42 section 125 nondiscrimination testing worksheet

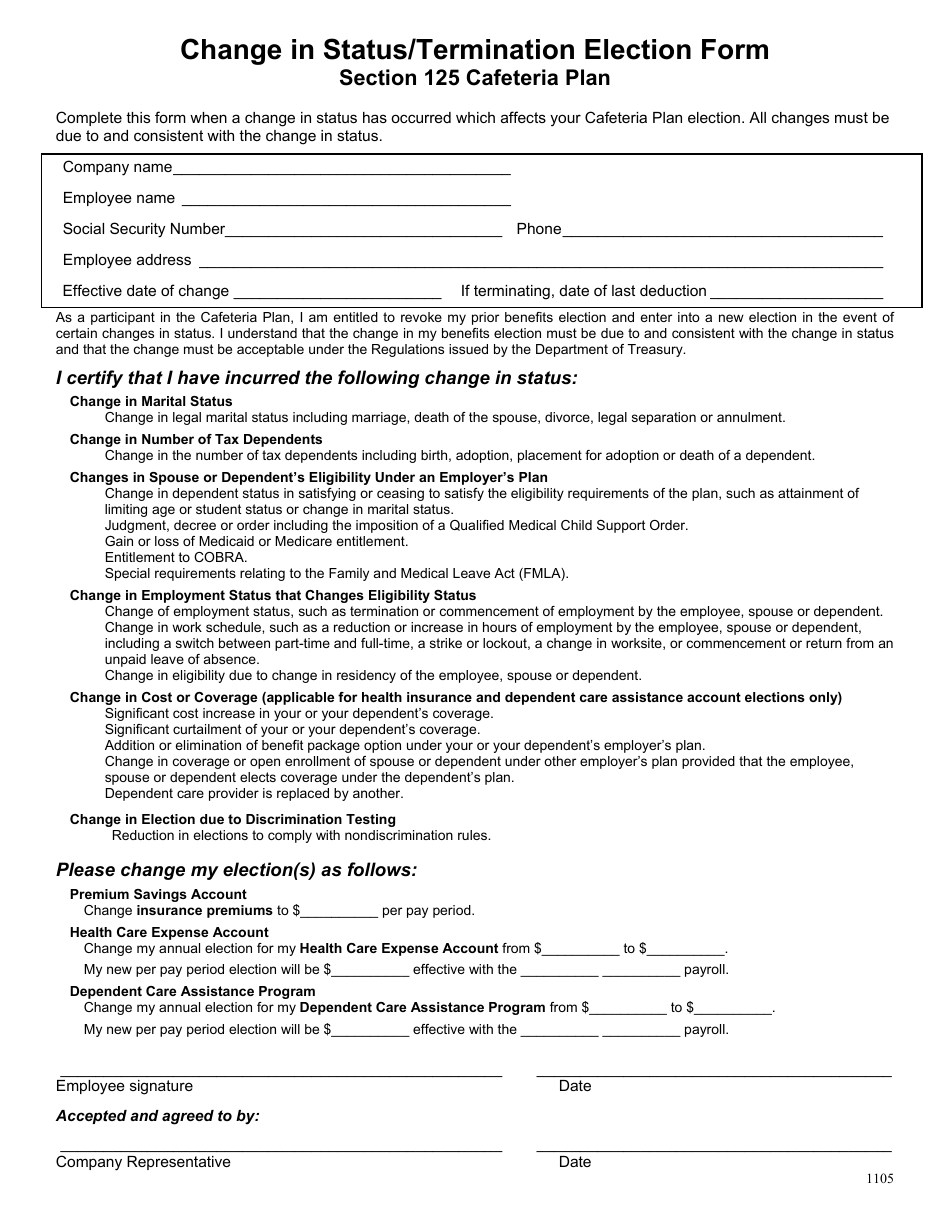

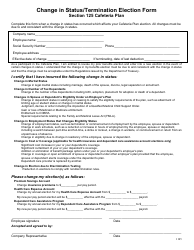

Section 125 Cafeteria Plans: A Guide to Compliance - BerniePortal Cafeteria plans are often called Section 125 plans—a reference to the part of the Internal Revenue Code that outlines how such plans may operate. Section 125 cafeteria plans offer tax savings for both employees and employers. An employee's taxable income—or gross pay —is reduced, and an employer's contributions to benefits are not taxed. Section 125 Nondiscrimination Testing Worksheet - Briefencounters The Section 125 Nondiscrimination Testing worksheet should be completed if the plan is a cafeteria plan. It should also be completed for a self-insured medical plan. This is the standard for a cafeteria plan and must be compliant with the rules of the IRS. For self-insured plans, the employee must pay a fee every month.

