38 nc 4 allowance worksheet

PDF How to fill out the NC-4 - One Source Payroll Items needed to fill out NC-4 Form NC-4 With Allowance Worksheet/schedules Copy of previous year Federal 1040, 1040A, or 1040 EZ Used to estimate income and deductions for 2014 Line 1 of NC-4 You are no longer allowed to claim a N.C. withholding allowance for yourself, your spouse, your children, or any other dependents. Filing the necessary and new NC-4 with your employer. It will send you to the NC-4 Allowance Worksheet to determine the number to enter here. Find the secton for your Marital Status and answer all the questions for that section and follow its directions. It may send you back with a number to enter on Line 1 or send you to complete Part II of the Allowance Worksheet.

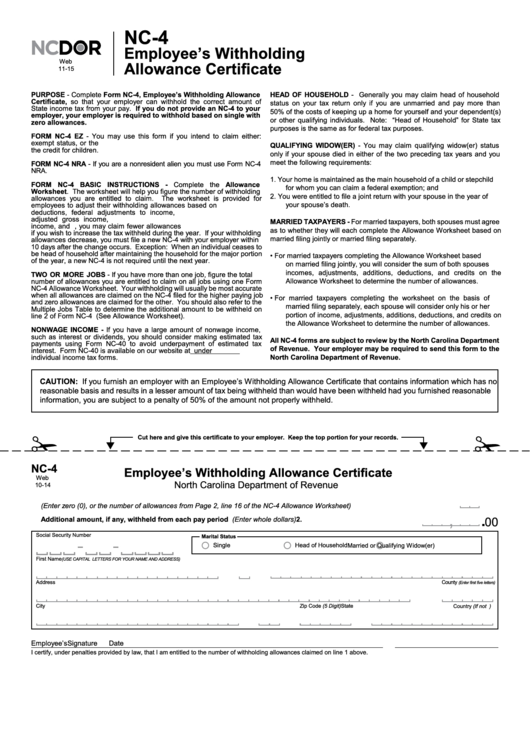

PDF NC-4 Employee's Withholding Allowance Certificate NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming for 2014 (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 Single Head of Household Married or Qualifying Widow(er)

Nc 4 allowance worksheet

Employee's Withholding Allowance Certificate NC-4 | NCDOR Form NC-4 Employee's Withholding Allowance Certificate. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. Appointments are recommended and walk-ins are first come, first serve. PDF NC-4 North Carolina Department of Revenue - Accuchex Payroll allowances you are entitled to claim. However, you may claim fewer allowances if you wish to increase the tax withheld during the year. If your withholding allowances decrease, you must file a new NC-4 with your employer within 10 days after the change occurs except that a new NC-4 is not required until the next year in the followng cases: 1. PDF NC-4 - media.icims.com NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, Line 17 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars) .00 Social Security Number Filing Status

