38 mortgage insurance premiums deduction worksheet

How to populate qualified mortgage insurance premiums on Schedule A ... For example, when you look at the federal worksheet, Line 5, it's 1.0 instead of the calculated amount. The reason the Qualified Mortgage Insurance Premium isn't being allowed is because of the limit on the amount you can deduct: The limit is $109,000 ($54,500 if Married Filing Separately). If the amount is more than $100,000 ($50,000 if Married Filing Separately), your deduction is limited, and you must use the worksheet to figure your deduction. Mortgage insurance premiums are still deductible for the 2017 tax year Since 2007, the premiums on mortgage insurance coverage have been tax deductible. On average, borrowers have been able to write off about $1,500 a year. But the deduction isn't permanent.

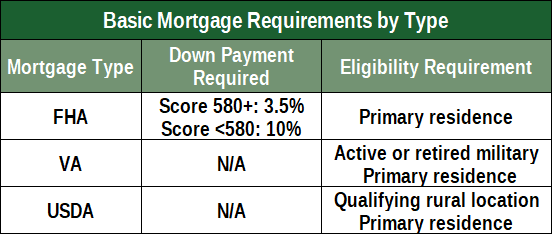

PDF 2018 Qualified Mortgage Insurance Premiums Deduction Worksheet Qualified Mortgage Insurance Premiums— Premiums that you pay or accrue for "qualified mortgage i nce" during 2017 in connection with home acquisition debt on your qualified home are deductible as home mortgage insurance premiums. Qualified mortgage insurance is mortgage insurance provided by the Veterans Administration, the Federal ...

