41 1040 qualified dividends and capital gains worksheet

Qualified Dividends and Capital Gains Worksheet.pdf ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Qualified Dividends And Capital Gain Tax Worksheet 2020 ... Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR line 16 or in the instructions for Form 1040-NR line 16 to figure your tax. The amount of qualified dividends used in the calculation of additional 10 tax withholding or alternative minimum tax is also shown on this worksheet.

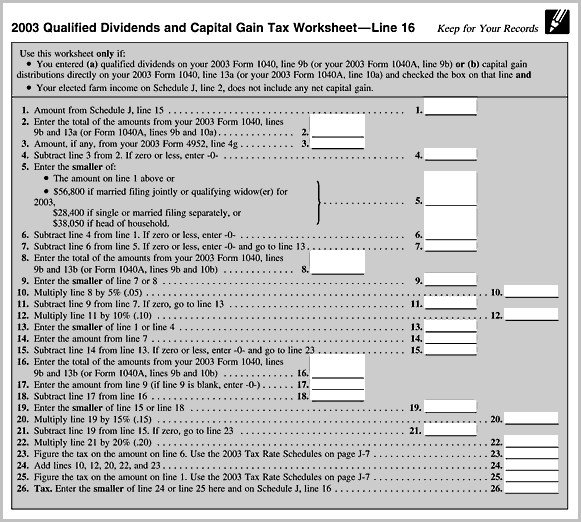

PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records Form 1040—Line 44 Before you begin: See the instructions for line 44 that begin on page 36 to see if you can use this worksheet to figure your tax. If you do not have to file Schedule D and you received capital gain distributions, be sure

1040 qualified dividends and capital gains worksheet

The Qualified Dividends and Capital Gains Tax worksheet ... The Qualified Dividends and Capital Gains Tax worksheet correctly calculates the 15% tax on these amounts but I cannot see how it is ever reflected on my 1040 return. Please show how the results from the Qualified Dividends and Capital Gain Tax worksheet are applied to the 1040 Forms. Solved: Qualified Dividends and Capital Gains not taxed un... When I look at the Qualified Dividends and Capital Gains Tax worksheet, it seems like I'm being taxed on most of it, instead of getting the $80,800 "exemption" for filing as Married Filing Jointly. Form 1040 Line 15 is $156,000, if I deduct the $80,800, net taxable income should be about $75,200, giving me a tax bill of about $9,000. Qualified Dividends and Capital Gains Worksheet - t6988 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

