42 calculating your paycheck worksheet

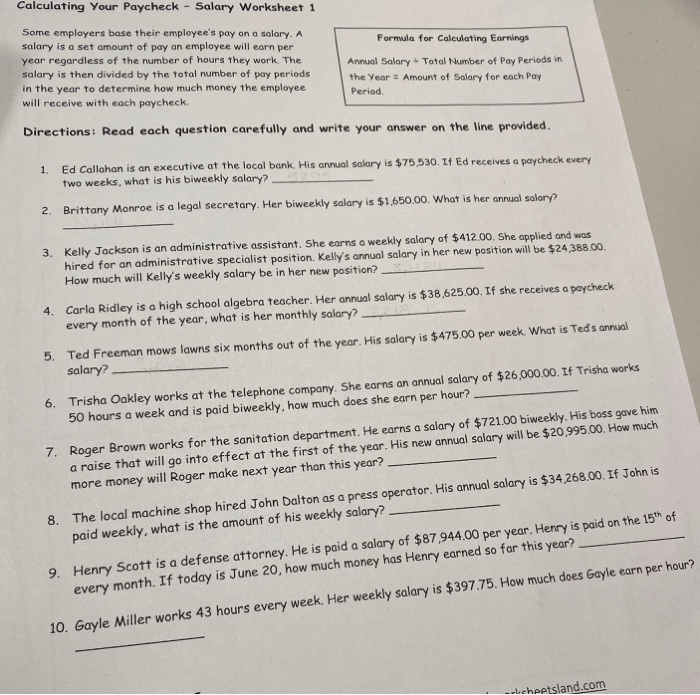

Calculating Your Paycheck Salary Worksheet 1 - Fill Out and ... Follow the step-by-step instructions below to eSign your calculating your paycheck worksheet answer key: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done. Solved Calculating Your Paycheck - Salary Worksheet 1 Some ... Calculating Your Paycheck - Salary Worksheet 1 Some employers base their employee's pay on a salary. A salary is a set amount of pay an employee will earn per year regardless of the number of hours they work.

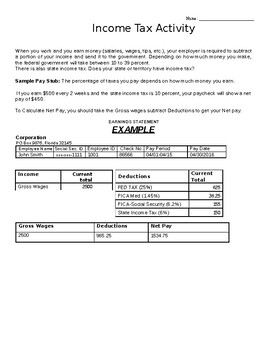

Calculating Your Paycheck Worksheets - Kiddy Math Some of the worksheets for this concept are Calculating the numbers in your paycheck, My paycheck, Paycheck math, Its your paycheck lesson 2 w is for wages w 4 and w 2, Chapter 1 lesson 1 computing wages, Understanding taxes and your paycheck, Reading a pay stub extension activity for managing money, Everyday math skills workbooks series.

