45 pastor's housing allowance worksheet

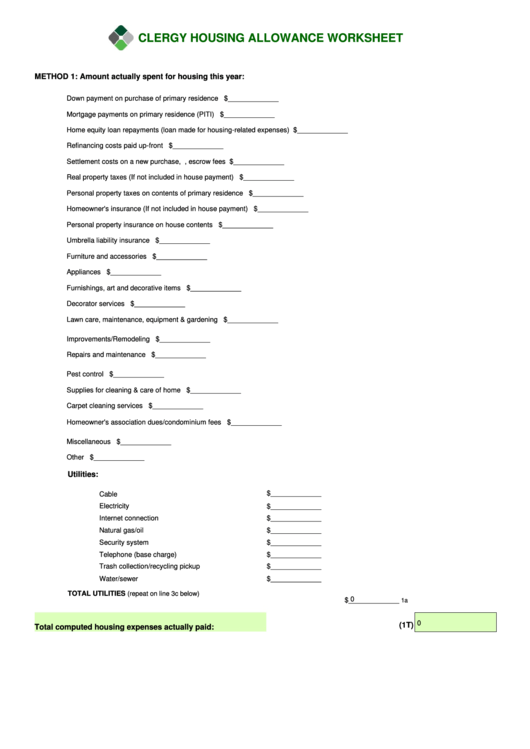

Everything Ministers/ Clergy Should Know About Their Housing Allowance A housing allowance may include expenses related to renting, purchasing (which may consist of down payments or mortgage payments) and/or maintaining a clergy member's current home. (It may not encompass expenses incurred as the result of commercial properties or vacation homes.) Any items for inclusion must be personal in nature for the ... Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet Downloadable .PDF Document 2019 Minister Housing Allowance Worksheet Download If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses. Downloadable Excel Spreadsheet

2022 Housing Allowance Form - Clergy Financial Resources The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. ... Clergy Financial Resources also offers Pro Advisor support for your housing and other tax questions. This support service is available at a flat rate of $75.00 ...

Pastor's housing allowance worksheet

2020 Housing Allowance For Pastors ... - The Pastor's Wallet Dec 16, 2019 · The housing allowance for pastors is not and can never be a retroactive benefit. Only expenses incurred after the allowance is officially designated can qualify for tax exemption. Therefore, it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020. Four Important Things to Know about Pastor's Housing Allowance When you fill out your taxes, your federal income (on the first page of your 1040) would show $35,000 ($50,000 less the $15,000 housing allowance). However, on your self-employed tax, your salary would be the full $50,000. Therefore, you would pay self-employment tax on the full $50,000. How Do You Report Your Clergy Housing Allowance To The IRS? Sep 13, 2021 · The housing allowance is exempt from income and should therefore not be reported here. If it is, the IRS will think you owe more in taxes and you will have a mess on your hands. If your church accidentally includes your housing allowance in Box 1, have them correct the mistake right away by filing an amended Form W-2. Boxes 3, 4, 5, and 6

