43 car and truck expenses worksheet

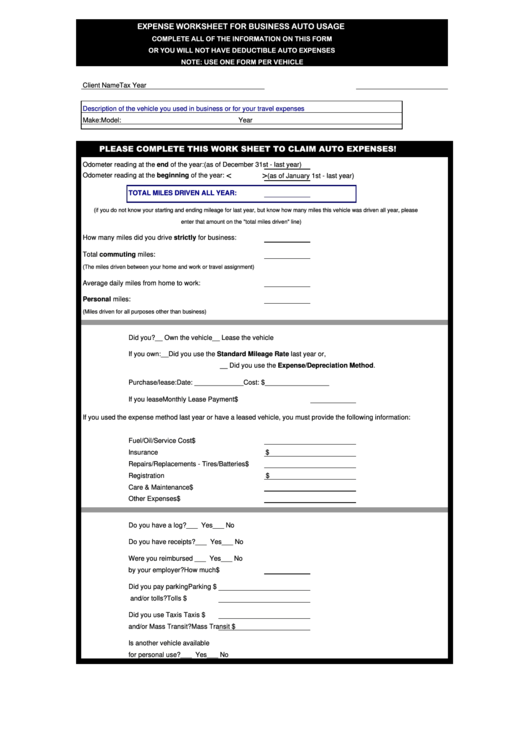

PDF Car and Truck Expense Deduction Reminders - IRS tax forms Expenses related to travel away from home overnight are travel expenses. These expenses are discussed in Chapter One of Publication 463, "Travel, Entertainment, Gift, and Car Expenses." However, if a taxpayer uses a car while traveling away from home overnight on business, the rules for claiming car or truck expenses are the same as stated ... What expenses can I list on my Schedule C? - Support Click the Listed Property Information tab and select your vehicle type from the drop-down list. Enter your mileage and your actual expenses here. Actual Car Expenses include: Depreciation, License and Registration, Gas and Oil, Tolls and Parking fees, Lease Payments, Insurance, Garage Rent and Repairs and Tires.

PDF 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET Title: 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: jodi Created Date: 1/29/2021 8:33:36 AM

Car and truck expenses worksheet

PDF Car and truck expenses worksheet 2019 - nslogisticservice.com Car and truck expenses worksheet 2019 Below is a list of scarce program C and a brief description of each: car and truck expenses: ã, there are two methods that you can use to deduce vehicle expenses, the standard mileage rate or current expenses . You can only use a vehicle method. To use the standard mileage speed, go to the car and truck ... Solved: Car and Truck Expense Worksheet - Intuit Accountants Solved: Car and Truck Expense Worksheet - Intuit Accountants Community. cginetto. Level 2. 03-07-2021 09:38 AM. Jump to solution. The worksheet will not permit an entry for personal miles. Instead, it adds up business and commuting and then come up with a negative figure where other personal miles is supposed to be. Free Printable Vehicle Expense Calculator - Microsoft Excel The Free Printable Vehicle Expense Calculator is a spreadsheet that is designed to calculate various vehicle maintenance and fuel costs to be used for business financial analysis. The table provides columns for date and odometer reading. In the fuel section you can track price per gallon, purchase amounts and gallons of fuel. There are also ...

Car and truck expenses worksheet. PDF Over-the-road Trucker Expenses List - Pstap When determining passenger vehicle expenses, you cannot use, under current IRS rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and 50.5 cents per mile for 2008) for vehicles used for hire such as taxicab, bus or tractor (over-the-road trucks). 1040 - Auto Expenses (K1, ScheduleC, ScheduleE, ScheduleF) The choices are: Schedule C*, Schedule E, Schedule F, Form 4835, or K-1 from a Partnership. Enter the same description and date placed in service as appeared on the 4562 screen. Answer the four required questions about business/personal use of the vehicle. Enter the Current Year Mileage. The current year business mileage is used to calculate ... PDF Trucker'S Income & Expense Worksheet TRUCKER'S INCOME & EXPENSE WORKSHEET ... Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost CAR and TRUCK EXPENSES ... truck Insurance, etc. INTEREST: Mortgage (business bldg.): Paid to financial institution Paid to individual OTHER INTEREST: PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287,48( Year T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Date Purchased (month, date and year) Ending Odometer Reading (December 31) Beginning Odometer Reading (January 1) - Total Miles Driven (End Odo -Begin Odo) Total Business Miles (do you have another vehicle?)

