45 income tax deduction worksheet

Income Tax Worksheet Download this income tax worksheet AKA income tax organizer to maximize your deductions and minimize errors and omissions. FileTax site offers FREE information to HELP YOU PLAN AND MANAGE YOUR STATE AND FEDERAL INCOME TAXES. Pension Protection Act of 2006 highlights. Key changes of tax law brought on by the act, including those related to IRA's ... Deductions | FTB.ca.gov Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction ... The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California ...

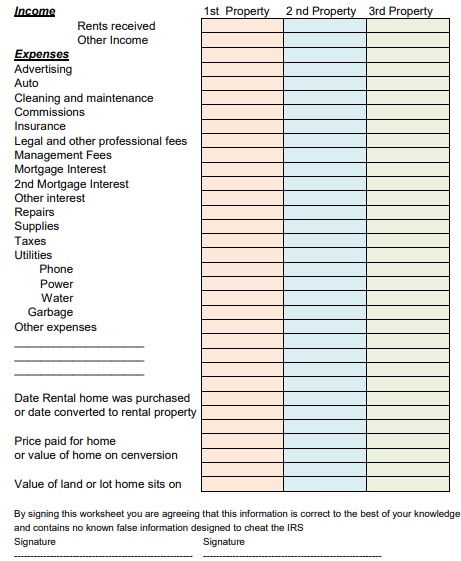

Free Rental Income and Expense Worksheet | Zillow Rental Manager To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Income tax deduction worksheet

Worksheet 2 (Tier 3 Michigan Standard Deduction) Estimator if the older of you or your spouse (if married filing jointly) was born during the period january 1, 1953 through january 1, 1954, and reached the age of 67 on or before december 31, 2020, you may deduct the personal exemption amount and taxable social security benefits, military compensation (including retirement benefits), michigan national … Tax Worksheets - Assured Tax Tax Worksheets & Logs Here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Remember, you'll need proof of your deductions - so keep those mileage logs, expense and donation receipts (property donation photos, too!) Tax Worksheets TAX DEDUCTION FINDER PDF Schedule a Tax Deduction Worksheet - Heinekamp Financial State Income Tax (current year estimate) $ Business Phones $ State Income Tax Withheld (from W-2) $ Business Travel $ ... SCHEDULE A TAX DEDUCTION WORKSHEET MEDICAL EXPENSES CONTRIBUTIONS PLEASE SIGN BELOW MISCELLANEOUS ADJUSTMENTS TO INCOME TAXES PAID CASUALTY INTEREST PAID Form 914 Rev. 2 (12/06)

Income tax deduction worksheet. PDF 2022 Form W-4 - IRS tax forms Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074 2022 Step 1: Enter Personal Information (a) First name and middle initial Last name Address City or town, state, and ZIP code Federal Worksheet - Canada.ca You may also have to complete the Federal Worksheet (for all provinces and territories) to calculate the amount for the following lines: Lines 12000 and 12010 - Taxable amount of dividends from taxable Canadian corporations Line 12100 - Interest and other investment income Line 22100 - Carrying charges, interest expenses, and other expenses The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. What is this tax and interest deduction worksheet - Intuit The tax and interest deduction worksheet shows the itemized deductions claimed for state and local taxes, including real estate taxes, and mortgage interest. You would only itemize if your total deductions were greater than the standard deduction for your filing status. However, these deductions can still be listed on your return.

PDF 19 2021 Itemized Deduction (Sch A) Worksheet 19 - 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000 If you checked any of the above, please stop here and speak with one of our Counselors. Federal Income Tax Deduction Worksheet Alabama Department of ... - signNow Easily find the app in the Play Market and install it for eSigning your federal income tax deduction worksheet alabama department of revenue alabama. In order to add an electronic signature to a federal income tax deduction worksheet alabama department of revenue alabama, follow the step-by-step instructions below: Log in to your signNow account. PDF Form 63 0036 Combined Disposable Income Worksheet ombined isposable Income Worksheet REV 63 0036 (1/27/22) Page 1 of 5 Instructions (worksheet is on the last page) ... income tax return, calculate any business, rental, etc. net income/loss without a deduction for depreciation expense. Include copies of all supporting documents. Line 5 If you filed a federal income tax return, enter the amount ... PDF Federal Income Tax Deduction Worksheet - Alabama Alabama Use Tax Worksheet Report 2021 purchases for use in Alabama from out-of-state sellers on which tax was not collected by the seller. Standard Deduction ... Federal Income Tax Deduction Worksheet. Title #10 Comm. Office Author: David Calhoun Created Date:

