38 rental income calculation worksheet

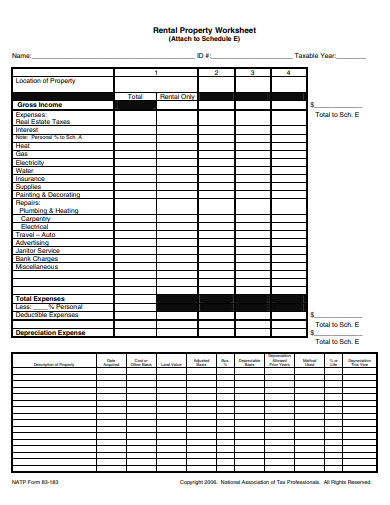

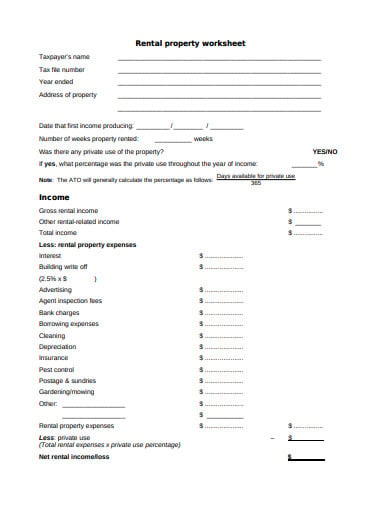

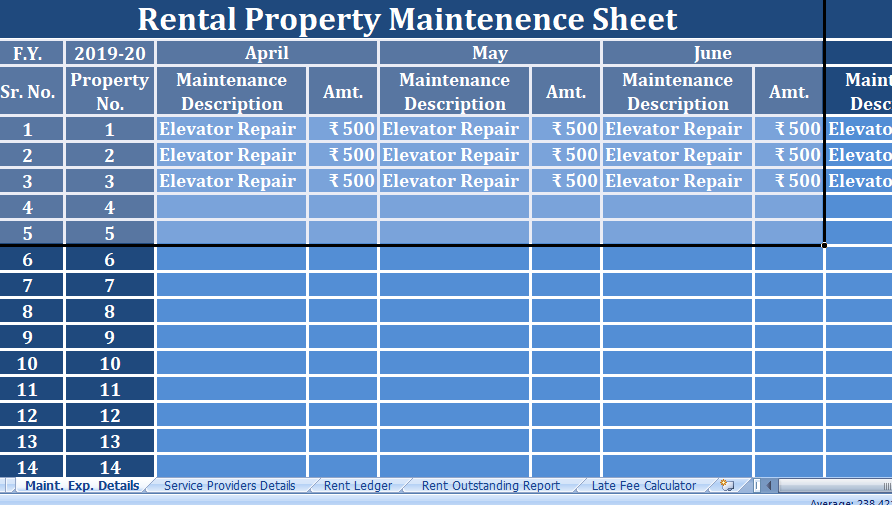

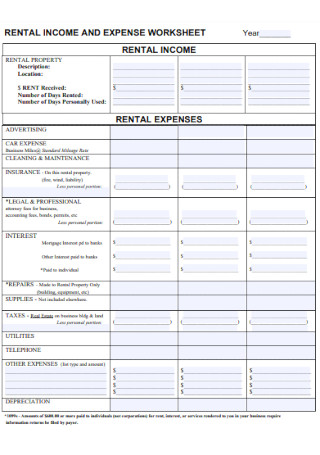

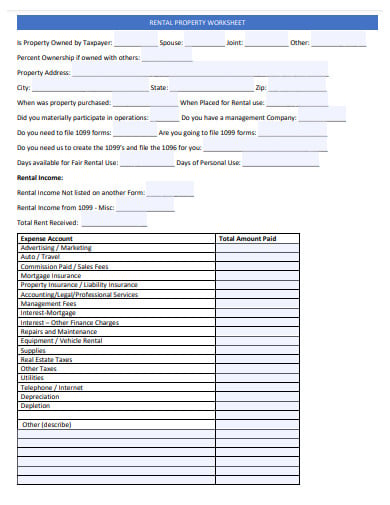

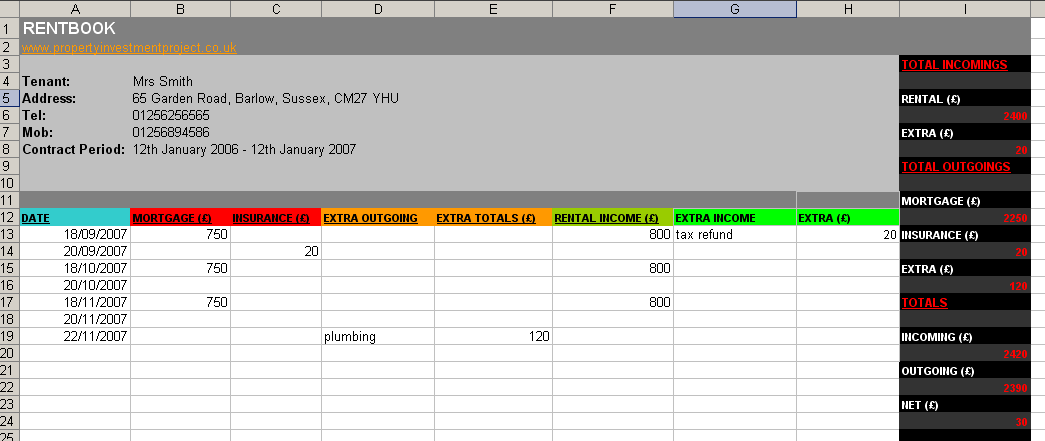

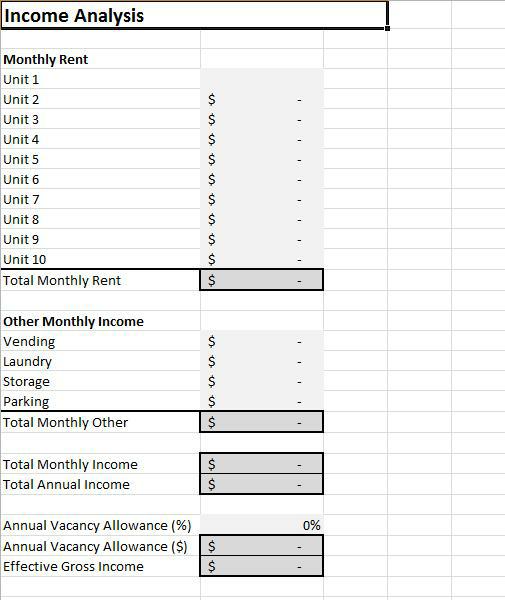

Self-Employed Borrower Tools by Enact MI Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1038 (Individual Rental Income from Investment Property (s) (up to 4 properties) Fannie Mae Rental Guide (Calculator 1039) Calculate qualifying rental income for Fannie Mae Form 1039 (Business Rental Income from Investment Property) Fannie Mae Form 1088 Cheat Sheet, Rental Income and Expense Worksheet - PropertyManagement.com 1 Income and expenses are an essential part of effectively managing your rental. 2 Personalize your expenses with this worksheet. 3 Totals are automatically calculated as you enter data. 4 This sheet will also track late fees and any maintenance costs.

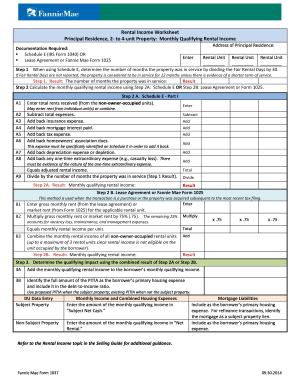

PDF Form 1038: Rental Income Worksheet - Enact MI Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: ... Click the gray button to calculate the adjusted monthly rental income. If Line A9 is zero, "error" will show. Schedule E, Line 3 Schedule E, Line 20 Schedule E, Line 9 Schedule E, Line 12

