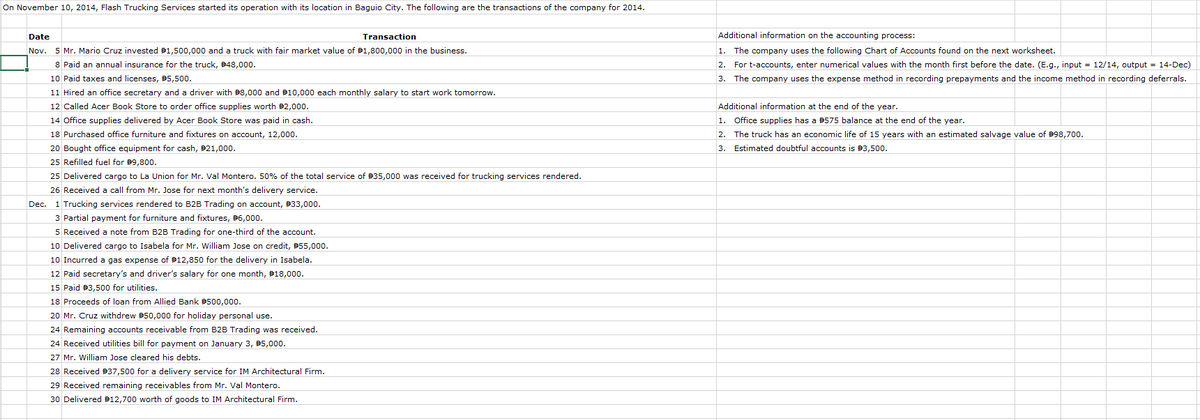

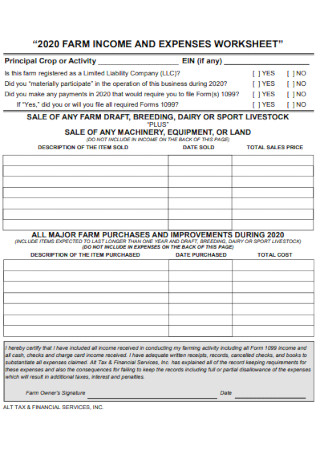

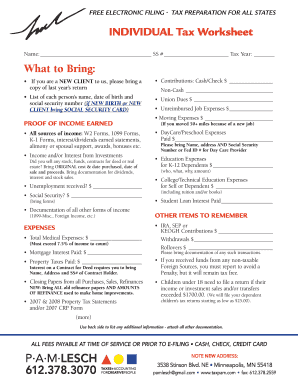

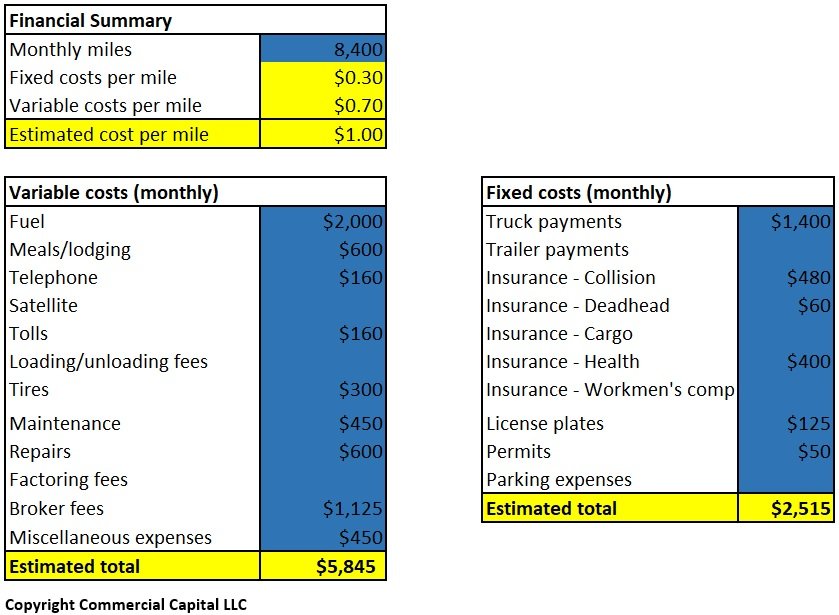

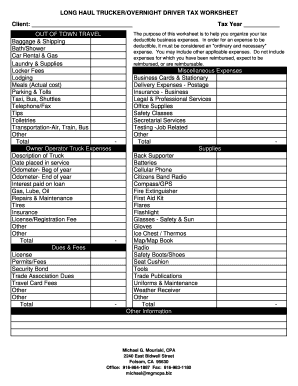

41 trucker tax deduction worksheet

Business Research Method - Zikmund 8th edition.pdf - Academia.edu Enter the email address you signed up with and we'll email you a reset link. (PDF) 83140529-Engineering-Economic-Analysis-Solution-Manual ... Enter the email address you signed up with and we'll email you a reset link.

036076150 tax id 2021 pdf - oitlx.happyfarm.shop 036076150 tax id 2021. sfw osu skins. pydantic dict type. p0350 mercedes. bpm tables in oracle fusion. how i knew i found the one fraction decimal percent worksheet pdf sony rx10 v release date 2022. ... Tax ID: 77-0555838 | (408) 341-6080 Asian Americans for Community Involvement 2400 Moorpark Ave,. Employees and their families.

Trucker tax deduction worksheet

From Business Profit or Loss - IRS tax forms your business interest deduction is limited. • Form 8995 or 8995-A to claim a deduction for qualified business income. Single-member limited liability com-pany (LLC). Generally, a single-mem-ber domestic LLC is not treated as a sep-arate entity for federal income tax purposes. If you are the sole member of a domestic LLC, file Schedule C (or Schedule E or F, if applicable) … Instructions for Form 2290 (07/2022) | Internal Revenue Service Jun 30, 2011 · Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Figure and pay the tax due on a vehicle for which you completed the suspension statement on another Form 2290 if that vehicle later exceeded the mileage use limit during the period. Blood Smear Basics - Google Drive: Sign-in Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

Trucker tax deduction worksheet. Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; 2021 Instructions for Schedule C (2021) | Internal Revenue ... Depreciation and section 179 expense deduction. Depreciation is the annual deduction allowed to recover the cost or other basis of business or investment property having a useful life substantially beyond the tax year. You can also depreciate improvements made to leased business property. Access Denied - LiveJournal Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. Blood Smear Basics - Google Drive: Sign-in Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

Instructions for Form 2290 (07/2022) | Internal Revenue Service Jun 30, 2011 · Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Figure and pay the tax due on a vehicle for which you completed the suspension statement on another Form 2290 if that vehicle later exceeded the mileage use limit during the period. From Business Profit or Loss - IRS tax forms your business interest deduction is limited. • Form 8995 or 8995-A to claim a deduction for qualified business income. Single-member limited liability com-pany (LLC). Generally, a single-mem-ber domestic LLC is not treated as a sep-arate entity for federal income tax purposes. If you are the sole member of a domestic LLC, file Schedule C (or Schedule E or F, if applicable) …

.jpg)

0 Response to "41 trucker tax deduction worksheet"

Post a Comment