39 self employed business expenses worksheet

PDF TAX YEAR 2021 SMALL BUSINESS CHECKLIST - Tim Kelly self-employed health insurance premiums outside services (paid to other businesses) postage printing and copy expense professional memberships retirement contributions for employees retirement contributions for owner(s) rental of vehicles, machinery or equipment rental of space or property repairs security email to lynn@timkelly.com or fax to ... PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... BUSINESS EXPENSES Advertising (Website, Business cards, Marketing, etc.) Commissions & fees you paid Contract labor Insurance Health Insurance if not covered by spouse or employer plan ... Microsoft Word - Self Employed and 1099 Worksheet Author: Jenya Rose Created Date:

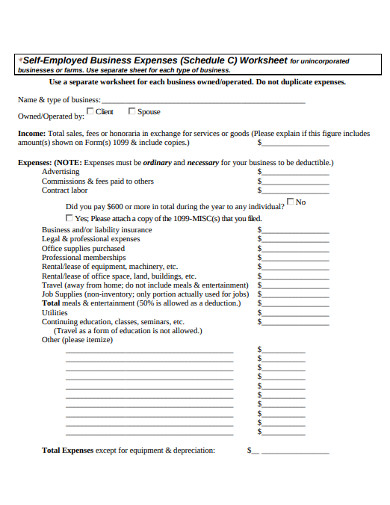

Self-Employed Business Expense Worksheet Business Cards Bank Char es CD, DVD Blanks Client Gifts BUSINESS SUPPLIES WORKSHEET LLC TAX YEAR The purpase of this worksheet is to help you organize your tax deductible business expenses. In order for expense to be deductible, it must be considered an *ordinary and necessary- expense. You may include other applicable expenses.

Self employed business expenses worksheet

PDF Self-Employed Worksheet - MB Tax Pro - Home Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? ... *Expenses must be ordinary and necessary and have a business purpose. The income and expenses above must be backed by receipts and/or other documentation. Title: Contractor's Deduction Worksheet The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it's usually better to just track your actual home expenses. Hopefully, this free worksheet — and the Keeper Tax app — can take the hassle out of expense tracking. {filing_upsell_block} Complete List of Self-Employed Expenses and Tax Deductions You can deduct the costs of your personal health insurance premiums as a self-employed person as long as you meet certain criteria: Your business is claiming a profit. If your business claims a loss for the tax year, you can't claim this deduction. You were not eligible to enroll in an employer's health plan.