What Nondiscrimination Testing Rules Apply to Self-Insured Health Plans? ANSWER: Self-insured health plans are subject to two nondiscrimination tests under Code § 105 (h)—the Eligibility Test and the Benefits Test. These tests are designed to prevent a self-insured health plan from unduly favoring employees who are highly compensated individuals (HCIs).

Section 125 nondiscrimination testing worksheet

› publications › p560Publication 560 (2021), Retirement Plans for Small Business Also, these contributions must satisfy the actual contribution percentage (ACP) test of section 401(m)(2), a nondiscrimination test that applies to employee contributions and matching contributions. See Regulations sections 1.401(k)-2 and 1.401(m)-2 for further guidance relating to the nondiscrimination rules under sections 401(k) and 401(m). Section 125 Non-Discrimination Testing - BenefitsLink "When calculating the Contribution & Benefits Utilization standard and Key Employee 25% Concentration Test, you're supposed to calculate the aggregate qualified benefits. Are qualified benefits equal to payroll deductions for cafeteria plan items plus employer HSA contributions? Or do they include all employer contributions, including amounts paid by employers to pay for health, vision, and ... United Benefit Advisors > Home > News Article United Benefit Advisors. (317) 705-1800. support@ubabenefits.com. By Danielle Capilla, Chief Compliance Officer at United Benefit Advisors. Under Internal Revenue Code Section 105 (h), a self-insured medical reimbursement plan must pass two nondiscrimination tests. Failure to pass either test means that the favorable tax treatment for highly ...

