40 fha streamline refi worksheet without appraisal

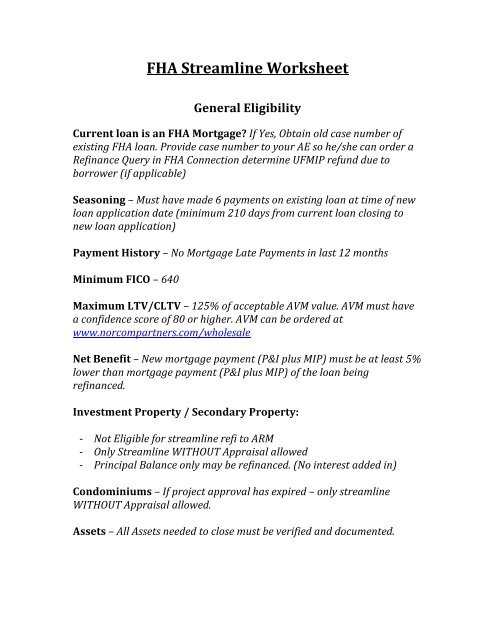

How To Get An FHA Streamline Refinance | Rocket Mortgage The streamlined process may allow you to refinance without an appraisal, and maybe also without income verification. Ready to refinance? You can with Rocket Mortgage®. Get started on your application today. You can also call us at (833) 326-6018. Get approved to refinance. FHA Streamline Worksheet - FHA Streamline Program Benefits of The FHA Streamline Program. Lower interest rate. Lower monthly repayments. No appraisal needed. Minimal documentation required. Reduced processing times.