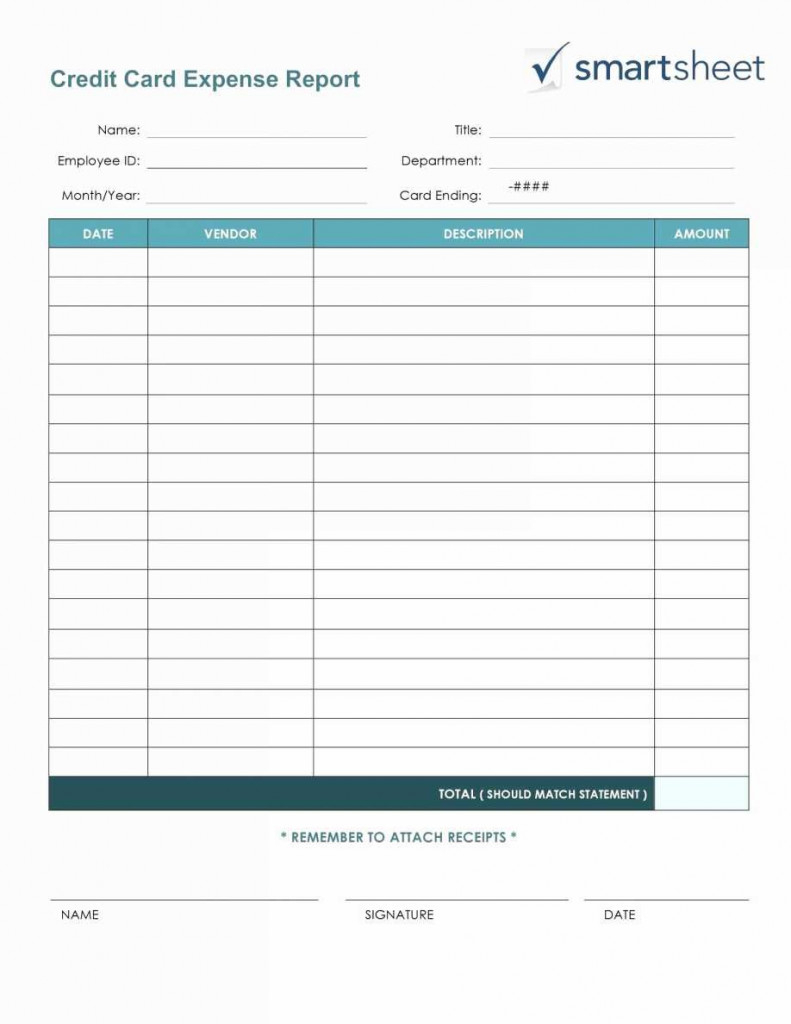

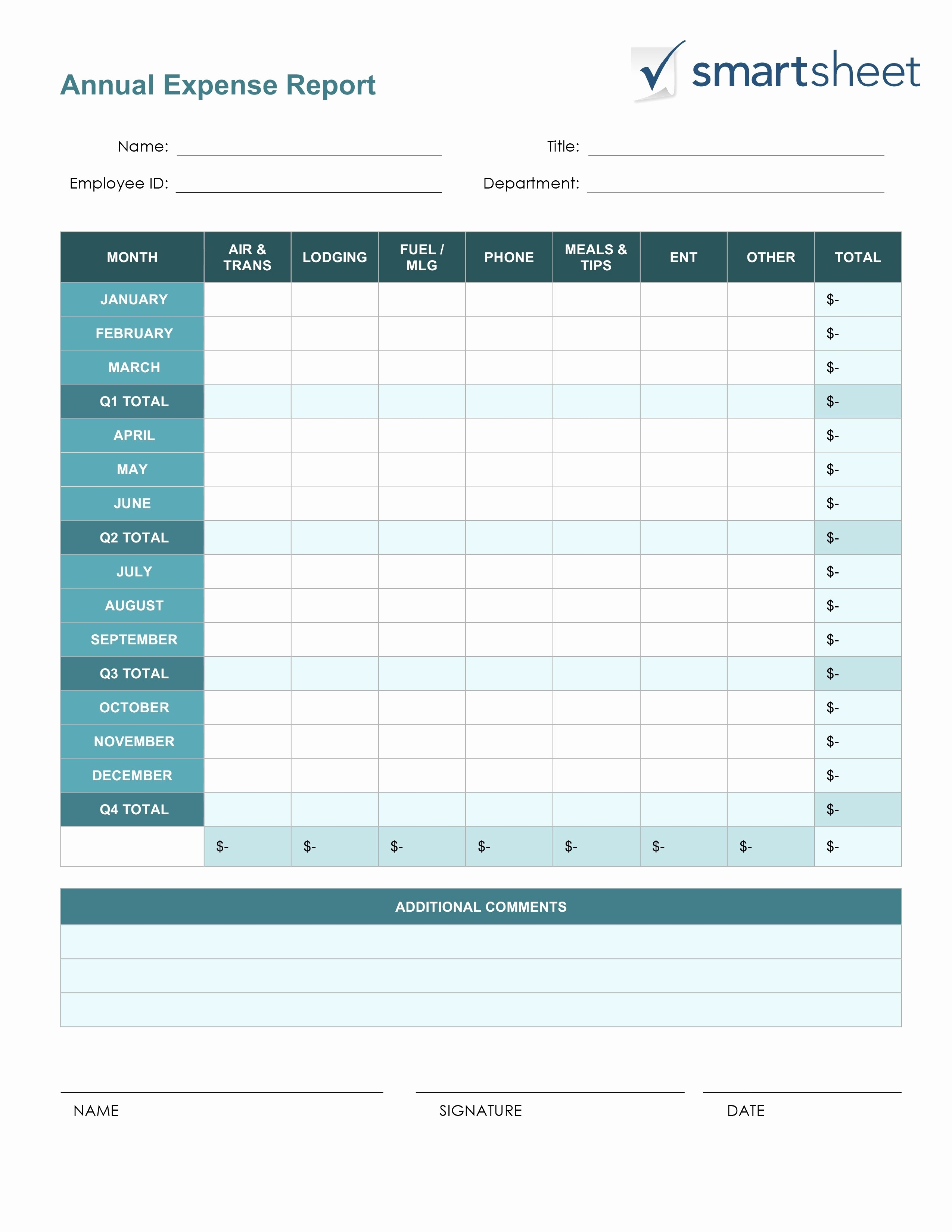

Self employed business expenses worksheet. 15 Tax Deductions and Benefits for the Self-Employed The self-employment tax refers to the Medicare and Social Security taxes that self-employed people must pay. This includes freelancers, independent contractors, and small-business owners. The... Business Expense Report Template | Free Samples & Sheets Self-Employed Business Expenses Worksheet. Self-employment provides one with a lot of freedom; therefore, you may end up spending more than you are gaining. The business expense report will enable you to know how much you are paying by including all the expenses; such as interior decor of the office or business, rent, electricity charges, meals ... Self Employed Income And Expenses Sheet Self Employed Income And Expenses Sheet. Published by Alexander; Monday, June 20, 2022; self employed expenses spreadsheet free regarding self employed expense Self Employment Worksheet - First Choice Tax Service Our goal is to make tax filing as simple as possible. Directions: 1. Click on the button below to get the Self-Employed Business Expenses Worksheet and print it out. 2. Look over the form and gather your tax information. 3. Fill out the form. Deliver it to us via email or in person. Download Here Don't Wait Contact Us Here I'm Ready

