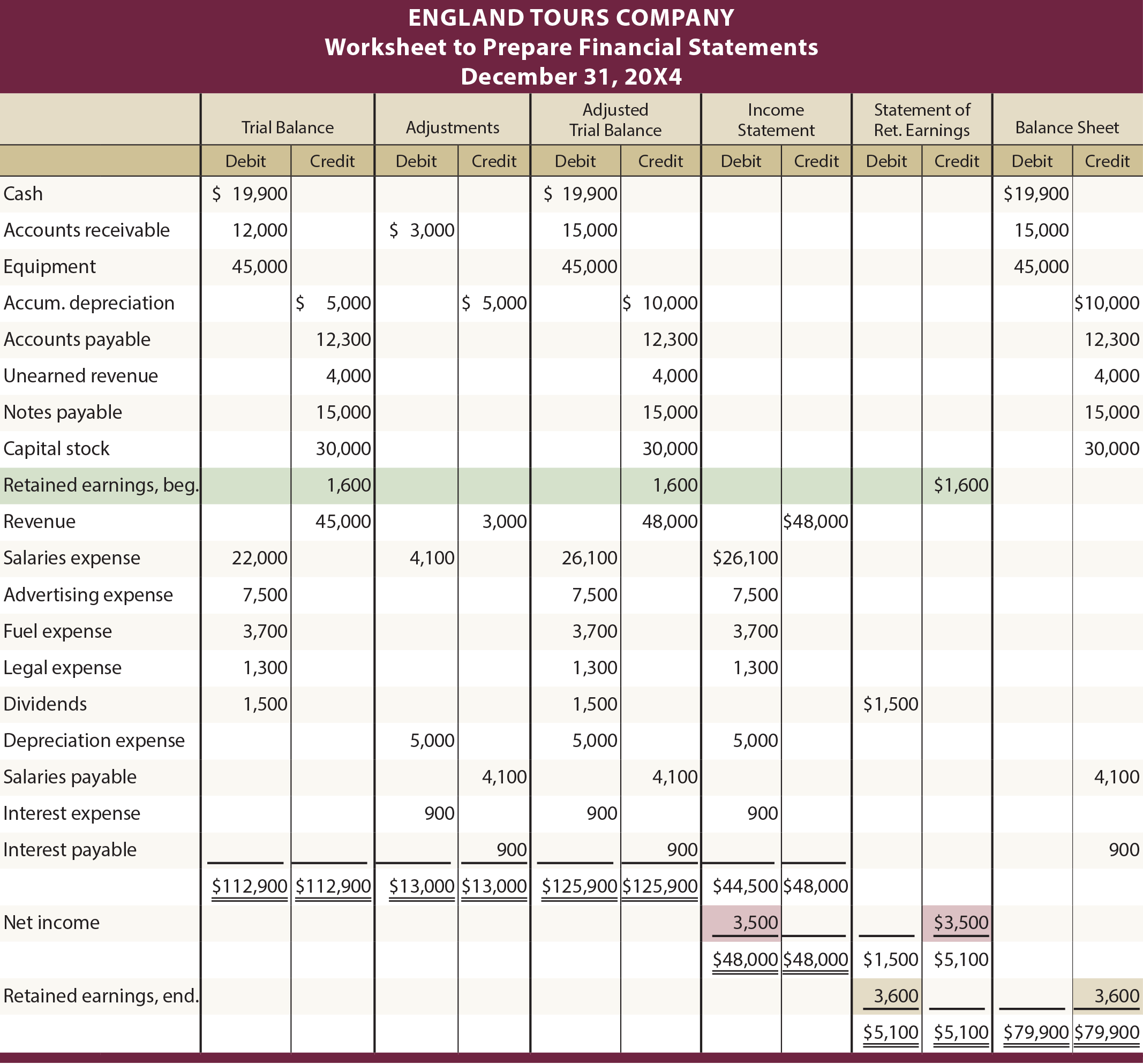

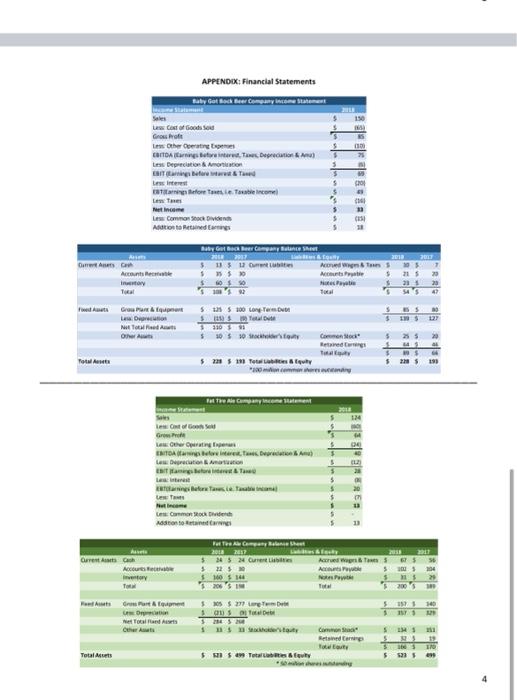

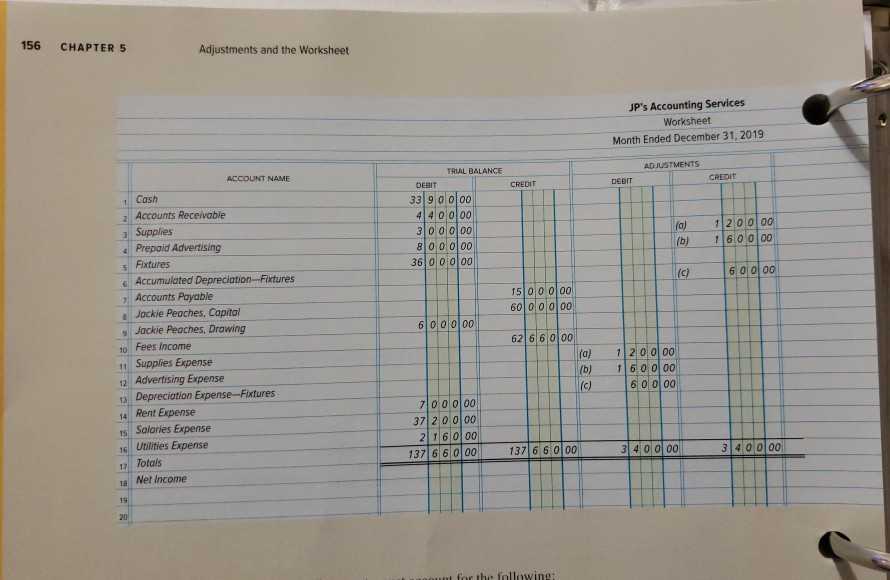

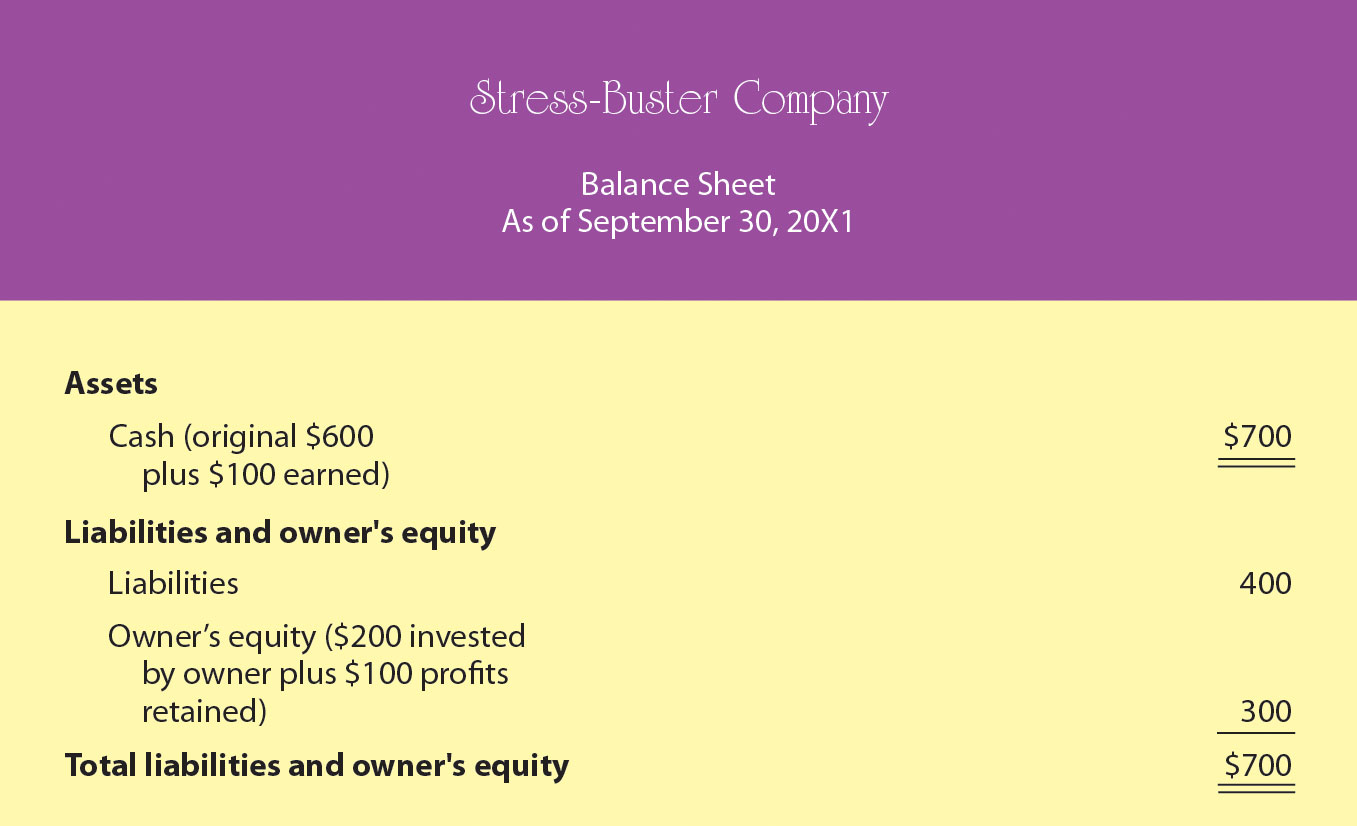

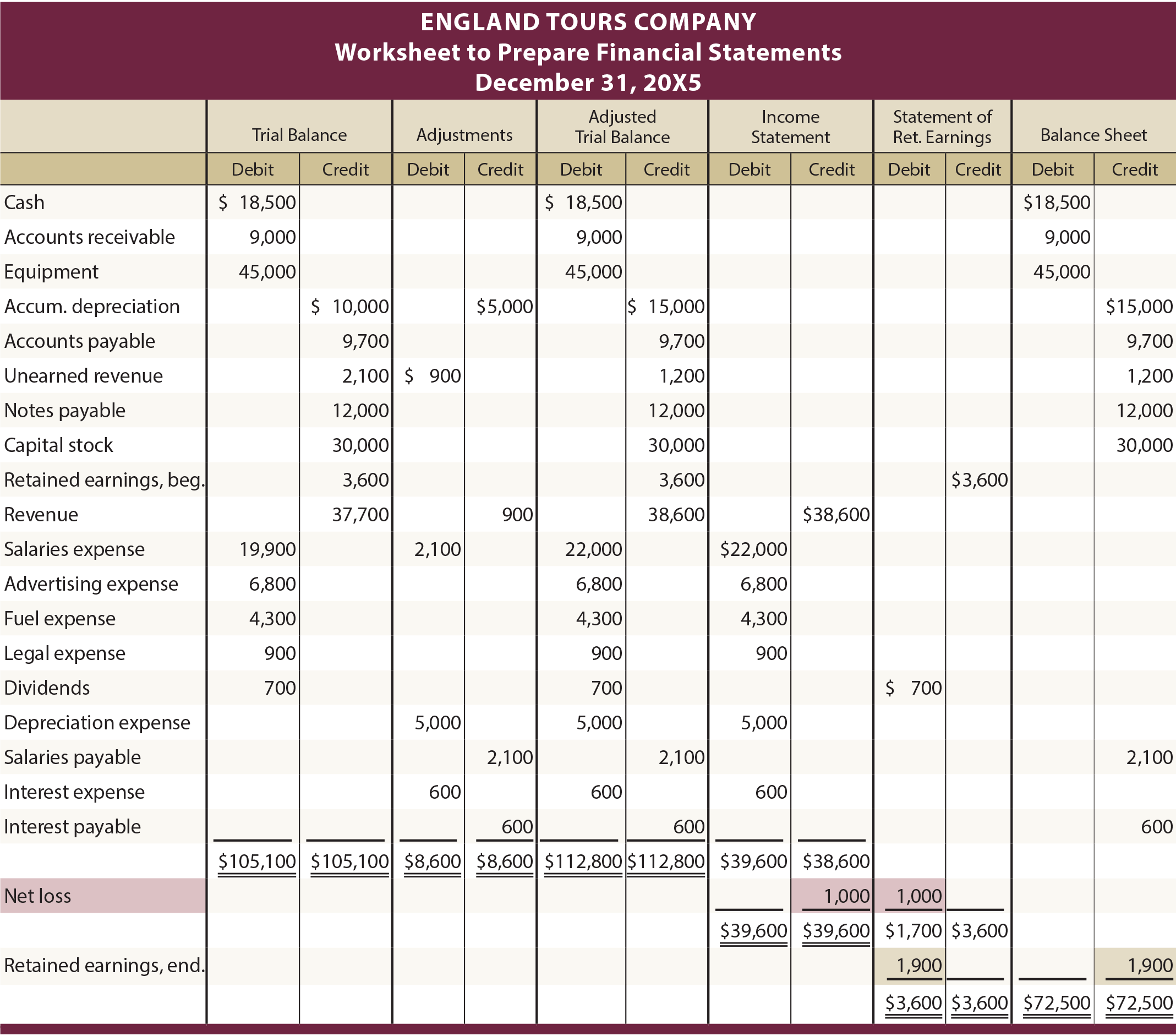

39 preparing a financial statement worksheet appendix e

› publications › p525Publication 525 (2021), Taxable and Nontaxable Income Emergency financial aid grants. Certain emergency financial aid grants under the CARES Act are excluded from the income of college and university students, effective for grants made after 3/26/2020. (See P.L. 116-136 and P.L. 116-260.) Economic impact payments. tfm.fiscal.treasury.gov › v1 › p2TFM Part 2 Chapter 4700 | Treasury TFM Significant entities that are FASAB and FASB reporters that report on the fiscal or calendar year-end are required to provide the representations shown in the current OMB Audit Bulletin, Section 8 and Appendix E. Federal entities should attach in Excel format a comprehensive SUM that includes uncorrected misstatements from the financial ...

