45 non cash charitable contributions worksheet

charitable-worksheet.pdffiller.comDonation Value Guide 2020 Excel Spreadsheet - Fill Online ... A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from ... Online Donation Value Guide Spreadsheet - Printable and Editable PDF Form How to prepare Donation Value Guide Spreadsheet 1 Open the template You do not have to search for a sample of Donation Value Guide Spreadsheet online and download the document. Open up the sample immediately inside the editor with one click. 2 Fill the form Fill every single field in the template supplying legitimate details.

Tax Guide for Churches & Religious Organizations generally eligible to receive tax-deductible contributions. To qualify for tax-exempt status, the organization must meet the following requirements (covered in greater detail throughout this publication): n the organization must be organized and operated exclusively for religious, educational, scientific or other charitable purposes;

Non cash charitable contributions worksheet

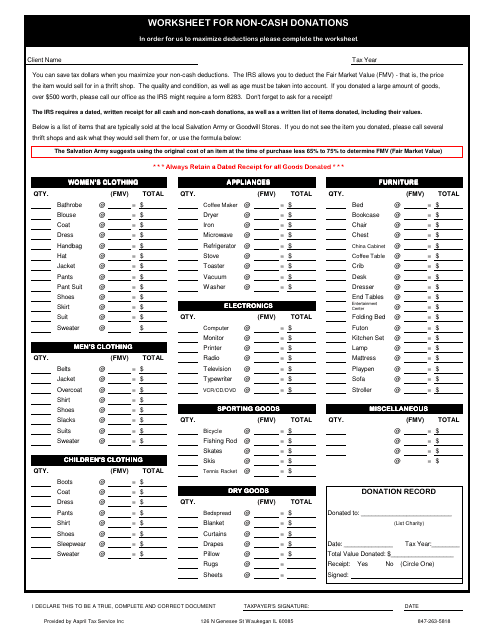

How to Estimate the Cost Basis on Non-Cash Charitable Deductions Charitable Contributions 2017. Because the standard deduction for 2017 is $6,370 for singles and $12,700 for married couples filing jointly, more taxpayers will itemize in 2017 than for the following tax year. For many, this may prove the last year they itemize deductions at least until the TCJA expires in 2026. 00:00 00:00. PDF Welcome | M. Greenwald Associates LLP EXPENSE WORKSHEET FOR NON-CASH CONTRIBUTIONS Drapes CLIENT NAME In order for us to maximize deductions please complete the work sheet TAX YEAR You can save tax dollars when you maximize your non-cash charitable deductions. The IRS allows you to deduct the Fair Market Value (FMV) — that is, the price the item would sell for in a thrift shop. The Donation Value Guide | What is my Goodwill Donation Worth? Furniture should be in gently-used, non-broken condition. Fabric should be free of stains and holes. Coffee Table $15 - $100. Dresser $20 - $80. End Table $10 - $75. Kitchen Set $35 - $135. Lamp, Floor $8 - $34. Lamp, Table $3 - $20. Sofa $40 - $395. Stuffed Chair $10 - …

Non cash charitable contributions worksheet. pdfFiller - Fill Online, Printable, Fillable, Blank A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non-cash charitable donations to the Salvation Army that do not exceed $5,000. People in the USA are encouraged to become contributors not only due to the moral virtues inherent to this act, but they will also be to claim corresponding deductions from ... itsdeductibleonline.intuit.comTax Deductions - ItsDeductible Any donation information you included in your Tax Year 2021 (or prior year) tax returns will remain in those tax returns. However, if you want to separately save any data you have entered into ItsDeductible you will need to export that data by October 18, 2022. Completing the application online is easy, fast and secure. Non-Taxable. This is a worksheet to help prepare you to fill out the TADS Financial Aid application and will not be ... Charitable Giving (list your three largest contributions) If you made tax deductible donations to . 1. CharityName 2. 202 1 Contributions non-profit organizations in 2021, list the threeorganizationsyou donatedthe most › articles › personal-financeCharitable Contributions: Tax Breaks and Limits - Investopedia Jan 13, 2022 · Nonitemizers can deduct cash gifts to charities of up to $300 if single and $600 if married, and itemizers' AGI limits stay at increased 2020 levels.

