44 cancellation of debt worksheet

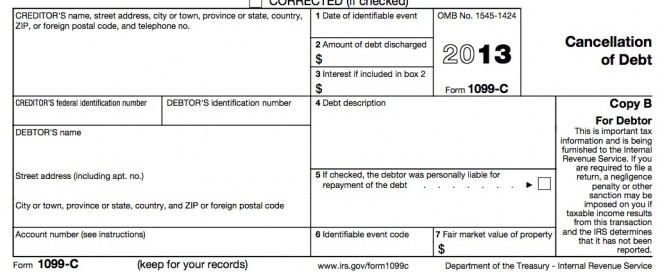

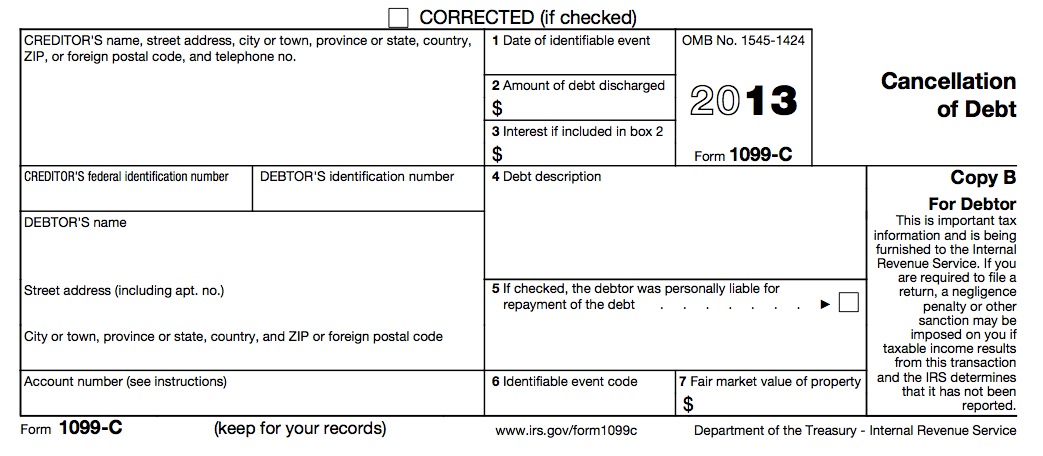

Cancellation of Debt - Mike Parisi Tax Consultants You can only exclude cancellation of debt income to the extent that you are considered insolvent. By applying this method you will not be taxed on the cancelled debt. Please fill out the Insolvency Worksheet provided below. Insolvency Worksheet Bankruptcy If your debt was cancelled in conjunction with Title 11 bankruptcy proceeding Chapter 7 or ... What Is Cancellation of Debt? | SOLVABLE Our company gets compensated by partners who appear on our website. Here is how we get compensated. Cancellation of debt form refers to IRS Form 1099-C, which will be filed by a creditor that agrees to forgive all or a portion of your debt. Under most circumstances, the amount forgiven must be reported as income for the year in question.

› finaid › resourcesForms to Download | Florida Atlantic University To view or download the required dependent/independent verification worksheet forms: Access the Financial Aid section on FAU Self-Service via MyFAU. Click the "Financial Aid Status" tile. (If prompted, select an “Academic Year" from the drop-down list.) Click the "Student Requirements" link. Additional Resources:

Cancellation of debt worksheet

Cancellation of Debt Income | Bills.com Cancellation of Debt Income Worksheet; Total Liabilities: Asset Fair Market Value: Insolvency Amount How Much Can Be Excluded From Income: Greg Example No. 1: $15,000-$7,000 = $8,000 Because this exceeds the amount of cancelled debt, Greg can exclude the entire $5,000 shown on his 1099-C. Greg Example No. 2: $10,000-$7,000 = How to Use IRS Form 982 and 1099-C: Cancellation of Debt - Pacific Debt If you have received a 1099-C for a debt forgiven after the debt's statute of limitation has run out (6 years in most states), technically that money is not income. However, because the creditor sent a 1099-C to the IRS, you need to contact the IRS to have them fill out a Form 4598. You may need to contact the creditor as well. › pub › irs-pdfAbandonments and Repossessions, Canceled Debts, - IRS tax forms Nonbusiness credit card debt cancellation. If you had a nonbusiness credit card debt can-celed, you may be able to exclude the canceled debt from income if the cancellation occurred in a title 11 bankruptcy case or you were insolvent immediately before the cancellation. You should read Bankruptcy or Insolvency under