Calculating your paycheck worksheet

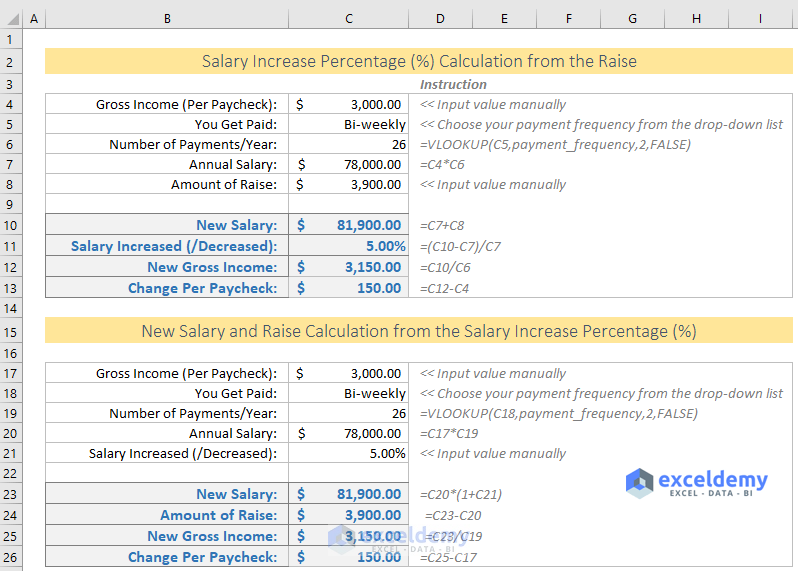

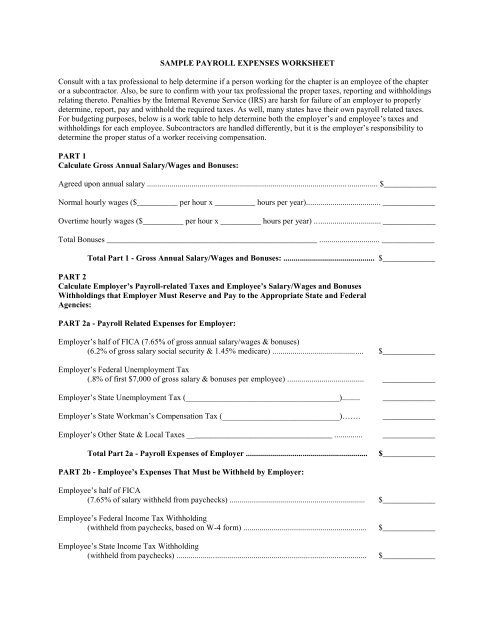

Payroll Expense Calculation Worksheets Calculate the average monthly payroll cost. Divide the total payroll costs in Box 5 by 12 and enter the resulting amount in Box 6. Enter the amount in Box 6 in the Average Monthly Payroll box on the Loan Request page of the PPP Loan Application. Step 7 Upload this Worksheet and all documents used to complete it to the Documents section of the ... Paycheck Calculator - Take Home Pay Calculator Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions, withholdings, federal tax, and allowances on your net take-home pay. Unlike most online paycheck calculators, using our spreadsheet will allow you to save your results, see how the calculations are done, and even customize it. PDF INCOME CALCULATION WORKSHEET - DUdiligence.com INCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1) Hourly: See Part II, Section 1a, 1b, 1c or 1d (seasonal worker) 2) Weekly: See Part II, Section 2 3) Bi-Weekly: See Part II, Section 3 4) Semi-Monthly: See Part II, Section 4 5) Overtime/Bonuses: See Part II, Section 5a or 5b 6) Commissioned: See Part II, Section 6