Self-Employed Individuals Tax Center | Internal Revenue Service Use the worksheet found in Form 1040-ES, Estimated Tax for Individuals to find out if you are required to file quarterly estimated tax. Form 1040-ES also contains blank vouchers you can use when you mail your estimated tax payments or you may make your payments using the Electronic Federal Tax Payment System (EFTPS). Expenses if you're self-employed: Overview - GOV.UK If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Example Your... PDF SELF EMPLOYED INCOME/EXPENSE SHEET - CPA Accounting SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate records required) COST OF GOODS SOLD (If Applicable) Beginning of the Year Inventory End of Year Inventory Purchases Other: Free Income and Expense Tracking Templates (for Excel) Step 2: Run the Excel program and select a pre-installed template for tracking personal expenses or spreadsheet. Pre-installed templates can be obtained by clicking the "File" tab and selecting "New" and then select "Sample templates" and choose "Personal Monthly Budget" and finalize by clicking "Create."

PDF Self-employed Income and Expense Worksheet INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $ $ OTHER BUSINESS INCOME COMMISSIONS $ $ OTHER BUSINESS INCOME INSURANCE (Other Than health) $ COST OF GOODS SOLD INTEREST (Business Loans) $ COST OF INVENTORY AT THE BEGINNING OF THE YEAR $ INTEREST (Business Loans) $ PDF Tax Magic Net Profit From Business Worksheet Self-employed Income/Expense Data Sheet -Office Copy 02.17.2018 . Tax Magic Net Profit From Business Worksheet (Please include a copy of your last year's return) . SUMMARY OF EXPENSES . ... If you do NOT have any business expenses, please provide an explanation . I, acknowledge that I have receipts and records regarding my personal business ... Publication 535 (2021), Business Expenses | Internal Revenue Service Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. PDF Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet 1 Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses.

PDF Self Employment Income Worksheet - mytpu.org Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS. Income: Months:

PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ...

XLS Self-employed doing: Employed by: I receive the following AVERAGE MONTHLY GROSS INCOME (based on 4.33 weeks or 2.165 bi-weekly periods per month) from the following sources: E. Rent Income 1 F. Business Income 2 I. Other (itemize) 3 Complete attached Business Expense Worksheet. Enter result on Line "F." Complete PART II in ALL CHILD SUPPORT CASES

12+ Business Expenses Worksheet Templates in PDF | DOC self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

Self-Employed Tax Deductions Worksheet (Download FREE) If you are concerned with how much you'll owe, don't worry. The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

PDF INCOME (total gross sales) : OPERATING EXPENSES COST OF GOODS SELF-EMPLOYED INDIVIDUAL DEDUCTIONS Debbie's Accounting Service 3575 Southside Blvd ... VEHICLE EXPENSES OPERATING EXPENSES COST OF GOODS EQUIPTMENT PROFESSIONAL. Title: Self Employed SCH C Business Deduction Worksheet.xlsx Author: nick Created Date: 1/14/2013 12:45:00 PM ...

PDF Schedule C -- Self Employed Business Income and Expense Worksheet Schedule C -- Self Employed Business Income and Expense Worksheet. Complete this form if you were self-employed during this tax year. A Small Business Questionnaire and a 1099 and Sales Tax Questionnaire is required in addition to this worksheet. Additional worksheets may be required to report home office and vehicle expenses. Business Name ...

PDF 2021 Self-Employed (Sch C) Worksheet - cotaxaide.org Business expenses Tools, etc. under $2,500 each Advertising $ Commissions and fees $ Health insurance premiums $ Business insurance $ Interest on business loans $ Office expense/supplies $ $ Rent (not home office) $ Repairs $ Supplies $ Licenses or fees Business expenses (cont.) Business part of phone $ Training for this business

PDF Schedule C Worksheet for Self Employed Businesses and/or ... - Kristels Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ...

8+ Income & Expense Worksheet Templates - PDF, DOC | Free & Premium ... So, here are the steps that will help you create your own sample expense report and income statement spreadsheet: Open your spreadsheet or worksheet application Let us Microsoft Excel for this example. Open the application, click on "File" and then select "New".

Complete List of Self-Employed Expenses and Tax Deductions You can deduct the costs of your personal health insurance premiums as a self-employed person as long as you meet certain criteria: Your business is claiming a profit. If your business claims a loss for the tax year, you can't claim this deduction. You were not eligible to enroll in an employer's health plan.

The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax Since most self-employed individuals have more than $1,500 in deductible business expenses each year, it's usually better to just track your actual home expenses. Hopefully, this free worksheet — and the Keeper Tax app — can take the hassle out of expense tracking. {filing_upsell_block}

PDF Self-Employed Worksheet - MB Tax Pro - Home Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? ... *Expenses must be ordinary and necessary and have a business purpose. The income and expenses above must be backed by receipts and/or other documentation. Title: Contractor's Deduction Worksheet

0 Response to "39 self employed business expenses worksheet"

Post a Comment