43 va residual income worksheet

PDF Va Underwriting Checklist VA UNDERWRITING CHECKLIST _____ VA Disclosures ___ VA 26-1880 Request for Certificate of Eligibility ___ VA 26-261a Certificate of Veteran Status ___ VA 26-8937 Verification of VA Benefits ___ VA 26-1802a Application Addendum ___ VA 26-0551 Debt Questionnaire ___ VA 26-0503 Federal Collection Policy ___ VA 26-0592 Counseling Checklist VA IRRRL Net Tangible Benefit Worksheet VA IRRRL Net Tangible Benefit Worksheet Revised 3.2022 All other VA requirements for guaranteeing an IRRRL are met, including the requirements related to exemption of income verification are satisfied. All VA loans are considered QM, but not all IRRRL loans have safe harbor. To have safe harbor, FCM must verify the VA

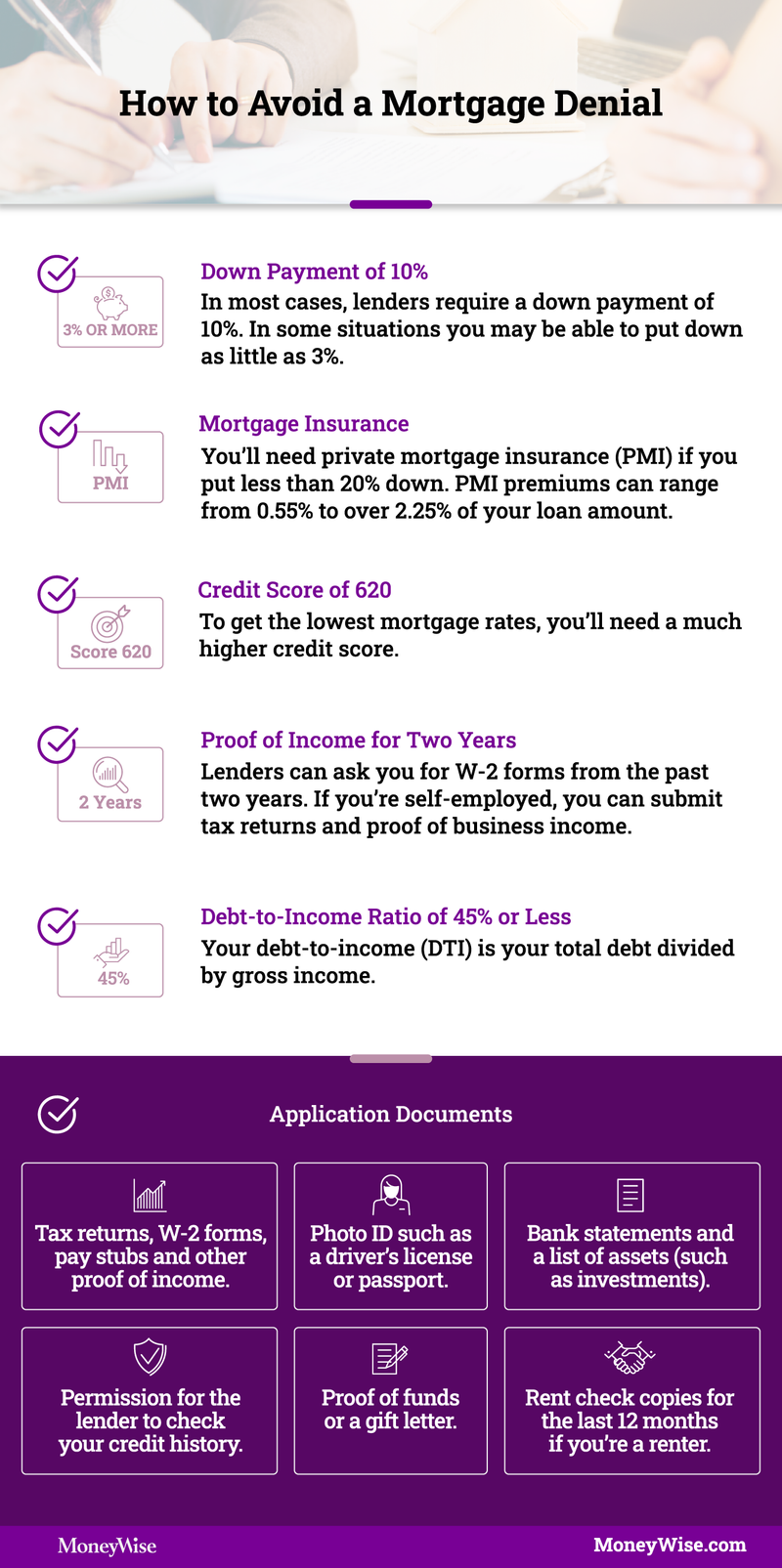

VA Residual Income Chart Shows How Much You Need to be VA Eligible One of the key factors, actually requirement, is that the borrower (s) meet the VA residual income chart. Better yet, exceeding the minimum VA residual income by 120% is considered a major compensating factor. In the end, it could turn a denial into a VA loan approval.

Va residual income worksheet

DOC Chapter 4 Chapter 4. Credit Underwriting. Overview. In this Chapter This chapter contains the following topics. Topic Topic Name See Page 1 How to Underwrite a VA-Guaranteed Loan 4-2 2 Income 4-6 3 Income Taxes and Other Deductions from Income 4-25 4 Assets 4-27 5 Debts and Obligations 4-29 6 Required Search for and Treatment of Debts Owed to the Federal Government 4-34 7 Credit History 4-40 8 ... VA Residual Income Calculator | Anytime Estimate Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck (s). Also included in the calculation is a maintenance & utilities expense. PDF Loan TypeCBC CBC - Chenoa Fund Residual Income Worksheet 1 of 3 01/09/2019 A. LOAN DATA 1. Loan Number 2. Borrower Name 3. Total Loan Amount 4. Total Exceptions (Total Household Size) B. INCOME Borrower Co-Borrower 5. Taxable Gross Monthly Income 6. Federal Deduction 7. State Deduction 8. Social Security Deduction 9. Medicare Deduction 10. Other Deductions 11.