Cancellation of debt worksheet. PDF Insolvency Worksheet Keep for Your Records - Tax Facts Insolvency Worksheet Keep for Your Records Date debt was canceled (mm/dd/yy) Part I. Total liabilities immediately before the cancellation (do not include the same liability in more than one category) Amount Owed Liabilities (debts) Immediately Before the Cancellation 1. Credit card debt $ 2. templates.office.com › en-us › Credit-Card-PayoffCredit Card Payoff Calculator - templates.office.com Easily see what it will take to pay off your credit card at different interest rates and payment amounts with this credit card payoff calculator. This simple credit card payoff template is perfecting for calculating credit card interest and payments. This is an accessible template. I Have a Cancellation of Debt or Form 1099-C In general, if you're liable for tax because a debt was canceled, forgiven, or discharged, you'll receive an Form 1099-C, Cancellation of Debt, from the lender or the person who forgave the debt. You may receive an IRS Form 1099-C while the creditor is still trying to collect the debt. If so, the creditor may not have canceled it. Cancellation of Debt: What It Is, How It Works & More | LendingTree You can use the IRS' insolvency worksheet to determine if you met this criteria before the debt cancellation. Keep in mind, though, that if your debts exceed your assets by less than the amount of debt cancelled — for instance, you're insolvent in the amount of $3,000, but did not have to pay $5,000 of your debt — the remaining amount ...

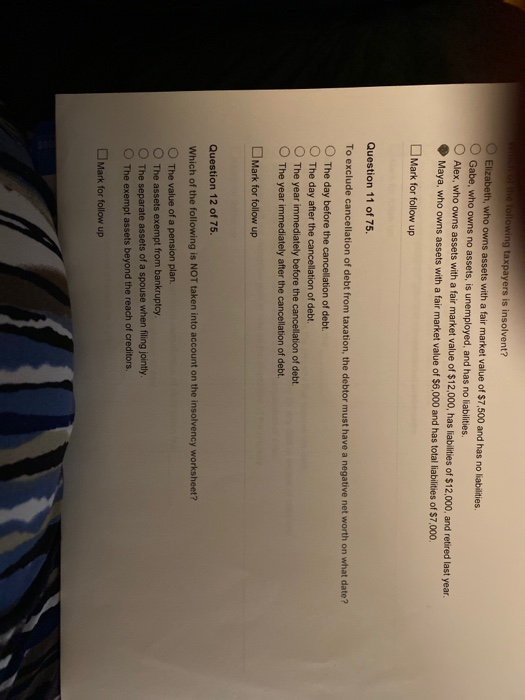

PDF Cancellation of Debt Insolvency Worksheet - RH Tax Services Cancellation of Debt ... Worksheet by: William Roos, EA, roos@bigsky.net Revised 11-27-12 NOTE: Do not use a spouse's separately owned assets in computing the taxpayer's insolvency. If any assets or liabilities are separately owned, use a separate worksheet for each spouse. Guide to Debt Cancellation and Your Taxes - TurboTax For example, suppose your credit card company cancels your outstanding balance of $10,000 at a time when your only asset is an investment account worth $25,000 and your other debts total $50,000. In this case, you owe more than you have, so you may qualify for the insolvency exclusion with regards to the $10,000 canceled credit card balance. Entering canceled debt in ProSeries - Intuit Type in CAN to highlight the line labeled Canceled Debt. Click OK to open the Canceled Debt Worksheet. Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental Cancellation of Debt - Insolvency — 1 Tax Financial Cancellation of Debt - Insolvency It includes a worksheet for a taxpayer to determine if he or she is insolvent and it explains the tax implications of cancelled debt. HIGHLIGHTS: Tax treatment of cancelled debt. Form 1099-C, Cancellation of Debt. Taxpayer insolvency and insolvency worksheet. Reduction of tax attributes due to discharge of debt.

