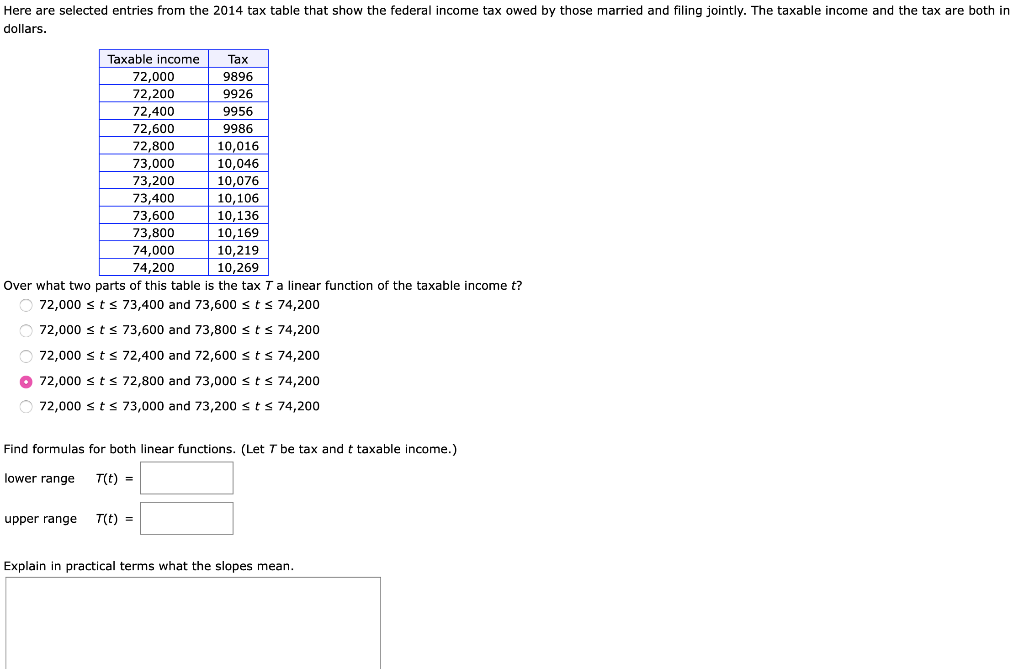

41 2014 tax computation worksheet

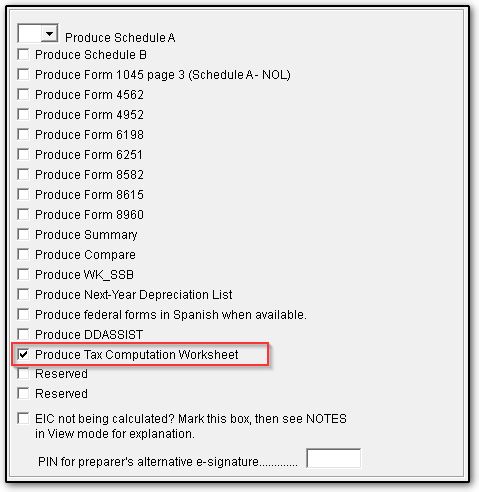

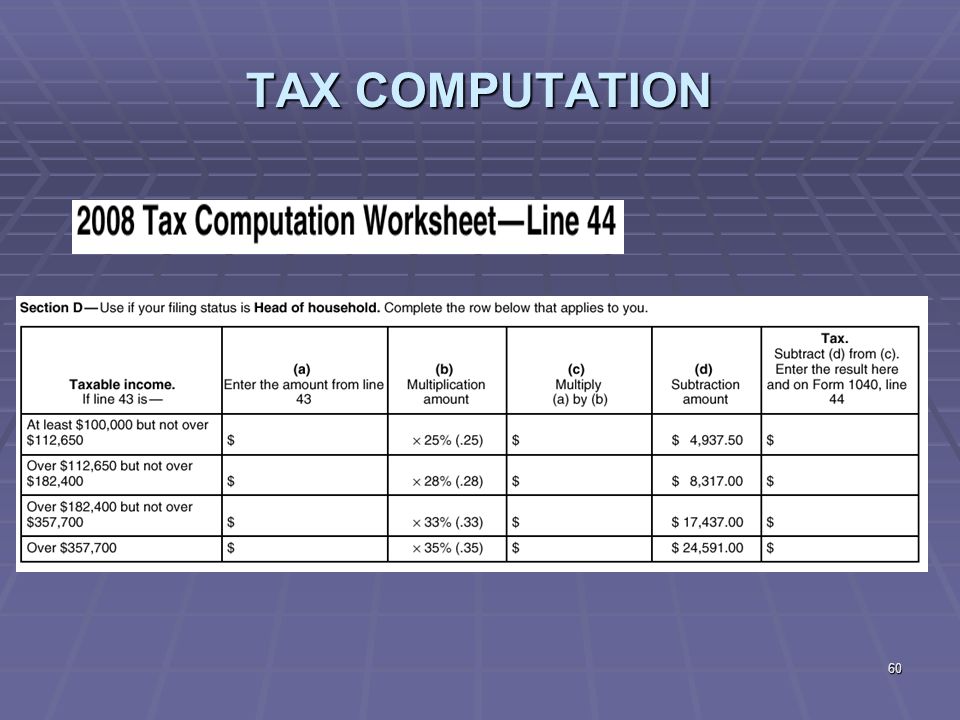

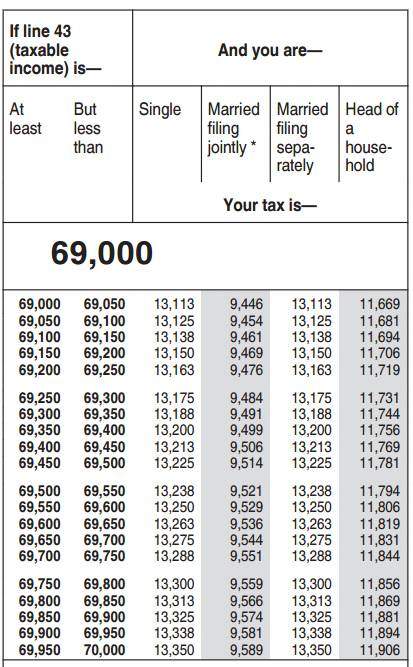

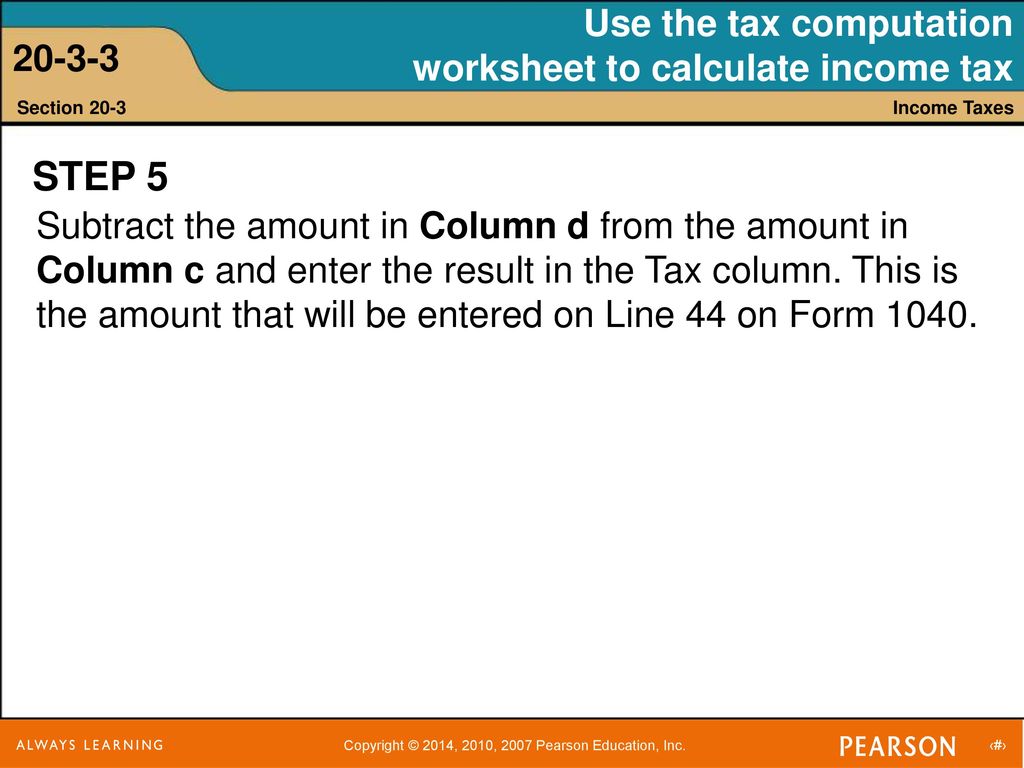

Maryland Tax Form 502 Instructions | eSmart Tax Find the Maryland tax corresponding to your income range. Enter the tax amount on line 22 of Form 502 or line 6 of Form 503. If your taxable income is $100,000 or more, use the MARYLAND TAX COMPUTATION WORKSHEET (17A) at the end of the tax table. 18. EARNED INCOME CREDIT, POVERTY LEVEL CREDIT, CREDITS FOR INDIVIDUALS AND BUSINESS TAX CREDITS. 1040 (2021) | Internal Revenue Service - IRS tax forms Tax Table or Tax Computation Worksheet. Form 8615. ... 2014-44 I.R.B. 753, ... Use the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax ...

Forms Archive - Alabama Department of Revenue For income tax form orders, ... Alabama Business Privilege Tax Financial Institution Group Computation Schedule: 2022: Instructions. Form BPT-IN with Calculations. Alabama Business Privilege Tax Initial Privilege Tax Return : 2022: Form BPT-IN. Alabama Business Privilege Tax Initial Privilege Tax Return: 2022: Instructions. Form BPT-IN Instruction. Alabama Business …

2014 tax computation worksheet

