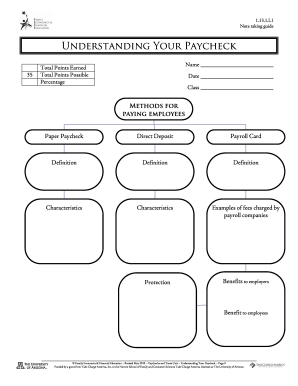

44 understanding your paycheck worksheet

It's Your Paycheck! Curriculum Unit | St. Louis Fed Curriculum Unit. It's Your Paycheck! is designed for use in high school personal finance classes. The curriculum includes 9 lessons. The lessons employ various teaching strategies to engage students so that they have opportunities to apply the concepts being taught. Each lesson includes the handouts and visuals needed to teach the lesson. Understanding Your Paycheck Teaching Resources | TpT - TeachersPayTeachers Paychecks- Understanding Pay and Paycheck Stub/Earnings Statement Exploration WorksheetThis activity involves students analyzing a paycheck stub/earnings statement in order to get a better understanding of it. Students will be given information about the pay period and tax amounts and asked to fill out a paystub.

Understanding Your Paycheck - Printable Worksheets Some of the worksheets displayed are Understanding taxes and your paycheck, Understanding taxes and your paycheck, Its your paycheck lesson 2 w is for wages w 4 and w 2, Understanding your paycheck, Nothing but net understanding your take home pay, Understanding it managing it making it work for you, My paycheck, Teen years and adulthood whats on a pay stub. Once you find your worksheet, click on pop-out icon or print icon to worksheet to print or download.

Understanding your paycheck worksheet

Understanding Your Paycheck Worksheets - Learny Kids Displaying top 8 worksheets found for - Understanding Your Paycheck. Some of the worksheets for this concept are Understanding taxes and your paycheck, Understanding taxes and your paycheck, Its your paycheck lesson 2 w is for wages w 4 and w 2, Understanding your paycheck, Nothing but net understanding your take home pay, Understanding it managing it making it work for you, My paycheck, Teen years and adulthood whats on a pay stub. PDF Understanding taxes and your paycheck - Consumer Financial Protection ... worker's paycheck is an important step toward gaining financial knowledge. Instructions. 1.Determine whether each statement is true (T) or false (F). 2.Provide an example or explanation with each answer. 3.If you're not sure, you can research the answers on the following webpages: §The consumer.gov webpage on taxes: PDF Reading a Pay Stub Worksheet - yeschick.weebly.com To help you better understand the difference between gross income, net income, and some common payroll deductions, analyze the pay stub for Jonathan. Then answer the following questions: 1. Who is Jonathan's employer? 2. What is the length of the pay period Jonathan just worked? 3. How many total hours did Jonathan work during this pay period? 4.