Va residual income worksheet. XLS Veterans Affairs Veterans Affairs PDF VA Home Loan Prequalification Worksheet - Learning Library VA Home Loan Prequalification Worksheet . Residual Incomes by Region For loan amounts of $79,999 and below Family Size Northeast Midwest South West 1 $390 $382 $382 $425 2 $654 ... adequate by two considerations: residual income and the debt-to-income ratio If a loan analysis PDF LOAN ANALYSIS - Veterans Affairs section e - monthly income and deductions. 44. items. 31. 40. 41. 42. spouse borrower. 43. total. approve application reject application $ $ $ gross salary or earnings from employment. deductions € pension, compensation or other net income€ (specify) € total€ (sum of lines 37 and 38) net take-home pay PDF Va Reo Net Rental Income Calculation Worksheet Job Aid Notes for VA REO Net Rental Income Calculation Worksheet usage: • Enable Macros before using the worksheet (if required). • Do not include one-unit Primary Residence on this worksheet. • Always refer to FAMC/Agency guidelines for correct Net Rental calculation. • Use additional worksheet for more properties than this worksheet allows.

VA Mortgage: Residual Income Guidelines For All 50 States Northeast Region VA Residual Income Tables. For Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, and Vermont, the VA residual income tables are ... How To Calculate VA Residual Income | 2021 Charts How do I calculate VA residual income? To find your approximate residual income, add up your regular monthly living expenses and subtract the total — along with your debt payments — from your gross monthly income. The money leftover after paying living expenses and debt is your residual income, which is also known as your discretionary income. VA Residual Income Guidelines - Military Benefits The VA might also refer to your residual income as your "balance available for family support." VA Residual Income Charts Here are the residual income charts for VA loans under $80,000 and VA loans over $80,000. We've further broken each chart down by family size and location. Finance your Dream Home $0 Down and No PMI. VA Residual Income Calculator and Chart - Loans101.com Mortgage Amortization Calculator (Extra Payments) Mortgage Payment Calculator. Private Mortgage Insurance Calculator. Rent or Buy Calculator. USDA Mortgage Calculator. USDA Mortgage Insurance Calculator. VA Funding Fee Calculator. VA Loan Payment Calculator. VA Residual Income Calculator.

