43 calculating sales tax worksheet

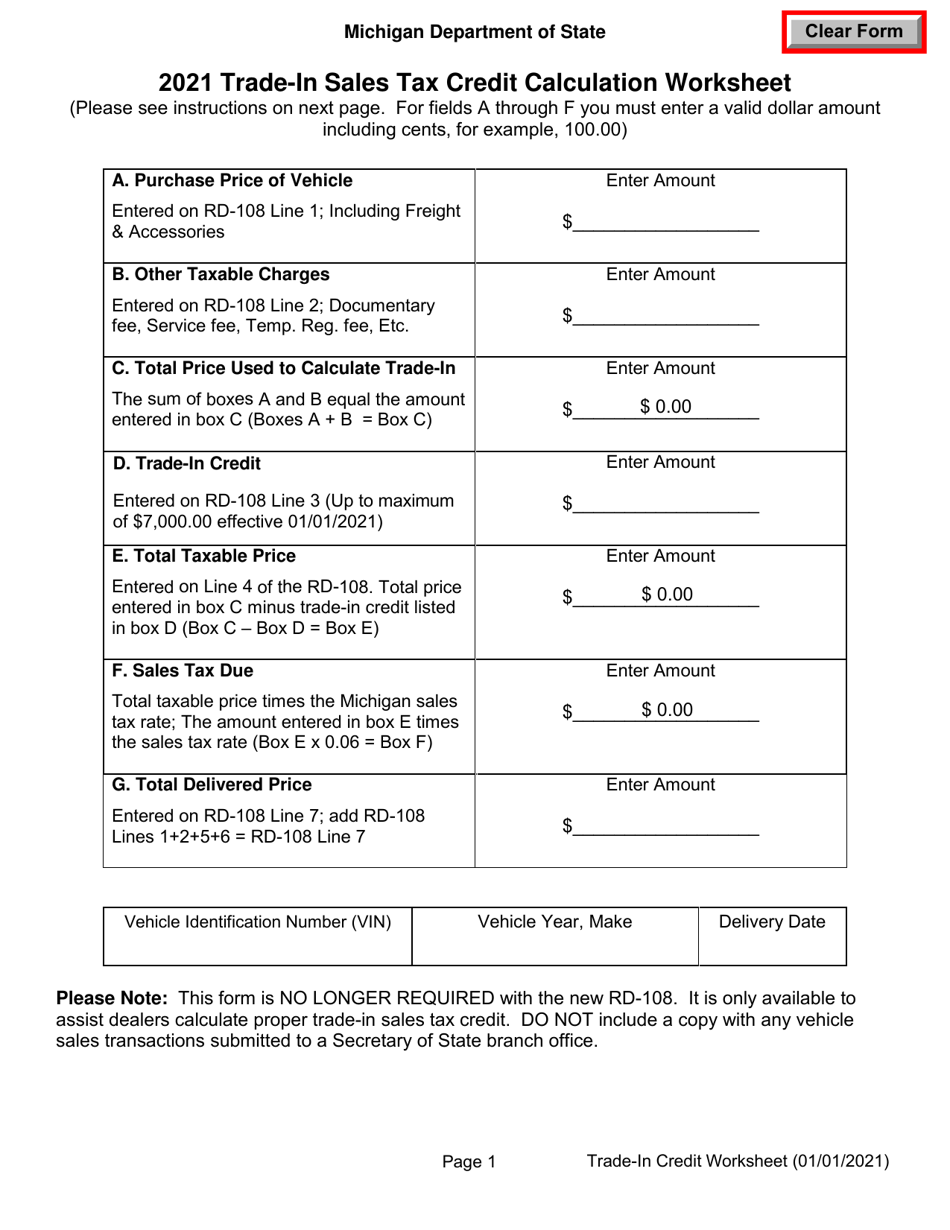

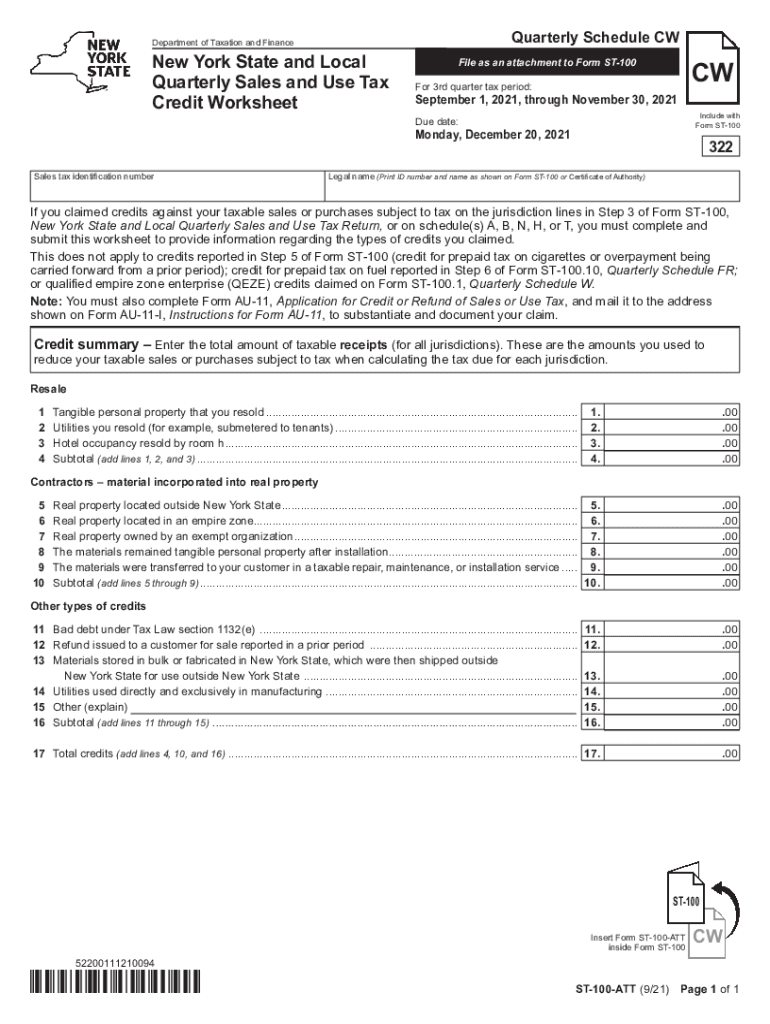

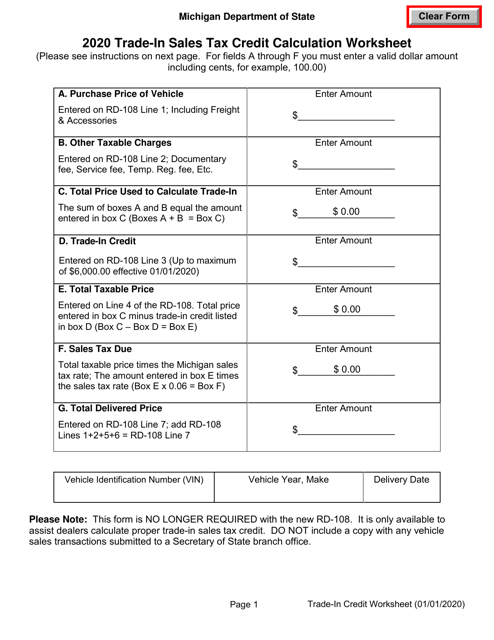

