38 airline pilot tax deduction worksheet

Tax Forms - Diamond Financial Flight Attendant Professional Deduction Fillable Worksheet United Pilot and Flight Attendant Per Diem Reports (GO TO MY INFO PER DIEM REPORT) Rental Real Estate Deduction Fillable Worksheet Military Deduction Worksheet Real Estate Agent Deduction Worksheet Other Professions Worksheets: Medical Police Firefighter Union Rep Salon Trucking Specialty Worksheet - Pilot-Tax Specialty Worksheet - Pilot-Tax Specialty Worksheet We have designed several professional deduction worksheets for a variety of professions. If you our your spouse are employed in one of the following professions, please download the worksheet and submit it to us with your full Organizer! Real Estate Agent Additional Contributions

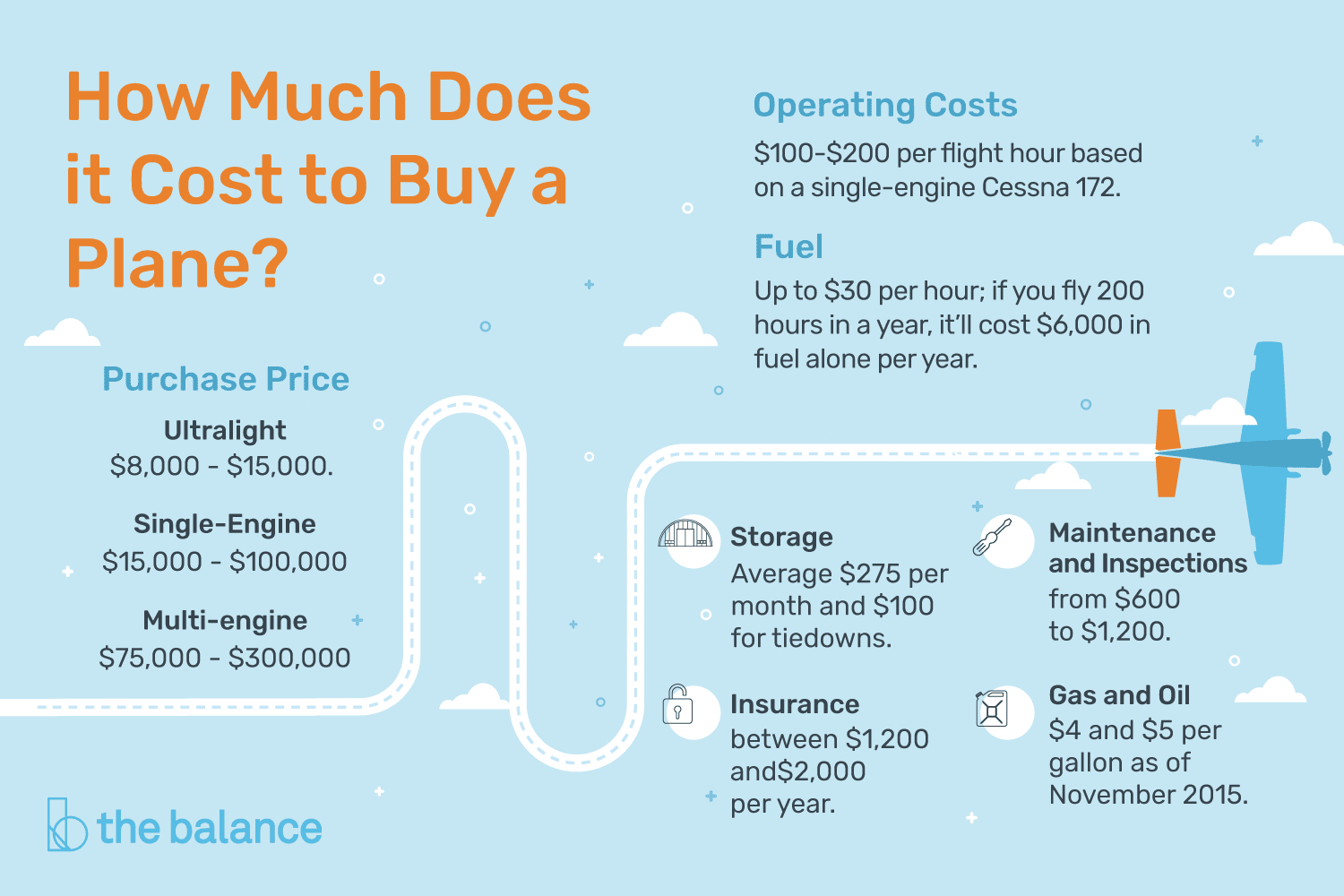

The Pilot's Guide to Taxes - AOPA - Aircraft Owners and Pilots Association The basic tax question posed by AOPA members who use aircraft for business purposes is whether their aircraft expenses are tax deductible. The types of expenses our members commonly look to deduct are the basic costs associated with aircraft operations, including maintenance, fuel, tie-down or hanger fees, landing fees, insurance, and depreciation.