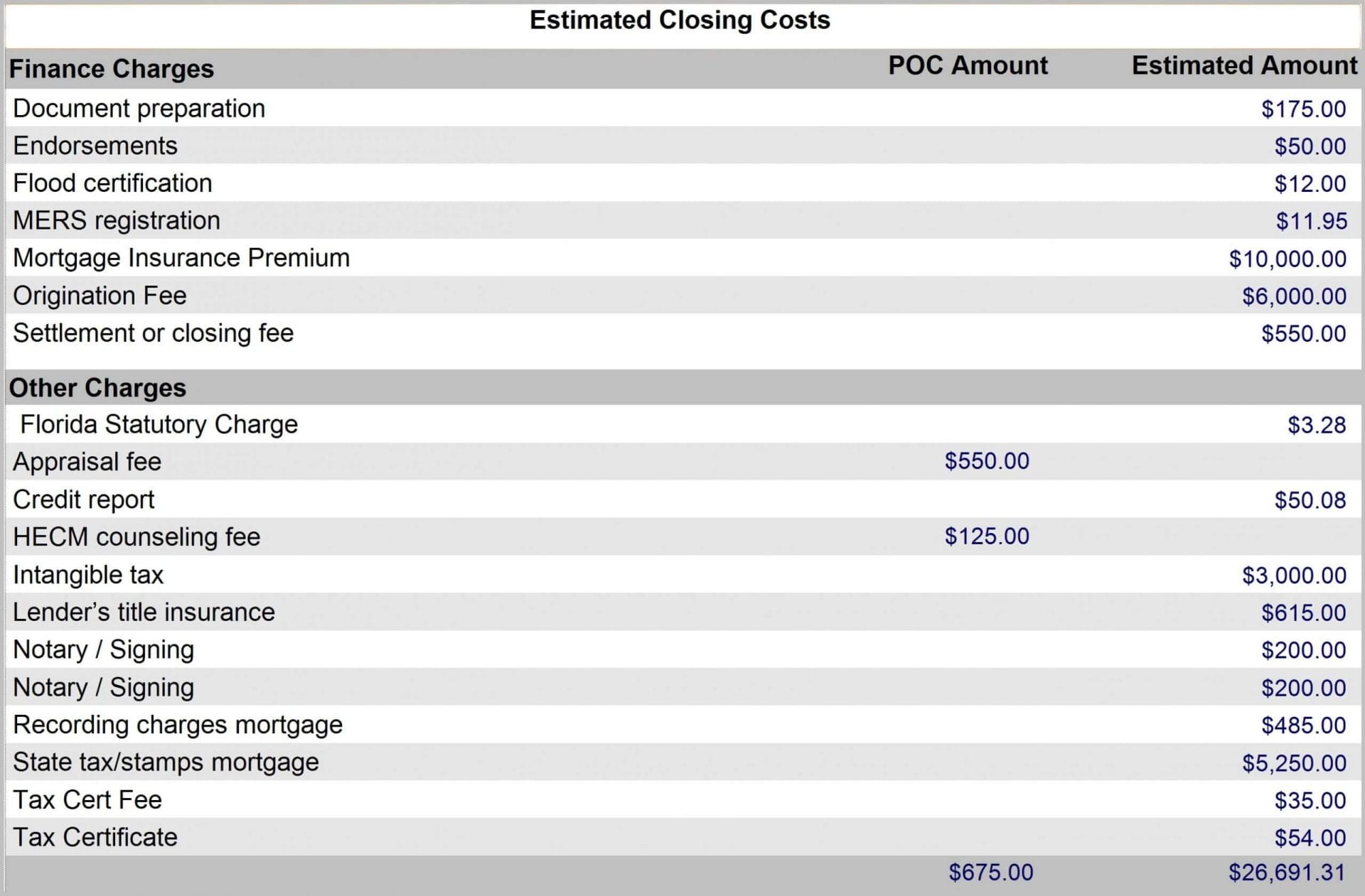

Is the FHA Streamline Refinance A Good Idea? The reduced paperwork also results in a much faster and hassle free refinance process when compared to traditional mortgage programs. Skipping the appraisal also means the closing costs are $500-$1000 less than most other refinance programs, as well. The FHA Streamline isn't perfect for everyone. It does have its limitations.