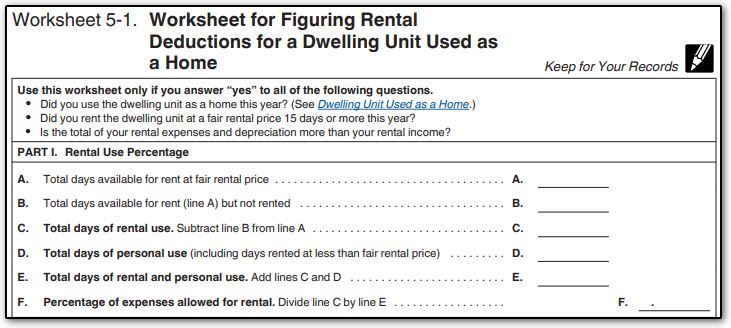

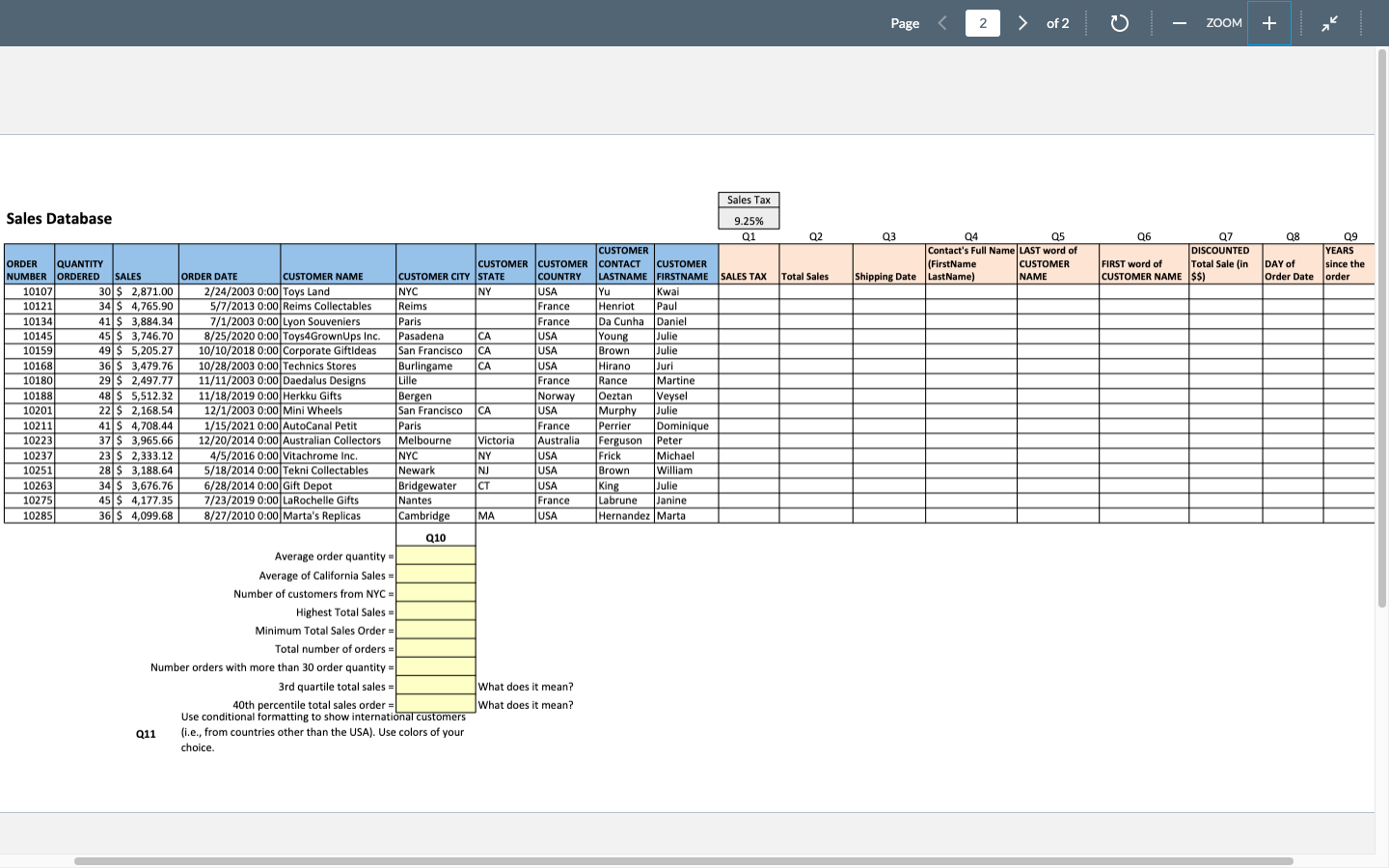

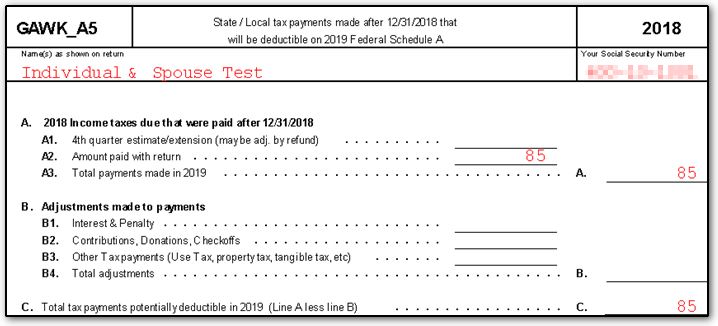

Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the … Use the Sales Tax Deduction Calculator The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