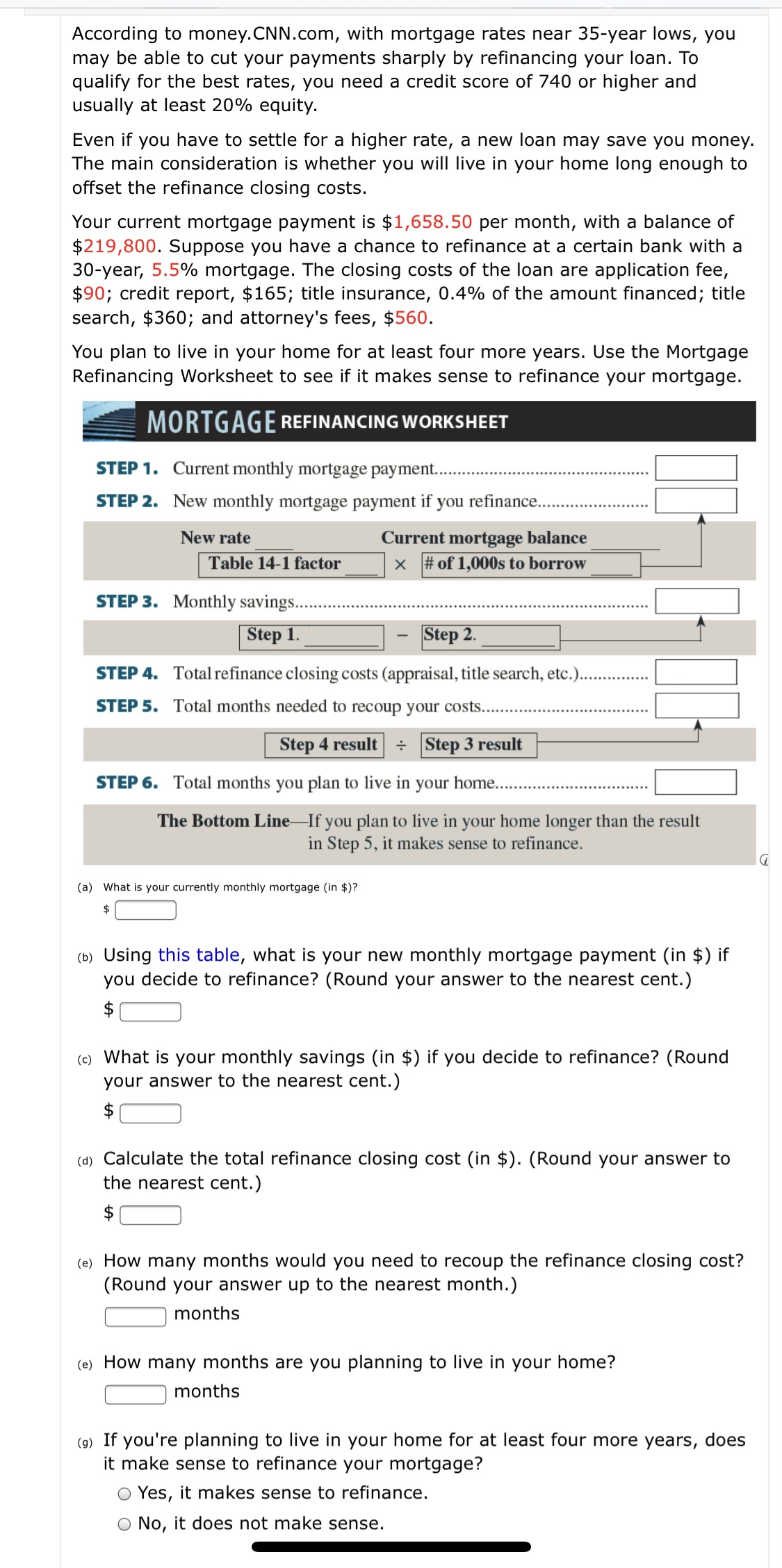

Mortgage insurance premiums deduction worksheet

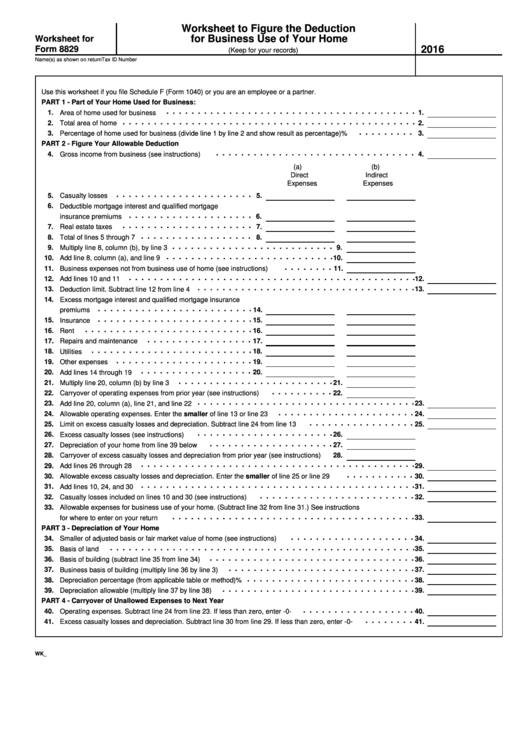

Can I Deduct My Mortgage Insurance Premiums? - The Nest Use the Worksheet The IRS provides you with a "Qualified Mortgage Insurance Premiums Deduction Worksheet" to fill out to determine limitations for deducting mortgage insurance. Again, this applies if your AGI exceeds $100,000, or $50,000 for married filing separately. Page 20 of 37 Instructions for Form 1041 and Schedules A, B, G, J, and ... deducting home mortgage interest. the insurance was obtained. but the tax is deductible only up to the Qualified Mortgage Insurance Premiums Deduction Worksheet Keep for Your Records 1. Enter the total premiums the estate or trust paid in 2009 for qualified mortgage insurance for a contract issued When Is Mortgage Insurance Tax Deductible? - Investopedia At the beginning of the loan, you prepay all of the required mortgage insurance for the term of the loan, in this case, $8,600. Deduction = ($8,600 / 84) x 6 months = $614.29 If your income is less...

Mortgage insurance premiums deduction worksheet. Learn About the Mortgage Insurance Premium Tax Deduction Mortgage insurance premiums can increase your monthly budget significantly—an additional $83 or so per month at a 0.5% rate on a $200,000 mortgage. However, in 2006, Congress made these payments tax-deductible to help reduce the burden of these costs. The tax deduction was scheduled to last through the 2016 tax year, but it has been extended through at least 2021. Qualified Mortgage Insurance Premiums Deduction Qualified Mortgage Insurance Premiums Deduction Worksheet. Qualified Mortgage Insurance Premiums Deduction Worksheet. U.S. Income Tax Return for Estates and Trusts. OMB: 1545-0092. IC ID: 191277. (31) … Can mortgage insurance premiums be deducted from income taxes as mortgage interest deduction? You can treat amounts you paid during 2019 for ... Mortgage Insurance Premium (MIP) Definition - Investopedia Until the 2017 Tax Cut and Jobs Act, mortgage insurance premiums were deductible in addition to allowable mortgage interest. 1 However, the Further Consolidated Appropriations Act of 2020 allows... Mortgage Insurance Premiums Deduction Worksheet Pdf (PDF) - thesource2 ... This mortgage insurance premiums deduction worksheet pdf, as one of the most effective sellers here will entirely be along with the best options to review. Storage of Inventory or Product Samples - IRS tax forms allowance, your expenses for mortgage interest, mortgage insurance premiums, and real property taxes are deductible under the normal ...