› pubs › policydocsPAPPG Chapter II - NSF Jun 01, 2020 · NSF 20-1 June 1, 2020 Chapter II - Proposal Preparation Instructions. Each proposing organization that is new to NSF or has not had an active NSF assistance award within the previous five years should be prepared to submit basic organization and management information and certifications, when requested, to the applicable award-making division within the Office of Budget, Finance & Award ...

Preparing a financial statement worksheet appendix e

› publications › p946Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200. › publications › p571Publication 571 (01/2022), Tax-Sheltered Annuity Plans (403(b ... Retirement income accounts. Division O, section 111 of P.L. 116-94 clarifies that employees described in section 414(e)(3)(B) (which include ministers, employees of a tax-exempt church-controlled organization (including a nonqualified church-controlled organization), and employees who are included in a church plan under certain circumstances after separation from the service of a church) can ... › publications › p969Publication 969 (2021), Health Savings Accounts and Other Tax ... The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889, Health Savings Accounts (HSAs); or The maximum annual HSA contribution based on your HDHP coverage (self-only or family) on the first day of the last month of your tax year.

Preparing a financial statement worksheet appendix e. › publications › p915Publication 915 (2021), Social Security and Equivalent ... Complete Worksheet 1 and Worksheets 2 and 3 as appropriate before completing this worksheet. 1. Enter the total amount from box 5 of ALL your Forms SSA-1099 and RRB-1099 for 2021, minus the lump-sum payment for years before 2021: 1. $9,000 Note. If line 1 is zero or less, skip lines 2 through 18, enter -0- on line 19, and go to line 20. › publications › p969Publication 969 (2021), Health Savings Accounts and Other Tax ... The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889, Health Savings Accounts (HSAs); or The maximum annual HSA contribution based on your HDHP coverage (self-only or family) on the first day of the last month of your tax year. › publications › p571Publication 571 (01/2022), Tax-Sheltered Annuity Plans (403(b ... Retirement income accounts. Division O, section 111 of P.L. 116-94 clarifies that employees described in section 414(e)(3)(B) (which include ministers, employees of a tax-exempt church-controlled organization (including a nonqualified church-controlled organization), and employees who are included in a church plan under certain circumstances after separation from the service of a church) can ... › publications › p946Publication 946 (2021), How To Depreciate Property Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200.

:max_bytes(150000):strip_icc()/financialstatements-aae574dcdec44b3c8113ec436a2e5c2a.png)

0 Response to "39 preparing a financial statement worksheet appendix e"

Post a Comment