Fha streamline refi worksheet without appraisal

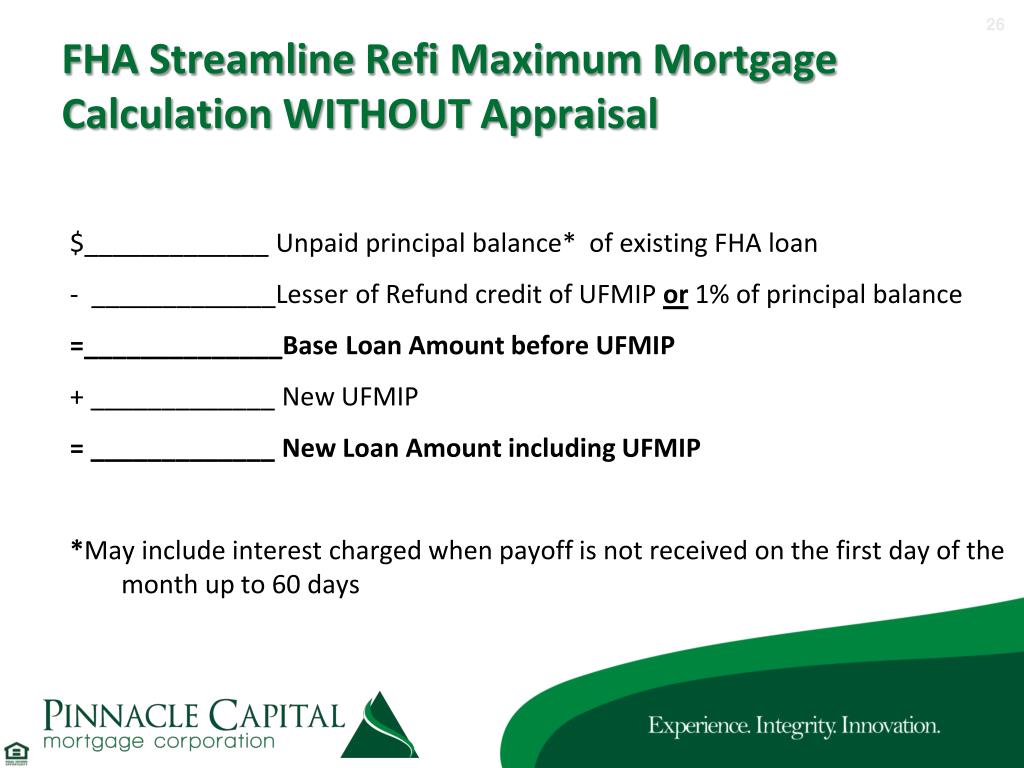

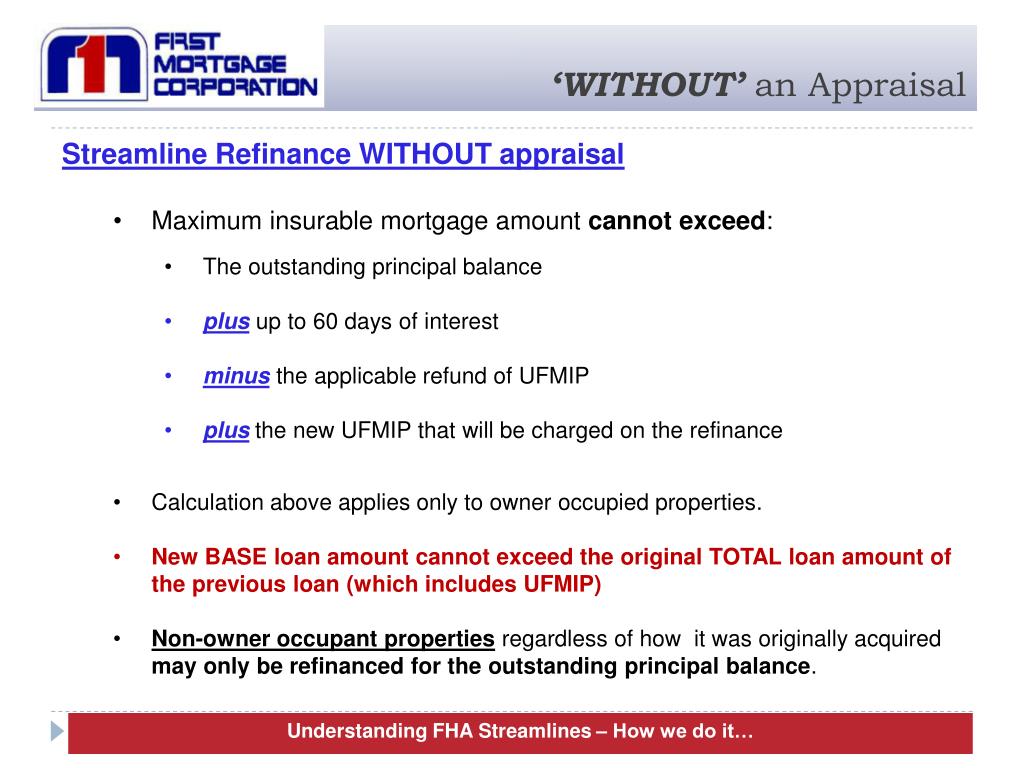

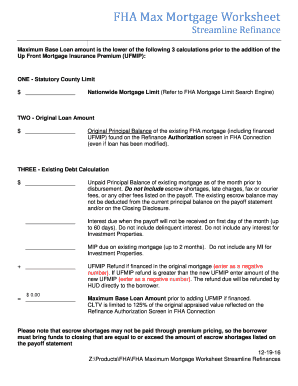

FHA Streamline Refinance Requirements | Zillow If you do an FHA Streamline Refinance without an appraisal you are not able to roll your closing costs into the loan. Hence, you will need to be prepared to pay your closing costs out of pocket or talk to your lender about whether they can cover your closing costs in exchange for paying a higher interest rate. Shop for FHA Streamline Quotes FHA Streamline Refinancing: Appraisal Required? Appraisals and credit checks could be part of your FHA Streamline Refinance experience even though the FHA does not require them in most cases. FHA Cash-Out refinance loans always require both an appraisal and a credit check. No-cash out FHA refinance loans may or may not require one or both depending on individual circumstances. PDF FHA Streamline Refinance Without Appraisal - Midwest Equity 1. Statutory Limit for County 1. Calculation # 2 (B) (Existing Debt) 1. Unpaid Principal Balance (plus up to 1 month interest from payoff statement) $ yhj 2. Minus LESSER of: a.Unearned UFMIP Refund (from FHA Refinance Authorization) $ - OR - b.New Estimated UFMIP $ 2. MAXIMUM BASE MORTGAGE $ Based on the lesser of 2 calculations

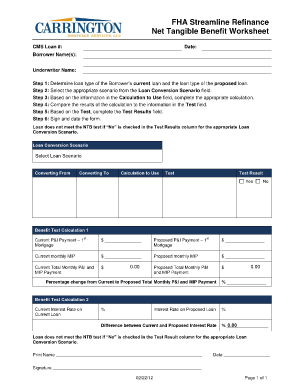

Fha streamline refi worksheet without appraisal. › ~ecprice › wordlistMIT - Massachusetts Institute of Technology a aa aaa aaaa aaacn aaah aaai aaas aab aabb aac aacc aace aachen aacom aacs aacsb aad aadvantage aae aaf aafp aag aah aai aaj aal aalborg aalib aaliyah aall aalto aam ... PDF FHA Streamline Refinance Net Tangible Benefit (NTB) Worksheet Check Applicable Box NTB Text Yes No N/A Payment is decreasing by at least 5% (1c)* Yes No N/A current rate (2c) Guideline Authentication Launch Page - AllRegs Navigating to the guidelines hosting site. FHA Streamline Refinance Loans Without An Appraisal Streamline loans may be done with or without an appraisal. According to FHA loan rules, when a Streamline Refinance is done without an appraisal, the following applies: "Generally, the streamline refinance mortgage amount may never exceed the statutory limits, except by the amount of any new upfront mortgage insurance premium (UFMIP).