Making a claim - debt What's a debt? Contracts; Gifts and private loans; Loans and credit cards; Electricity, gas, water and phone bills. Sample letter to utility provider; Making a claim Currently selected. Identify the other party; Letter of demand. Sample letter of demand - debt 1; Sample letter of demand - debt 2; Responding to a claim. Responding to a letter of ... How To Avoid State Tax On Student Debt Forgiveness 02.09.2022 · WASHINGTON, DC - MAY 12: Student loan borrowers gather near The White House to tell President Biden ... [+] to cancel student debt on May 12, 2020 in Washington, DC. (Photo by Paul Morigi/Getty ... financialaid.fsu.edu › contactContact the Office of Financial Aid | Office of Financial Aid Phone: 850-644-0539 Fax: 850-644-6404 Address: Office of Financial Aid Suite 4400A University Center Tallahassee, FL 32306-2430 Email: General questions: financialaid@fsu.edu spartancentral.uncg.edu › formsForms - Spartan Central Student Loan Debt Forgiveness; ... Household Size Worksheet: Independent Students; ... Withdrawal/Cancellation request for non attendance;

Get Insolvency Worksheet Canceled Debts - US Legal Forms Ensure the data you add to the Insolvency Worksheet Canceled Debts is up-to-date and correct. Include the date to the document using the Date tool. Select the Sign tool and make an electronic signature. Feel free to use three available alternatives; typing, drawing, or capturing one. Make sure that each field has been filled in correctly.

Cancellation of Debt Insolvency Worksheet - Thomson Reuters Cancellation of Debt Insolvency Worksheet This tax worksheet calculates a taxpayer's insolvency for purposes of excluding cancellation of debt income under IRC Sec. 108. A debt includes any indebtedness whether a taxpayer is personally liable or liable only to the extent of the property securing the debt.

11715: 1099-C - Cancellation of Debt and Form 982 - Drake Software Where in the software would I enter a Cancellation of Debt, Form 1099-C? Enter this information in the 99C screen. If the amount is a discharged debt that is excludable from gross income, it should also be reported on Form 982. In that case, select 982 from the For box drop list on the 99C screen, and also complete the 982 screen.

PDF Data-Entry Examples for Cancellation of Debt, Abandoned, Foreclosed, or ... 15). This amount can be used to determine how much income from the cancellation of debt may be excluded due to insolvency. After Arthur's insolvency is calculated, UltraTax CS calculates the net income from the cancellation of debt to be included on the Schedule C on the Cancellation of Debt Worksheet (Figure 1 8). The net income amount is ...

Insolvency Worksheet | SOLVABLE In the worksheet, you will list all your assets and liabilities. Be careful to only list assets you acquired before the day of debt cancellation. For the values of assets and liabilities, you must use the values they had on the debt cancellation day.

› publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... This publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax purposes as having income and may have to pay tax on this income. Note.

Free Debt Tracker and Payoff Printable - Savor + Savvy Option One: Look for the bill that has the highest interest ( Avalanche Method) and work at paying that one off first. This means that you work at paying more than the minimum due each month to knock it out the fastest. The idea here is that you should eliminate the highest interest charges first.

PDF Asheville Tax Service | Asheville area since 1989 Serving the Asheville area since 1989. For over 30 years, our knowledgeable tax professionals have provided clients with premium service for a reasonable preparation fee! We believe that having your taxes prepared should be a pleasant and understandable experience, personalized to meet your specific needs. We value establishing and maintaining ...

