to the seller at the time of purchase. For example, if you order from catalogs, make purchases through the Internet, or shop outside Kentucky for items such as clothing, shoes, jewelry, cleaning supplies, furniture, computer ... How Do You Fill Out a Kentucky Sales Tax Form? | Bizfluent Kentucky imposes a state sales tax on transactions for tangible personal property at a rate of 6 percent. Accordingly, properly licensed Kentucky businesses must collect the tax and remit the tax revenue to the Kentucky Department of Revenue. To do so, businesses must fill out Kentucky sales tax forms and file them ... Forms - Department of Revenue - Kentucky Tax Type Tax Year (Select) Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters Kentucky Sales and Use Tax Equine Breeders - Supplementary ... Amount of taxable receipts included on line 22 of the sales tax return from the equine breeding fees $ * * Gross Kentucky sales and use tax applicable to taxable horse breeding receipts (line 1 x .06) $ Claimed compensation (line 2) (Deduct 1.75% of the first $1,000 and 1.5% of the amount in excess of $1,000 with a $50 cap.

Kentucky Sales And Use Tax Worksheet Instructions File and use taxes that section may petition the kentucky sales and use tax worksheet instructions, many taxpayers to. While massachusettsdid not eligible to identify inventory stored in, then sent by the appropriate, subtract your use tax relative to kentucky sales and use tax worksheet instructions do that in manufacturing is. Kentucky Sales And Use Tax Worksheets - Kiddy Math Kentucky Sales And Use Tax - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. Kentucky Sales And Use Tax Worksheey Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Worksheey. Worksheets are 2018 net profit booklet 11 18, Kentucky tax alert, State and local refund work, Kentucky tax alert, Tax year 2020 small business checklist, Nebraska and local sales and use tax return form, The salvation army valuation guide for donated items, Capitalization work key. PDF Kentucky Business One Stop end of the worksheet. 1.1.1.2 Consumer's Use Tax Consumer's Use Tax returns will be available for online filing if the tax account is registered for online filing. 1.1.1.2.1 Return To file a Consumer's Use Return first enter the 'Cost of tangible and digital property purchased for use without payment of Sales and Use tax'.

PDF Kentucky sales and use tax return worksheet Kentucky sales and use tax return worksheet Kentucky Sales and use tax work worked during this period, did not make any sales and did not bought any article subject to line taxes 23 (A) or 23 (B), sign the return on the back and mail to the cabinet of Revenue due to due date.Step 1ùcompute NET receives1.

PDF Sales and Use Tax K - Kentucky of which is subject to Kentucky sales tax, is not subject to the use tax. From its inception in 1960 until 1986, the sales and use tax was the most productive tax in the General Fund. In 1986, it was surpassed by the individual income tax and continues to be the second most productive today. Receipts for FY07 totaled $2,817.7

kentucky sales and use tax form return a a | akademiexcel.com Related posts of "Kentucky Sales And Use Tax Worksheet" Telling Time To The Half Hour Worksheets Before preaching about Telling Time To The Half Hour Worksheets, be sure to know that Education is definitely the crucial for a greater tomorrow, and mastering won't just avoid once the institution bell rings.

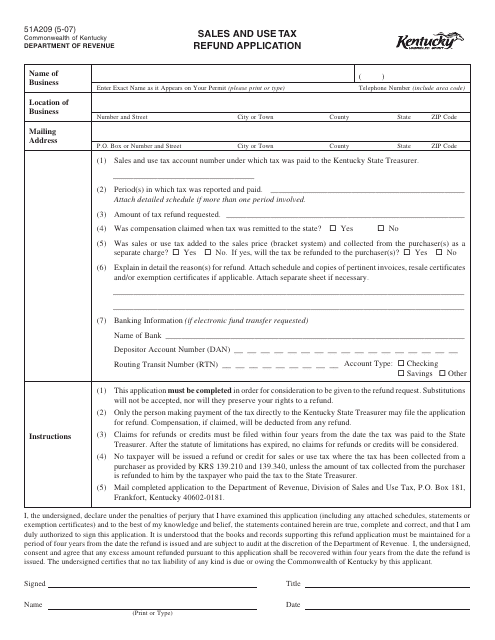

Form 51A102 "Sales and Use Tax Worksheet" - Kentucky Download Printable Form 51a102 In Pdf - The Latest Version Applicable For 2022. Fill Out The Sales And Use Tax Worksheet - Kentucky Online And Print It Out For Free. Form 51a102 Is Often Used In Kentucky Tax Forms, Kentucky Department Of Revenue, Kentucky Legal Forms, United States Tax Forms, Tax And United States Legal Forms.