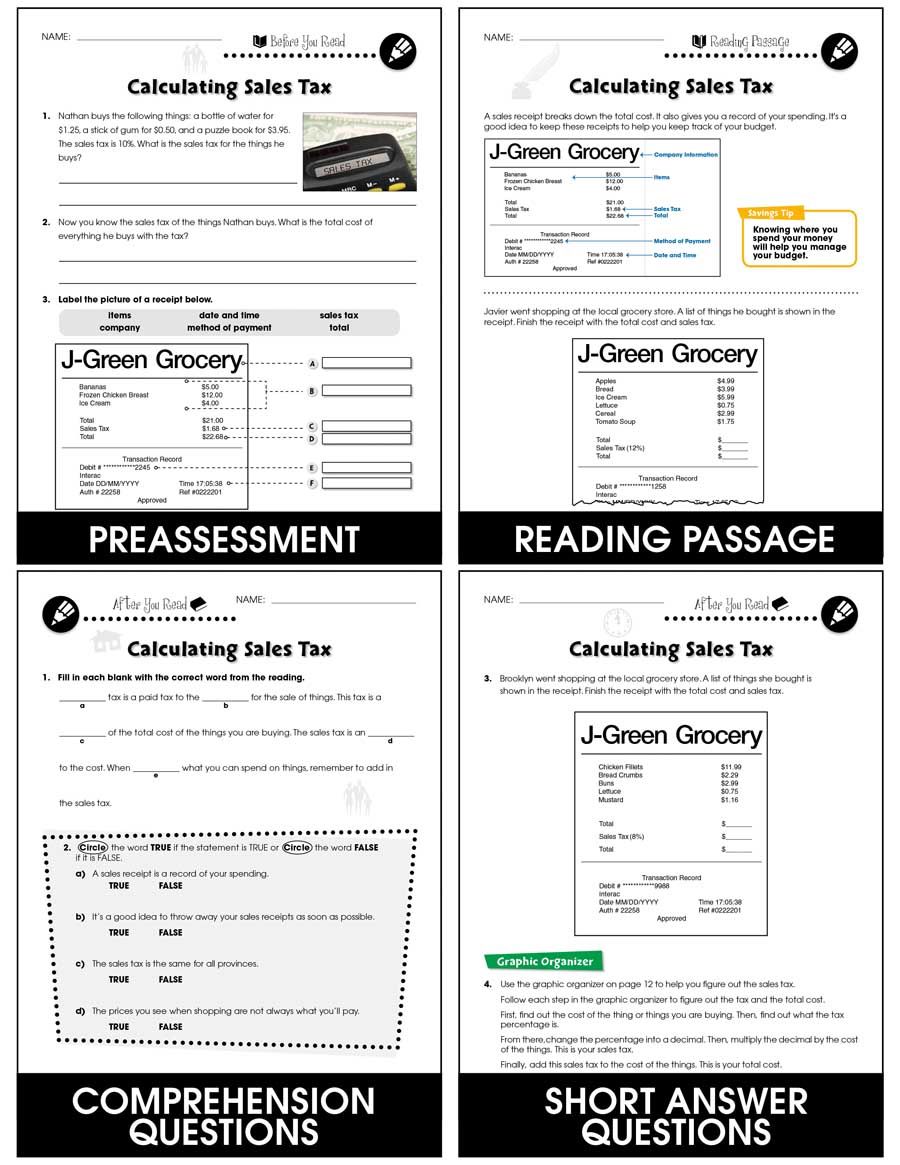

Calculating Sales Tax Worksheets - K12 Workbook Calculating Sales Tax Displaying all worksheets related to - Calculating Sales Tax. Worksheets are Sales tax and discount work, Sales tax practice work, Calculating sales tax, Calculating sales tax, Calculating sales tax, Unit 3, Sales tax tips and discounts, Sales tax tips and discounts. *Click on Open button to open and print to worksheet. 1.

