39 qualified dividends and capital gain tax worksheet 2015

Capital Gain Tax Worksheet - 2015 Form 1040Line 44 ... 2015 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain … Qualified Dividend - Overview, Criteria, Practical Example Criteria for a Dividend to be "Qualified" Criteria for a dividend to be taxed at the long-term capital gains rate: 1. The dividend must be paid by a United States corporation Corporation A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating for profit. Corporations are allowed to enter or by a foreign corporation that meets ...

Schedule D - Viewing Tax Worksheet - TaxAct Expand the Federal Forms folder and then expand the Worksheets folder Scroll down and click Schedule D Tax Worksheet - Tax Worksheet - Line 20 Click Print and then click the worksheet name and the worksheet will appear in a PDF read-only format.

Qualified dividends and capital gain tax worksheet 2015

PDF Qualified Dividends and Capital Gain Tax Worksheet -Line ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. How to Dismantle an Ugly IRS Worksheet | Tax Foundation One of these is on most kinds of income, and another of these is on qualified corporate dividends and capital gains. There are seven and three brackets for each of these kinds of income, but the cutoffs for the brackets are based on the combination of both kinds of income. 35+ Ideas For Qualified Capital Gains Worksheet 2015 Qualified Capital Gains Worksheet 2015 is important information accompanied by photos and HD images sourced from all websites in the world. Download this image for free in High Definition resolution using a "download button" option below. If you do not find the exact resolution you are looking for, go for Original or higher resolution.

Qualified dividends and capital gain tax worksheet 2015. 2014 Qualified Dividends and Capital Gain Tax Worksheet ... 2014 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain … 1040 US Individual Income Tax Return - eFile.com Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42).45 pages 2015_TaxReturn_GregAbbott.pdf Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1 O4ONR, tine 42).14 pages Solved: My 2015 turbotax online does not show "tax ... last updated May 31, 2019 7:38 PM My 2015 turbotax online does not show "tax calculation worksheet" I had qualified dividends and net long capital gains. I wanted to see if TB used worksheet to calculate the tax of capital gains and qualified dividends at the rate of 15% TurboTax Online 0 1 135 Reply 1 Best answer Anita01 New Member

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. Qualified Dividends and Capital Gain Tax - TaxAct Qualified Dividends and Capital Gain Tax With the passing of the American Taxpayer Relief Act of 2012, certain taxpayers may now see a higher capital gains tax rate than they have in recent years. The new tax rates continue to include the 0% and the 15% rates; however, will also now include a 20% rate. Capital Form Gain Dividends And Qualified Tax Worksheet ... If you have qualified dividends, you should use the qualified dividends and capital gain tax worksheet in the Form 1040 instructions to calculate your tax and take advantage of the lower rates on capital gains and qualified dividends. Each kind of investment income can be taxed differently. PDF 2015 Form 6251 - IRS tax forms 2015 Form 6251 Form 6251 Department of the Treasury Internal Revenue Service (99) Alternative Minimum Tax—Individuals Information about Form 6251 and its separate instructions is at . Attach to Form 1040 or Form 1040NR. OMB No. 1545-0074 2015 Attachment Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR

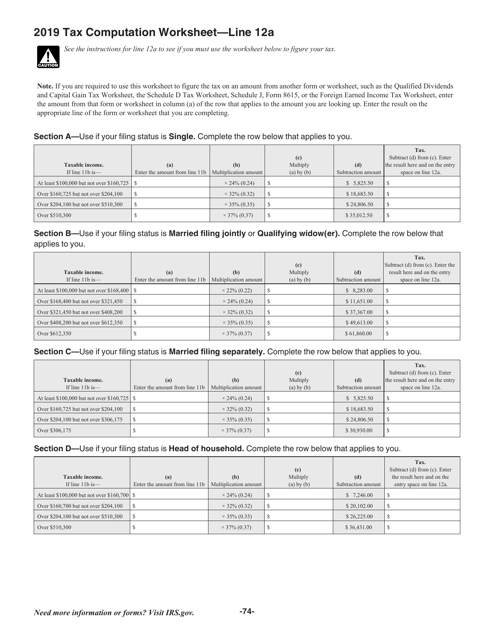

How Capital Gains and Dividends Are Taxed Differently In the case of qualified dividends, these are taxed the same as long-term capital gains. For 2021 and 2022, individuals in the 10% to 12% tax bracket are still exempt from any tax. Investors who ... 2015 Capital Gains Carryover Worksheet - Templates ... 2015 Capital Gains Carryover Worksheet. irs qualified dividends and capital gains worksheet form california instructions federal tax simpletax 4684 2014 tax covers 3 21 3 individual in e tax returns 2014 federal tax forms bloethe tax school december 3 3 21 3 individual in e tax returns irs qualified dividends and capital gains worksheet 2010 ... PDF 2015 Form 8615 - One Stop, Every Tax Form If the Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or Schedule J (Form 1040) is used to figure the tax, check here . . . . . . . . . 9 10 Enter the parent's tax from Form 1040, line 44; Form 1040A, line 28, minus any alternative Qualified Dividends and Capital Gains Worksheet - Page 33 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

39 Qualified Dividends And Capital Gain Tax Worksheet Fillable - combining like terms worksheet

2015 Tax Return - Elizabeth Warren 37 Enter the amount from line 6 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44, or the amount from line 13 ...39 pages

Solved Please help me find the remaining line ... - Chegg Please help me find the remaining line items of a Qualified Dividends and Capital Gain Tax Worksheet for a sample 2015 tax return, while showing the work to find your answer. Expert Answer First of all at line 20 the amount should be 10117. Since the amount at line 7 is $7397 which is less then $100000 thus tax ta … View the full answer

2015 Instructions for Schedule D - Capital Gains and Losses To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

Qualified Dividends and Capital Gain Tax Worksheet Form ... Use the qualified dividends and capital gain tax worksheet 2021 2015 template to simplify high-volume document management. Show details How it works Upload the capital gains tax worksheet 2021 Edit & sign 2021 qualified dividends and capital gain tax worksheet from anywhere Save your changes and share capital gains worksheet 2021

Capital Gains Tax Calculation Worksheet - The Balance Capital gains are short-term or long-term, depending on how long you owned the assets before selling them. Long-term tax rates are lower in most cases, set at 0%, 15%, or 20% as of 2022. Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another ...

Qualified Dividends And Capital Gain Tax Worksheet 2019 - Fill Online, Printable, Fillable ...

Solved: How can I view and print a copy of the "Qualified ... Solved: How can I view and print a copy of the "Qualified Dividends and Capital Gains Tax Worksheet" form for my 2017 return?

J.K. Lasser's Your Income Tax 2016: For Preparing Your 2015 ... J.K. Lasser Institute · 2015 · Business & EconomicsFor Preparing Your 2015 Tax Return J.K. Lasser Institute ... On both the Qualified Dividends and Capital Gain Tax Worksheet and the Schedule D Tax Worksheet ...

How to Figure the Qualified Dividends on a Tax Return ... Treat qualified dividends (found in box 1b of your 1099-DIV) as ordinary dividends, which are subject to the zero to 15 percent tax rate that applies to capital gains. Subject qualified dividends...

:max_bytes(150000):strip_icc()/486989097-56a938ab3df78cf772a4e54c.jpg)

0 Response to "39 qualified dividends and capital gain tax worksheet 2015"

Post a Comment