Rental income calculation worksheet

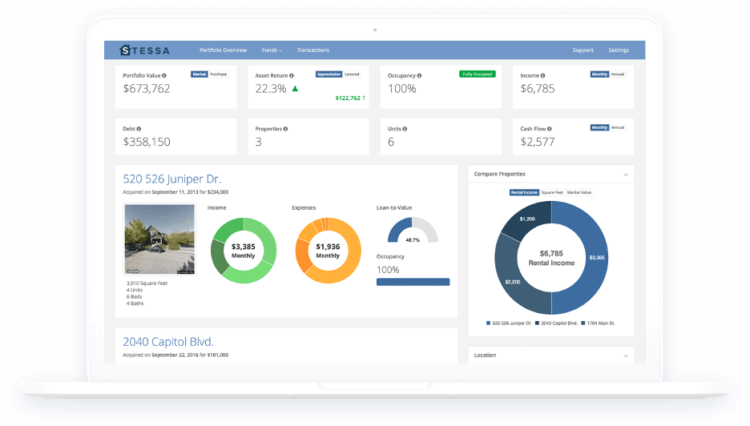

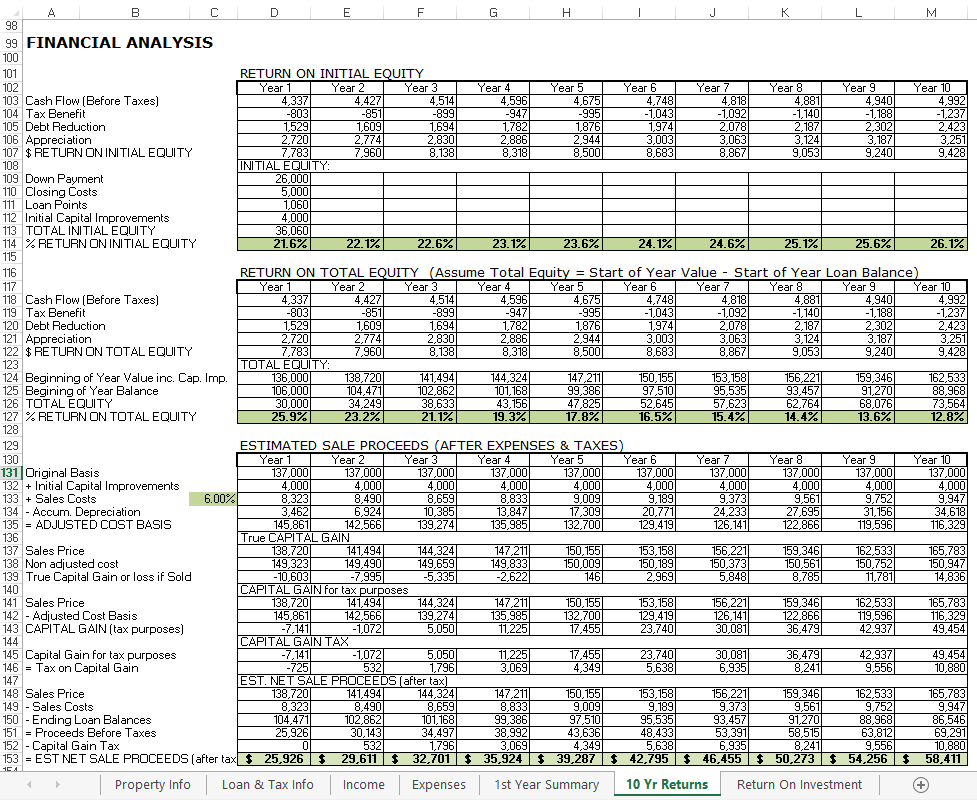

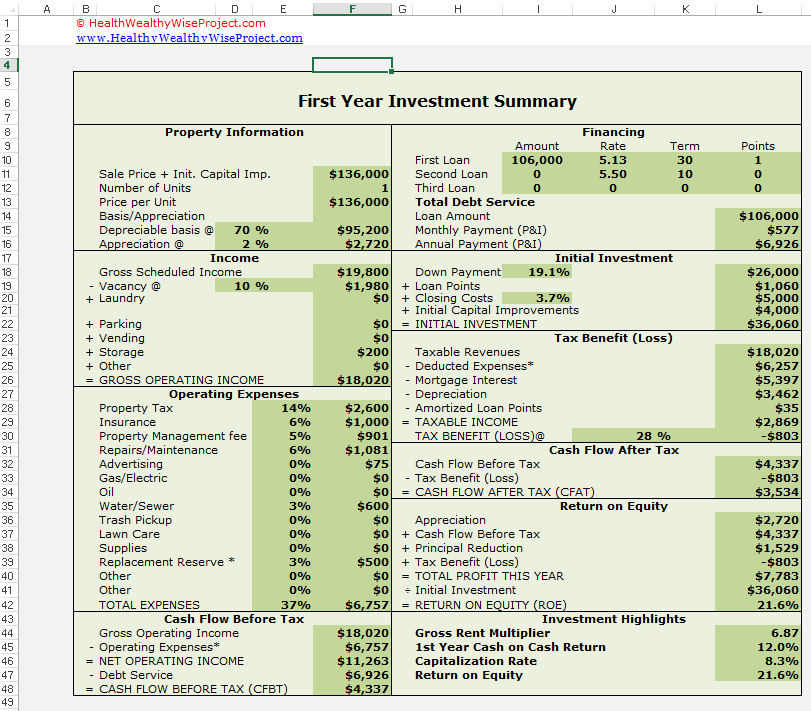

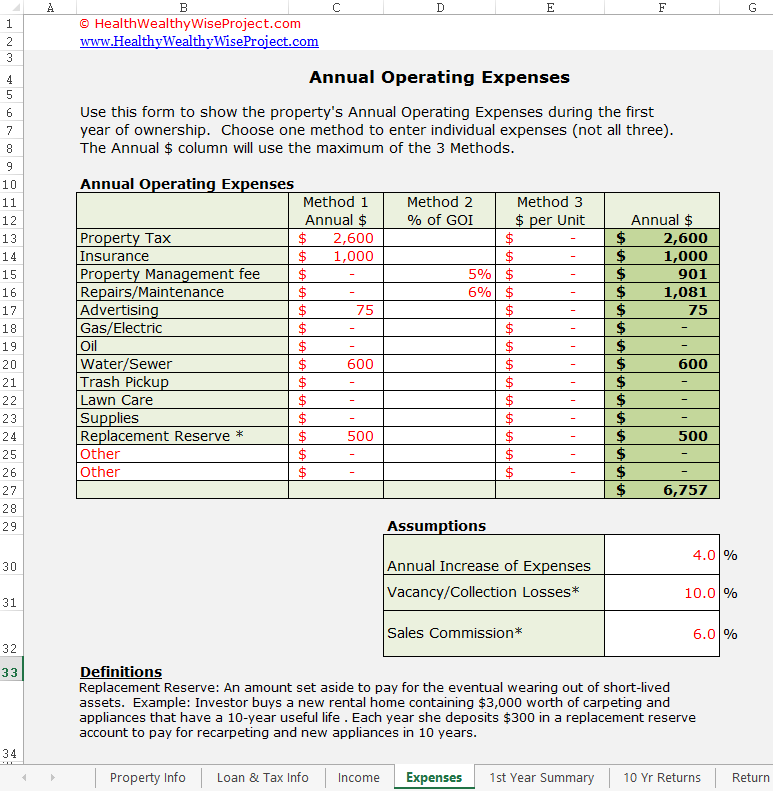

Rental Income and Expense Worksheet: Free Resources - Stessa Real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or "ROI," identify opportunities to increase revenues, and make sure they are claiming every tax deduction the IRS allows. In this article, we'll take an in-depth look at the rental income and ... 2022 Rental Property Analysis Spreadsheet [Free Template] - Stessa Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value, There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value. Income Analysis Worksheet | Essent Guaranty Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Rental Property - Investment , (Schedule E) Determine the average monthly income/loss for a non-owner occupied investment property.

Rental income calculation worksheet. B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ), PDF CHAPTER 5. DETERMINING INCOME AND CALCULATING RENT 5-1 Introduction income reflected on Mary's copy of her form 1040 as her annual income. 5-6 Calculating Income—Elements of Annual Income A. Income of Adults and Dependents 1. Figure 5-2 summarizes whose income is counted. 2. Adults. Count the annual income of the head, spouse or co-head, and other adult members of the family. In addition, persons under the ... Income Calculation Worksheet - NRPS Right click on the below link, select "open in a new tab" to launch the Income Calculation Worksheet: Income Calculation Worksheet Income Calculation Worksheet is required to be utilized on all wag... Income Calculations - Freddie Mac IRS Form 1040, W-2 Income – Officer Compensation (Section 5304.1(d))1 (+) (+) Subtotal of W-2 income from self-employment $ $ 1 Validate with business returns and IRS Form 1125-E, Compensation of Officers, as applicable

Mgic income calculation worksheet 2022 There are certain steps to read a balance sheet and they are:Step 1: First step suggest calculation of assets. Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (Line 4) + b. PDF INCOME CALCULATION WORKSHEET - LoanSafe Step 1 Enter Monthly Gross Rental Income $ Step 2 Total Monthly Income used for qualifying = Subtotal from step 1 multiplied by 75% $ Step 3 Enter monthly PITI (principal, interest, taxes & insurance) $ Step 4 Enter monthly MI (mortgage insurance) $ Step 5 Enter monthly HOA (homeowners association) dues $ Step 6 Enter other monthly expenses $ St... PDF VA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID - Franklin American Notes for VA REO Net Rental Income Calculation Worksheet usage: • Enable Macros before using the worksheet (if required). • Do not include one-unit Primary Residence on this worksheet. • Always refer to FAMC/Agency guidelines for correct Net Rental calculation. • Use additional worksheet for more properties than this worksheet allows. PDF FHA REO NET RENTAL INCOME CALCULATION WORKSHEET JOB AID - Franklin American The first worksheet is specific to rental income calculated from property which is not the subject property. This includes REO owned and reported on tax returns, recently converted primary to investment property, or recently acquired investment property. Subject property rental income will be calculated on a separate she...

