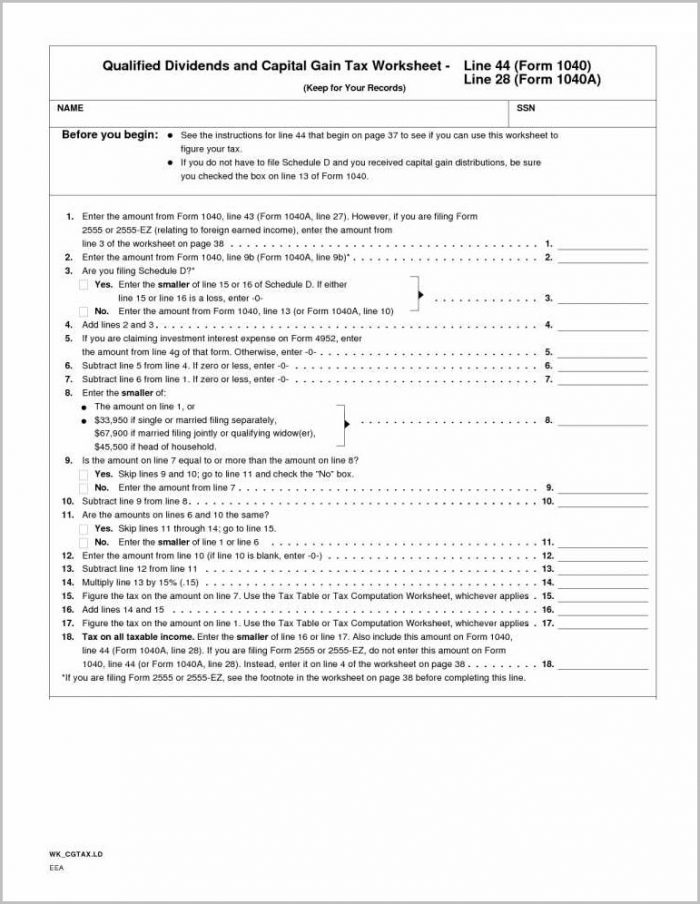

38 qualified dividends and capital gain tax worksheet

I can't find the Qualified Dividends and Capital Gain Worksheet so I ... Solved: I need to find the QUALIFIED DIVIDENDS AND CAPITAL GAIN TAX WORKSHEET Welcome back! Ask questions, get answers, and join our large community of tax professionals. How to Figure the Qualified Dividends on a Tax Return Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Qualified Dividends Tax Worksheet - Fill Out and Use The IRS has made available a new qualified dividends tax worksheet form (1096-DIV) for the 2019 tax year. The form is used to report distributions on Form 1040, Schedule B, and ensure that the correct amount of tax is withheld. This guide will provide an overview of the form and instructions on how to complete it.

Qualified dividends and capital gain tax worksheet

What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D. 'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... by Anura Gurugeon February 24, 2022 This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand. SMILE. Have done so for years. I was well trained by an AMAZING tax accountant over a decade. He did all of his returns, & he had HUNDREDS of clients, by […] › newsroom › qualified-business-incomeQualified Business Income Deduction | Internal Revenue Service The deduction is limited to the lesser of the QBI component plus the REIT/PTP component or 20 percent of the taxable income minus net capital gain. QBI is the net amount of qualified items of income, gain, deduction and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and ...

Qualified dividends and capital gain tax worksheet. How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income. 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments Qualified Dividends and Capital Gain Tax Explained — Taxry The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you. Lines 1-7 are for ordinary income and qualified income. Lines 8-11 are for non-taxable qualified income. Lines 12-14 are for qualified taxable income. Lines 15-19 are for the 15% bracket qualified income. Easy Calculator for 2021 Qualified Dividends and Capital Gain - Etsy Description. This is an excel spreadsheet to help aid in your calculations for the 2021 Qualified Dividends and Capital Gains Worksheet. This is to be used in conjunction with the 2021 form 1040 instructions from the IRS website to calculate tax on line 16 of form 1040 using the Qualified Dividends and Capital Gains Worksheet if required.

Qualified Dividends and Capital Gains Worksheet - t6988 - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Solved: Qualified Dividends and Capital Gain Tax Worksheet Level 15. May 17, 2021 6:05 PM. You open your tax file...you have to be inside it somewhere. Then you go to the Tax Tools menu on the left side and open n it. Then you click on the Print Center, and save/print a PDF copy ....with ALL the worksheets. Yep...got to pay for the software with a Credit Card in order to print.

Qualified Dividends and Capital Gains Flowchart - The Tax Adviser The complexity comes from the phaseout of the 0% and 15% rates as other taxable income rises. It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations (Form 1040 Instructions (2013), p. 43). With a good understanding of the mechanics, preparers can spot opportunities to advise clients to ... Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is ... 2019_Qualified_Dividends_and_Capital_Gain_Tax_Wor (1) (2).pdf Tools for Tax Pros TheTaxBook™ Qualified Dividends and Capital Gain Tax Worksheet (2019) • See Form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 11b. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions ...

How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do.

PDF Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to ... For 2003, the IRS added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the Schedule D. The worksheet is for taxpayers with dividend income only or those whose only capital gains are capital gain distributions reported in box 2a or 2b of Form 1099-DIV ...