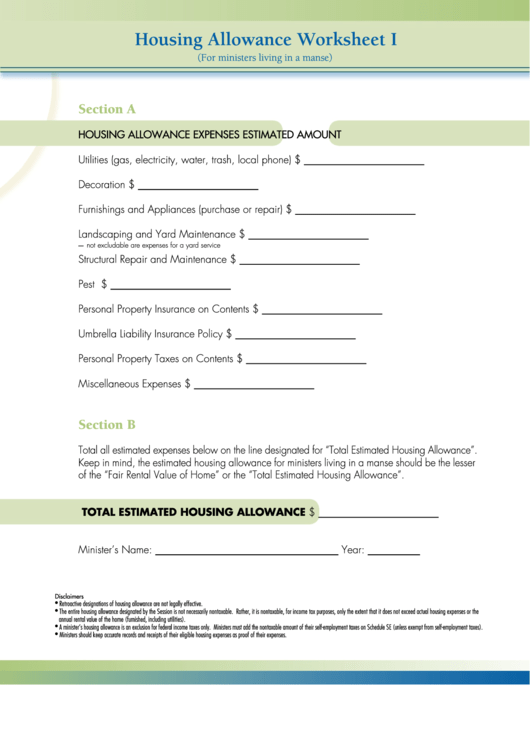

Pastor's housing allowance worksheet. Pastoral Housing Allowance for 2021 - PCA RBI If you have questions, give us a call at (678) 825-1198 to schedule an appointment with a Financial Planning Advisor. You can also request an appointment online. Resources: Housing Allowance Worksheet I - Manse Housing Allowance Worksheet II - Renting or Mobile Home Housing Allowance Worksheet III - Homeowner Housing Allowance Resolution Form PDF Ministers' Housing Allowance Resource Kit Taxes with housing allowance • Salary of $50,000 • Housing Allowance of $28,000 • Reduction of Taxable Income $50,000 - $28,000 = $22,000 • Taxed on $22,000 * 12% = $2,640 • Owed income tax of $2,640 In this illustration there is a $3,360 tax savingswith the Housing Allowance. 2 3. Q. Housing Allowance For Pastors 2021 | Todos-somos 2022 31 Clergy Housing Allowance Worksheet Worksheet Info 2021 from eddiefreecbd634.blogspot.com. To find it, go to the app store and type signnow in the search field. The rental/housing allowance which may be excluded from a minister's gross income is limited to the lesser of (1) the amount of the rental/housing allowance designated by the ... Pastors Housing Allowance Worksheet - Fill Out and Sign Printable PDF ... Follow the step-by-step instructions below to design your clergy housing allowance worksheet 2022: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

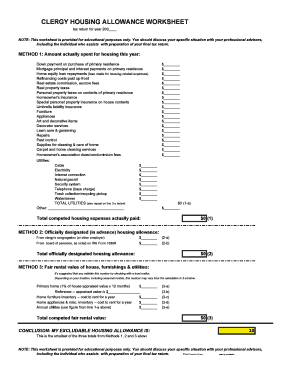

Housing Allowance Examples - Fill Out and Sign Printable PDF Template ... Quick guide on how to complete ministers housing allowance worksheet. Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online. signNow's web-based service is specially made to simplify the management of workflow and optimize the whole process of competent document management. Use ... PDF Housing Exclusion Worksheet - ECFA Housing Exclusion Worksheet. Minister Living in Housing. Owned by or Rented by the Church. Minister's name: _____ For the period _____, 20___ to _____, 20____ ... Properly designated housing allowance $ _____(B) The amount excludable from income for federal income tax purposes is the lower of A or B (or reasonable compensation). Title: PDF Clergy Housing Allowance Worksheet EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources PDF HOUSING ALLOWANCE GUIDE - CBF Church Benefits Housing Allowance of $28,000 Reduction of Taxable Income $50,000 - $28,000 = $22,000 Taxed on $22,000 * 12% = $2,640 Owed income tax of $2,640 A: The main advantage of declaring a housing allowance is that it helps the minister save in paying income tax (see the illustration below). That savings on taxes can be used for

housing allowance for pastors worksheet - Marine Staggs CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE. A pastors housing allowance must be established or designated by the church or. They must pay Social SecurityMedicare tax on the entire compensation of 65000. A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing ... Ministers' Compensation & Housing Allowance | Internal Revenue Service The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter "Excess allowance" and the amount on the dotted line next to line 1. PDF 2021 Minister's Housing Allowance Worksheet - MinistryCPA 2021 Minister's Housing Allowance Worksheet Amount Portion of cash compensation designated as housing allowance Homeowner's or renter's insurance (if not already included in mortgage payments) Real estate taxes (if not already included in mortgage payments) Furnishings, appliances, carpeting, etc. Utilities Housing Allowance For Pastors Worksheet - Merbeinvanillaslice Housing Allowance For Pastors Worksheet. Owned by or rented by the church. The housing allowance is for pastors/ministers only. That the allowance 1) represents compensation for ministerial services, 2) is used to pay housing expenses, and 3) does not exceed the fair rental value of the home (furnished, plus utilities). In allowance, ,

PDF Clergy Housing Allowance Worksheet NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, ... METHOD 2: Officially designated (in advance) housing allowance: From clergy's congregation (or other employer) $_____ (2-a) From board of pensions, as noted on IRS Form 1099R $_____ (2-b)