Publication 590-A (2021), Contributions to Individual Retirement ... The Instructions for Form 1040 include a similar worksheet that you can use instead of the worksheet in this publication. ... Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA. Ordinarily, when you have basis in your IRAs, any distribution is considered to include both nontaxable and taxable amounts. Without a special rule, the … 2020 Income Tax Forms | Nebraska Department of Revenue Form 1041N, Electing Small Business Trust Tax Calculation Worksheet. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms . Form 7004N, Application for Automatic Extension of Time to File Nebraska Corporation, Fiduciary, or Partnership Return. Form. Form 4797N, 2020 Special Capital Gains Election and Computation. … 2020 Corporation Tax Booklet 100 | FTB.ca.gov - California For taxable years beginning on or after January 1, 2014, the IRS allows corporations with at least $10 million but less than $50 million in total assets at tax year end to file Schedule M-1 (Form 1120/1120‑F), Reconciliation of Income (Loss) per Books With Income per Return, in place of Schedule M-3 (Form 1120/1120‑F), Net Income (Loss) Reconciliation for Corporations With …

2014 tax computation worksheet. Estate Tax - FAQ | Georgia Department of Revenue As of July 1st, 2014, O.C.G.A. § 48-12-1 was added to read as follows: § 48-12-1. Elimination of estate taxes and returns; prior taxable years not applicable (a) On and after July 1, 2014, there shall be no estate taxes levied by the state and no estate tax returns shall be required by the state. (b) Tax, penalty, and interest liabilities and refund eligibility for prior taxable years shall ... Corporate Income and Franchise Tax Forms | DOR Apr 07, 2014 · 83-180 | Application for Automatic Six Month Extension for Corporate Income & Franchise Tax Return 83-300 | Corporate Income Tax Voucher 83-305 | Interest and Penalty on Underestimate of Corporate Income Tax Form 1040 - Wikipedia In 2014 there were two additions to Form 1040 due to the implementation of the Affordable Care Act—the premium tax credit and the individual mandate.. In most situations, other Internal Revenue Service or Social Security Administration forms such as Form W-2 must be attached to the Form 1040, in addition to the Form 1040 schedules. There are over 100 other specialized … Publication 560 (2021), Retirement Plans for Small Business For tax years beginning after December 31, 2019, eligible employers can claim a tax credit for the first credit year and each of the 2 tax years immediately following. The credit equals 50% of qualified startup costs, up to the greater of (a) $500; or (b) the lesser of (i) $250 for each employee who is not a “highly compensated employee” eligible to participate in the employer …