Section 8 Rent Calculation Worksheet - FormsPal Section 8 Rent Calculation Worksheet - Fill Out and Use. The Section 8 Rent Calculation Worksheet is a document that you will use to determine how much rent your landlord can charge for your unit. This worksheet contains information from the Fair Market Rent Chart and the Maximum Allowable Income. Click the orange button down below to start ... Fannie Mae Rental Income Worksheet - Fill Out and Sign Printable PDF ... Quick guide on how to complete fannie mae income calculation worksheet 2021. Forget about scanning and printing out forms. Use our detailed instructions to fill out and eSign your documents online. signNow's web-based service is specially designed to simplify the organization of workflow and optimize the process of competent document management. Single-Family Homepage | Fannie Mae Monthly qualifying rental income (loss): Step 2. Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025. Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Step 2A. Schedule E - Part I Rental Property - Investment | Essent Mortgage Insurance Determine the average monthly income/loss for a non-owner occupied investment property. ... Rental Property - Investment ... 2022-rental-property-investment-schedule-e-worksheet.pdf. 2022-rental-property-investment-schedule-e-calculator.xls. Sub-title (Schedule E) Follow Us on LinkedIn. Footer parent. About Essent.

Fuel tax credits calculation worksheet | Australian Taxation ... There are three steps to calculate your fuel tax credits using our Worksheet. Download a printable version of Fuel tax credits calculation worksheet (NAT 15634, 372KB) in PDF This link will download a file. Step 1: Work out your eligible quantities. Work out how much fuel (liquid or gaseous) you acquired for each business activity.

Cash Flow Analysis (Form 1084) - Fannie Mae Schedule E – Supplemental Income and . Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

PDF FNMA Rental Income Calculation Worksheet FNMA Rental Income Calculation Worksheet EFFECTIVE IMMEDIATELY: Pursuant to FannieMae announcement SEL-2011-10 dated Sept. 27, 2011, and the corresponding updated FannieMae guidelines dated Sept. 27, 2011, the following changes will be effective for all Sierra Pacific Mortgage conventional loan transactions and Non-Agency Jumbo's not yet