Calculating sales tax worksheet

PDF Sales Tax Worksheet - EMSD63 Sales Tax Worksheet Directions: Using percents and proportions solve the following problems. Show all work. 1. If the sales tax rate in 7.25% in California, how much did Debbie pay if she bought a pair of jeans for $38? 2. Kristen bought a scarf for $22 in New York. In New York there is a 6.2% sales PDF New - to Be Used Only to File Quarterly Tax Returns Prior to 1st ... IFTA QUARTERLY TAX RETURN WORKSHEET . NEW - TO BE USED ONLY TO FILE QUARTERLY TAX RETURNS PRIOR TO 1. ST. QUARTER 2021 . See 'Instructions for Completing the IFTA Quarterly Tax Return' Below for Information . ... Multiply Column 12 by Column 13 to calculate the tax or credit due for the jurisdiction. If there is a surtax, How Itemizers Can Calculate Sales Tax Write-Offs - AccountingWEB Apr 15, 2021 · It discusses the “Optional sales tax tables” that are included in the instructions for Schedule A of Form 1040 and help that’s available at the IRS’s Web site, irs.gov. The site offers an online tool designed to help perplexed taxpayers—or even paid preparers for that matter—calculate the IRS-blessed deduction.

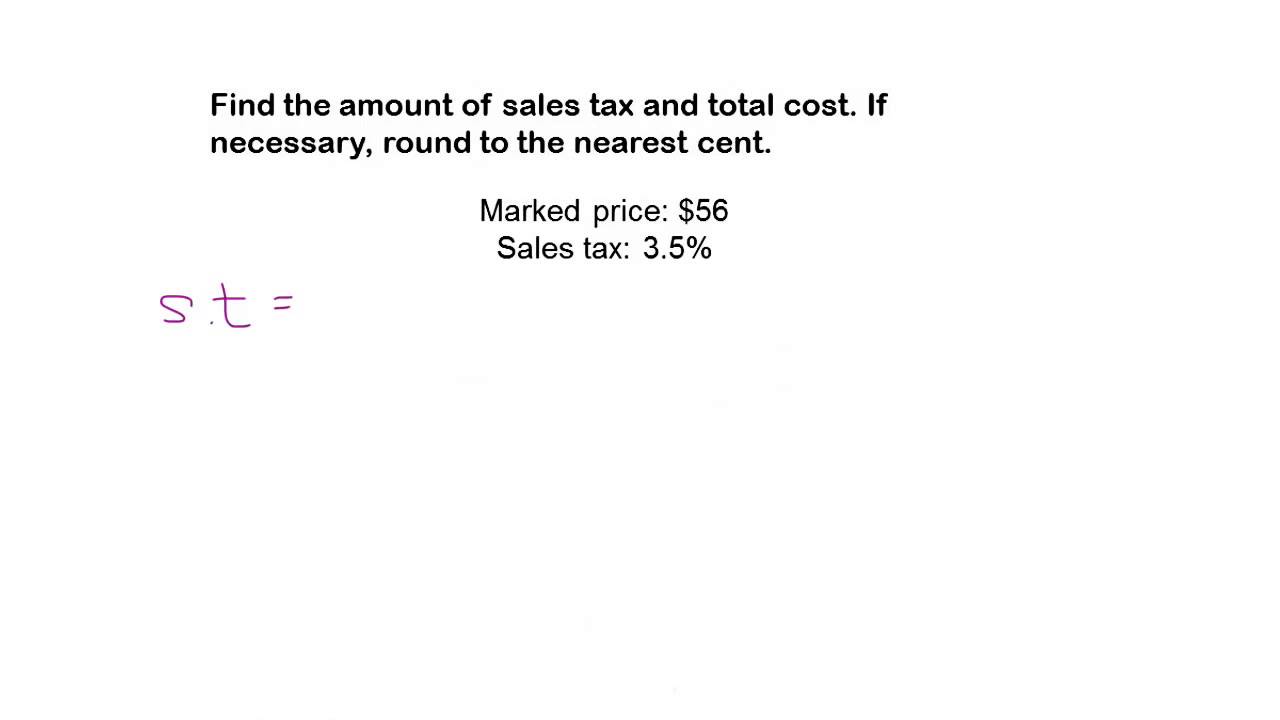

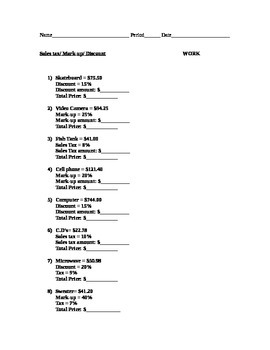

Calculating sales tax worksheet. Publication 523 (2021), Selling Your Home - IRS tax forms Any sales tax you paid on your home (such as for a mobile home or houseboat) and then claimed as a deduction on a federal tax return ... For each number, take the number from your “Total” worksheet, subtract the number from your “Business or Rental” worksheet, and enter the result in your “Home” worksheet (for example, subtract the ... Sales Tax Worksheets - Math Worksheets 4 Kids Find the sales tax and calculate the total cost of the items using these 3-part printable worksheets! Finding the Original Price If the sale price is $460 and the sales tax rate is 4%, what is the original price? All there's to do is to substitute the values in the appropriate formula and proceed to solve for the missing values. GST/HST calculator (and rates) - Canada.ca The following table provides the GST and HST provincial rates since July 1, 2010. The rate you will charge depends on different factors, see: Type of supply - learn about what supplies are taxable or not. Where the supply is made - learn about the place of supply rules. Who the supply is made to - to learn about who may not pay the GST/HST. Calculate Sales Tax Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. Calculating Sales Tax ReloadOpenDownload 2. Calculating Sales Tax ReloadOpenDownload 3. Tax and Tip (Percent) Word Problems ReloadOpenDownload 4. Scarf T-shirt Jeans Sweater Shorts $63 $286 - ReloadOpenDownload 5. Sale Price = Sales Tax = Total Cost - ReloadOpenDownload 6.

