38 tax write off worksheet

PDF Worksheet for Firefighters TAX YEAR 201 - Juda Kallus reading at both the beginning and end of the tax year. Keep receipts for all car operating expenses - gas, oil, repairs, insurance, etc., and of any reimbursement you received for your expenses. H TRAVEL OUT-OF-TOWN Expenses of traveling away from "home" overnight on job-related and continuing-education trips are deductible. Your Tax Worksheet | Etsy Taxes Made Easy, Multi-Year Photography Tax Spreadsheets, Tax Write Offs, Audit Prep Guide BP4UPhotoResources (335) $4.00 $9.99 (60% off) Tax Prep Checklist Tracker Printable, Tax Prep 2022, Tax Checklist, Tax List, Tax Tracker ModernFunTemplates (5) $1.12 $1.49 (25% off)

ค้นพบวิดีโอยอดนิยมของ write off tax worksheet | TikTok TikTok video from Sherman the CPA (@shermanthecpa): "📌 Top Tax 5 Write-offs for LLCs!If you connect any of these things to a business purpose, you may be able to deduct it to put more money 💰 in your pockets.Follow @shermanthecpa to learn more. #taxwriteoffs #taxdeductions #taxwriteoff #taxdeduction #taxdeductible #writeoff #businesstaxes ...

Tax write off worksheet

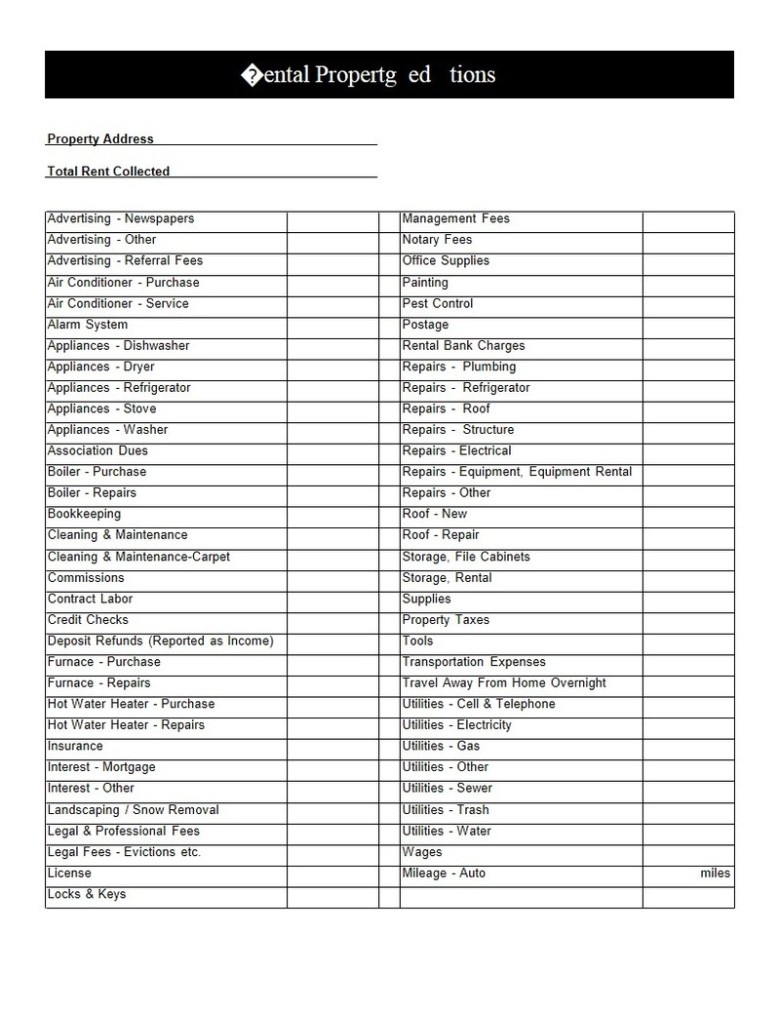

PDF Tax Deduction Worksheet - Oxford University Press Tax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant Free 1099 Template Excel (With Step-By-Step Instructions!) How to Use this 1099 Template. There are 6 basic steps to using this 1099 Template. Step 1. Enter all expenses on the "All Business Expenses" tab of the free template. Step 2. Identify the total amount of each expense type by using the filter option on the "All Business Expenses" tab. Step 3. Free Rental Income and Expense Worksheet | Zillow Rental Manager To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Tax write off worksheet. Independent Contractor Expenses Spreadsheet [Free Template] - Keeper Tax See write-offs 1. 🟩 Schedule C Expense Categories This first tab is your bread and butter. All you need to do here is customize it with your name, and fill in your business-use percentages. (Those boxes are in yellow — hover over the cell for notes!) Everything else here will show up automatically, based on what you enter in the other two tabs. IRS Guidelines and Information | Donating to Goodwill Stores If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations. According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Fair market value is the price a willing buyer would pay for them. Value … PDF Your Home Page 1 of 22 10:39 - 18-Jan-2022 - IRS tax forms This publication also has worksheets for calculations relating to the sale of your home. It will show you how to: 1. Determine if you have a gain or loss on the sale of ... FormComments. Or, you can write to the Internal Reve-nue Service, Tax Forms and Publications, 1111 Constitu-tion Ave. NW, IR-6526, Washington, DC 20224. The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula

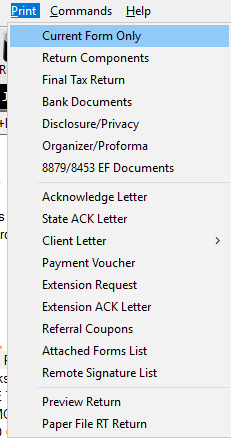

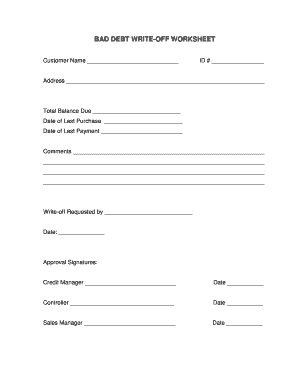

› tax-return-preparation-checklist2021 Tax Return Preparation and Deduction Checklist in 2022 The eFile Tax App will do the the complicated math and gather all the tax forms for you as you enter information and answer questions. Use the tax statement forms below to report all your income and other information and let us do the hard work for you. See how the eFile platform works and compare eFile to other popular tax preparation platforms. An Updated Tax Write-Off Worksheet, by the Nosiest Employee at the IRS ... The Second City Training Center. 50+ Humor Writing Websites. Points in Case. 1-on-1 Short Humor Coaching. James Folta. Kelsey Harper New York. Kelsey is a writer/performer/comedian based in New York. She is a graduate of the Dramatic Writing program at NYU. Kelsey co-hosts a monthly variety show, Pigeon Presents, at the Knitting... 18+ Rental Property Worksheet Templates in PDF The expenditure is made on your property like paying off the electricity, Gas, Heat, a bill needs to be mentioned by you in the template of the Sample Rental Property Worksheet. This is a type of property inventory where you can write the income and expense both in a systematic manner. 9. Rental Property Calculation Worksheet Template › publications › p560Publication 560 (2021), Retirement Plans for Small Business Or you can write to: Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. NW, IR-6526 Washington, DC 20224. Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments as we revise our tax forms, instructions, and publications.

Alternative Fuel Infrastructure Tax Credit - Energy 31.12.2021 · Fueling equipment for natural gas, propane, liquefied hydrogen, electricity, E85, or diesel fuel blends containing a minimum of 20% biodiesel installed through December 31, 2021, is eligible for a tax credit of 30% of the cost, not to exceed $30,000. Permitting and inspection fees are not included in covered expenses. Fueling station owners who install qualified equipment … PDF Contractor's Deduction Worksheet - MB Tax Pro Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? YES_____ NO_____ Income: Office Expense Office Supplies ... Total Miles Driven Taxes & Licenses Answering Service Tax (business) Bank Charges Tax Preparation Commissions Telephone: Contract Labor Business Line ... Free Clothing Donation Tax Receipt - PDF | Word - eForms Donating clothes can be a great tax write-off for any individual that pays income tax at the end of the year. It may not be much but commonly an organization that does take used clothing will "round up" or estimate the clothes to be at a higher price than they may actually be sold. Step 1 - Gather Usable Clothes Riley & Associates: Certified Public Accountants Teachers Expense Worksheet (.xlsx) Tradesmen Annual Expense Spreadsheet Tradesmen Expense Worksheet (.pdf) Tradesmen Expense Worksheet (.xlsx) House Cleaning (.pdf) Web Designer (.pdf) Massage Therapist (.pdf) Mechanic (.pdf) Online Sales (.pdf) Other Tax Checklists Annual Rental Property Worksheet (.pdf) Non-Cash Contributions (.pdf)

PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... make sure I have your last year's tax return so I can follow it. Otherwise, answer the following: Date you purchased the property ... ***Please email or fax worksheet De'More Tax Service Office: 817-726-2181 Mobile: 972-885-9709 Fax: 206-736-0982 Email: taxes@demoretaxservice.com Email: demoretaxservice@gmail.com .

› publications › p505Publication 505 (2022), Tax Withholding and Estimated Tax ... Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ...

Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

The Epic Cheat Sheet to Deductions for Self-Employed Rockstars That means, if you go out for a $500 meal, the deductible portion is only $250. Also know that the 2018 tax bill eliminated client entertainment as a tax deduction. That means that you can no longer write off taking your client out to events, like the ballet or a baseball game.

Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ...

Tax expense journal - templates.office.com Track your tax expenses with this accessible tax organizer template. Utilize this tax expense spreadsheet to keep a running total as you go. Take the stress out of filing taxes with this easy-to-use tax deduction spreadsheet. Excel Download Open in browser Share Find inspiration for your next project with thousands of ideas to choose from

smartasset.com › taxes › tax-breaks-you-can-claimTax Breaks You Can Claim Without Itemizing - SmartAsset Jan 11, 2022 · But some workers – like performing artists and certain government officials – can simply include them on their income tax returns (line 24 of Schedule 1). 9. Jury Duty Payments. Besides the above-the-line deductions, there are other tax breaks (called write-in adjustments) that you can write in and claim without itemizing.

0 Response to "38 tax write off worksheet"

Post a Comment