Publication 590-B (2021), Distributions from Individual Retirement ... Enter the total amounts contributed and deducted during the current year if you were age 70½ (or older) at the end of the year. If this is your first QCD worksheet also include contributions you deducted in prior years during which you were age 70½ (or older) at the end of the year. 2. 10,000: 3. Add the amounts on lines 1 and 2. 3. 10,000: 4. › tax-center › filingClaiming A Charitable Donation Without A Receipt | H&R Block If claiming a deduction for a charitable donation without a receipt, you can only include cash donations, not property donations, of less than $250. And, you must provide a bank record or a payroll-deduction record to claim the tax deduction. You need a receipt and other proof for both of these: Cash donations of $250 or more; Non-cash donations PDF NON-CASH CHARITABLE CONTRIBUTION WORKSHEET - Holberton Tax non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women's clothing qty amount qty amount subtotal bathrobe 12.00 x = 9.00 x = What does "Noncash Contributions Worksheet: Cost/adjusted ... - Intuit You need to enter the worth of the property that you donated. For example if you donated a couch, it would be what you paid for the couch when you originally purchased it. June 1, 2019 12:45 PM. Go back to your charity entries and make sure you have filled out all of the information. It is likely that you did not enter the basis for something ...

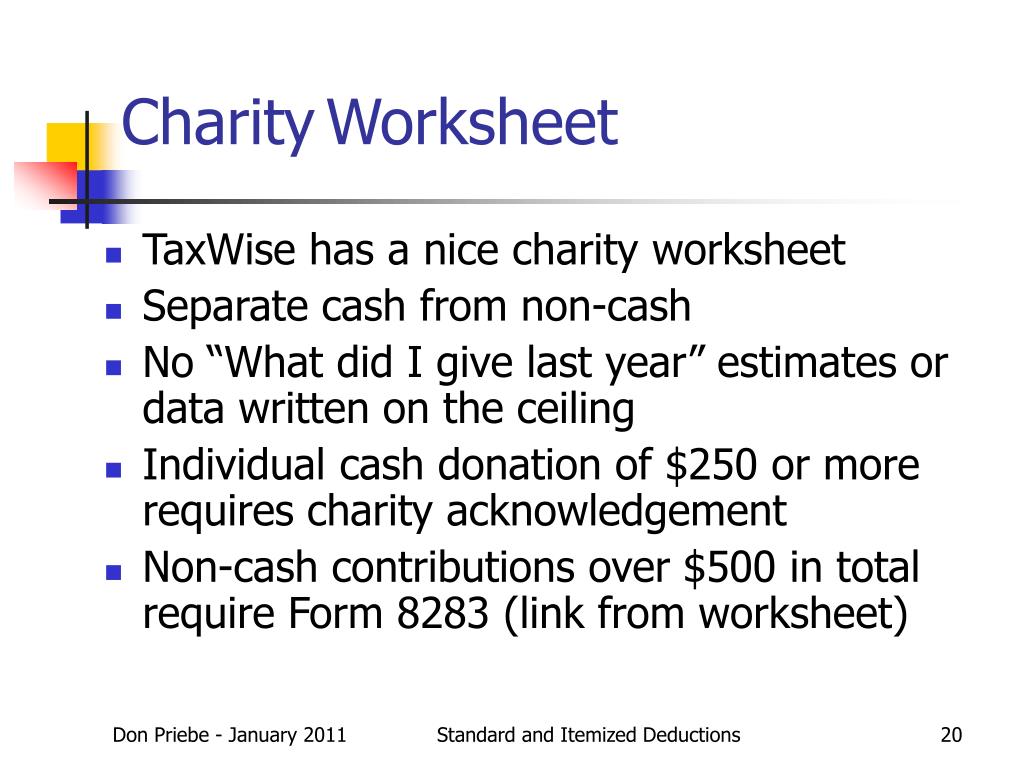

Publication 526 (2021), Charitable Contributions - IRS tax forms Noncash Contributions Out-of-Pocket Expenses How To Report Reporting expenses for student living with you. Noncash contributions. Total deduction over $500. Deduction over $5,000. Vehicle donations. Clothing and household items not in good used condition. Qualified appraisal. Qualified appraiser. Easement on building in historic district. About Form 8283, Noncash Charitable Contributions Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500. Current Revision Form 8283 PDF Instructions for Form 8283 (Print Version) PDF Recent Developments images.template.net › wp-content › uploadsNoncash charitable deductions worksheet. challenged by the Internal Revenue Service. For more information on Charitable Contributions and Non-Cash Donations please refer to IRS Publication 526. TAXPAYERS NAME(S): description of items donated. Retain this worksheet with your receipts in your tax file. Your receipts should include a reasonably accurate PDF 2020 Charitable Contributions Noncash FMV Guide - DHA CPAs Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good or better con-dition at the time they were donated. Recordkeeping Rules for Charitable Contributions