Alabama Tax Law Changes - Federal Income Tax Deduction Worksheet The increased federal income tax deduction will reduce the amount of tax due on an Alabama individual income tax return. Tax returns that have already been electronically filed do not need to be amended. The Alabama Department of Revenue will adjust returns that have already been e-filed. Tax returns that were paper filed will need to be amended. PDF Itemized Deductions Detail Worksheet (PDF) - IRS tax forms were on a pre-tax basis) • Funeral, burial, or cremation expenses • Health savings account payments for medical expenses • Operation, treatment, or medicine that is illegal under federal or state law • Life insurance or income protection policies, or policies providing payment for loss of life, limb, sight, etc. • Maternity clothes 1040 (2021) | Internal Revenue Service - IRS tax forms Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet, whichever applies, to figure your tax. See the instructions for line 16 for details.. Line 3b. ... You should receive a Form 1099-R showing the total amount of any distribution from your IRA before income tax or other deductions were withheld. This ... PDF 2021 Itemized Deduction (Sch A) Worksheet National Tax Training Committee September 13, 2021 2021 Itemized Deduction (Sch A) Worksheet (type-in fillable) I donated a vehicle worth more than $500 I made more than $5,000 of noncash donations I paid interest on borrowings for investments I repaid income (taxed in prior year) over $3,000

Alabama Federal Income Tax Deduction Worksheet Federal Income Tax Deduction Worksheet requires you to list multiple forms of income, such as wages, interest, or alimony . We last updated the Federal Income Tax Deduction Worksheet in January 2022, so this is the latest version of Federal Income Tax Deduction Worksheet, fully updated for tax year 2021.

Tax Deduction | Excel Templates Included in this template or Features Included in this excel tax deduction template you will receive an itemized deductions calculator that comes with two sections known as the header section and the calculation section. These areas are where you will fill out your personal financial details that correspond to each category. Optional Tips 1.

PDF For taxable year ending in 2021 Ohio IT 4708 A PTE's taxable year for Ohio income tax purposes is the same as its taxable year for federal income tax purposes. - 6 - IT 4708 Rev. 12/21 % Cumulative Estimated Payments Made On or before the 15th day of the 4th month of the taxable year. 22.5% of the current year tax liability On or before the 15th day of the 6th month of the taxable year.

PDF Contractor's Deduction Worksheet - MB Tax Pro Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? YES_____ NO_____ Income: Office Expense Office Supplies Outside Services Parking & Tolls Expenses: Postage Accounting Printing Advertising Rent, Business Equipment Business Cards Rent, Office Rent ...

Downloadable tax organizer worksheets Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The source information that is required for each tax return is unique. Therefore we also have specialized worksheets to meet your specific needs. All the documents on this page are in PDF format.

PDF Tax Deduction Worksheet - Oxford University Press Tax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant