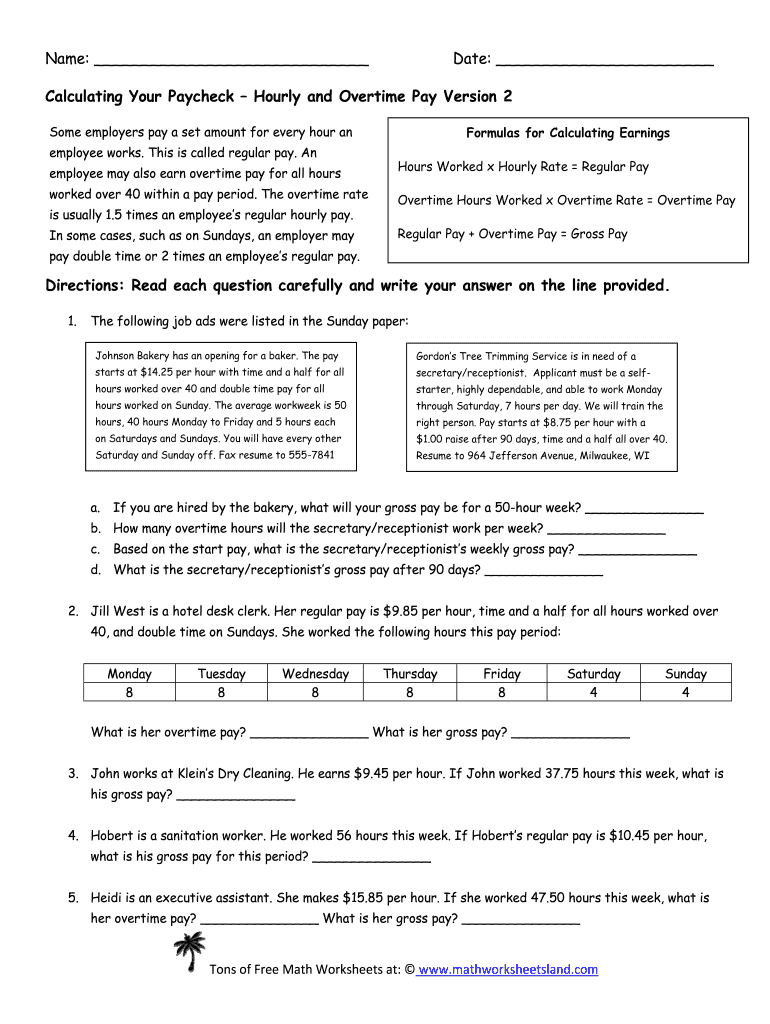

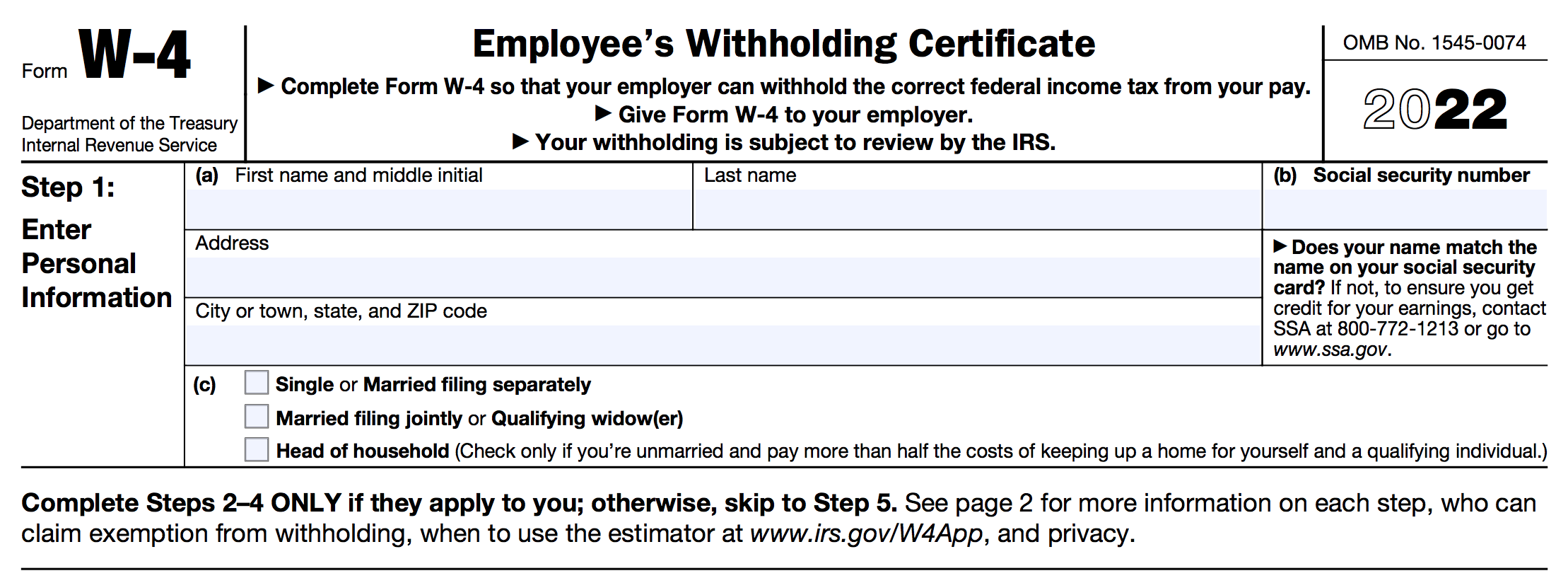

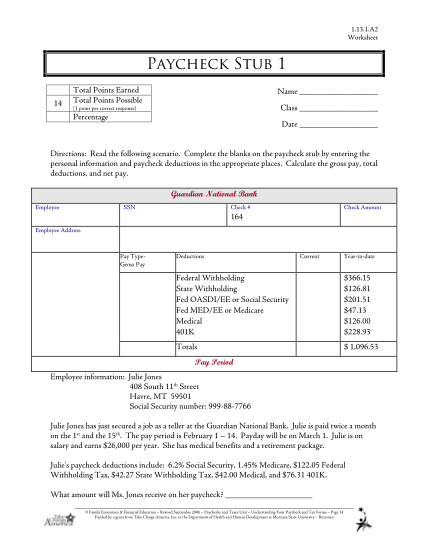

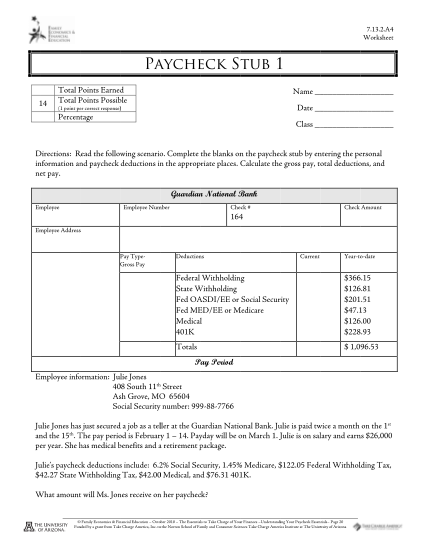

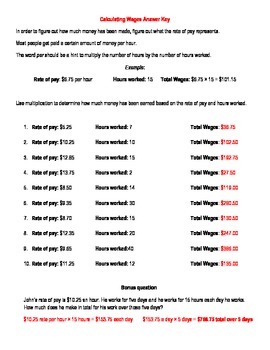

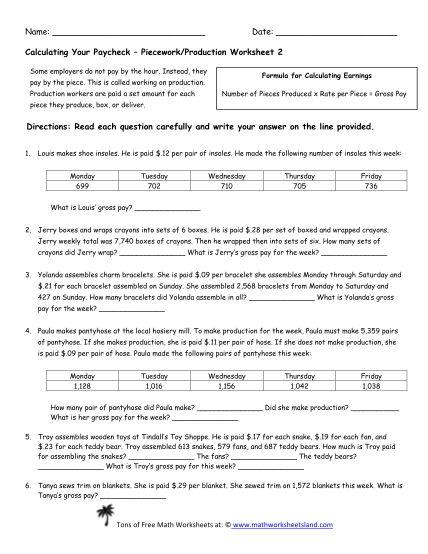

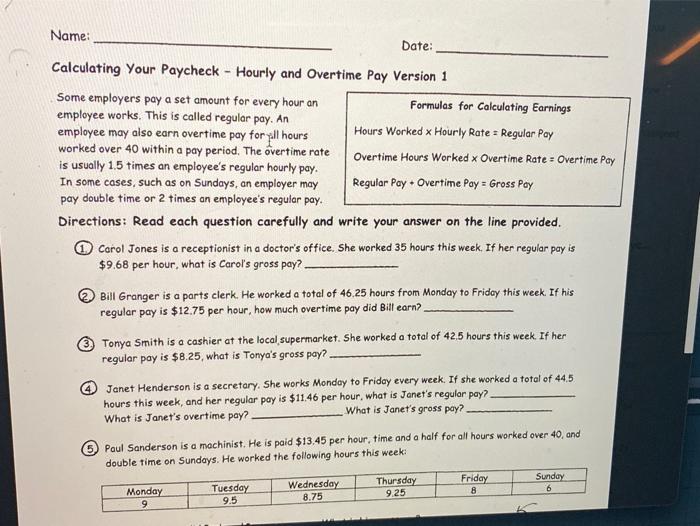

Calculating your paycheck worksheet. Calculating Your Withholding | Integrated Service Center To calculate the amount of Paid Family Medical Leave withheld from your paycheck, multiply your gross wages by .6%. You pay 73.22% of that 0.6%. Note that premiums are capped at the 2022 Social Security Wage Base of $147,000; the maximum premium paid for PFML is $649.32. PDF My Paycheck - CTECS - which is your net pay. You were informed at your orientation that deductions include federal taxes (15%), FICA (6.0%), and Medicare (1.65%). What is your net pay for one week? 14. You got your first paycheck and you were excited to see that it was more than you thought! You forgot to figure in tips. As a busser, your employer adds 5% for ... PDF Bring Home The Gold - National Payroll Week Your paycheck = total hours worked x rate of pay. 4. Name two mandatory deductions. 5. Name three other deductions. 10 Calculating a Paycheck #1 EMPLOYEE AT A GOURMET COFFEE Employee's name: Pay period Weekly Semimonthly Monthly Number of allowances (0 or more) Single Married GROSS PAY 1. STUDENT 4: Calculating Wages and Income - ConsumerMath.org STUDENT 4: Calculating Wages and Income. Length = 3 weeks. In this unit you will learn different ways to earn money including hourly, salary, tips, and commission. You will also learn how to accurately compare different income values using equivalent hourly wage calculations. Calculate wages from straight time, overtime, double-time.