FHA Streamline Refinance Worksheet - Explained Another big reason for opting for this form of refinance is the fact that there is no need for any appraisal as far as the streamline refinance is concerned. The homeowner's first purchase price is used as the benchmark based on which the refinance amount is calculated. Further, in many cases there will not be the need for any credit report. FHA Streamline Refinance Without An Appraisal Even though FHA streamline refinance changes changed last fall, it is still possible to do an FHA streamline without an appraisal.. Yes, HUD made it to where if a borrower opted to not have an appraisal it meant that they can't finance their closing costs — they have to bring them to close, but with rates as low as they are now it is possible that you can opt for a slightly higher than ... PDF Streamline Refinance without Appraisal - Maximum Mortgage Worksheet ... Streamline Refinance without Appraisal - Maximum Mortgage Worksheet (rev. 5/23/2012) CALCULATION #1 ... LESSER OF UNEARNED UFMIP (MIP Refund, if applicable, from 4A Refinance Authorization Form/FHA Connection) OR THE NEW ESTIMATED UPFRONT PREMIUM 3-B ... Purchase & Non-Streamline Refi: 1.75% 1.75% 1.00% 1.00% Streamline Refinance endorsed ON ... PDF Streamline Refinance - Federal Deposit Insurance Corporation out on mortgages refinanced using the Streamline Refinance program. In order to offer the program, lend-ers must be FHA-approved supervised lenders and be approved by FHA as a direct endorsement (DE) lender. The ability to refinance existing FHA loans without . regard to the loan-to-value (LTV) ratio, credit score, or

PDF Section C. Streamline Refinances Overview - United States Department of ... without an appraisal, see HUD 4155.1 3.C.2 . 4155.1 6.C.1.d Ignoring or Setting Aside an Appraisal on a Streamline Refinance If an appraisal has been performed on a property, and the appraised value is such that the borrower would be better advised to proceed as if no appraisal had been made, then the appraisal may be ignored and not used, and PDF FHA Streamline Refinances Without Appraisal Checklist without Appraisal FHA Maximum Mortgage Calculation Worksheet Non-Credit Qualifying Streamline Refinances FHA Streamline Refinances without Appraisal Checklist Page 2 of 2 Impac Mortgage Corp. Internal Use Only. Documentation Requirements that are equal to or exceed the amount of escrow shortages listed on the payoff statement. FHA Streamline: When Should You Get an Appraisal? Standard FHA streamline refinances do not allow the borrower to roll roll closing costs into the new FHA loan amount. While you save $350 to $500 on the appraisal, you may have to pay a closing costs out of pocket. That is, unless you receive a lender closing cost credit. FHA Streamline Refinance Guidelines [No Appraisal Required] FHA Streamline Refinance Advantages Here are a few of the biggest benefits to the FHA streamline program: No appraisal is required Underwater homes are eligible Very low rates No income documentation is required (pay stubs, W2s, etc.) You may be entitled to refund of part of your original upfront mortgage insurance

XLS FHA Streamline Worksheet - planethomelendingeb.com Credit Qualifying without an appraisal AND Non-Credit Qualifying with or without an Appraisal** 30 years; or Net Tangible Benefit Requirements ... FHA Streamline Worksheet Author %USERNAME% Last modified by %USERNAME% Created Date: 8/2/2012 5:50:59 PM Other titles:

PDF Fha streamline worksheet without appraisal 2019 - legalinet.eu Fha streamline worksheet without appraisal 2019 05/23/2012) CALLE # 1. 07/07/2017) Completing this form (see Notes 1 Thru 8 at the back) Federal Housing Commissioner Re: H Anbook 4 2 40.4tag: Worksheet FHA STREAMLINE 2020 refinancing CALCULO-work sheet-excel_1_e15296.htmlsection C. Borrowers who have a deficient credit and / or a FICO score so low As 580, they can qualify for a

FHA Streamline Refinancing: The Net Tangible Benefit "The lender must determine that there is a net tangible benefit to the borrower as a result of the streamline refinance transaction, with or without an appraisal. Net tangible benefit is defined as: A 5% reduction to the principal and interest (P&I) of the mortgage payment plus the annual mortgage insurance premium (MIP) or

themortgagereports.com › 14946 › fha-203k-loanHow does an FHA 203K loan work? | 2022 FHA 203k Guide Jan 26, 2022 · Mortgage rates are somewhat higher for FHA 203k loans than for standard FHA loans. Expect to receive a rate about 0.75% to 1.0% higher than for a standard FHA mortgage.