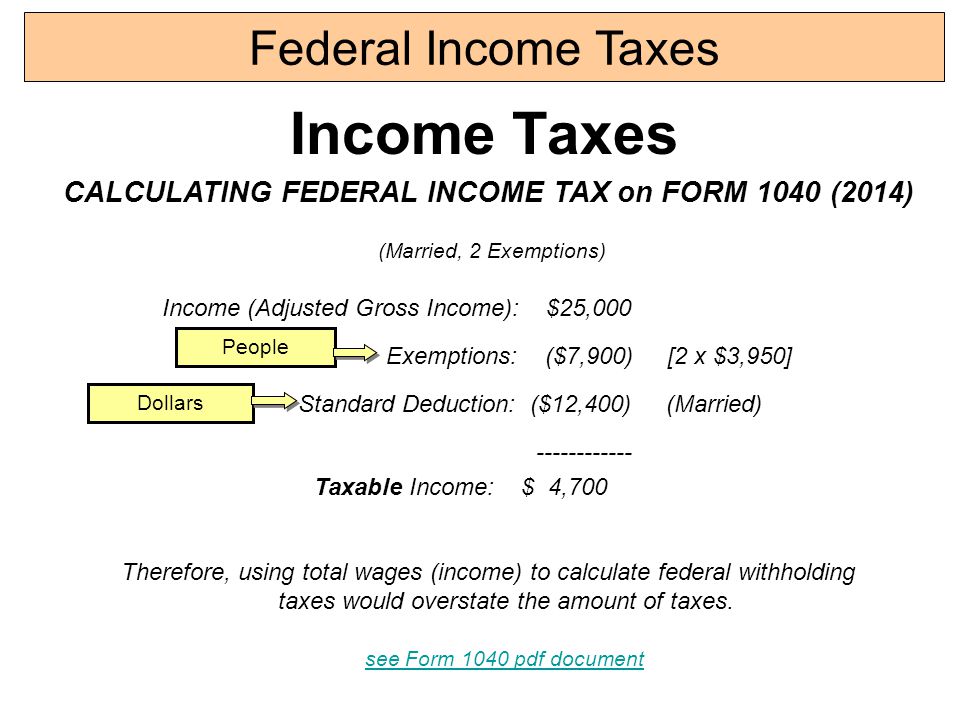

Publication 929 (2021), Tax Rules for Children and Dependents Figure the tax on the amount on line 4. Use the Tax Table, the Tax Computation Worksheet, the Qualified Dividends and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, or the child’s actual Schedule J (Form 1040), whichever applies. Enter the tax amount on line 17. Income Tax - Alabama Department of Revenue Income Tax administers individual income tax, business privilege tax, corporate income tax, partnerships, S-Corporation, fiduciary and estate tax, financial institution excise tax, and withholding taxes for businesses and individuals. Search. Homepage > Income Tax; Resources. Income Tax FAQ Estimated Tax Payments; Payment Options; Due Dates; Certificate of … 2020 Corporation Tax Booklet 100 | FTB.ca.gov - California For taxable years beginning on or after January 1, 2014, the IRS allows corporations with at least $10 million but less than $50 million in total assets at tax year end to file Schedule M-1 (Form 1120/1120‑F), Reconciliation of Income (Loss) per Books With Income per Return, in place of Schedule M-3 (Form 1120/1120‑F), Net Income (Loss) Reconciliation for Corporations With … 2020 Income Tax Forms | Nebraska Department of Revenue Form 1041N, Electing Small Business Trust Tax Calculation Worksheet. Form. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years. View Forms . Form 7004N, Application for Automatic Extension of Time to File Nebraska Corporation, Fiduciary, or Partnership Return. Form. Form 4797N, 2020 Special Capital Gains Election and Computation. …

Publication 590-A (2021), Contributions to Individual Retirement ... The Instructions for Form 1040 include a similar worksheet that you can use instead of the worksheet in this publication. ... Tax treatment of a rollover from a traditional IRA to an eligible retirement plan other than an IRA. Ordinarily, when you have basis in your IRAs, any distribution is considered to include both nontaxable and taxable amounts. Without a special rule, the …

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/2014-12-10-at-7.59-PM.png?strip=all&lossy=1&w=2560&ssl=1)

![Solved Exercise 7.8.25. [S][Section 7.7][Goal 7.1][Goal 7.6 ...](https://media.cheggcdn.com/study/005/0050a60e-9b5c-4a67-b863-65da22e091d8/image)

![Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download]](https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-facebook.jpg?strip=all&lossy=1&ssl=1)

0 Response to "41 2014 tax computation worksheet"

Post a Comment