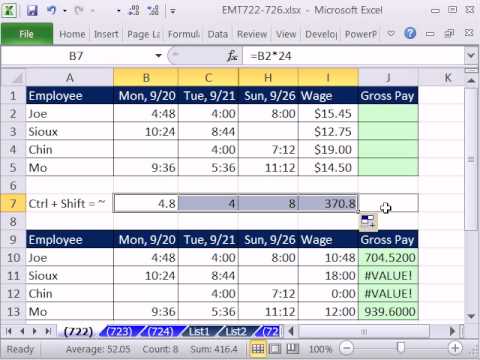

PDF Consumer Financial Protection Bureau Consumer Financial Protection Bureau Free Time Card Calculator | Timesheet Calculator ... Free Time Card Calculator. Total your weekly timecard hours in decimal format for payroll. Our easy time tracking software automatically totals worker hours & overtime. Learn More. A break deduction can be entered in hours, minutes, or both. Calculating Your Gross Monthly Income Worksheet Calculating Your Gross Monthly Income Worksheet (continued, page 2 of 2) If you are not paid regularly $ _____ ÷ 12 months = $ _____ (income from last (gross monthly year's tax return income) before deductions) Other gross monthly income = $ _____ (spouse's monthly income, second job, Calculating Gross Pay Worksheet Answers Some of the worksheets for this concept are Wage calculation work 312 Calculating gross and weekly wages work Hourly and overtime pay version 2 and answer keys Chapter 1 lesson 1 computing wages How to determine Calculating your paycheck. Calculating Gross Pay Worksheet. Is the data presented in a way that an average overall income can be ...

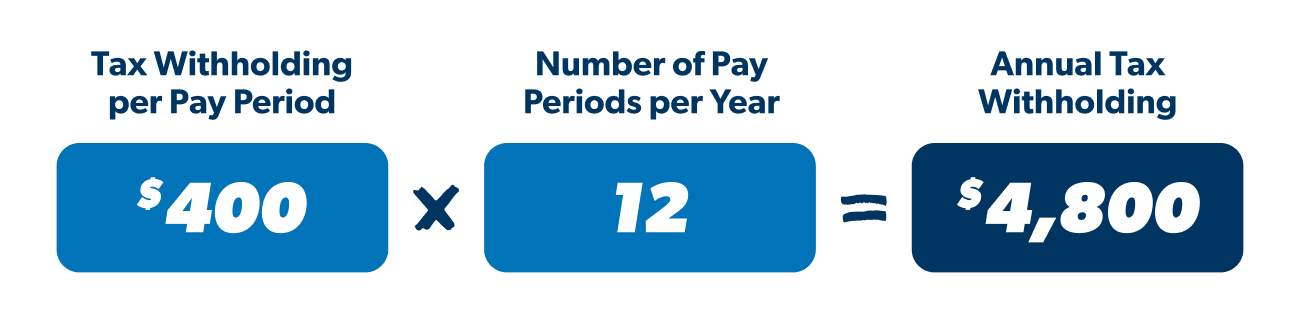

PDF Calculating Your Gross Monthly Income Worksheet Calculating Your Gross Monthly Income Worksheet (continued, page 2 of 2) If you are not paid regularly $ _____ ÷ 12 months = $ _____ (income from last (gross monthly year's tax return income) before deductions) Other gross monthly income = $ _____ (spouse's monthly income, second job, PDF Life Insurance Imputed Income Calculation - Marvell Benefits Basic Life Insurance Imputed Income Calculation Worksheet The IRS says that employer paid life insurance amounts in excess of $50,000 is considered taxable income to you. Marvell Basic Life Insurance plan pays 2.5 times your salary. You are taxed based on the value of the benefit (not the benefit itself). The value is determined It's Your Paycheck! Curriculum Unit | St. Louis Fed It's Your Paycheck! is designed for use in high school personal finance classes. The curriculum includes 9 lessons. The lessons employ various teaching strategies to engage students so that they have opportunities to apply the concepts being taught. Each lesson includes the handouts and visuals needed to teach the lesson. Kami Export - calculating your paycheck worksheet 1.pdf ... The salary is then divided by the total number of pay periods in the year to determine how much money the employee will receive with each paycheck. Formula for Calculating Earnings Annual Salary ÷ Total Number of Pay Periods in the Year = Amount of Salary for each Pay Period.

