38 qualified education expenses worksheet

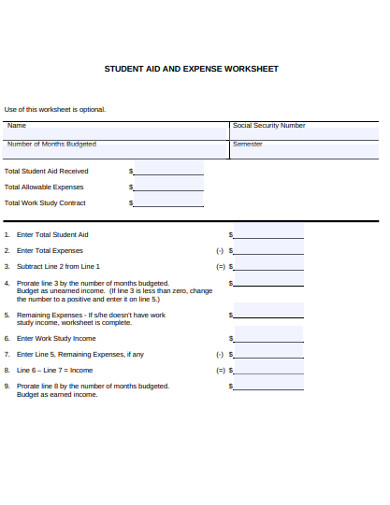

How do I calculate the amount of qualified education expenses? This total would become the qualified expenses plus any eligible books and supplies. For example, Box 5 is $1000 and Box 1 is $3000, then the qualified expense amount would be $2000 plus any books or supplies. If the amount in Box 5 is greater than the amount in Box 1, then you are not eligible to take an education credit. PDF Educational Expenses Worksheet - University of Michigan The Educational Expenses Worksheet is a form you can complete if you wish to request an adjustment to your financial aid budget ... regulations are subject to change through legislation or policy changes by the U.S. Department of Education. REV: 01/28/2022 O:/InDesign/Tracking Forms/Archive tracking forms/Forms2122.

Adjusted qualified education expenses worksheet form To calculate the eligible expenses for their credit, take the $7,000 ($3,000 grant + $4,000 loan) paid in 2019, plus the $500, for books and enter on line 1 of the worksheet above. The $3,000 will be entered on line 2a. The line 3 amount would be $3,000. Subtracting line 3 from line 1, you get qualified education expenses of $4,500.

Qualified education expenses worksheet

1040 - American Opportunity and Lifetime Learning Credits (1098T) Complete the Adjusted Qualified Education Expenses Worksheet in the Instructions for Form 8863 to determine what amount to enter on line 27 for the American Opportunity Credit or line 31 for the Lifetime Learning Credit. See the field help (F1) for lines 27 and 31 for additional information regarding which qualified expenses should be entered here. Education Expenses Worksheet for 2018 Tax Year Remaining expenses that qualify for scholarships/grants but not LLC/AOC Line 9 $0. Line 3 - Line 4. Put 0 if negative. Amount of scholarships/grants to transfer to student as income Line 10 $0. See "Your 2018 tax return included education expenses" for amount to put on return. Line 7 - Line 8 - Line 9. Put 0 if negative. PDF A OPPORTUNITY TAX CREDIT WORKSHEET - Tyler Hosting qualified education expenses and $4,400 for his room and board for the fall 2013 semester. He and the college meet all the requirements for the American opportunity credit. He figures his American opportunity credit based on qualified education expenses of $4,000, which results in a credit of $2,500.

Qualified education expenses worksheet. Guide to IRS Form 1099-Q: Payments from Qualified Education Programs For example, suppose your qualified education expenses are $10,000, you receive a $2,000 Pell grant and boxes 1 and 2 of your 1099-Q report a gross distribution of $8,000 and earnings of $1,000. Your adjusted expenses are $8,000—which means you don't have to report any education program distributions on your tax return. PDF 2020 Education Expense Worksheet - H&R Block Education Expenses 1. Payments received for qualified tuition and related expenses (total from column B above)1. 2. Amounts actually paid during 2020 for qualified tuition and related expenses (total from column D above) . . . . . . . 2. 3. Knowledge Base Solution - How do I enter qualified education expenses ... How do I enter qualified education expenses for Form 8863 in a 1040 return using interview forms? Go to Interview Form IRS 1098-T - Tuition Statement. In Box 70 - Qualified expenses override, enter the applicable amount. In Box 71 - Education code, use the lookup value (double-click or press F4) to select the applicable codes. Calculate the return. Qualified Ed Expenses | Internal Revenue Service Nov 03, 2021 · Qualified education expenses must be paid by: You or your spouse if you file a joint return, A student you claim as a dependent on your return, or; A third party including relatives or friends. Funds Used. You can claim an education credit for qualified education expenses paid by cash, check, credit or debit card or paid with money from a loan.

What Counts As Qualified Education Expenses? - Credit Karma The lifetime learning credit is worth 20% of the first $10,000 of qualified education expenses, up to a maximum of $2,000 per return. Unlike the AOTC, the LLC does not include a refundable tax credit, meaning if the amount of the credit exceeds the tax you owe, you can't get the excess as a refund. You can claim the LLC for an unlimited ... Qualified Education Worksheet March 19, 2020 12:18 PM The amount on line 18 would be the education expenses used for purposes of qualifying for an education credit or tuition and fees deduction. You can't use the same expenses to exclude income on your education plan that you used to receive an education expense credit or deduction. Education Expenses - IRS tax forms scholarship. (But for exceptions, see Payment for services in Publication 970, Tax Benefits for Education.) Use Worksheet 1–1 below to figure the amount of a scholarship or fellowship you can exclude from gross income. Education Expenses The following are qualified education expenses for the purposes of tax-free scholarships and fellowships:

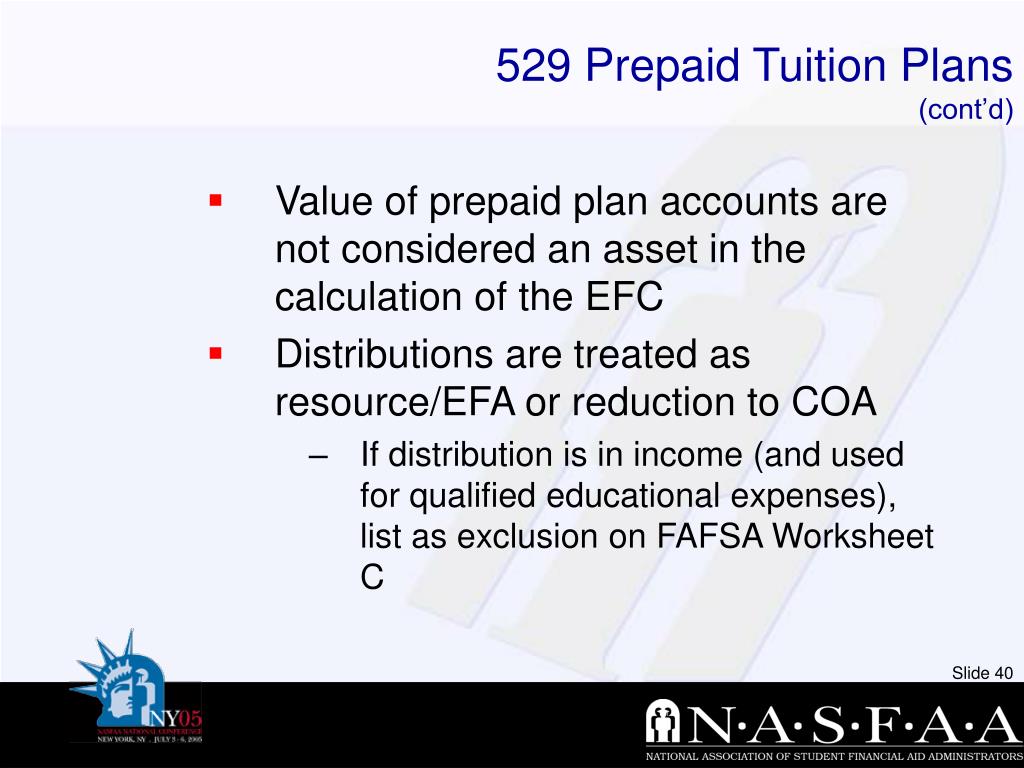

Reporting 529 Plan Withdrawals on Your Federal Tax Return When 529 plan funds are used to pay for qualified education expenses there is usually nothing to report on your federal income tax return. Form 1099-Q and Form 1098-T will list the amount of the 529 plan distribution and how much was used to pay for college tuition and fees, but it is up to the 529 plan account owner to calculate the taxable portion. Qualified Education Expenses Exception (Code 08) (for IRAs) - TaxAct Form 5329 - Qualified Education Expenses Exception (Code 08) (for IRAs) The qualified education expenses must not include amounts paid using grants, scholarships, or other tax-free benefits. Who Is Eligible. You can take a distribution from your IRA before you reach age 59 1/2 and not have to pay the 10% additional tax if, for the year of the ... Entering education expenses in ProSeries - Intuit Check the box for either Taxpayer or the spouse showing they have qualified education expenses. Click the QuickZoom to the Student Information Worksheet. You can have as many Student Information Worksheets as you need for the tax return. Just make sure every student has their own Student Information Worksheet, as their name will be at the top. Cost Report Data - Worksheet Formats Worksheet S-8 * Hospital-based Rural Health Clinic / Federally Qualified Health Center Statistical Data: form: instructions: S900: Worksheet S-9 Parts I-IV * Hospice Identification Data: form: instructions: S111: Worksheet S-11 Part I * Hospital-based FQHC Identification Data: form: instructions: S112: Worksheet S-11 Part II *

Education Expense Credit - Credits - Illinois Education Expense Credit You may figure a credit for qualified education expenses, in excess of $250, you paid during the tax year if you were the parent or legal guardian of a full-time student who was under the age of 21 at the close of the school year, you and your student were Illinois residents when you paid the expenses, and

Publication 970 (2021), Tax Benefits for Education | Internal ... If you pay qualified education expenses in both 2021 and 2022 for an academic period that begins in the first 3 months of 2022 and you receive tax-free educational assistance, or a refund, as described above, you may choose to reduce your qualified education expenses for 2022 instead of reducing your expenses for 2021..

Why are the Adjusted Qualified Higher Education Expenses on my 1099-Q ... The qualified expenses for 1099-Q funds are tuition, books, lab fees, AND room & board. That's it. If there are any excess 1099-Q funds they are taxable. The amount is included in the total on line 7.. Finally, out of pocket money is applied to qualified education expenses

Adjusted Qualified Education Expenses Worksheet Adjusted Qualified Education Expenses Worksheet Posted on April 11, 2022 by admin The statement which is prepared for ascertaining profit of enterprise on the end of an accounting interval known as an income assertion. The difference between the totals of debit and credit columns is transferred to the steadiness sheet column of the worksheet.