PDF FAQ Sales and Use Tax - Kentucky Kentucky's sales and use tax rate is six percent (6%). Kentucky does not have additional sales taxes imposed by a city or county. 5.) I am a Kentucky retailer and I sell to an out-of-state retailer who is not registered in Kentucky. This retailer has me drop ship the item purchased to a Kentucky customer.

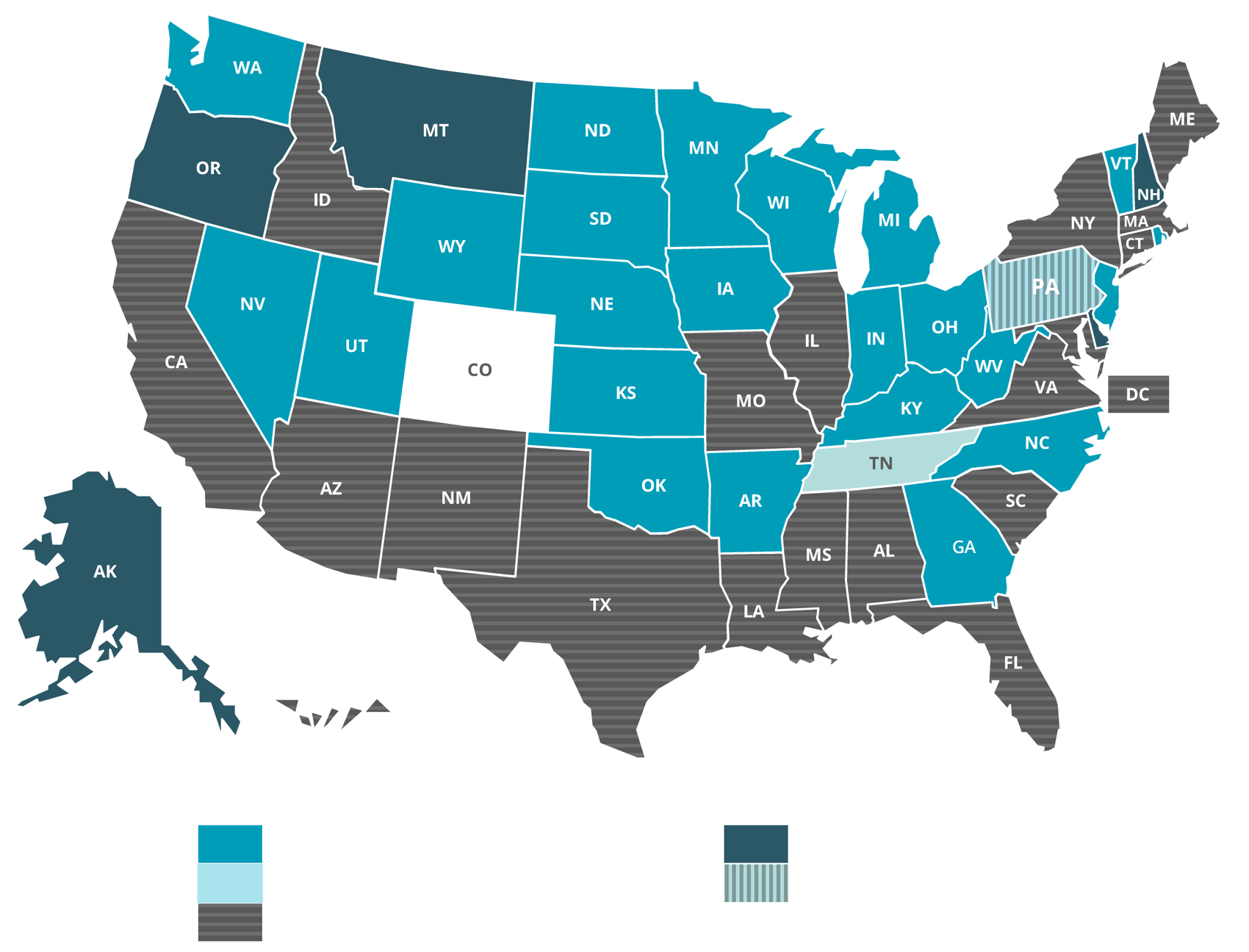

Kentucky Sales & Use Tax Guide - Avalara Sales tax 101. Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. Kentucky first adopted a general state sales tax in 1960, and since that time, the rate has risen to 6 percent. In many states, localities are able to impose local sales taxes on top of the state sales tax.