Airline pilot tax deduction worksheet

Free Occupation Worksheet - Pacific Tax & Financial Group Receive A Free Occupation Tax Deductions Worksheet Airline PilotAutomobile SalespersonArtistBusiness ProfessionalClergyConstruction WorkerDay Care Skip to content 955 Boardwalk Ste 203 | San Marcos, CA 92078 Tax Deductions - Airline Pilot Central Forums A company called Tax Crew out in California has a great worksheet called the "2005 Tax Organizer" that you can get from there web page. They also have ones for prior tax years if needed, but I think they are all relatively the same. You can print it out and use it for yourself or have them file your return. It is a downloadable .pdf file. PDF 2011 Aircrew Taxes Flight Attendant Worksheet AIRCREW TAXES (770) 884-7565 FAX (770) 795-9799 1 Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer

Airline pilot tax deduction worksheet. PDF Flight Crew Expense Report and Per Diem Information There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this form to detail your flight attendant and pilot tax deductions. PDF Pilot Professional Deductions - Diamond Financial Pilot Professional Deductions Proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) Do not provide these to Diamond Financial; keep them for your records. All expenses below must be specifically for business use and not reimbursed by employer. Enter amounts as year's totals unless otherwise specified. Airbnb Tax Deductions Checklist for Hosts | Hurdlr This will determine the tax treatment of your rental and help you calculate your deductions. Add up your total operating costs (utilities, insurance, food for guests, etc.) you incurred each month during the year so you can calculate your deductions. If you took our advice on keeping information in real time, this should already be done! PDF PROFESSIONAL DEDUCTIONS - Pilot-Tax We cannot take a deduction for any expense for which you COULD have been reimbursed. For example: if your airline will reimburse you for your uniform alteration expenses but you just did not get around to submitting your receipts for reimbursement. The IRS will not allow this expense as a deduction because you 'could' have been reimbursed.

Airline Crew Taxes Bigger Refunds - Maximizing all deductions, tax credits, and write-offs available. Faster Refunds - With electronic filing and direct deposit, money in 14 to 21 days from filing date. Low Fees - Competent, professional service at half the cost of comparable tax firms. If you do your own taxes, you could be costing yourself $100s or even $1000s. PDF 2020 a ear - Pilot-Tax Please list the institutions for which 2020 interest income was received for you, your spouse, and any dependents under the age of 24. If your child files their own tax return and their interest and dividends are over $2,200, it must be reported on your return or be taxed at your tax rate on their return. flightax.com Brett Morrow and Pilot Tax, for the past 8 years have been solid in handling my taxes. They certainly know how to handle airline crew taxes from US airlines as well when I was an Ex-Pat, flying for a foreign airline. They knew the process. I have been impressed each year working with Brett Morrow and Pilot Tax. 25 examples! What can flight crews write off? Why or why not? - EZPerDiem Expense example 15: A pilot tips a van driver to take him from the airport to the hotel (or vice versa). Yes. A tip to a van driver is deductible. This is a travel expense. Also, because it is a travel expense that is less than $75 a receipt is not required. However, the van tips still need to be substantiated.

Tax Deduction Worksheet for Pilots, Flight Attendants, & Other Airline ... This worksheet provides a way for you to organize your credit and deduction information only. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is taxable or deductible. Tax regulations change often and specific circumstances may determine whether Downloads - Pilot-Tax Dependent Worksheet If you are claiming a dependent or you are Head of Household and claiming a dependent, you must complete this form and list each dependent. Flight Deductions If you live in AL, AR, CA, HI, NY, MN or PA your state will allow Flight Deductions. We will need the completed "Flight Deduction Organizer". Foreign Domicile Organizer Flight Crew Expense Report - Blue Skies Tax Service There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this online submit form to detail your flight attendant and pilot tax deductions. PDF Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ...

Pilot-Tax - Your Tax Professionals Flight Deductions. "Brett Morrow and Pilot Tax, for the past 8 years have been solid in handling my taxes. They certainly know how to handle airline crew taxes from US airlines as well when I was an Ex-Pat, flying for a foreign airline. They knew the process. I have been impressed each year working with Brett Morrow and Pilot Tax.".

Air Crew Tax Specialist for Pilots and Crew Members The link to download the client tax organizers or applicable worksheets are below. In order to prepare your tax returns you must complete the blocks that pertain to your individual tax situation. Only items of income and expenses for the particular tax year you want us to prepare should be printed on the organizer or worksheet.

PDF 2011 Aircrew Taxes Flight Attendant Worksheet AIRCREW TAXES (770) 884-7565 FAX (770) 795-9799 1 Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer

Tax Deductions - Airline Pilot Central Forums A company called Tax Crew out in California has a great worksheet called the "2005 Tax Organizer" that you can get from there web page. They also have ones for prior tax years if needed, but I think they are all relatively the same. You can print it out and use it for yourself or have them file your return. It is a downloadable .pdf file.

Free Occupation Worksheet - Pacific Tax & Financial Group Receive A Free Occupation Tax Deductions Worksheet Airline PilotAutomobile SalespersonArtistBusiness ProfessionalClergyConstruction WorkerDay Care Skip to content 955 Boardwalk Ste 203 | San Marcos, CA 92078

0 Response to "38 airline pilot tax deduction worksheet"

Post a Comment