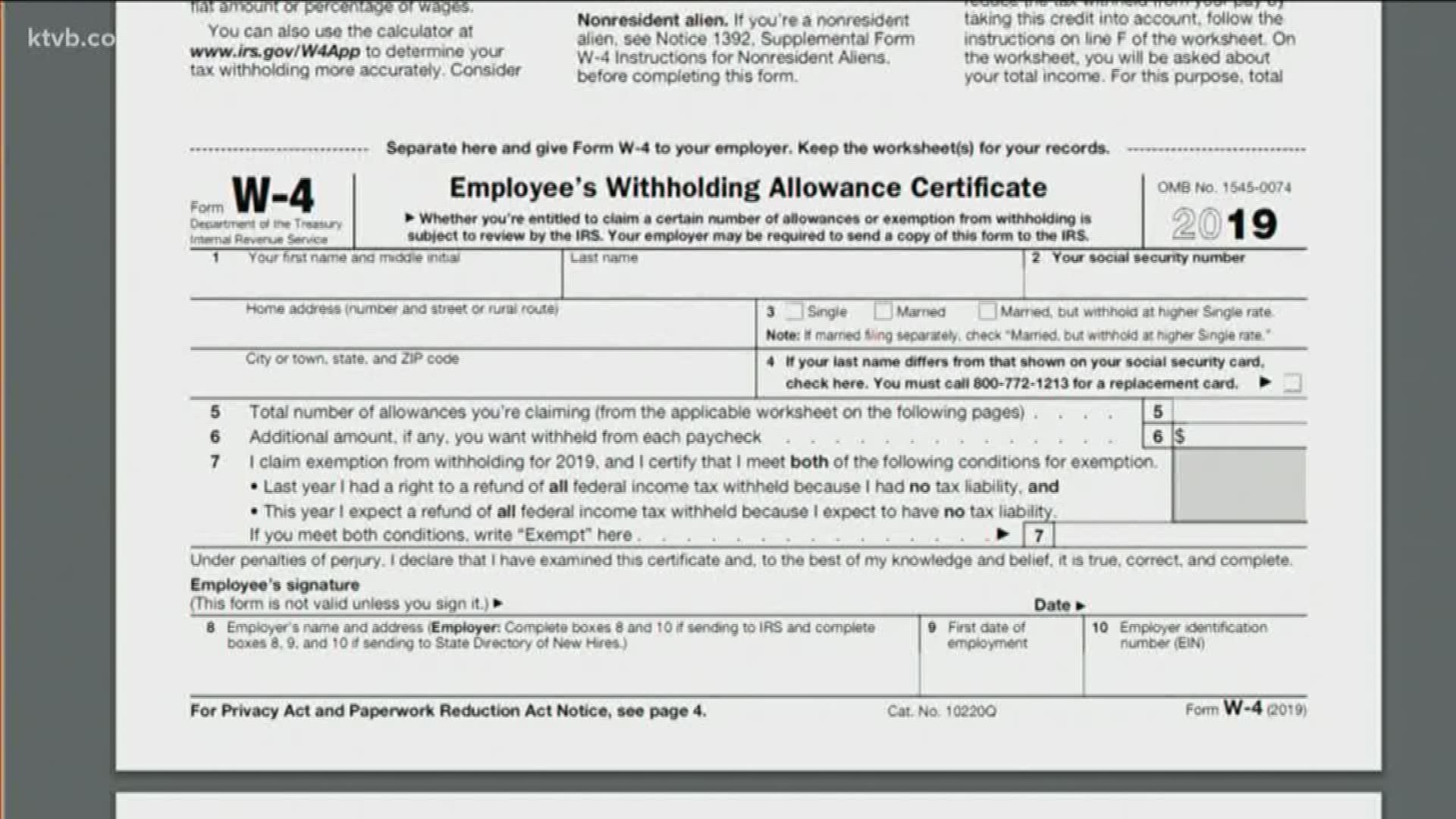

Tax Withholding Estimator | Internal Revenue Service If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. It's a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Use tab to go to the next focusable element.