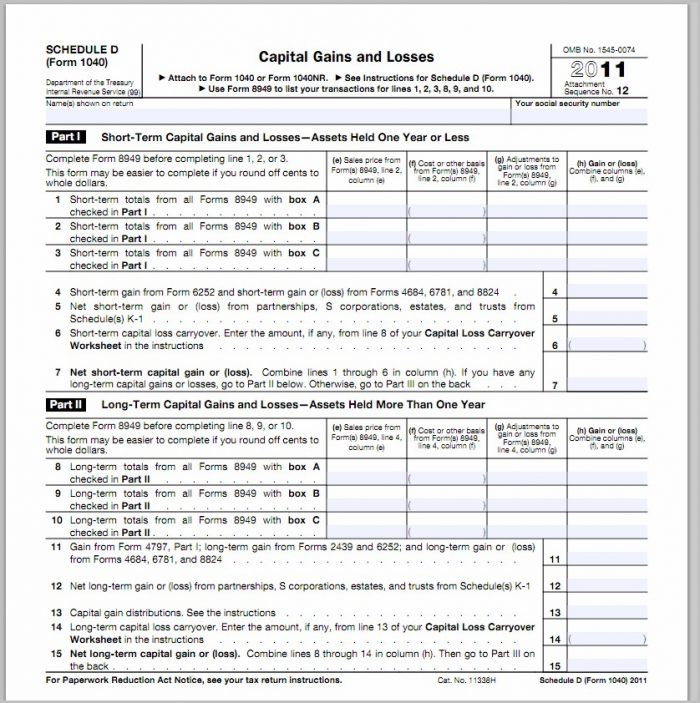

1040 qualified dividends and capital gains worksheet. Qualified Dividends and Capital Gain Tax Worksheet Form ... Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. Qualified Dividends and Capital Gain Tax Worksheet. - CCH According to the IRS Form 1040 instructions for line 44: Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet. Qualified Dividends and Capital Gains Worksheet - ACC330 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Diy Qualified Dividends And Capital Gain Worksheet - The ... IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is checked. 1) Enter the amount from Form 1040, line 15. However, if filing Form 2555 (relating to foreign earned income), enter the Qualified Dividends Tax Worksheet ≡ Fill Out Printable PDF ... The IRS has made available a new qualified dividends tax worksheet form (1096-DIV) for the 2019 tax year. The form is used to report distributions on Form 1040, Schedule B, and ensure that the correct amount of tax is withheld. This guide will provide an overview of the form and instructions on how to complete it. What are qualified dividends? 1040NOW Help Qualified Dividends and Capital Gain Tax Worksheet (Individuals) If you completed the Qualified Dividends and Capital Gain Tax Worksheet in the Instructions for Form 1040 and you don't have to file Schedule D, you may have to adjust the amount of your foreign source qualified dividends and capital gain distributions.

Tax Return 3 - Qualified Dividends.pdf - Qualified ... Qualified Dividends and Capital Gain Tax Worksheet—Line 16 Keep for Your Records See the earlier instructions for line 16 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040 ... Fillable Form 1040 Qualified Dividends and Capital Gain ... Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 . On average this form takes 7 minutes to complete. The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures; 2 check-boxes Tax Worksheet 2014 - Balancing Equations Worksheet Capital Gains and Losses along with its worksheet Schedule E. If you enrolled someone who is not claimed as a dependent on your tax return or for more information see the instructions for Form 8962. Profit or Loss from Business. December 2013 as a worksheet to figure the 2014 tax on qualified dividends or net capital gain. Tax Worksheet Line 2. PDF Qualified Dividends and Capital Gain Tax Worksheet: An ... for several years, the irs has provided a tax computation worksheet in the form 1040 and 1040a instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete schedule d. taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use …

PDF 1040.com 1040.com

Calculation of tax on Form 1040, line 16 - Thomson Reuters Tax Tables. You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a.

Solved Instructions Form 1040 Schedule 1 Schedule 5 ... instructions form 1040 schedule 1 schedule 5 schedule b qualified dividends and capital gain tax worksheet form 1040 x 7,000 6 173,182 4,453.50 + 22% 38,700 7 173,182 → 14,089.50 + 24% 2018 tax rate schedules 38,700 82,500 82,500 157,500 157,500 200,000 200,000 500,000 500,000 82,500 157,500 32,089.50 + 32% 9 8 24,000 45,689.50 + 35% 200,000 9 …

How Your Tax Is Calculated: Qualified Dividends and Capital ... Instead, 1040 Line 16 "Tax" asks you to "see instructions." In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. The 25 lines are so simplified, they end up being difficult to follow what exactly they do.

Why doesn't the tax on my return (line 16) match ... - Support When you have qualified dividends or capital gains, you do not use the tax table. Instead, you will need to use the Capital Gains Worksheet to figure your tax. 1040 Instructions Line 16 , Qualified Dividends and Capital Gains Worksheet. The program has already made this calculation for you.

1040 (2021) | Internal Revenue Service Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

Qualified Dividends and Capital Gains Worksheet - t6988 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Solved: Qualified Dividends and Capital Gains not taxed un... When I look at the Qualified Dividends and Capital Gains Tax worksheet, it seems like I'm being taxed on most of it, instead of getting the $80,800 "exemption" for filing as Married Filing Jointly. Form 1040 Line 15 is $156,000, if I deduct the $80,800, net taxable income should be about $75,200, giving me a tax bill of about $9,000.

0 Response to "41 1040 qualified dividends and capital gains worksheet"

Post a Comment