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Schedule D Tax Worksheet If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. Qualified Dividends and Capital Gain Tax Worksheet.

ttlc.intuit.com › community › taxesSolved: When you have ordinary dividends and qualified ... May 31, 2019 · Qualified dividends are taxed at the same tax rate that applies to net long-term capital gains, while non-qualified dividends are taxed at ordinary income rates. I like the term 'non-qualified'. I think people may be confused by the use of 'ordinary' for both income and dividend. One might expect ordinary dividends to be taxed as ordinary income.

PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a ... complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box ... enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a ...

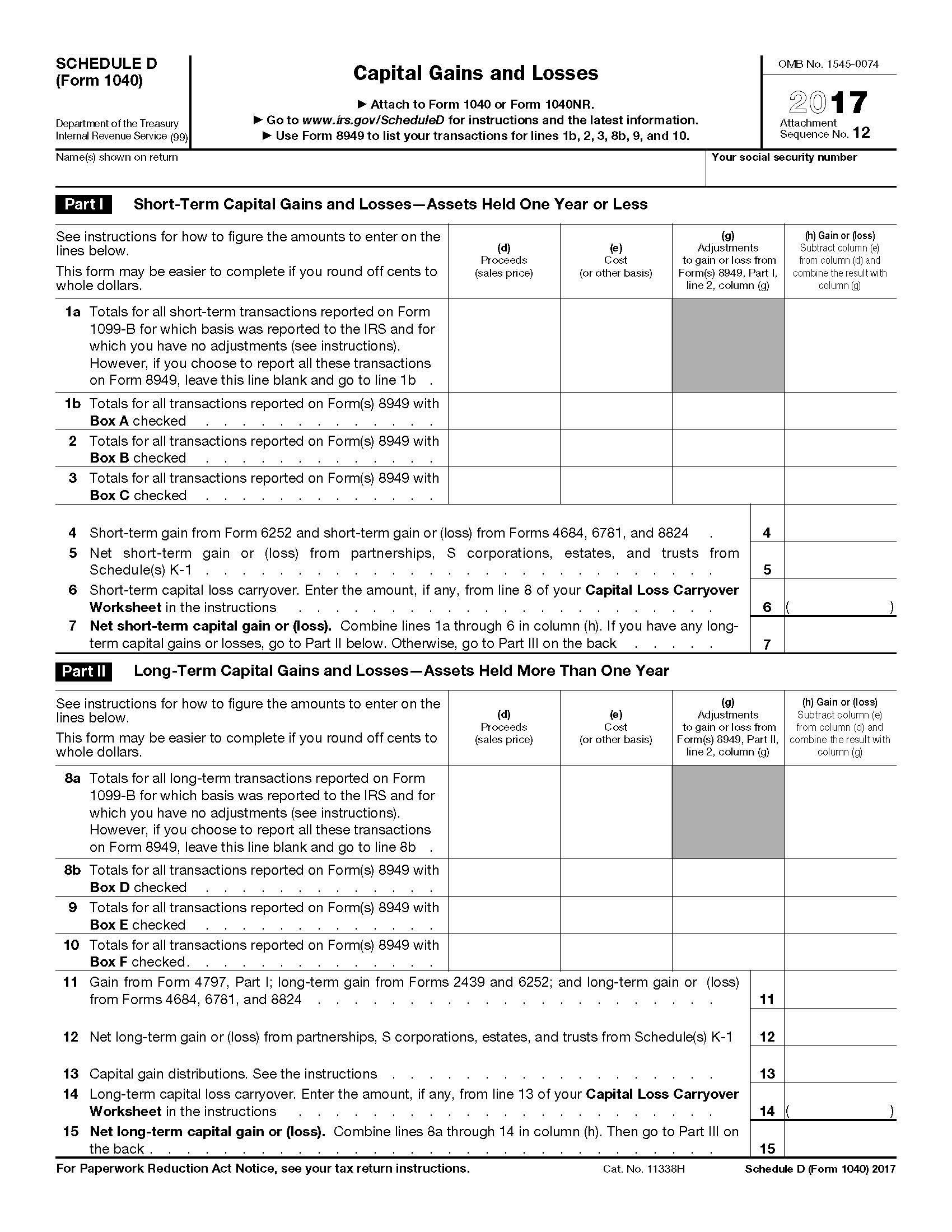

› taxtopics › tc409Topic No. 409 Capital Gains and Losses - IRS tax forms May 19, 2022 · Capital Gain Tax Rates. The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow(er).

Qualified Dividend And Capital Gain Tax Worksheet Qualified Dividend And Capital Gain Tax Worksheet. This analysis aims to develop worthy Electronic Student Worksheets (E-Worksheet) based project using FlipHTML5 in mild interference topic. E-Worksheet developed to stimulate student's science course of abilities. This analysis used design and development analysis which consisted of four ...

› newsroom › qualified-business-incomeQualified Business Income Deduction | Internal Revenue Service The deduction is limited to the lesser of the QBI component plus the REIT/PTP component or 20 percent of the taxable income minus net capital gain. QBI is the net amount of qualified items of income, gain, deduction and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and ...

'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... by Anura Gurugeon February 24, 2022 This is NOT sophisticated or fancy. It is very SIMPLE & BASIC. I do my taxes by hand. SMILE. Have done so for years. I was well trained by an AMAZING tax accountant over a decade. He did all of his returns, & he had HUNDREDS of clients, by […]

What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

0 Response to "38 qualified dividends and capital gain tax worksheet"

Post a Comment