PDF Instructions for Form IT-196 New York Resident, Nonresident, and Part ... deduction for mortgage insurance premiums is not allowed as a New York itemized deduction for tax year 2021. Lines 10 and 11 - Home mortgage interest A home mortgage is any loan that is secured by your main home or second home. It includes first and second mortgages, home equity loans, and refinanced mortgages. PDF Mortgage Insurance Premiums Deduction Worksheet - Line 8d Schedule A 2020 Enter the total premiums you paid in 2020 for qualified mortgage insurance for a contract issued after December 31, 2006 Enter the amount from Form 1040 or 1040-SR, line 11 Enter $100,000 ($50,000 if married filing separately) Is the amount on line 2 more than the amount on line 3? Your deduction isn't limited. Enter the amount from line 1 of this worksheet on Schedule A, line 8d. Don't complete the rest of this worksheet. Subtract line 3 from line 2. Qualification Worksheet Mortgage - Katychallengerbaseball Others may have too high of an income to qualify for the deduction related to PMI. your deduction will be reduced and you must use the Mortgage insurance premiums deduction Worksheet to figure your. Mortgage Qualification Worksheet Lender Fees Worksheet 57 Beautiful Graph mortgage broker fee agreement lender Fees Worksheet 57 Beautiful Graph ... PDF 2019 Qualified Mortgage Insurance Premiums Deduction Worksheet Mortgage insurance premiums you paid or accrued on any mortgage insurance contract issued before January 1, 2007, are not deductible. Limit on amount you can deduct. You cannot deduct your mortgage insurance premiums if the amount on Form 740-NP, line 8, is more than $109,000 ($54,500 if married filing separate returns). If the amount on Form 740-NP, line 8, is more than $100,000 ($50,000 if married filing separate returns), your deduction is limited and e worksheet below to figure your ...

Montana Standard Deduction, Qualified Mortgage Insurance Premiums ... *Obsolete, see form 2 instructions Form 2 Worksheet V and IV requires you to list multiple forms of income, such as wages, interest, or alimony .. We last updated the Standard Deduction, Qualified Mortgage Insurance Premiums Deduction and Itemized Deduction Limitation (OBSOLETE) in March 2021, and the latest form we have available is for tax year 2019. Publication 936 (2021), Home Mortgage Interest Deduction If your AGI on Form 1040 or 1040-SR, line 11, is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums. Otherwise, figure your deductible mortgage insurance premiums for the current year using the rules explained under Mortgage Insurance Premiums in Part I. If the amount on Form 1040 or 1040-SR, line 11, is $100,000 or less ($50,000 or less if married filing separately), enter the full amount of your qualified mortgage insurance ... Understanding the Deductible Home Mortgage Interest Worksheet ... - Intuit To access the Deductible Home Mortgage Interest Worksheet in ProSeries: Open your client's Form 1040 return. Tap the F6 key to go to the Open Forms window. In the Find: field, enter "D," "H," and "M" to find Ded Home Mort in the form menu. Double-click Ded Home Mort or select OK. The program will take you to the Deductible Home Mortgage ... PDF Deduction Interest Mortgage - IRS tax forms Mortgage insurance premiums. The item- ized deduction for mortgage insurance premi- ums has been extended through 2021. You can claim the deduction on line 8d of Schedule A (Form 1040) for amounts that were paid or ac- crued in 2021. Home equity loan interest.

Mortgage Insurance Tax Deductions - MortgageMark.com There are various Types of Mortgage Insurance - such as monthly MI, single paid MI, and split premiums - and all MI types are eligible for the tax deduction with two exceptions: 1) MI paid on investment properties, and 2) MI paid on cash-out refinances transaction. Borrower-paid Mortgage Insurance that was acquired in 2007 or later can be ...