8863/8917 - Education Credits and Deductions - Drake Software In Drake 15 and prior, Details for two schools can be entered on the first 8863 screen for each student Press Page Down to enter additional information for 3 or more schools on subsequent screens.; Complete the Adjusted Qualified Education Expenses Worksheet in the Instructions for Form 8863 to determine what amount to enter on line 27 for the American Opportunity Credit or line 31 for the ...

Can I Deduct My Computer for School on Taxes? - TurboTax Oct 16, 2021 · Education tax credits. The government uses tax policy to encourage activities such as paying for education and saving for retirement. While the names and amounts vary, the IRS generally provides for some type of educational tax credit to help offset the costs of qualifying tuition and related expenses.

PDF Determining Qualified Education Expenses - IRS tax forms the worksheet above. The $3,000 Pell Grant will be entered on line 2a. The line 3 amount is $3,000. Subtracting line 3 from line 1, you get qualified education expenses of $4,500. If the resulting qualified expenses are less than $4,000, the student may choose to treat some of the grant as income to make more of the expenses eligible for the ...

PDF Figuring Qualified Expenses for Education Credits to be Entered on Form ... for education expenses will be the most helpful credit on most tax returns. The AOC may be used for qualified education expenses paid for . four post-secondary education years. The Lifetime Learning Credit will only be used for students who are beyond their 4th year of post-secondary education, (i.e. Graduate

How do I report Qualified Education Expenses involving a 1099-Q? You have two options with how to report your Qualified Education Expenses on Form 1099-Q. To demonstrate, we will use the following example: Dave received a 1099-Q for a distribution that he received from his QTP (Qualified Tuition Program). His gross distribution (box 1) was $5000 and his earnings (box 2) were $1500.

Qualified Dividend Definition - Investopedia Jan 22, 2022 · Qualified Dividend: A qualified dividend is a type of dividend to which capital gains tax rates are applied. These tax rates are usually lower than regular income tax rates.

Adjusted Qualified Education Expenses Worksheet - Blogger The 7609 paid in tuition is not considered there. Qualified education expenses dont include the cost of. Adjusted qualified education expenses worksheet. 1 Tuition 2 Room. Based on his adjusted qualified education expenses of 4000 Bill would be able to claim an American opportunity tax credit of 2500.

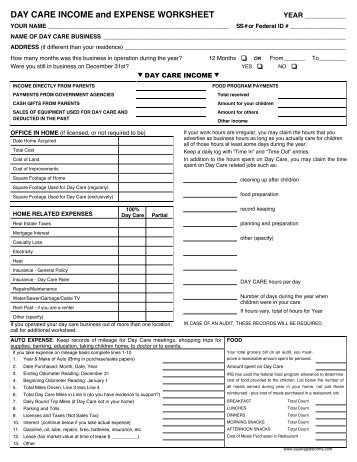

PDF IL-1040-RCPT, Receipt for Qualified K-12 Education Expenses Add the amounts in the "Total Amount of Qualified Expenses Paid by Parent or Guardian" column for each student. Use this total to complete the K-12 Education Expense Credit Worksheet on Schedule ICR. Total $ (This required information may be (K-12 only) provided by the recipient)

Qualified 529 expenses | Withdrawals from savings plan | Fidelity American Opportunity Tax Credit allows families of undergraduates to deduct the first $2,000 spent on qualified education expenses and 25% of the next $2,000. To qualify for the full credit in 2019, single parents must have a modified adjusted gross income of $80,000 or less, or $160,000 or less if married and filing jointly.

Qualified Teacher and Educator Tax Deductions 2021 Returns Start and e-File your Education Tax Return Now. For Tax Year 2021, teachers or educators can generally deduct unreimbursed, out-of-pocket, school, trade, or educator business expenses up to $250 on their federal tax returns using the Educator Expense Deduction. You do not have to itemize your deductions to claim this.

PDF A OPPORTUNITY TAX CREDIT WORKSHEET - Tyler Hosting qualified education expenses and $4,400 for his room and board for the fall 2013 semester. He and the college meet all the requirements for the American opportunity credit. He figures his American opportunity credit based on qualified education expenses of $4,000, which results in a credit of $2,500.

Education Expenses Worksheet for 2018 Tax Year Remaining expenses that qualify for scholarships/grants but not LLC/AOC Line 9 $0. Line 3 - Line 4. Put 0 if negative. Amount of scholarships/grants to transfer to student as income Line 10 $0. See "Your 2018 tax return included education expenses" for amount to put on return. Line 7 - Line 8 - Line 9. Put 0 if negative.

![HSA Qualified Medical Expenses List [HSA-QMELIST] - $49.00 : Banker ...](https://store.bankersonline.com/images/medium/QMELIST_MED.gif)

0 Response to "38 qualified education expenses worksheet"

Post a Comment