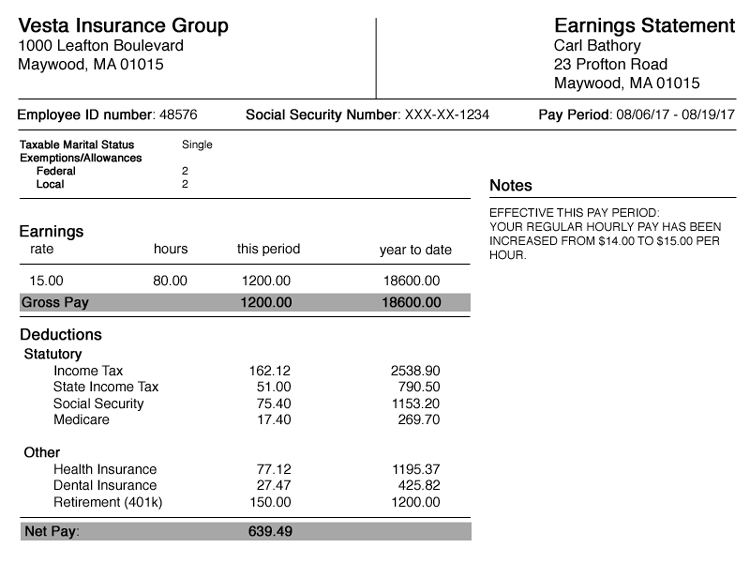

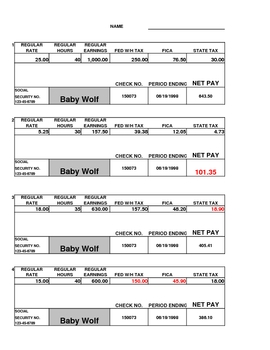

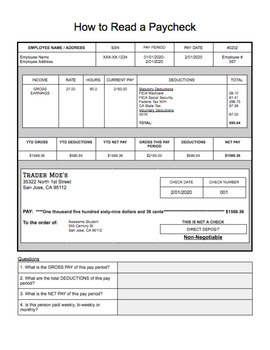

Understanding your paycheck worksheet. PDF Understanding Your Paycheck - Biz Kids 1. Identify paycheck deduc-tions. 2. Learn the purpose of taxes. 3. Understand the difference between an employee and a contractor. 4. Learn financial terms. EPISODE SYNOPSIS What's on your pay stub? The Biz Kid$ learn about taxes and other deductions that are taken out of your paycheck. Meet some entre-preneurs who are independent PDF It's Your Paycheck! Lesson 2: 'W' is for Wages, W-4, and W-2 Gross pay is the amount people earn per pay period before any deductions or taxes are paid. Net pay is the amount people receive after taxes and other deductions are taken out of gross pay. 6. Explain that one tax people pay is federal income tax. Income tax is a tax on the amount of income people earn. People pay a percentage of their income ... PDF Understanding Your Paycheck Lesson Plan 1.13 Hint: A way to double check your work is to add your deductions and your net income. If they do not equal your gross income, then you need to recalculate. Joe works the same amount of hours each month. Joe worked 80 hours in the last pay period and he earns $12 per hour. Joe's gross pay= 80 hours x $12.00 1. $_____ How to Read A Pay Stub - Information, Earnings & Deductions A paycheck stub summarizes how your total earnings were distributed. The information on a paystub includes how much was paid on your behalf in taxes, how much was deducted for benefits, and the total amount that was paid to you after taxes and deductions were taken. Paycheck stubs are normally divided into 4 sections: Personal and Check Information

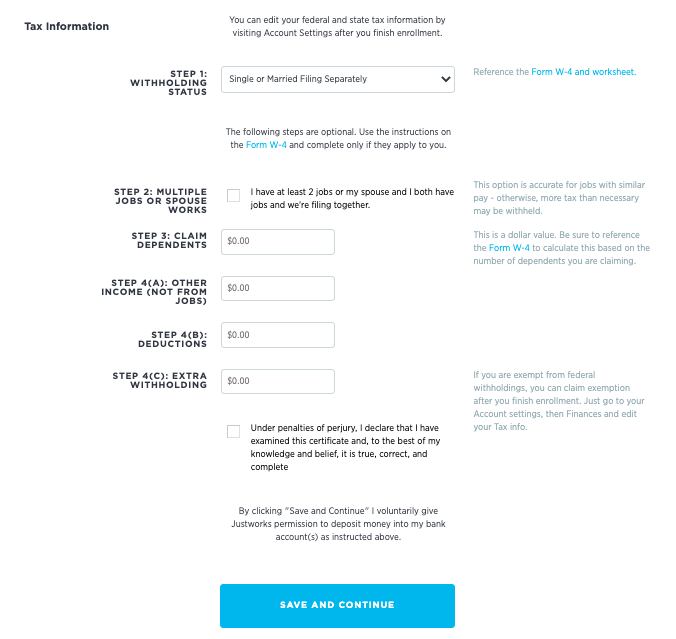

PDF Consumer.gov - what to know and do Your Paycheck • Explain the parts of a paycheck and pay stub using precise vocabulary in speaking Web Navigation Objectives • Recognize and navigate among the three parts of the Your Paycheck section • Recognize the relationship of the Your Paycheck section to the rest of the Managing Your Money section and to the other two major sections of the site Workplace Basics: Understanding Your Pay, Benefits, and Paycheck When you view your pay stub, you'll find two notable figures: your earnings (or gross pay) and your net pay. Your earnings is the amount of money you make based on your pay rate. After a number of taxes and deductions are applied, you're left with your net pay, or the money that's available to you on your paycheck. Understanding Paychecks Teaching Resources | Teachers Pay Teachers Paychecks- Understanding Pay and Paycheck Stub/Earnings Statement Exploration WorksheetThis activity involves students analyzing a paycheck stub/earnings statement in order to get a better understanding of it. Students will be given information about the pay period and tax amounts and asked to fill out a paystub. Understanding you paycheck stub worksheet Understanding you paycheck stubDefinitions of the basic parts of a paycheck stub - pay and deductions. ID: 342213. Language: English. School subject: Career Education. Grade/level: Middle School - High School. Age: 12+. Main content: Paycheck terms. Other contents:

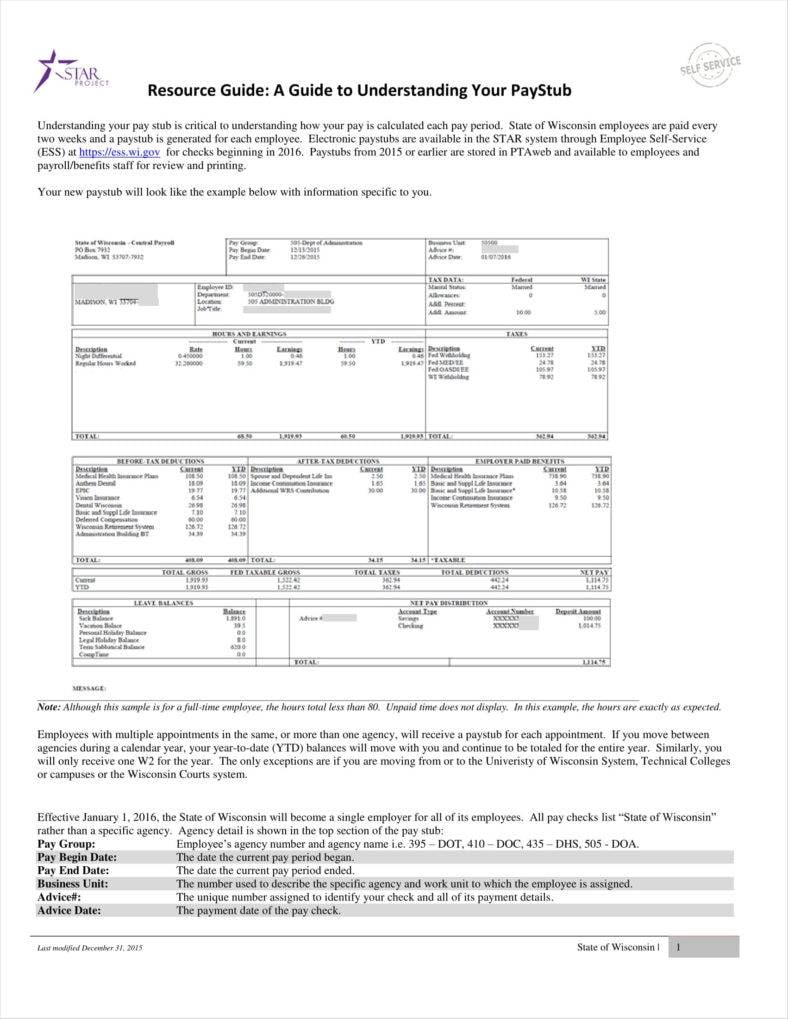

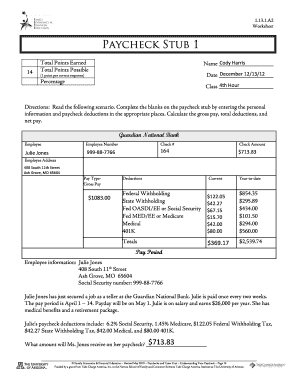

Understanding your paycheck worksheet At a glance, you'll see your gross pay, your net pay, your state and federal taxes and any other deductions you pay —including health insurance premiums and pension contributions. 1. Gross Pay. Your gross pay is the total amount of money you earn in any given pay period—before taxes and other deductions are taken out. Understand Your Paycheck.docx - 1.13.1.A3 Worksheet... Calculate the gross pay, total deductions, and net pay. Hank's Culinary Center Employee SSN Check # 164 Check Amount Employee Address Number of Hours Worked and Pay Type-Deductions Current Year-to-date Hourly Rate Gross Pay Federal Withholding State Withholding $433.84 Fed OASDI/EE or Social Security Fed MED/EE or Medicare $331.10. Medical $0.00 401K $799.26 Totals Pay Understanding Your Paycheck: Pay, Benefits, & Taxes - Bank of America ... Typical elements of a paystub include: Pay information: date of pay period, check number. Employee information: your name, address, company department. Tax data: Marital status, allowances/exemptions and tax withholding information (from the Form W-4 you completed) Hours and earnings: Earnings for this pay period as well as year-to-date (YTD ... How to Read a Paycheck or Pay Stub - Better Money Habits Calculating net pay. 1.Gross pay minus 2.Mandatory deductions minus 3.Voluntary deductions equals 4.Net pay. Gross pay. The total amount you've earned before any deductions are taken out. This is not the amount you take home however. Mandatory deductions. Wages that are withheld from your paycheck to meet certain legal obligations like taxes.