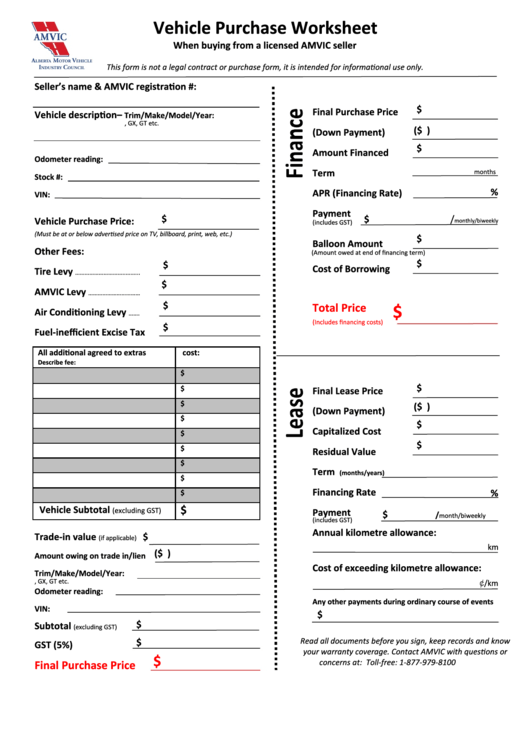

Deducting Business Vehicle Expenses | H&R Block $19,500 for trucks or vans; This applies to leases beginning in 2021. For tables with lease-inclusion amounts, see Publication 463: Travel, Entertainment and Gift Expenses at . You can't use the standard mileage rate if you: Used the actual expenses method in the first year you placed the car in service Car & Truck Expenses Worksheet: Cost must be entered "schedule C -- Car & Truck Expenses Worksheet: Cost must be entered." Hi everyone, I almost complete my tax return but at the end the program asked me to entered my vehicle cost. There are an empty box next to the question and I need to enter a number before I can file my tax return electronically. PDF VEHICLE EXPENSE WORKSHEET - Beacon Tax Services VEHICLE EXPENSE WORKSHEET (If claiming multiple vehicles, use a separate sheet for each) Required for all claims: • Do you have any other vehicle available for personal use? Yes No • Do you have written mileage records to support your deduction? Yes No Completing the Car and Truck Expenses Worksheet in ProSeries Completing the Total Car and Truck Expenses section This section should be completed for all vehicles. Entries in this section will be used to calculate the actual expenses for the vehicle. Completing the Vehicle Depreciation Information section If you are claiming the standard mileage rate this section can be left blank.

PDF 2020 Sched C Worksheet - Alternatives Schedule C Worksheet for Self-Employed Filers and Contractors - tax year 2020 ... Car and truck expenses o You may deduct car/truck expenses for local or extended business travel, including: between one workplace and another, to meet clients or customers, PDF Vehicle Expense Worksheet - CPA Jones Car and Truck Expense Worksheet GENERAL INFO Vehicle 1 Vehicle 2 * Must have to claim standard mileage rate Dates used if not for the time period Description of Vehicle * Date placed in service* Total Business miles* Total Commuting Miles* Other Miles* Total Miles for the period* PDF (Schedule C) Self-Employed Business Expenses Worksheet for Single Expenses: (NOTE: Expenses must be ordinary and necessary for your business to be deductible.) Advertising $_____ Car and Truck expenses: From worksheet on next page $_____ Commissions & fees paid to others $_____ Contract labor $_____ Did you pay $600 or more in total during the year to any individual? ... TurboTax Car and Truck Expense Bug: How-To Fix Editing Problem/Issue in ... Turbo-Tax wont allow you to edit/delete Car and Truck section - Schedule C worksheet? How to delete ONLY that section, without having to delete and start you...