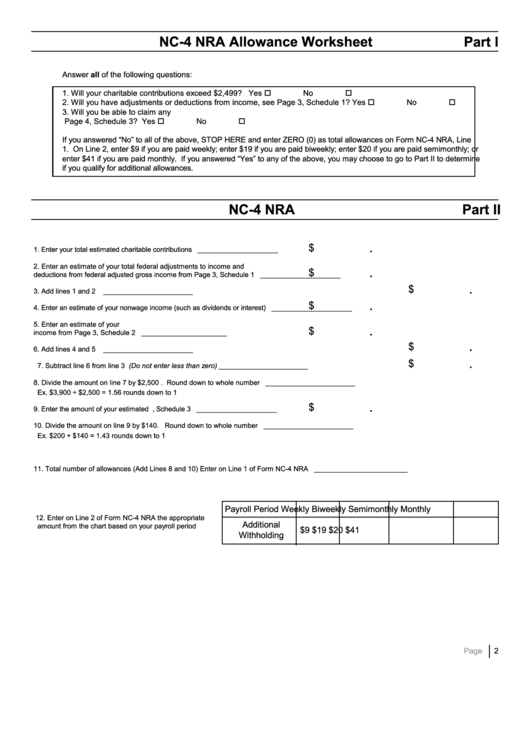

Nc 4 allowance worksheet. How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for ... Claim Dependents. If your income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000. Multiply the number of other dependents by $500 . Add the amounts above and enter the total. NC-4 NRA Part II NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 1 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income, see Page 4, Schedule 2? Yes o No o 4. PDF NC-4 Employee's Withholding Allowance Certificate - Galactic, Inc NC-4 Employee's Withholding Allowance Certificate 1. Total number of allowances you are claiming for 2014 (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2. Additional amount, if any, withheld from each pay period (Enter whole dollars),. 00 Single Head of Household Married or Qualifying Widow(er) Nc 4 Allowance Worksheet Form - Fill Out and Sign Printable PDF ... Use a nc 4 allowance worksheet template to make your document workflow more streamlined. Show details How it works Open the nc 4 form and follow the instructions Easily sign the nc 4nc with your finger Send filled & signed nc4 allowance worksheet or save Rate the nc 4 form 2022 printable 4.9 Satisfied 51 votes

NC-4 Employee's Withholding - University of Colorado NC-4 Allowance Worksheet Answer allof the following questions for your filing status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $12,499? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3. Will you have federal adjustments or State deductions from income? Employee's Withholding Allowance Certificate NC-4 | NCDOR Form NC-4 Employee's Withholding Allowance Certificate. NC-4-Web.pdf. PDF • 429.87 KB - January 04, 2021 Withholding, Individual Income Tax. Categorization and Details. Forms. Document Entity Terms. Withholding. Individual Income Tax. Document Organization. files. Date Published: Last Updated: January 4, 2021. NC 4 EZ Fillable Form - Fill Out and Sign Printable PDF Template | signNow FORM NC-4 BASIC INSTRUCTIONS — Complete the NC-4 Allowance Worksheet. What is a NC 4 tax form? An NC-4 to your employer, your employer is required to withhold based on the filing status, \u201cSingle\u201d with zero allowances. FORM NC-4 EZ — You may use Form NC4-EZ if you plan to claim either the N.C. Standard Deduction or the N.C. deq.nc.gov › about › divisionsInside Fisheries | NC DEQ Raleigh, NC 27603 Map It 877-623-6748. Mailing Addresses. Work for Us. Job Opportunities at DEQ; For State Employees; DEQ Intranet; Twitter Feed. Tweets by NC DEQ ...

PDF NC-4 NRA Nonresident Alien Employee's Withholding Allowance Certificate NC-4 NRA Allowance Worksheet Answer all of the following questions: 1. Will your charitable contributions exceed $2,499? Yes o Noo 2. Will you have adjustments or deductions from income, see Page 3, Schedule 1? Yes o Noo 3. Will you be able to claim any N.C. tax credits or tax credit carryovers from Page 4, Schedule 3? PDF NC-4 Web Employee's Withholding Allowance Certificate - Human Resources Allowance Certificate NC-4 Web 2-15 1.Total number of allowances you are claiming (Enter zero (0), or the number of allowances from Page 2, line 16 of the NC-4 Allowance Worksheet) 2.Additional amount, if any, withheld from each pay period (Enter whole dollars) Single Head of Household Married or Qualifying Widow(er) Marital Status PDF NC-4 Employee's Withholding - rssed.org If line 3 or line 4 above applies to you, enter the year effective and write "EXEMPT" here 1. Total number of allowances you are claiming (From Line F of the Personal Allowances Worksheet on Page 2) Additional amount, if any, you want withheld from each pay period (Enter whole dollars) 2. PDF NC-4EZ Employee's Withholding Allowance Certificate - Prefer not to complete the extended Form NC-4 - Qualify to claim exempt status (See lines 3 or 4 below) Important: If you are a nonresident alien you must use Form NC-4 NRA. You may complete Form NC-4, if you plan to claim N.C. itemized deductions, federal adjustments to income, or N.C. deductions.

