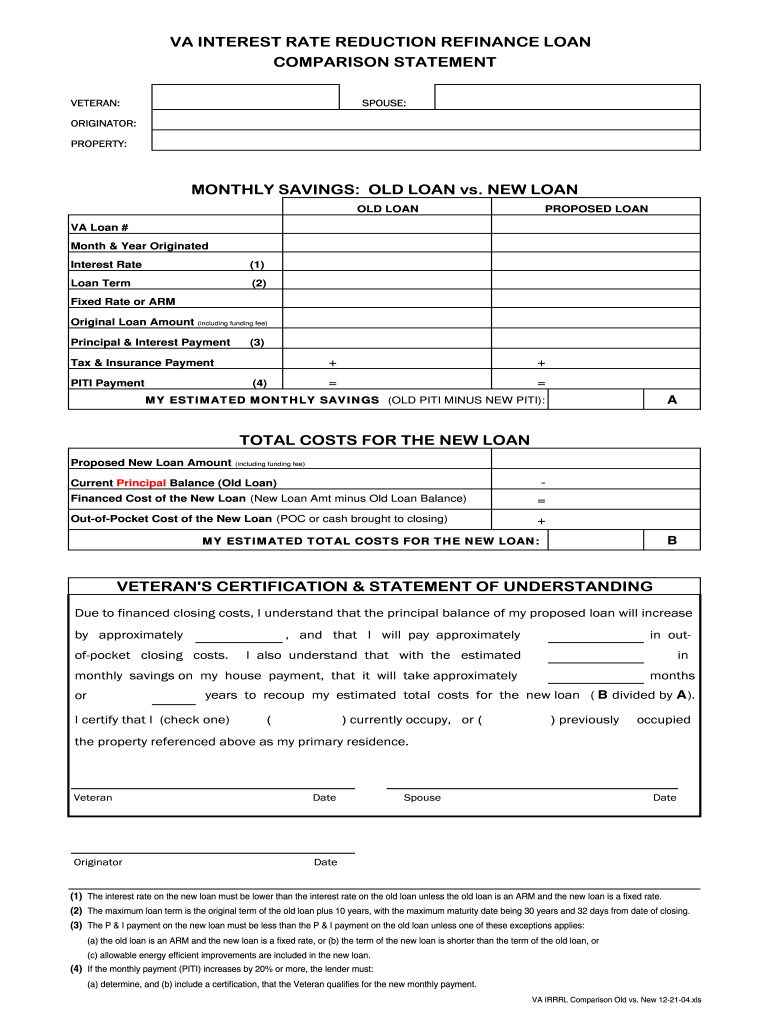

42 interest rate reduction refinancing loan worksheet

Tips For Student Loan Repayment - Lower Student Loan ... - Sallie … You may also qualify for a 0.25 percentage point interest rate reduction on your eligible loan(s). 1 You need to be current with your loan payments to enroll. Submit Payments through the Sallie Mae ® Mobile App. Make payments and manage your Sallie Mae student loan from your iPhone ® or Android (TM) phone. Learn more about the mobile app. Loan Modification Vs. Refinance | Rocket Mortgage Jul 03, 2022 · A loan modification can also help you change the terms of your loan if your home loan is underwater. Contact your lender if you think you qualify for a modification. On the other hand, a refinance replaces your existing mortgage with a new loan. When you refinance, you can change your loan’s term, your interest rate and even your loan type.

The Best Free Debt-Reduction Spreadsheets - The Balance 20.01.2022 · Squawkfox Debt-Reduction Spreadsheet . The author of the spreadsheet and the Squawkfox blog, Kerry Taylor, paid off $17,000 in student loans over six months using this downloadable Debt Reduction Spreadsheet.. Start by entering your creditors, current balance, interest rates, and monthly payments to see your current total debt, average interest rate, and …

Interest rate reduction refinancing loan worksheet

A Consumer's Guide to Mortgage Refinancings - Federal Reserve Tip: Refinancing is not the only way to decrease the term of your mortgage. By paying a little extra on principal each month, you will pay off the loan sooner and reduce the term of your loan. For example, adding $50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than $27,000 in interest costs. Publication 537 (2021), Installment Sales | Internal Revenue Service The consideration remaining after this reduction must be allocated among the various business assets in a certain order. For asset acquisitions occurring after March 15, 2001, make the allocation among the following assets in proportion to (but not more than) their FMVs on the purchase date in the following order. Certificates of deposit, U.S. Government securities, … What Are Mortgage Points and How Do They Work? - Better … Mortgage points, also known as discount points, are fees a homebuyer pays directly to the lender (usually a bank) in exchange for a reduced interest rate. This is also called “buying down the rate.” Essentially, you pay some interest up front in exchange for a lower interest rate over the life of your loan. Each point you buy costs 1 ...

Interest rate reduction refinancing loan worksheet. What Is the Snowball Method and How Does It Work? - Debt.org 09.01.2018 · Find a solution that offers a lower interest rate and monthly payments that you can afford. The reasoning behind Solution No. 1 isn’t difficult: Unless it’s the debt with the smallest balance — putting it first on your list — the longer a debt with the highest interest rate is allowed to fester, the higher the total will be when you finally get around to it. 38 Debt Snowball Spreadsheets, Forms & Calculators - TemplateLab 08.04.2018 · Then you use the money to pay off your current loan. You can customize your snowball plan to suit your needs. If you can’t negotiate the interest rate, don’t write-off this method altogether. You can create your own debt repayment plan. Just use a debt payoff spreadsheet or a debt snowball worksheet. Publication 4681 (2021), Canceled Debts, Foreclosures, … 31.12.2020 · If you refinanced a student loan with another loan from an eligible educational organization or a tax-exempt organization, that loan may also be considered as made by a qualified lender. The refinanced loan is considered made by a qualified lender if it’s made under a program of the refinancing organization that is designed to encourage students to serve in … What Is A Tangible Net Benefit? | Rocket Mortgage Aug 22, 2022 · Fixed to ARM: The interest rate reduction must be at least 2%. To the extent that the interest rate reduction is achieved by buying mortgage discount points, if you buy more than one point (1% on the loan amount), you have to have at least 10% equity, verified by an appraisal. VA Net Tangible Benefit Forms

What Are Mortgage Points and How Do They Work? - Better … Mortgage points, also known as discount points, are fees a homebuyer pays directly to the lender (usually a bank) in exchange for a reduced interest rate. This is also called “buying down the rate.” Essentially, you pay some interest up front in exchange for a lower interest rate over the life of your loan. Each point you buy costs 1 ... Publication 537 (2021), Installment Sales | Internal Revenue Service The consideration remaining after this reduction must be allocated among the various business assets in a certain order. For asset acquisitions occurring after March 15, 2001, make the allocation among the following assets in proportion to (but not more than) their FMVs on the purchase date in the following order. Certificates of deposit, U.S. Government securities, … A Consumer's Guide to Mortgage Refinancings - Federal Reserve Tip: Refinancing is not the only way to decrease the term of your mortgage. By paying a little extra on principal each month, you will pay off the loan sooner and reduce the term of your loan. For example, adding $50 each month to your principal payment on the 30-year loan above reduces the term by 3 years and saves you more than $27,000 in interest costs.

0 Response to "42 interest rate reduction refinancing loan worksheet"

Post a Comment