Qualified Mortgage Insurance Premium Definition & Example A qualified mortgage insurance premium may be tax-deductible if the mortgage originated after 2006, though there are income limits. The amount of insurance premiums a borrower has paid appears on IRS Form 1098, which the lender sends to the borrower once a year. It is important to note, however, that the tax-deductibility of mortgage insurance ...

PDF Deduction Interest Mortgage - IRS tax forms Mortgage insurance premiums. The item- ized deduction for mortgage insurance premi- ums has been extended through 2020. You can claim the deduction on line 8d of Schedule A (Form 1040) for amounts that were paid or ac- crued in 2020. Home equity loan interest.

PDF 740 K I 2021 SCHEDULE A - Kentucky mortgage insuance premiums if the amount of Form 740, line 9, is more than $109,000 ($54,500 if married filing separately on a combined return or separate returns) If the amount of Form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate return), your deduction is limited and you must use the worksheet below to figure the deduction.

Mortgage Insurance Premiums - TaxAct See Line 13 in the instructions for Schedule A (Form 1040) and complete the Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your adjusted gross income is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums. Form 1098. The mortgage interest statement you receive should show not only the total interest paid during the year, but also your mortgage insurance premiums paid during the year, which may ...

PDF Deductions (Form 1040) Itemized - IRS tax forms creased standard deduction, re-port amounts only on line 28 as instructed. See Increased Standard De-duction Reporting, later. Mortgage insurance premiums. The deduction for mortgage insurance premi-ums has been extended through 2017. You can claim the deduction on Line 13 for amounts that were paid or accrued in 2017.

How to Deduct Private Mortgage Insurance (PMI) for 2022, 2023 How to File for the PMI Deduction. You will need to itemize the PMI deduction and use the Schedule A form. Put the amount of PMI paid last year on line 13 (if your income is under $100,000). Then, exclude any premiums that have been pre-paid for this year. Remember, taxes are based on last year's income and expenditures.

PDF 2019 Qualified Mortgage Insurance Premiums Worksheet You cannot deduct your mortgage insurance premiums if the amount of Form 740, line 9, is more than $109,000 ($54,500 if married filing separately on a combined return or separate returns). If the amount of Form 740, line 9, is more than $100,000 ($50,000 if married filing separately on combined return or separate returns), your deduction is limited and you must use the worksheet below to figure your deduction. 1.

PDF 2021 Instructions for Schedule A - IRS tax forms •Insurance premiums for medical and dental care, including premiums for qualified long-term care insurance con-tracts as defined in Pub. 502. But see Limit on long-term care premiums you can deduct, later. Reduce the insurance premiums by any self-employed health insurance deduction you claimed on Schedule 1 (Form 1040), line 17. You

PDF DEPARTMENT OF TAXATION ANNOUNCEMENT NO. 2021-01 - Hawaii For taxpayers filing Form N-11, the deduction for mortgage interest premiums and other deductible interest will be added together in Worksheet A-3 in the 2020 Form N-11 Instructions and reported on Form N-11, line 21c. Mortgage Insurance Premiums Enter the qualified mortgage insurance premiums you paid under a mortgage insurance

Qualified Mortgage Insurance Premiums - No Longer Deductible You can't deduct your mortgage insurance premiums if the amount on Form 1040, line 38, is more than $109,000 ($54,500 if married filing separately).

When Is Mortgage Insurance Tax Deductible? - Investopedia At the beginning of the loan, you prepay all of the required mortgage insurance for the term of the loan, in this case, $8,600. Deduction = ($8,600 / 84) x 6 months = $614.29 If your income is less...

Page 20 of 37 Instructions for Form 1041 and Schedules A, B, G, J, and ... deducting home mortgage interest. the insurance was obtained. but the tax is deductible only up to the Qualified Mortgage Insurance Premiums Deduction Worksheet Keep for Your Records 1. Enter the total premiums the estate or trust paid in 2009 for qualified mortgage insurance for a contract issued

Can I Deduct My Mortgage Insurance Premiums? - The Nest Use the Worksheet The IRS provides you with a "Qualified Mortgage Insurance Premiums Deduction Worksheet" to fill out to determine limitations for deducting mortgage insurance. Again, this applies if your AGI exceeds $100,000, or $50,000 for married filing separately.

![[OR] Help me evaluate mortgage terms | Program Realty](https://carson.s3.amazonaws.com/grabs/loanestimate1.png)

0 Response to "38 mortgage insurance premiums deduction worksheet"

Post a Comment