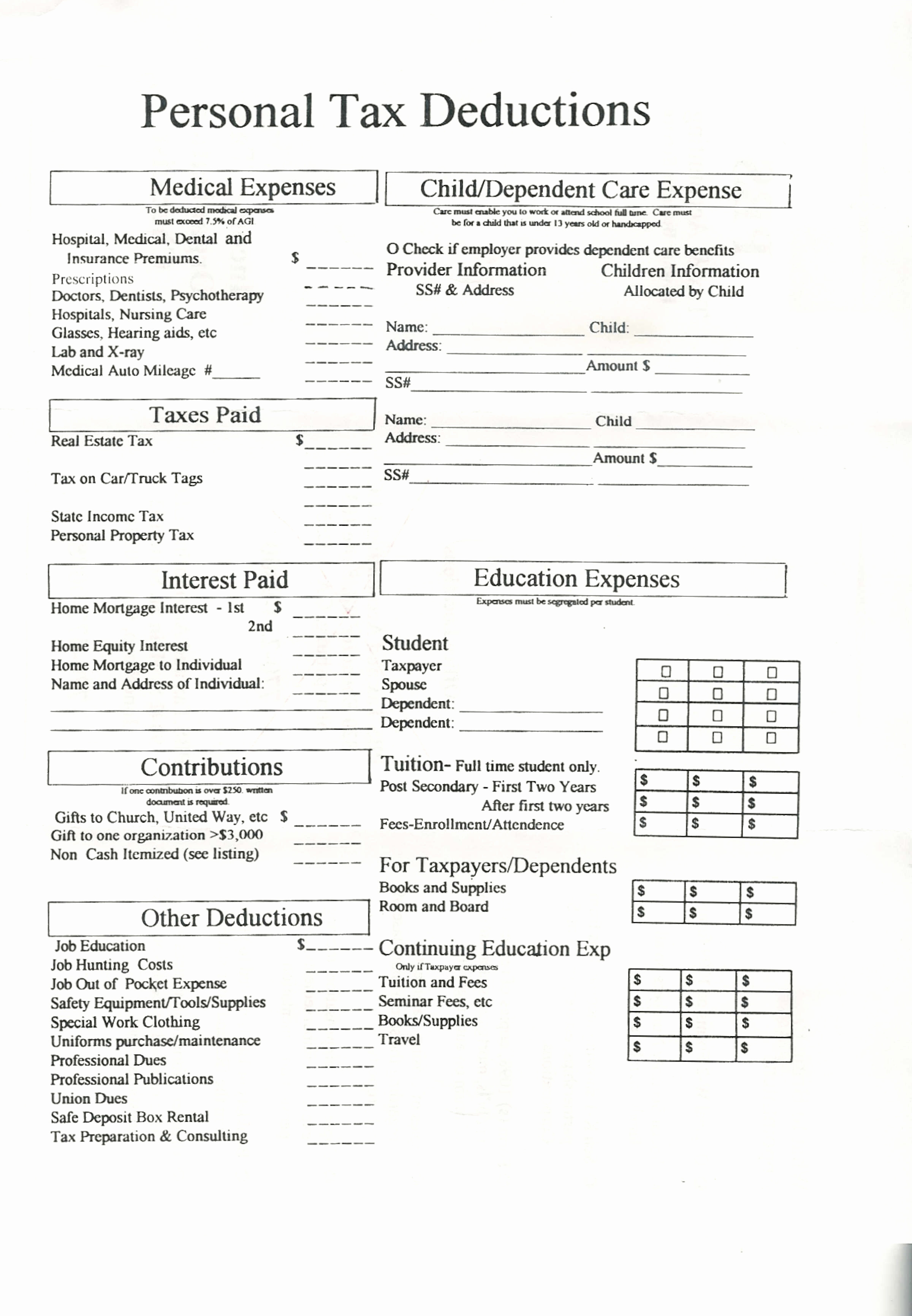

Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

PDF Federal Income Tax Deduction Worksheet - Alabama Federal Income Tax Deduction Worksheet Line 2 Penalty on Early Withdrawal of Savings The Form 1099-INTgiven to you by your bank or savings and loan association will show the amount of any penalty you were charged for withdrawing funds from your time savings deposit before its ma- turity. Enter this amount on line 2, Column B only.

AL - Federal Income Tax Deduction Worksheet Changes (Drake21) The amount of the credits based on 2020 federal law will automatically be calculated on lines 3, 4, 8b, and 9e of AL INC WK, Federal Income Tax Deduction Worksheet. The corresponding federal worksheets for each credit will also be printed. If necessary, overrides to these amounts may be made on AL screen ITDW.

Qualified Business Income Dedution Smart Worksheet - Intuit The Qualified Business Income Deduction Smart Worksheet is located at bottom of the Schedule C. You can preview the worksheet using these steps: TurboTax CD/Download Go into Forms Mode by clicking on the Forms icon in the top right of the blue bar. In the Forms in My Return list on the left, click on Schedule C (business name).

How to Calculate Deductions & Adjustments in a W-4 Worksheet The standard deduction amount is currently set to $12,950 for single individuals or married individuals filing separately, $19,400 for the head of household, and $25,900 for a qualifying widower or a married couple filing jointly in 2022. You can only claim either the standard deduction or itemized deductions.

PDF Schedule a Tax Deduction Worksheet - Heinekamp Financial State Income Tax (current year estimate) $ Business Phones $ State Income Tax Withheld (from W-2) $ Business Travel $ ... SCHEDULE A TAX DEDUCTION WORKSHEET MEDICAL EXPENSES CONTRIBUTIONS PLEASE SIGN BELOW MISCELLANEOUS ADJUSTMENTS TO INCOME TAXES PAID CASUALTY INTEREST PAID Form 914 Rev. 2 (12/06)

Tax Worksheets - Assured Tax Tax Worksheets & Logs Here are a variety of logs and worksheets to help in accurately reporting your income and deductions. Remember, you'll need proof of your deductions - so keep those mileage logs, expense and donation receipts (property donation photos, too!) Tax Worksheets TAX DEDUCTION FINDER

Worksheet 2 (Tier 3 Michigan Standard Deduction) Estimator if the older of you or your spouse (if married filing jointly) was born during the period january 1, 1953 through january 1, 1954, and reached the age of 67 on or before december 31, 2020, you may deduct the personal exemption amount and taxable social security benefits, military compensation (including retirement benefits), michigan national …

0 Response to "45 income tax deduction worksheet"

Post a Comment