2021 Instructions for Schedule C (2021) - Internal Revenue Service Figuring your allowable expenses for business use of the home. Using Form 8829. Using the simplified method. Shared use (for simplified method only). Example. Part-year use or area changes (for simplified method only). Example 1. Example 2. Example 3. Reporting your expenses for business use of the home. If you used the simplified method.

Vehicle Expense Spreadsheet Excel Template (Free) This helps to minimize partial or complete failure, and thus minimize business interruption. It acts as a preemptive insurance policy against catastrophic failures. Excel Vehicle Expense Spreadsheet Template Download (Simply enter your name and email address) Video on how to create the Vehicle Expense Tracker (Part 1)

Truck Expenses Worksheet | Spreadsheet template, Printable worksheets ... The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Realtor Tax Deduction Worksheet.

PDF VEHICLE EXPENSE WORKSHEET - Pace and Hawley VEHICLE EXPENSE WORKSHEET Pace & Hawley, LLC COMPLETE A SEPARATE WORKSHEET FOR EACH VEHICLE WITH BUSINESS USE ... Taxpayer name: Tax year: Vehicle make: Vehicle model: Vehicle year: Type of vehicle? Auto Truck/Van/SUV Heavy vehicle Other (describe) Date in service: From / / To / / Date of disposition (if applicable) / / YES NO 1. ...

PDF NEW CLIENT Car And Truck Expenses ORG18 (Employees use ORG17 ORG19 ACTUAL EXPENSES Vehicle 1 Vehicle 2 Vehicle 3 8Gasoline, oil, repairs, insurance, etc ........................................ 9Vehicle registration fee (excluding property tax) .......................... 10Vehicle lease or rental fee.....................................................

PDF Car and Truck Expenses Worksheet (Complete for all vehicles) Car and Truck Expenses Worksheet (Complete for all vehicles) 1 Make and model of vehicle 2 Date placed in service 3 Type of vehicle 4a Ending mileage reading b Beginning mileage reading cTotal miles for the year

Rules for Auto & Truck Expenses on a Schedule C | Bizfluent The All-Inclusive Line 9. Deduct car and truck expenses on Line 9 of Schedule C. You can use this line if you're a business, an independent contractor or a statutory employee who can deduct his job-related costs. When you figure this deduction, your first decision is whether to write off actual expenses or use the standard deduction.

Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep allowed ... 1. Delete the vehicle and start over again 2. Add it back in with its original service date. 3. Calculate your estimated depreciation per year based on miles used for business Also try these fixes: Go back to the sale of vehicle and delete any numbers in the AMT section. or

Rules for Deducting Car and Truck Expenses on Taxes You have two options for deducting car and truck expenses. You can use your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and depreciation.

PDF 2021 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET Title: 2021 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: mvoytovich Created Date: 2/8/2022 2:19:28 PM

Free Printable Vehicle Expense Calculator - Microsoft Excel The Free Printable Vehicle Expense Calculator is a spreadsheet that is designed to calculate various vehicle maintenance and fuel costs to be used for business financial analysis. The table provides columns for date and odometer reading. In the fuel section you can track price per gallon, purchase amounts and gallons of fuel. There are also ...

Solved: Car and Truck Expense Worksheet - Intuit Accountants Solved: Car and Truck Expense Worksheet - Intuit Accountants Community. cginetto. Level 2. 03-07-2021 09:38 AM. Jump to solution. The worksheet will not permit an entry for personal miles. Instead, it adds up business and commuting and then come up with a negative figure where other personal miles is supposed to be.

PDF Car and truck expenses worksheet 2019 - nslogisticservice.com Car and truck expenses worksheet 2019 Below is a list of scarce program C and a brief description of each: car and truck expenses: ã, there are two methods that you can use to deduce vehicle expenses, the standard mileage rate or current expenses . You can only use a vehicle method. To use the standard mileage speed, go to the car and truck ...

0 Response to "43 car and truck expenses worksheet"

Post a Comment