Calculating Sales Tax Worksheet: Fillable, Printable & Blank PDF Form ... How to Edit The Calculating Sales Tax Worksheet with ease Online. Start on editing, signing and sharing your Calculating Sales Tax Worksheet online with the help of these easy steps: click the Get Form or Get Form Now button on the current page to access the PDF editor. hold on a second before the Calculating Sales Tax Worksheet is loaded Canada Sales Tax: A Simple Guide to PST, GST, and HST GST (Good and Services Tax) GST is a Canada-wide tax that can show up in two different ways, depending on the province in which your business is registered: A separate tax, charged at a rate of 5%. A portion of a province-specific Harmonized Sales Tax (HST) See the table below for the GST/HST rate in your province. Publication 463 (2021), Travel, Gift, and Car Expenses - IRS tax forms Generally, the cost of a car, plus sales tax and improvements, is a capital expense. Because the benefits last longer than 1 year, you generally can’t deduct a capital expense. However, you can recover this cost through the section 179 deduction (the deduction allowed by section 179 of the Internal Revenue Code), special depreciation ... PDF Sales Tax Practice Worksheet - MATH IN DEMAND students to check t • • This worksheet works best to reinforce sales tax. • Make sure that students bubble in their answers for the front page (#1-7) and the back page (#8-14). The bubbles allow heir answers and results in a more confident student. In addition, it makes it a lot easier for you to do a quick

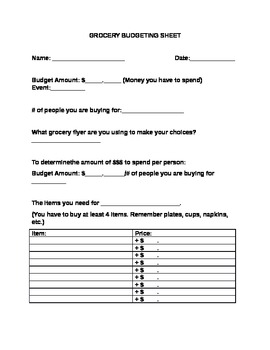

Sales Tax Worksheets Teaching Resources | Teachers Pay Teachers This product includes 12 worksheets. There are 12 questions on each worksheet, asking students what is the final price with sales tax? With a picture visual of what they are buying as well as the sales tax rate. This is a great functional reading / money skill to practice with students as they work on independent living skills. Sales & Use Tax | South Dakota Department of Revenue The sales tax applies to the gross receipts of all retail sales, including the sale, lease, or rental of tangible personal property or any product transferred electronically, and the sale of services. The state sales and use tax rate is 4.5%. For additional information on sales tax, please refer to our Sales Tax Guide (PDF). See Sales Tax Guide Calculating Sales Tax Worksheets & Teaching Resources | TpT This is a real-world situation activity where students will work within a budget and calculate percents of a number, discounts, sales tax and totals. It can be used as an in-class assignment, homework or as a review. Students can also be placed in groups and complete cooperatively!SKILL-Finding perc Subjects: Publication 969 (2021), Health Savings Accounts and Other Tax … The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889, Health Savings Accounts (HSAs); or. ... The Sales Tax Deduction Calculator (IRS.gov/SalesTax) figures the amount you can claim if you …

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

Provincial Sales Tax - Ministry of Health Understand Provincial Sales Tax PST is a six per cent sales tax that applies to taxable goods and services consumed or used in Saskatchewan. It applies to goods and services purchased in the province as well as goods and services imported for consumption or use in Saskatchewan.