PDF Monthly Income Worksheet - Home - Framework Monthly Income Worksheet Remember to use your net income, or "take-home pay," as you complete this worksheet. Monthly wages/salary calculations Paid weekly $ _____ per week x 52 weeks ÷ 12 months = _____ total monthly wages/salary* Paid every two weeks $

Quiz & Worksheet - Calculating Payroll Costs | Study.com About This Quiz & Worksheet. Examining what is good for us but not so good for a business, this quiz and corresponding worksheet will help you gauge your knowledge of calculating payroll costs.

Free Paycheck Calculator: Hourly & Salary - SmartAsset But calculating your weekly take-home pay isn't a simple matter of multiplying your hourly wage by the number of hours you'll work each week, or dividing your annual salary by 52. That's because your employer withholds taxes from each paycheck, lowering your overall pay.

PDF Calculating the numbers in your paycheck This answer guide provides suggested answers for the numbers in "Calculating the numbers in your paycheck" worksheet. Keep in mind that students' answers may vary. The important thing is for students to have reasonable justification for their answers.

How to Calculate Payroll | Taxes, Methods, Examples, & More If your employee is salaried, determine their annual wages and divide it by the number of pay periods in the year (e.g., 26 pay periods for biweekly). The amount is the employee's gross wages for the pay period.

PDF Name: Employee Pay & Benefits Review Worksheet Explain the ... Employee Pay & Benefits Review Worksheet Calculating Net Pay Directions: For each of the examples below calculate their net pay. 1. Sandra earns $13.50 per hour and works 32 hours a. What is her Gross Pay: 13.50 *32 = $432 b. Calculate her deductions Deduction % Of Gross Pay Amount Taken Out Federal Tax 15% 64.80 Social Security 6.2% 26.78

Calculating Your Paycheck Salary 1 Worksheets - Kiddy Math Some of the worksheets for this concept are Amp calculating your paycheck salary 1 key work, My paycheck, Amp calculating your paycheck salary 1 key work, Chapter 1 lesson 1 computing wages, Its your paycheck lesson 2 w is for wages w 4 and w 2, Ch 06 3g, Chapter 1 gross income lesson salary work answers, Answer key to understanding your paycheck.

Calculating the numbers in your paycheck | Consumer ... Student materials. Calculating the numbers in your paycheck (worksheet) How to read a paystub (handout) Cómo calcular las cifras de su cheque de pago (hoja de ejercicios) Note: Please remember to consider your students' accommodations and special needs to ensure that all students are able to participate in a meaningful way.

Calculating Your Paycheck Salary Worksheet 1 Answer Key ... The tips below will help you fill out Calculating Your Paycheck Salary Worksheet 1 Answer Key quickly and easily: Open the template in the full-fledged online editing tool by clicking Get form . Complete the necessary fields which are colored in yellow.

PDF INCOME CALCULATION WORKSHEET - DUdiligence.com INCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1) Hourly: See Part II, Section 1a, 1b, 1c or 1d (seasonal worker) 2) Weekly: See Part II, Section 2 3) Bi-Weekly: See Part II, Section 3 4) Semi-Monthly: See Part II, Section 4 5) Overtime/Bonuses: See Part II, Section 5a or 5b 6) Commissioned: See Part II, Section 6

Paycheck Calculator - Take Home Pay Calculator Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions, withholdings, federal tax, and allowances on your net take-home pay. Unlike most online paycheck calculators, using our spreadsheet will allow you to save your results, see how the calculations are done, and even customize it.

Payroll Expense Calculation Worksheets Calculate the average monthly payroll cost. Divide the total payroll costs in Box 5 by 12 and enter the resulting amount in Box 6. Enter the amount in Box 6 in the Average Monthly Payroll box on the Loan Request page of the PPP Loan Application. Step 7 Upload this Worksheet and all documents used to complete it to the Documents section of the ...

0 Response to "42 calculating your paycheck worksheet"

Post a Comment