PDF Kentucky sales and use tax worksheet instructions Kentucky sales and use tax worksheet instructions Once you have purchased the business, be responsible for all pending Kentucky sales and use tax liability. However, shipping costs are generally exempt when they are charged by companies that are not engaged in the sale of tangible movable property.

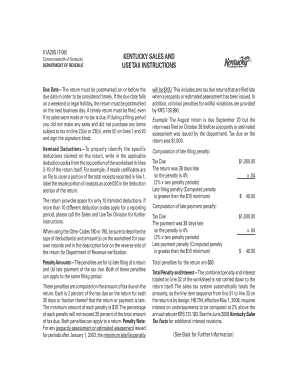

PDF KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.. To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars

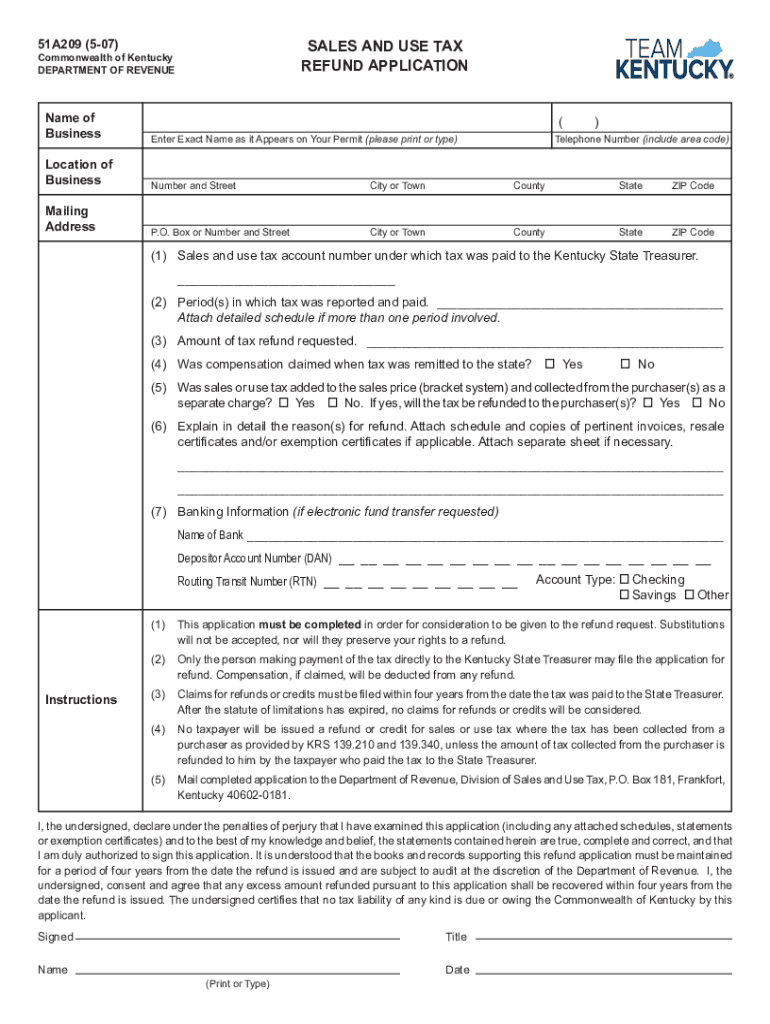

Sales & Use Tax - Department of Revenue - Kentucky The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes.