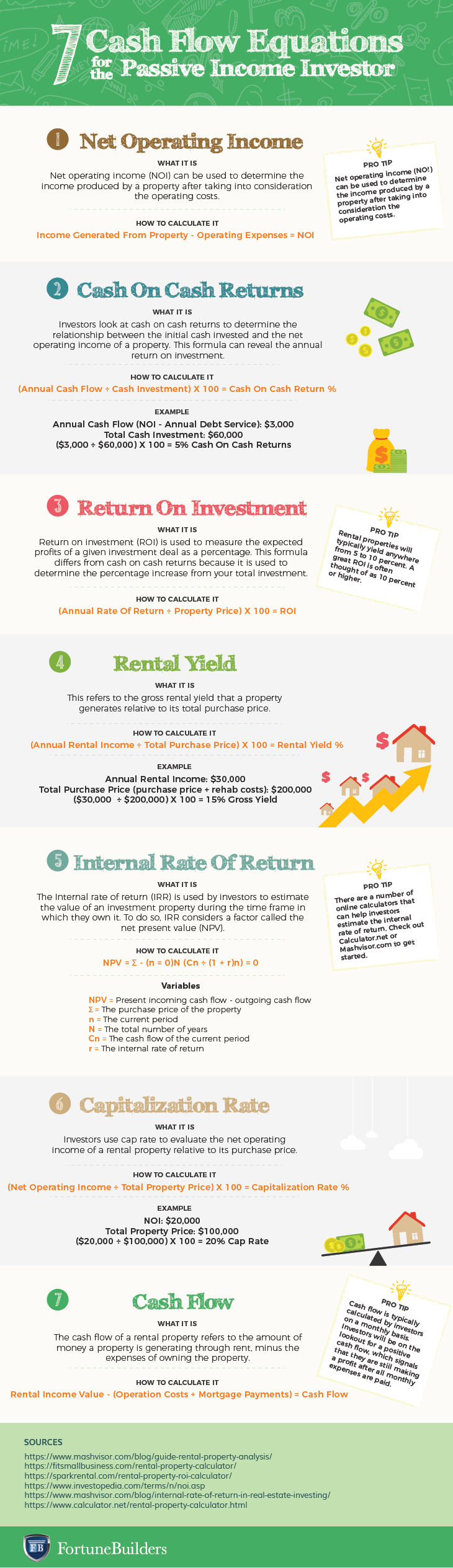

Rental Property Calculator | Zillow Rental Manager Additional rental income: Any additional money earned from the tenant like income from utilities, laundry, storage or parking fees. Use our free rental income and expense worksheet to keep track of your monthly cash flow. How to calculate ROI on rental property. First, calculate the return on investment by subtracting the total gains from the cost.

PDF Income & Resident Rent Calculation Worksheet - HUD Exchange 6) Net income from operation of a business or profession. $0 . 7) Interest, dividends, and other net income of any kind from real or personal property. Where net family assets are in excess of $5,000, annual income shall include the . greater of actual income derived from net family assets or a percentage of the value

Rental Income and Expense Worksheet - Rentals Resource Center To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Sep 07, 2022 · Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet – Principal Residence, 2– to 4–unit Property ,

SEB cash flow worksheets - MGIC Updated for the 2021 tax year, our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage pros. MGIC's self-employed borrower worksheets are uniquely suited for analyzing: Cash flow and YTD profit and loss (P&L) Comparative income, Liquidity ratios, Rental income, Get the worksheets,

Rental income calculation worksheet Rental Income Calculation Worksheets. Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The. The cap rate is another metric in real estate investing which you calculate by dividing the NOI by the property's value.

PDF SECTION 8 RENT CALCULATION WORKSHEET - FormsPal • 30% of monthly adjusted income; • 10% of monthly gross income; • The welfare rent (in as-paid states only); or • The PHA minimum rent (PHA determined). 30% of Monthly Adjusted Income: 1. _____ Enter Annual Adjusted Income (from Annual Income Worksheet) Divided by 12. This is Monthly Adjusted Income. 2.

PDF Calculator and Quick Reference Guide: Rental Income - Enact MI 10 Number of Months Considered (Line 2)* / 11 Monthly Income/Loss = 12 Monthly Mortgage Payment (Verified) - 13 Monthly Net Rental Income/Loss** = , Rental Income Calculation 2021 2020 NOTES, 1 Gross Rents (Line 3) *Check applicable guidelines if not using 12 months.

Mortgage industry tools and resources from MGIC Rethink MI: Fresh solutions for lenders and loan officers. If you think mortgage insurance is just for first-time homebuyers, it's time to rethink your MI strategy. MI Solutions can broaden your borrowers' financial options so they find the loan - and home - that's best for them.

Single-Family Homepage | Fannie Mae Equals adjusted monthly rental income A10 existing PITIA (for non-subject property). Step 2A. Result: Monthly qualifying rental income (or loss): B1 Enter the gross monthly rent (from the lease agreement) or market rent (reported on Form 1007 or Form 1025). For multi-unit properties, combine gross rent from all rental units. B2 Multiply x.75 ...

CoC Rent Calculation - Step 1: Determine the Annual Income - HUD Exchange Count the annual income of the head, spouse or co-head, and other family members 18 and older; Categorize income sources as either "included" or "excluded". (See Exhibit 5-1 of the HUD Occupancy Handbook for list of income inclusions and exclusions) Input information into the Rent Calculation Worksheet

PDF Net Rental Income Calculations - Schedule E - Freddie Mac 6 Establishing DTI ratio (Section 5306.1(d)): Subtract the monthly payment amount from the net rental income. For one property, if the result is positive, add it to the income; if the result is negative, add it to the monthly liabilities. For multiple properties, subtract the monthly payment amount from the net rental income for each proper...

Income Analysis Worksheet | Essent Guaranty Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Rental Property - Investment , (Schedule E) Determine the average monthly income/loss for a non-owner occupied investment property.

2022 Rental Property Analysis Spreadsheet [Free Template] - Stessa Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value, There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value.

Rental Income and Expense Worksheet: Free Resources - Stessa Real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or "ROI," identify opportunities to increase revenues, and make sure they are claiming every tax deduction the IRS allows. In this article, we'll take an in-depth look at the rental income and ...

0 Response to "38 rental income calculation worksheet"

Post a Comment