PDF MINISTER'S HOUSING EXPENSES WORKSHEET - AGFinancial MINISTER'S HOUSING EXPENSES WORKSHEET ANNUAL HOUSING EXPENSES Rent (if a primary residence was ented for all or part of the year)$ Down payment on a home $ Remodeling and improvements $ Installment payments on a mortgage loan to purchase or improve your home $ (include both principal and interest)

Brit A Z | PDF | Nature - Scribd brit-a-z.txt - Free ebook download as Text File (.txt), PDF File (.pdf) or read book online for free. A to Z

PDF CLERGY/PASTOR HOUSING ALLOWANCE FAQ's - AccuPay Q. How is the housing allowance reported for social security purposes? A. It is reported by the pastor on Schedule SE of Form 1040, line 2, together with salary. (ChurchPay Pros by AccuPay will provide the amount of a pastor's compensation designated as housing allowance in Box 14 of the pastor's W-2 to assist tax preparers.)

Home [online.gci.org] You are about to be signed out. You will be signed out in seconds due to inactivity. Your changes will not be saved. To continue working on the website, click "Stay Signed In" below.

Clergy housing allowance - Intuit Look at the schedule SE adj sheet in section 2, line 5B. if you are seeing your housing allowance twice what you expect, you need to take additional action. Go to the W2 for that income. On the wks (worksheet) make sure you 0 out the housing allowance (since it already has it) but do enter the amount you spent of qualifying expense. This sorted ...

PDF 2020 Minister Housing Allowance Worksheet - The Pastor's Wallet 2020 Minister Housing Allowance Worksheet Mortgage Payment *Real Estate Taxes *Homeowners Insurance Mortgage Down Payment & Closing Costs Rent Renter's Insurance HOA Dues/Condo Fees Home Maintenance & Repairs Utilities Furniture & Appliances Household Items Home Supplies Yard Service Yard Care Tools & Supplies Miscellaneous Other: Other: Other:

Pathfinder Honor Worksheets English | PDF | Coins | Knitting Distributed by: AdventSource 5040 Prescott Avenue Lincoln, NE 68506 1.800.328.0525 Other printed materials available: Honors Handbook Pathfinder Brochure Pathfinder Staff Manual AY/Pathfinder Class Instructors Manual Seven Steps for Successful Pathfinder Leadership Pathfinder Club Drill Manual The Happy Path North American Division Youth Ministries Director: James L. Black.

PDF Ministerial Housing Allowance Worksheet - Miller Management A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. The amount spent on housing reduces a qualifying minister's federal and state income tax burden. Section 107 of the Internal Revenue Code (IRC) states that:

Minister's Housing Expenses Worksheet - AGFinancial Minister's Housing Expenses Worksheet Share Get the most out of your Minister's Housing Allowance. This worksheet will help you determine your specific housing expenses when filing your annual tax return. Minister's Housing Expenses Worksheet Download the free resource now.

Sample Housing Allowance for Pastors - Payroll Partners Resolved, that the total compensation paid to Pastor [First/Last Name] for calendar year 20__ shall be [Pastor's Compenstation $00,000,] of which [Amount $00,000] is hereby designated as a housing allowance; and it is further. Resolved, that the designation of [Amount $00,000] as a housing allowance shall apply to calendar year 20__ and all ...

How Do You Report Your Clergy Housing Allowance To The IRS? Sep 13, 2021 · The housing allowance is exempt from income and should therefore not be reported here. If it is, the IRS will think you owe more in taxes and you will have a mess on your hands. If your church accidentally includes your housing allowance in Box 1, have them correct the mistake right away by filing an amended Form W-2. Boxes 3, 4, 5, and 6

Four Important Things to Know about Pastor's Housing Allowance When you fill out your taxes, your federal income (on the first page of your 1040) would show $35,000 ($50,000 less the $15,000 housing allowance). However, on your self-employed tax, your salary would be the full $50,000. Therefore, you would pay self-employment tax on the full $50,000.

0 Response to "45 pastor's housing allowance worksheet"

Post a Comment