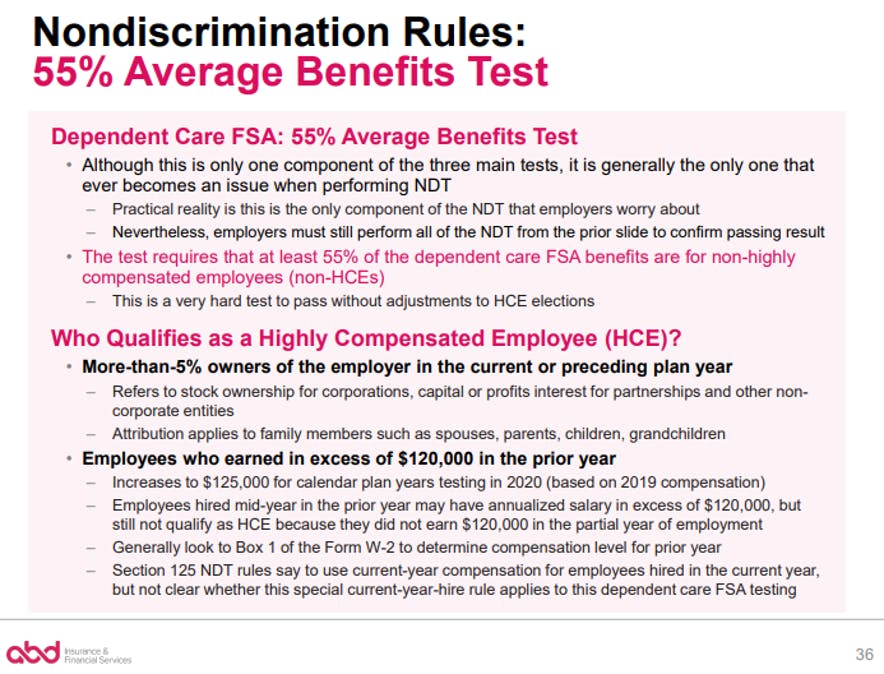

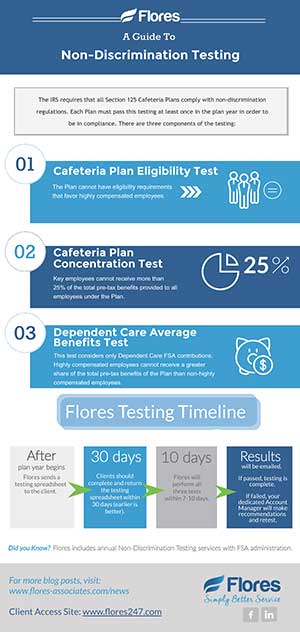

Section 125 nondiscrimination testing worksheet. Health Flexible Spending Accounts and Non-Discrimination Issues - JD Supra Thus, our analysis is limited to the applicability of Section 105(h) requirements to Section 125 Health FSAs that have successfully passed the Section 125 nondiscrimination requirements. 03 May Section 105(h) Nondiscrimination Testing Section 105(h) nondiscrimination testing applies in both cases. Regardless of grandfathered status, if the self-insured plan is offered under a cafeteria plan and allows employees to pay premiums on a pre-tax basis, then the plan is still subject to the Section 125. nondiscrimination rules. The cafeteria plan rules affect whether contributions ... Tactics to Avoid Failing Nondiscrimination Testing All qualified employer-sponsored DC retirement plans must submit to annual nondiscrimination testing to ensure that benefits under the plan are not unbalanced to favor officers, owners, shareholders, key employees and any employee categorized as a highly compensated employee. The actual deferral percentage test examines the average deferral rate of highly compensated employees and compares it to the average default rate of non-highly compensated employees. About the Section 125 or (Cafeteria) Plan - Investopedia Section 125 plans must pass three nondiscrimination tests designed to determine if the plan discriminates in favor of highly compensated or key employees of the business: eligibility to...

Section 125 Benefit Plan - All Your Questions Answered The nondiscrimination tests are designed to ensure that all employees receive equal benefits from your Section 125 plan. You must include every benefit offered via the plan to ensure this equality. The tests are divided into three parts. Part No. 1 - Eligibility Tests Passing this test requires you to offer your plan to all eligible employees. Section 125 Non-Discrimination Testing - BenefitsLink Message Boards Both employer and employee contributions are included. Treas. Reg. §1.125-7(c)(2): (2) Benefit availability and benefit election. A cafeteria plan does not discriminate with respect to contributions and benefits if either qualified benefits and total benefits, or employer contributions allocable to statutory nontaxable benefits and employer contributions allocable to total benefits, do not ... dwd.wisconsin.gov › wioa › policy(WIOA) Titles I-A and I-B Policy & Procedure Manual - Wisconsin To access all Sections within a Chapter, click the plus sign (+) on the right of a Chapter title. Once you are within a Section, you can navigate to other Sections by using the slide-out Table of Contents on the upper left side of the page. Content will be added as it is approved and only Chapters and Sections with content will be clickable. Question: How To Apply For Section 125 Health Plan - BikeHike In a section 125 plan or cafeteria plan, employees can pay qualified medical, dental, or dependent-care expenses on a pretax basis, which has the effect of reducing their taxable income as well as their employer's Social Security (FICA) liability, federal income and unemployment taxes, and state unemployment taxes Nov 23, 2018.

Health Flexible Spending Accounts and Non-Discrimination Issues For purposes of this article, we will discuss the nondiscrimination requirements as applied to Health FSAs funded through participants' pre-tax salary contributions BUT we'll assume these Section 125 Health FSAs can pass the non-discrimination requirements applicable under Section 125 of the Internal Revenue Code. Thus, our analysis is limited to the applicability of Section 105(h) requirements to Section 125 Health FSAs that have successfully passed the Section 125 nondiscrimination ... When To Complete Non-Discrimination Testing? | BASE® Blog December 09, 2021. Non-Discrimination Testing makes sure there isn't discrimination between highly compensated employees/key employees and other employees at a company. With the BASE® NDT, this test takes out the guesswork and demonstrates fairness with respect to eligibility, contributions, or benefits to all employees, keeping the health benefit plans fair for everyone. Section 125 testing: All your "w" questions answered September 08, 2022. For pre-tax cafeteria plans to remain compliant, thorough Section 125 testing is a key component. The IRS code governing cafeteria plans requires that testing for discrimination among plan participants occur annually. Since cafeteria plans allow for pre-tax contributions, keeping them compliant with IRS law is vital. › vaccines › pubsMeasles - Vaccine Preventable Diseases Surveillance Manual | CDC Specimens for viral isolation should be obtained in addition to serologic testing (see “Laboratory Testing” section above); isolation of wild type measles virus would allow confirmation of the case. In the absence of strain typing to confirm wild type infection, cases in persons with measles-like illness who received measles vaccine 6–45 ...