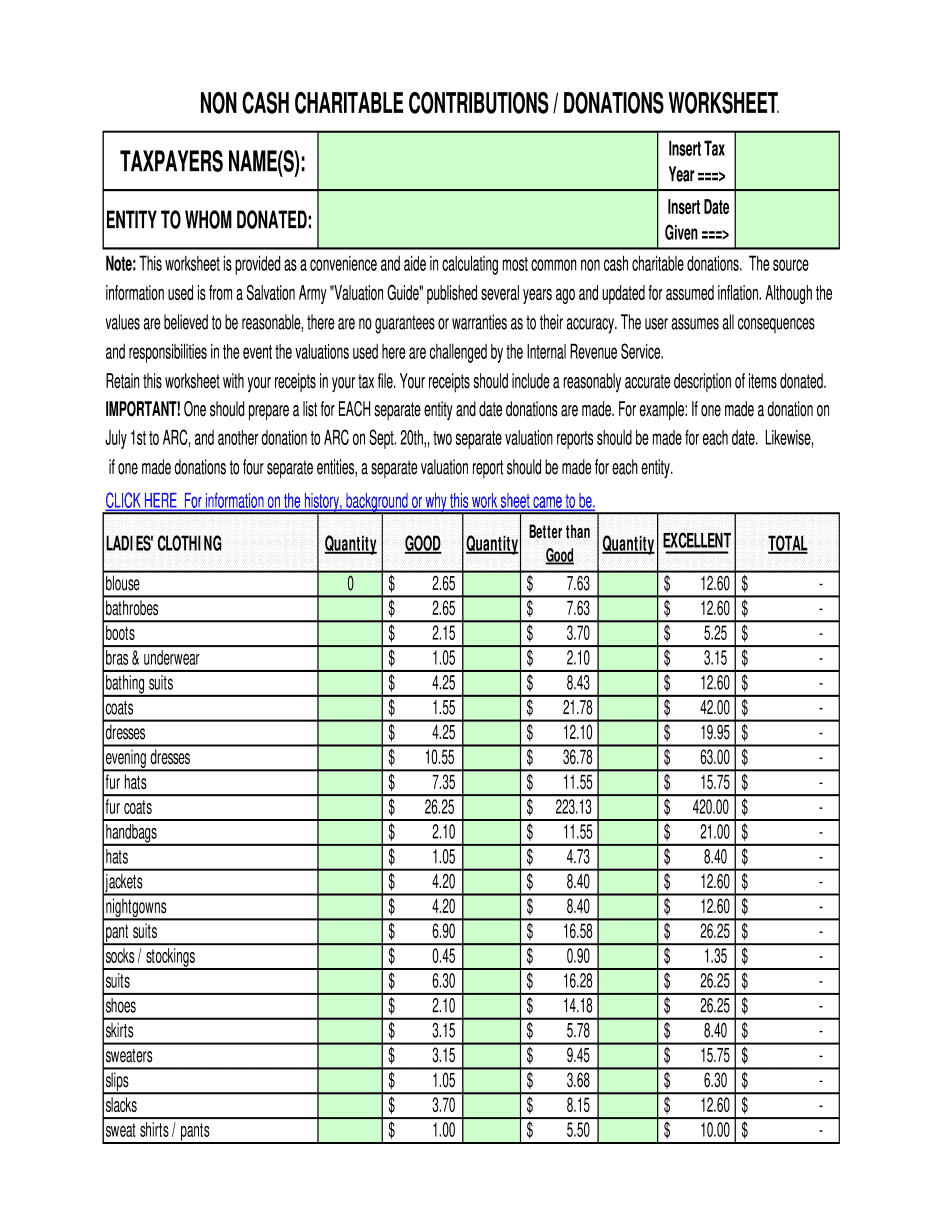

PDF Non-cash Charitable Contributions / Donations Worksheet Insert Date Given ===> Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation.