Calculate Sales Tax | Worksheet | Education.com Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost.

DOC Sales Tax and Discount Worksheet - Chester Sales Tax and Discount Worksheet -Math 6 In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper?

Sales tax calculator, GST and PST 2022 - Calcul Conversion Formula for calculating the GST and QST. Amount before sales tax x (GST rate/100) = GST amount. Amount without sales tax x (QST rate/100) = QST amount. Amount without sales tax + GST amount + QST amount = Total amount with sales taxes.

Calculating a Sales Tax Lesson Plan, Worksheet, Classroom Teaching Activity Print out the teaching lesson pages and exercise worksheets for use with this lesson: Printable lesson worksheet and activity. To teach and learn money skills, personal finance, money management, business, careers, and life skills please go to the Money Instructor home page. Teaching Money Calculate Sale Tax Lesson Plan Rules Guide Elementary ...

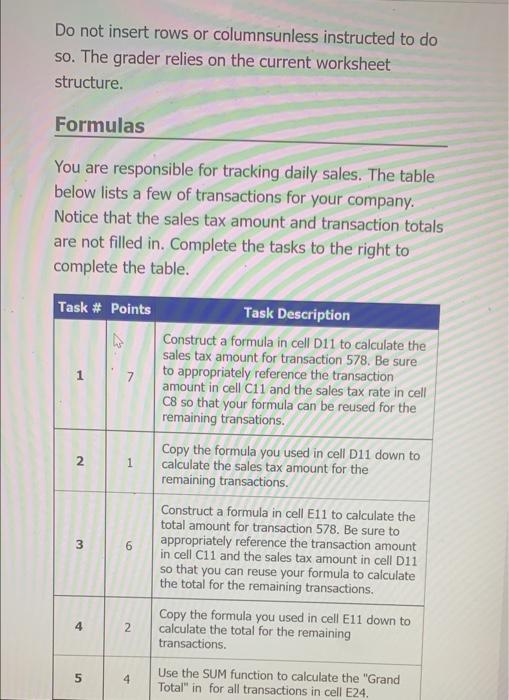

PDF Calculating Sales Tax - raymondgeddes.com Sales Tax Sales Receipt Worksheet Sales Tax Rate: ____ Sales Tax Rate Converted to Decimal: ___ Receipt #1 Customer Name: Monica Item Name Retail Price x Quantity = Total Price Retro Pencils $.20 5 $ Piranha Sharpener $.50 1 $ 6-Color Pen $.75 2 $ Dessert Eraser $.15 2 $ _____ Subtotal $ Sales Tax Amount $ _____ Total $

Calculating Sales Tax | Worksheet | Education.com To figure it out, you'll have to practice calculating sales tax. Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems.

May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

How Itemizers Can Calculate Sales Tax Write-Offs - AccountingWEB Apr 15, 2021 · It discusses the “Optional sales tax tables” that are included in the instructions for Schedule A of Form 1040 and help that’s available at the IRS’s Web site, irs.gov. The site offers an online tool designed to help perplexed taxpayers—or even paid preparers for that matter—calculate the IRS-blessed deduction.

PDF New - to Be Used Only to File Quarterly Tax Returns Prior to 1st ... IFTA QUARTERLY TAX RETURN WORKSHEET . NEW - TO BE USED ONLY TO FILE QUARTERLY TAX RETURNS PRIOR TO 1. ST. QUARTER 2021 . See 'Instructions for Completing the IFTA Quarterly Tax Return' Below for Information . ... Multiply Column 12 by Column 13 to calculate the tax or credit due for the jurisdiction. If there is a surtax,

PDF Sales Tax Worksheet - EMSD63 Sales Tax Worksheet Directions: Using percents and proportions solve the following problems. Show all work. 1. If the sales tax rate in 7.25% in California, how much did Debbie pay if she bought a pair of jeans for $38? 2. Kristen bought a scarf for $22 in New York. In New York there is a 6.2% sales

:max_bytes(150000):strip_icc()/Christmas-Shopping-Worksheet-3-56a602eb5f9b58b7d0df784d.jpg)

0 Response to "43 calculating sales tax worksheet"

Post a Comment