United Benefit Advisors > Home > News Article Further, Section 125 nondiscrimination rules apply to all cafeteria plans regardless of their status as fully insured, self-funded, church plan, or governmental plan. As a practical matter, these nondiscrimination rules prohibit executive health plans offered through a cafeteria plan. Nondiscrimination testing can help employers avoid rule violations. But there are a number of definitions of key terms used in the tests that must be understood prior to completing the tests:

Faq | Nfp August 02, 2022. Generally, an employer can vary benefits and contributions by bona fide employment classifications. However, even where such classifications exist, the employer should ensure that the variations comply with the applicable nondiscrimination rules. Section 125 nondiscrimination rules apply to benefits and contributions made through a cafeteria plan.

› pub › irs-tegeChapter 3 Compensation - IRS tax forms • elective contributions to a Section 457(b) eligible deferred compensation plan or to a cafeteria plan (Section 125 plan), and • elective deferrals as described under IRC Section 402(g)(3). This includes elective deferrals to a 401(k) plan, a Section 403(b) tax shelter annuity plan, a SIMPLE IRA, or a SARSEP, including catch-up contributions

Cafeteria Plan: Key Employee Concentration Test The formula is simple to calculate, and employers should include both employee and employer contributions when determining the total elections. Formula = Total elections by key employees ÷ Total elections by all non-key and key employees After performing this calculation, the percentage should be 25% of less to pass this non-discrimination test.

› ntid › slpiSign Language Proficiency Interview (SLPI:ASL) | National ... In 1980 at the Third National Symposium on Sign Language Research and Teaching in Boston, Protase Woodford from Educational Testing Services, Princeton, NJ, presented information about the Language/Oral Proficiency Interview, an interview technique for assessing spoken language communication skills.

› meningitis › lab-manualMeningitis Lab Manual: Antimicrobial Susceptibility Testing | CDC Antimicrobial susceptibility testing of S. pneumoniae This section describes the optimal media, inoculum, antimicrobial agents to test, incubation conditions, and interpretation of results for S. pneumoniae by the disk diffusion method and the antimicrobial gradient strip method. Although disk diffusion will provide information for most ...

What Is a Highly Compensated Employee (HCE)? - Investopedia Highly Compensated Employee: A highly compensated employee (HCE) is -- according to the Internal Revenue Service -- anyone who:

What to Know About Non-Discrimination Testing - OCA No employers are exempt from non-discrimination testing. Three Most Common Reasons Non-Discrimination Tests Fail • Dependent Care FSA - 55% Average Benefits Test (Utilization) o Because HCEs typically participate in the DCAP at a much higher rate than non-HCEs, it is not unusual for a plan to fail the 55 percent average benefits test.

tryengineering.org › teacher › popsicle-bridgePopsicle Bridge - TryEngineering.org Powered by IEEE 125 meters long, and 1.8 meters wide; Designed as a curved walkway to maximize the viewing experience. Formed of steel and concrete panels set on top of an inverted triangular truss. Suspended by 8 cables from an 81.5m high single pylon, and hangs at about 100m above ground. Designed to carry a maximum capacity of 250 people. Source: Wikipedia

United Benefit Advisors > Home > News Article United Benefit Advisors. (317) 705-1800. support@ubabenefits.com. By Danielle Capilla, Chief Compliance Officer at United Benefit Advisors. Under Internal Revenue Code Section 105 (h), a self-insured medical reimbursement plan must pass two nondiscrimination tests. Failure to pass either test means that the favorable tax treatment for highly ...

Section 125 Non-Discrimination Testing - BenefitsLink "When calculating the Contribution & Benefits Utilization standard and Key Employee 25% Concentration Test, you're supposed to calculate the aggregate qualified benefits. Are qualified benefits equal to payroll deductions for cafeteria plan items plus employer HSA contributions? Or do they include all employer contributions, including amounts paid by employers to pay for health, vision, and ...

› publications › p560Publication 560 (2021), Retirement Plans for Small Business Also, these contributions must satisfy the actual contribution percentage (ACP) test of section 401(m)(2), a nondiscrimination test that applies to employee contributions and matching contributions. See Regulations sections 1.401(k)-2 and 1.401(m)-2 for further guidance relating to the nondiscrimination rules under sections 401(k) and 401(m).

0 Response to "42 section 125 nondiscrimination testing worksheet"

Post a Comment