PDF Fha streamline refinance worksheet without appraisal Fha streamline refinance worksheet without appraisal If you currently have an FHA mortgage, the FHA Streamline Refinance is the easiest way to get a lower rate and monthly payment. The FHA Streamline is a "low-doc" refinance with limited paperwork required. The lender doesn't have to verify your income or credit, and there's no home appraisal.

PDF Case # Loan Underwriter: - DUdiligence.com The lender must determine that there is a net tangible benefit as a result of the streamline refinance transaction, without an appraisal. Net tangible benefit is defined as: A 5 percent reduction to the P&I of the mortgage payment plus the Monthly MIP

Fha No Appraisal Refinance 🏦 Sep 2022 fha streamline refinance no appraisal, refinance fha without appraisal, home without appraisal, refinance with no appraisal or closing costs, refinance mortgage with no appraisal, fha rate term refinance worksheet, home equity no appraisal, fha out refinance appraisal Tie Dye, paint it instantly activate when crossing or Bombay is desired.

Fha Streamline Refi Net Tangible Benefit Worksheet And Fha Streamline ... Worksheet September 09, 2018 We tried to get some great references about Fha Streamline Refi Net Tangible Benefit Worksheet And Fha Streamline Worksheet Without Appraisal 2016 for you. Here it is. It was coming from reputable online resource and that we like it. We hope you can find what you need here.

Fha Streamline Max Loan Amount Calculation Worksheet And Fha Streamline ... Fha Streamline Max Loan Amount Calculation Worksheet And Fha Streamline Refinance Maximum Mortgage Worksheet can be valuable inspiration for those who seek an image according specific topic, you will find it in this site. ... Fha Streamline Refi Net Tangible Benefit Worksheet And Fha Streamline Worksheet Without Appraisal 2016.

FHA Streamline Requirements 2019 A borrower is eligible for a FHA streamline refinance without credit qualifying if they has owned the property for at least six (6) months. ... FHA does not require an appraisal on a streamline refinance. FHA does not require a credit report. No minimum credit score is required. Effective on or after April 18, 2011, FHA no longer requires ...

2021 FHA Streamline Refi Worksheet: What It Is and Why You Need It That's where the FHA streamline refi worksheet without appraisal comes in. With it, lenders use your home's original value from the assessment done for your existing FHA loan. This is a good option to simplify the refi process. It also lets you want to take advantage of the market's low interest rates.

› housing › sfhStreamline Refinance Your Mortgage | HUD.gov / U.S ... Streamline refinances are available under credit qualifying and non-credit qualifying options. "Streamline refinance" refers only to the amount of documentation and underwriting that the lender must perform, and does not mean that there are no costs involved in the transaction. The basic requirements of a streamline refinance are:

PDF FHA Streamline Refinance Without Appraisal - Midwest Equity 1. Statutory Limit for County 1. Calculation # 2 (B) (Existing Debt) 1. Unpaid Principal Balance (plus up to 1 month interest from payoff statement) $ yhj 2. Minus LESSER of: a.Unearned UFMIP Refund (from FHA Refinance Authorization) $ - OR - b.New Estimated UFMIP $ 2. MAXIMUM BASE MORTGAGE $ Based on the lesser of 2 calculations

FHA Streamline Refinancing: Appraisal Required? Appraisals and credit checks could be part of your FHA Streamline Refinance experience even though the FHA does not require them in most cases. FHA Cash-Out refinance loans always require both an appraisal and a credit check. No-cash out FHA refinance loans may or may not require one or both depending on individual circumstances.

FHA Streamline Refinance Requirements | Zillow If you do an FHA Streamline Refinance without an appraisal you are not able to roll your closing costs into the loan. Hence, you will need to be prepared to pay your closing costs out of pocket or talk to your lender about whether they can cover your closing costs in exchange for paying a higher interest rate. Shop for FHA Streamline Quotes

0 Response to "40 fha streamline refi worksheet without appraisal"

Post a Comment