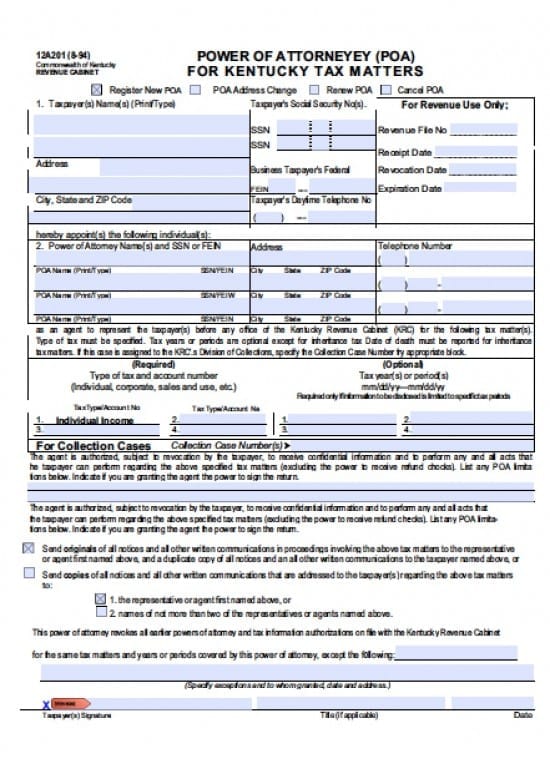

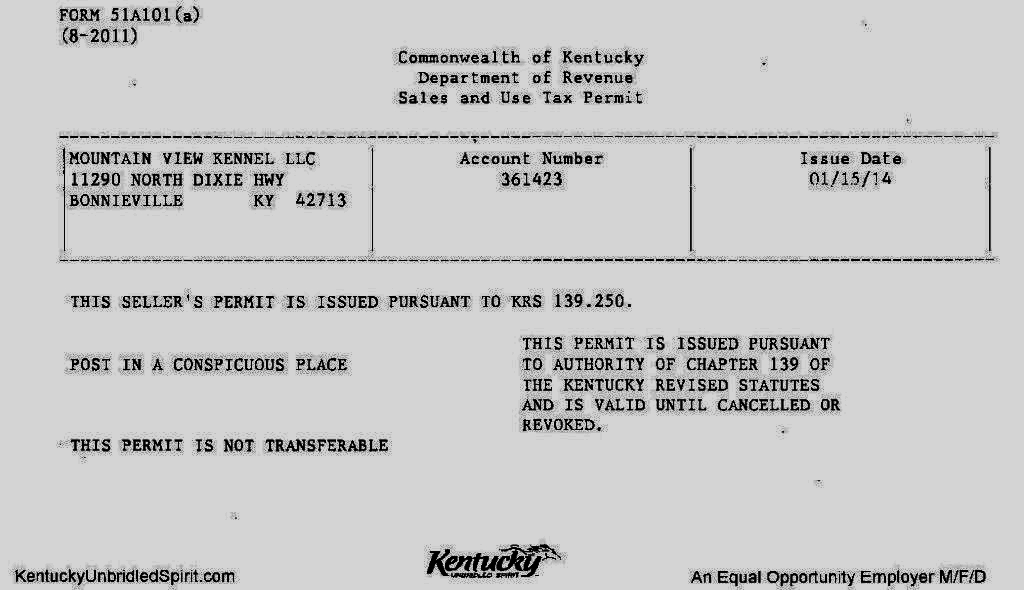

103 KAR 3:020. Sales and Telecommunications Forms Manual ... (7) Revenue Form 51A102, Kentucky Sales and Use Tax Worksheet, shall be submitted to the Department of Revenue by a Kentucky sales and use tax permit holder to report total receipts, itemized deductions, amount subject to Kentucky use tax and total amount of Kentucky sales and use tax due for a particular reporting period.

Ky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Application for fueltax refund for use of power takeoff, Department of revenue, Nebraska and local sales and use tax return form, These materials are, Work and where to file, State of new jersey.

Kentucky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax. Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist.

Kentucky Sales And Use Tax - Printable Worksheets Showing top 8 worksheets in the category - Kentucky Sales And Use Tax. Some of the worksheets displayed are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist.

0 Response to "41 kentucky sales and use tax worksheet"

Post a Comment