Single-Family Homepage | Fannie Mae 0 0 0 0. 0 0 0 0. 0 0 0 0. 0 0 0 0. 0 0 0 0. 0 0 0 0. Fannie Mae Form 1038 02/23/16. Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) PDF Working with Ability-to-Repay (ATR/QM) and HOEPA Regulations of the debt to income ratio. • Small Creditor category of QMs - If you have less than two billion dollars in assets and originate 500 or fewer mortgages per year, loans you make and hold in portfolio are Qualified Mortgages as long as you have considered and verified a consumer's debt-to-income ratio (though no specific debt-to-income ratio ... Residual Income (Definition, Formula) | How to Calculate? Equity Charge = US$4,800,000. Residual Income can be calculated using the below formula as, Residual Income = Net Income of the firm - Equity charge: = US$4,700,500 - US$4,800,000. As seen from the negative economic profit, it can be concluded that AEW has not earned enough to cover the equity cost of capital. PDF SUMMARY PAGE The figures on this summary must match exactly the final ... INCOME AND DEBT WORKSHEET 01/09/14 Posted 08/20/14 Page 1 of 6 Borrower Name: _____ Loan Number: _____ ... Residual Income Evaluation Attestation RE: Date of Evaluation The undersigned hereby affirms and attests that in connection with the mortgage loan for . Borrower name(s) securing the property located at .

Get Va Residual Income Calculator - US Legal Forms Now, creating a Va Residual Income Calculator takes at most 5 minutes. Our state online blanks and clear guidelines eliminate human-prone errors. Adhere to our simple steps to have your Va Residual Income Calculator prepared rapidly: Find the web sample from the library. Type all necessary information in the required fillable areas.

VA Residual Income Charts and Loan Requirements for 2022 Each table shows the residual income requirement based on the region and family size. VA Residual Income Needed Chart for Loan Amounts of $79,999 and Below For families over 5, add $75 for each additional family member up to seven. VA Residual Income Needed Chart for Loan Amounts of $80,000 and Above

VA Residual Income Chart And Requirements | Quicken Loans So, if you have a family of four and live in Michigan, your regional residual requirement is $1,003. If your DTI is at 43%, you now must have a residual income of $1,203 to be approved for a VA loan. Understanding your debt-to-income ratio and residual income balance can be difficult.

Residual Income Formula | Calculator (Examples With Excel Template) Residual Income of the company is calculated using the formula given below Residual Income = Operating Income - Minimum Required Rate of Return * Average Operating Assets Residual Income = $80,000 - 12% * $500,000 Residual Income = $20,000 Therefore, the residual income of the company during the year is $20,000. Residual Income Formula - Example #3

VA Residual Income Chart - How to Calculate Residual Income VA Residual Income Charts The residual income minimums reflect how housing costs and other expenses vary based on family size and where in the country you're buying. That's why larger families in the Northeast and the West need more residual income than similar families in the Midwest and South.

Getting A VA Loan Using Self-Employed Income VA Self-Employed Income Calculation. If your business made $100,000 last year, but you wrote off $50,000 in losses or expenses, lenders will only count the remaining $50,000 as effective income toward a mortgage. Needless to say, that can come as a shock to many prospective borrowers.

Residual Income - Blueprint Monthly Income Taxes - Taxable Income Amount: $0.00; Suggested Federal Rate: Federal Income Tax: $0.00: Suggested State Rate: State Income Tax: $0.00: Social Security/Medicare: $0.00: Total Income Tax: $0.00: Residual Income Residual Income Amount: $0.00; Adjustment to required residual income

PDF Loan TypeCBC CBC - Chenoa Fund Residual Income Worksheet 1 of 3 01/09/2019 A. LOAN DATA 1. Loan Number 2. Borrower Name 3. Total Loan Amount 4. Total Exceptions (Total Household Size) B. INCOME Borrower Co-Borrower 5. Taxable Gross Monthly Income 6. Federal Deduction 7. State Deduction 8. Social Security Deduction 9. Medicare Deduction 10. Other Deductions 11.

VA Residual Income Calculator | Anytime Estimate Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck (s). Also included in the calculation is a maintenance & utilities expense.

DOC Chapter 4 Chapter 4. Credit Underwriting. Overview. In this Chapter This chapter contains the following topics. Topic Topic Name See Page 1 How to Underwrite a VA-Guaranteed Loan 4-2 2 Income 4-6 3 Income Taxes and Other Deductions from Income 4-25 4 Assets 4-27 5 Debts and Obligations 4-29 6 Required Search for and Treatment of Debts Owed to the Federal Government 4-34 7 Credit History 4-40 8 ...

0 Response to "43 va residual income worksheet"

Post a Comment