Screen 1099C - Cancellation of Debt, Abandonment (1040) - Thomson Reuters Cancellation of Debt Use this section to exclude and give a reason to exclude any income due to cancellation of debt as indicated from information entered on 1099-C Facsimile. Information from this section is reported on the Cancellation of Debt Worksheet. Exclude 100% of canceled debt from income

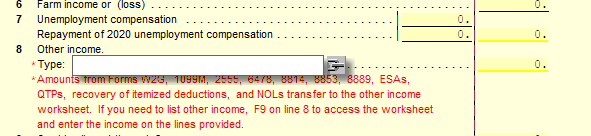

Knowledge Base Solution - How do I enter cancellation of debt in ... - CCH There is not a specific IRS 1099-C input form to fill in. Instead, depending how the cancellation of debt is to be treated, there are a few methods to get this to flow correctly to your return. Method 1: To have the amounts from the IRS 1099-C flow to the 1040 line 21 as other income.

Reorg Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

The Safe Way to Cancel a Credit Card - Investopedia 20.12.2021 · Redeem unused rewards on your account before you call to cancel. Ideally, pay off all your credit card accounts (not just the one you’re canceling) to $0 before canceling any card.

Colleges Are in Debt, but Students Pay for It | The Nation 07.09.2022 · A decade ago, the Debt Collective called for the cancellation of student debt. As the nationwide organizing project picked up speed, activists seized the moment and urged the president to take ...

PDF Assess Avoid Attack - USAA Use this worksheet to get a big-picture view of all your debts. • Complete the frst four columns of the worksheet. We've provided a credit card example to help get you started. • Common types of debts you may have include credit cards, mortgages, auto loans, payday loans and unsecured loans.

Cancellation of Debt - Intuit Form 1099-C (Cancellation of Debt), fill out accordingly Form 982, you will need to indicate the reason for the discharge within Part 1 General information and you will need to include an amount within Part II Reduction of Tax Attributes (accordingly to the reason) Canceled Debt Worksheet (fill out the Part accordingly to your reason or exclusion)

Knowledge Base Solution - How do I enter a cancellation of debt in a ... Method 2: To fill out the Deferral of Income Recognition From Discharge of Indebtedness Go to Federal Interview Form CD-1 - Deferral of Income Recognition From Discharge of Indebtedness. In Boxes 30-128 - Applicable Debt Instrument Information, enter information as needed. In Boxes 130-157 - Prior Year Information, enter information as needed.

Office of Financial Aid August 16, 2022: Fall disbursements begin August 22, 2022: Fall classes begin August 30, 2022: Standard disbursement of fall financial aid August 30 - September 2, 2022: Deferments provided by the Financial Aid Office September 2, 2022: Tuition due (for those who do not have or qualify for deferment) October 1, 2022: 2023-2024 FAFSA Opens October 7, 2022: Deferment …

Forms to Download | Florida Atlantic University To view or download the required dependent/independent verification worksheet forms: Access the Financial Aid section on FAU Self-Service via MyFAU. Click the "Financial Aid Status" tile. (If prompted, select an “Academic Year" from the drop-down list.) Click the "Student Requirements" link. Additional Resources:

Publication 4681 (2021), Canceled Debts, Foreclosures, … 31.12.2020 · Robin completes a separate Insolvency Worksheet and determines she was insolvent to the extent of $4,000 ($9,000 total liabilities minus $5,000 FMV of her total assets). She can exclude her entire canceled debt of $2,500. When completing his separate tax return, James checks the box on line 1b of Form 982 and enters $5,000 on line 2. He completes Part …

PDF 2020 Cancellation of Debt Insolvency - Tax Happens Cancellation of debt (COD) is settlement of a debt for less than the amount owed. A debt may be cancelled by a lender voluntarily or through bankruptcy or other le- gal proceedings and may result in ordinary income, in- come from the sale of assets, or both. Cancelled Debt Situation Tax Treatment Debt owed is cancelled or forgiven.

financialaid.fsu.eduOffice of Financial Aid August 16, 2022: Fall disbursements begin August 22, 2022: Fall classes begin August 30, 2022: Standard disbursement of fall financial aid August 30 - September 2, 2022: Deferments provided by the Financial Aid Office

PDF Insolvency Determination Worksheet Insolvency (Out of Scope for VITA ... Cancellation of Debt - Nonbusiness Credit Card Debt Cancellation Generally, if a taxpayer receives Form 1099-C for canceled credit card debt and was solvent immediately before the debt was canceled, all the canceled debt will be included on Form 1040, line 21, Other Income. No additional supporting forms or schedules are needed to report ...