PDF Understanding Your Paycheck - Ms. Christy Garrett Ann Arbor Huron High ... Complete the blanks on the paycheck stub by entering the personal information and paycheck deductions in the appropriate places. Calculate the gross pay, total deductions, and net pay. Guardian National Bank Employee Employee Number Check # 164 Check Amount Employee Address Pay Type- Gross Pay Deductions Current Year-to-date

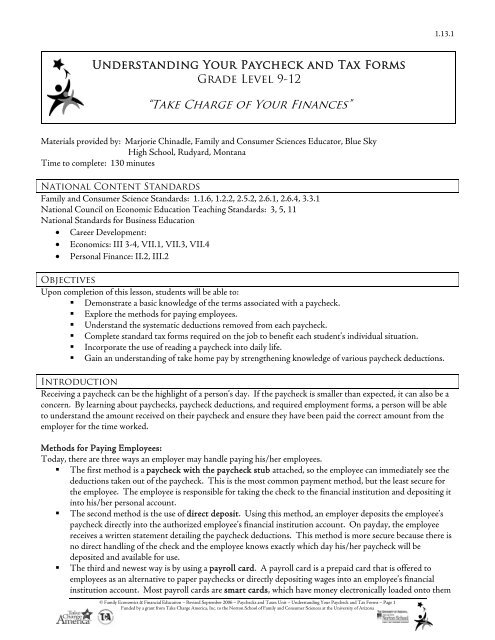

PPT Understanding Your Paycheck - Albany HS Career and Technical Education Understanding Your Paycheck Author: nchinadle Last modified by: dina.murray Created Date: 1/21/2003 11:37:59 PM Document presentation format ... with Payroll Cards Taxes Starting a New Job Form W-4 Steps to Completing a Form W-4 Form I-9 Reading a Paycheck Paycheck Stub Personal Information Pay Period Gross Pay Net Pay Deductions Federal ...

PDF Understanding Your Paycheck Lesson Plan 1 13 1 Revised March 09 Final Directions: Answer the following questions to help provide the information for the paycheck. Hint: A way to double check your work is to add your deductions and your net income. If they do not equal your gross income, then you need to recalculate. Joe works the same amount of hours each month.

Get Understanding Your Paycheck Worksheet - US Legal Forms Comply with our easy steps to get your Pay Stub Worksheets For Students prepared quickly: Choose the template in the library. Complete all required information in the required fillable fields. The easy-to-use drag&drop interface makes it easy to... Check if everything is filled out properly, without ...

Understanding Your Paycheck | Biz Kids Lesson Plan | Lesson 125 ... Understanding Your Paycheck Students receive a sample earnings statement and break down the different categories of information. Students then break into groups of four and play the 'Paycheck Mystery Word Game'. What Students Learn Why there are deductions on your paycheck What the deductions are for What's the purpose of taxes Suggested Time

PDF Let s Talk TAXES - Red Canoe Credit Union Basic info: Your pay stub includes employer and employee details and outlines the time period for which your paycheck is issued. Gross Pay: The amount you earn per pay period. It may be expressed as your salary divided by the number of paychecks you receive per year, or as your hourly rate multiplied by the hours worked. Overtime compensation

PDF Directions: Using the pay check stub above, answer the following questions. 1. deductions (n): money that is subtracted or taken out from your pay 2. federal taxes (n): a percentage of an employee's wages that goes to the federal government 3. gross pay (n): the amount of money in an employee's paycheck before any deductions have been taken out 4. net pay (n): the amount of money left in an employee's paycheck after all the