PDF NC-4 Employee's Withholding 11-15 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

Form Nc 4 ≡ Fill Out Printable PDF Forms Online FORM NC-4 BASIC INSTRUCTIONS - Complete the NC-4 Allowance Worksheet. The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N.C. itemized deductions, and N.C. tax credits. However, you may claim fewer allowances than

myidp.sciencecareers.orgHome Page [myidp.sciencecareers.org] You have put a lot of time and effort into pursuing your PhD degree. Now it’s time to focus on how to leverage your expertise into a satisfying and productive career.

NC-4 Employee's Withholding - Symmetry Software NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the "Multiple Jobs Table" to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

› withhold › ncFederal and North Carolina Paycheck Withholding Calculator NC-4 Allowance Worksheet Part II; Schedule 1 Estimated N.C. Itemized Deductions Qualifying Mortgage Interest: Real estate property taxes: Charitable Contributions (Same as allowed for federal): Medical and Dental Expenses (Same as allowed for federal): Itemized Total (after limits) Schedule 2 Estimated Child Deduction Amount

How to Complete your NC Withholding Allowance Form (NC-4) Starting a new job or need to change the amount of withholding from your paycheck? The NC-4 video will help you fill out the NC-4 form to make sure you are h...

PDF Versatrim FORM NC-4 BASIC INSTRUCTIONS - complete the NC-4 Allowance Worksheet The worksheet will help you determine your withholding allowances based on federal and State adjustments to gross income including the N.C. Child Deduction Amount, N C. itemized deductions, and N.C. tax credits. However, you may claim fewer allowances than

policies.ncdhhs.gov › divisional › social-servicesFOOD AND NUTRITION SERVICES CERTIFICATION INCOME AND ... deduction. The amount is automatically calculated by NC FAST. Effective October 1, 2019: Household Size Standard Deduction 1 $177 2 $177 3 $177 4 $184 5 $215 6+ $246 C. Earned Income Deduction Current SUA, BUA, and TUA Amounts Food and Nutrition Services Unit Size SUA BUA TUA 1 $550 $331 $29 2 $610 $364 $29

PDF NC-4 Employee's Withholding 9-16 Allowance Certificate NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the Multiple Jobs Table to determine the additional amount to be withheld on line 2 of Form NC-4 (See Allowance Worksheet).

PDF Form NC-4 Instructions for Completing Form NC-4 Employee's Withholding ... BASIC INSTRUCTIONS- Complete the Personal Allowances Worksheeton Page 2 of Form NC-4. An additional worksheet is provided on Page 2 for employees to adjust their withholding allowances based on itemized deductions, adjustments to income, or tax credits.

PDF Frequently Asked Questions Re: Employee's Withholding Allowance ... included when completing the NC-4 Allowance worksheet. Q16. When do we send a NC-4EZ or NC-4 to the Department? A16. If an employee claims more than 10 allowances, you should forward this document to the Department and keep a copy for your records. Q17. Does the employer have to provide both the NC-4 & the NC-4EZ to their employees? A17. No.

PDF NC-4 Employee's Withholding 10-17 Allowance Certicate NC-4 Allowance Worksheet Answer all of the following questions for your ling status. Single - 1. Will your N.C. itemized deductions from Page 3, Schedule 1 exceed $11,249? Yes o No o 2. Will your N.C. Child Deduction Amount from Page 3, Schedule 2 exceed $2,499? Yes o No o 3.

› media › 11624c; sides of paper. - NCDOR NC-4 Allowance Worksheet. Your withholding will usually be most accurate when all allowances are claimed on the NC-4 filed for the higher paying job and zero allowances are claimed for the other. You should also refer to the “Multiple Jobs Table” to determine the additional amount to be withheld on Line 2 of Form NC-4 (See page 4).

0 Response to "38 nc 4 allowance worksheet"

Post a Comment