Contact the Office of Financial Aid | Office of Financial Aid Phone: 850-644-0539 Fax: 850-644-6404 Address: Office of Financial Aid Suite 4400A University Center Tallahassee, FL 32306-2430 Email: General questions: financialaid@fsu.edu Work Study questions: FA-FWS@fsu.edu CARE Program questions: FA-Care@fsu.edu NOTE: The CARE program is unrelated to the CARES Act.If you have questions about the CARES …

Abandonments and Repossessions, Canceled Debts, - IRS tax forms Worksheet for Foreclosures and Reposessions.....13 Chapter 3. Abandonments.....14 Chapter 4. How To Get Tax Help....14 Future Developments For the latest information about developments related to Pub. 4681, such as legislation enacted after it was published, go to IRS.gov/ Pub4681. What’s New Discharge of student loan debt. If your stu-dent loan debt was discharged, in …

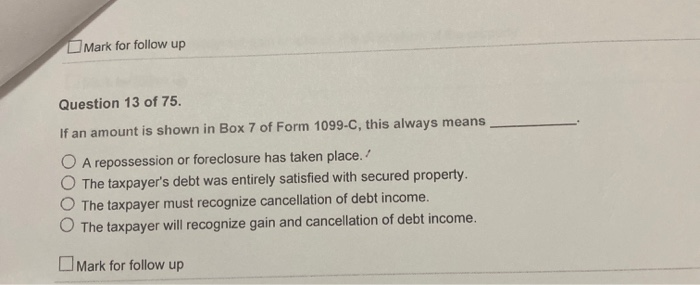

PDF Cancellation of debt - Center for Agricultural Law and Taxation 5/26/2016 4 Foreclosure Worksheet #1 Figuring Cancellation of Debt Income The amount on line 3 will generally equal the amount shown in box 2 of Form 1099‐C. This amount is taxable unless you meet one of the exceptions Enter it on line 21, Other Income, of your Form 1040 Foreclosure Worksheet # 2 Figuring Gain from Foreclosure

Cancellation Of Debt Insolvency - 2021 - CPA Clinics Form 1099-C, Cancellation of Debt If a lender cancels or forgives a debt of $600 or more, it must provide the borrower with Form 1099-C, showing the amount of cancelled debt to be reported as income. Generally, you must include all cancelled amounts, even if less than $600, as Other Income on Form 1040. Examples of COD Income

› pub › irs-pdfAbandonments and Repossessions, Canceled Debts, - IRS tax forms Nonbusiness credit card debt cancellation. If you had a nonbusiness credit card debt can-celed, you may be able to exclude the canceled debt from income if the cancellation occurred in a title 11 bankruptcy case or you were insolvent immediately before the cancellation. You should read Bankruptcy or Insolvency under

How to Use IRS Form 982 and 1099-C: Cancellation of Debt - Pacific Debt If you have received a 1099-C for a debt forgiven after the debt's statute of limitation has run out (6 years in most states), technically that money is not income. However, because the creditor sent a 1099-C to the IRS, you need to contact the IRS to have them fill out a Form 4598. You may need to contact the creditor as well.

Cancellation of Debt Income | Bills.com Cancellation of Debt Income Worksheet; Total Liabilities: Asset Fair Market Value: Insolvency Amount How Much Can Be Excluded From Income: Greg Example No. 1: $15,000-$7,000 = $8,000 Because this exceeds the amount of cancelled debt, Greg can exclude the entire $5,000 shown on his 1099-C. Greg Example No. 2: $10,000-$7,000 =

/1099-C-69a52b42698048d68609c2c79946530d.jpg)

0 Response to "44 cancellation of debt worksheet"

Post a Comment