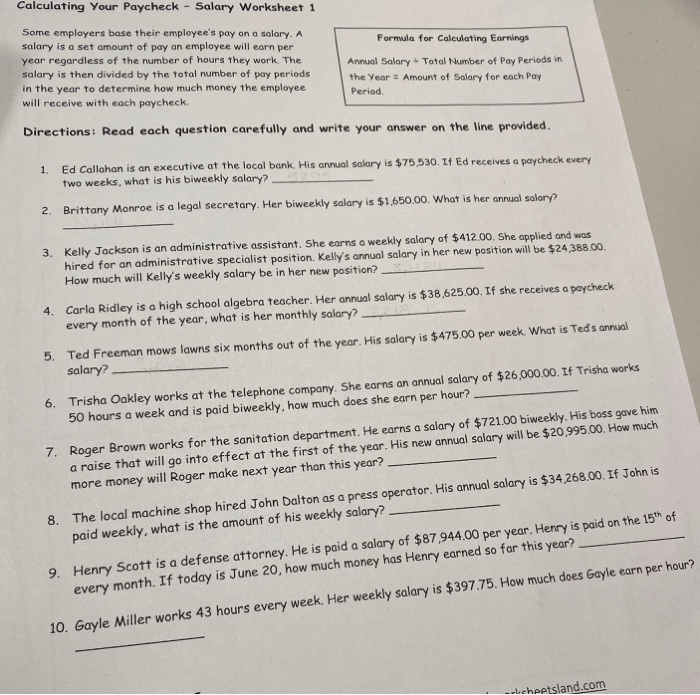

understanding your paycheck worksheet answers Calculating Your Paycheck Salary Worksheet 1 Answers — db-excel.com. 8 Pics about Calculating Your Paycheck Salary Worksheet 1 Answers — db-excel.com : Understanding Your Paycheck Worksheet - Nidecmege, Understanding Your Paycheck Worksheet - Nidecmege and also Calculating Your Paycheck Salary Worksheet 1 Answers — db-excel.com.

Calculating the numbers in your paycheck | Consumer Financial ... Student materials. Calculating the numbers in your paycheck (worksheet) How to read a paystub (handout) Cómo calcular las cifras de su cheque de pago (hoja de ejercicios) Note: Please remember to consider your students' accommodations and special needs to ensure that all students are able to participate in a meaningful way.

PDF Understanding taxes and your paycheck - Consumer Financial Protection ... money have been deducted from your pay. A paycheck is the money you receive for doing your job after deductions. To get the money, you cash your paycheck at a bank, credit union, or other business. You can also deposit your paycheck in your bank or credit union account. 2. TRUE: Gross income is all the money you earned at your job. But you don't get

Understanding Your Paycheck Worksheet Answers / Understanding Your ... Understanding your paycheck can take some time. Use this free lesson to better understand your pay and work benefits. Identify paycheck learn the purpose of understand the difference . The skills you will learn in this chapter will be very valuable in your future. Use this free lesson to better understand your pay and work benefits.

PDF Reading a Pay Stub Worksheet - yeschick.weebly.com To help you better understand the difference between gross income, net income, and some common payroll deductions, analyze the pay stub for Jonathan. Then answer the following questions: 1. Who is Jonathan's employer? 2. What is the length of the pay period Jonathan just worked? 3. How many total hours did Jonathan work during this pay period? 4.

PDF Understanding taxes and your paycheck - Consumer Financial Protection ... worker's paycheck is an important step toward gaining financial knowledge. Instructions. 1.Determine whether each statement is true (T) or false (F). 2.Provide an example or explanation with each answer. 3.If you're not sure, you can research the answers on the following webpages: §The consumer.gov webpage on taxes:

Understanding Your Paycheck Worksheets - Learny Kids Displaying top 8 worksheets found for - Understanding Your Paycheck. Some of the worksheets for this concept are Understanding taxes and your paycheck, Understanding taxes and your paycheck, Its your paycheck lesson 2 w is for wages w 4 and w 2, Understanding your paycheck, Nothing but net understanding your take home pay, Understanding it managing it making it work for you, My paycheck, Teen years and adulthood whats on a pay stub.

/cloudfront-us-east-1.images.arcpublishing.com/gray/R52VURZWYRCAVKEVIWRFQWLCLM.jpg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "44 understanding your paycheck worksheet"

Post a Comment