Charitable Contributions: Tax Breaks and Limits - Investopedia Jan 13, 2022 · Nonitemizers can deduct cash gifts to charities of up to $300 if single and $600 if married, and itemizers' AGI limits stay at increased 2020 levels.

non cash charitable contributions/donations worksheet 2007-2022 - Fill ... Complete non cash charitable contributions/donations worksheet 2007-2022 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. Save or instantly send your ready documents. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners ...

PDF Missing Information: Non-Cash Charitable Contributions Worksheet Missing Information: Non-Cash Charitable Contributions Worksheet (pg 4) Prepared By: HMS CERTIFIED PUBLIC ACCOUNTANTS 09-24-2013 457 Lake Howell Rd. Maitland FL 32751 Tel: (407) 571-4080 Fax: (407) 571-4090 information@hmscpa.com Men's Clothing $$ Guideline Your Cost # Items Value Today Deduction Jackets 7.50 - 25.00 Overcoats 15.00 - 60.00

Noncash charitable deductions worksheet. - imgix challenged by the Internal Revenue Service. For more information on Charitable Contributions and Non-Cash Donations please refer to IRS Publication 526. TAXPAYERS NAME(S): description of items donated. Retain this worksheet with your receipts in your tax file. Your receipts should include a reasonably accurate

IRS Guidelines and Information | Donating to Goodwill Stores Noncash Charitable Contributions — applies to deduction claims totaling more than $500 for all contributed items. If a donor is claiming over $5,000 in contribution value, there is a section labeled “Donee Acknowledgement” in Section B, Part IV of Internal Revenue Service (IRS) Form 8283 that must be completed. ... Goodwill Industries of ...

XLSX ATS Advisors - Certified Public Accountants in Plymouth, Michigan - ATS ... non cash charitable contributions / donations worksheet better than good what is your original cost based on reciepts, or your best estimate, of the items donated? the intent of this worksheet is to summarize your non-cash chartable contributions for the purpose of tax preparation and reporting. you the taxpayer, are responsible for maintaining ...

Get and Sign Salvation Army Donations 2007-2022 Form Follow the step-by-step instructions below to design your donation value guide 2022: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

PDF Non-Cash Charitable Contributions Worksheet - LB Tax Services Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in

Solved: What number should I use for the "Cost/adjusted basis ... - Intuit Say that according to the TurboTax ItsDeductable option my non-cash contributions to a charity totaled $5000 (i.e., Schedule A, Part 1, Line 2, Value of contribution = $5000) Schedule A, Part IV, Line 10 then asks "Cost or adjusted basis in the donated property." Do we enter $5000 in this space if ItsDeductable says the value is $5000?

PDF NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for ... NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: MISCELLANEOUS LOW HIGH AVG QTY AMOUNT VALUE Adding Machines 24.00 90.00 57.00 Christmas Trees 18.00 60.00 39.00 Broiler Ovens 18.00 30.00 24.00 Copier 120.00 240.00 180.00 Home Computer 180.00 600.00 390.00

goodwillnne.org › donate › donation-value-guideDonation Value Guide | What is my Goodwill Donation Worth? Furniture should be in gently-used, non-broken condition. Fabric should be free of stains and holes. Coffee Table $15 - $100. Dresser $20 - $80. End Table $10 - $75.

Solved: Contribution Carryover Worksheet - Intuit Accountants It is possible that Lacerte proformad as non cash due to the AGI limit change. To better understand the IRS issue with the claim for the contribution tell us on what line the carry forward amount was reported on the 2020 schedule A. The 2020 cash contribution should be deductible up to 100% of AGI.

XLS Noncash charitable deductions worksheet. Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file.

Charitable Donations | H&R Block Non-cash donations of $5,000 or more. If your non-cash single charitable donation for one item or a group of similar items is more than $5,000: The organization must give you a written acknowledgement. You must keep the records required under the rules for donations of more than $500 but less than $5,000. If you're calculating if a deduction ...

Donation Calculator Use this donation calculator to find, calculate, as well as document the value of non-cash donations. You can look up clothing, household goods furniture and appliances. Using The Spreadsheet. If you are using a tablet or mobile device, you cannot enter any data. However, you can browse the sheet to find values.

0 Response to "45 non cash charitable contributions worksheet"

Post a Comment