44 simple business income worksheet

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). › createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

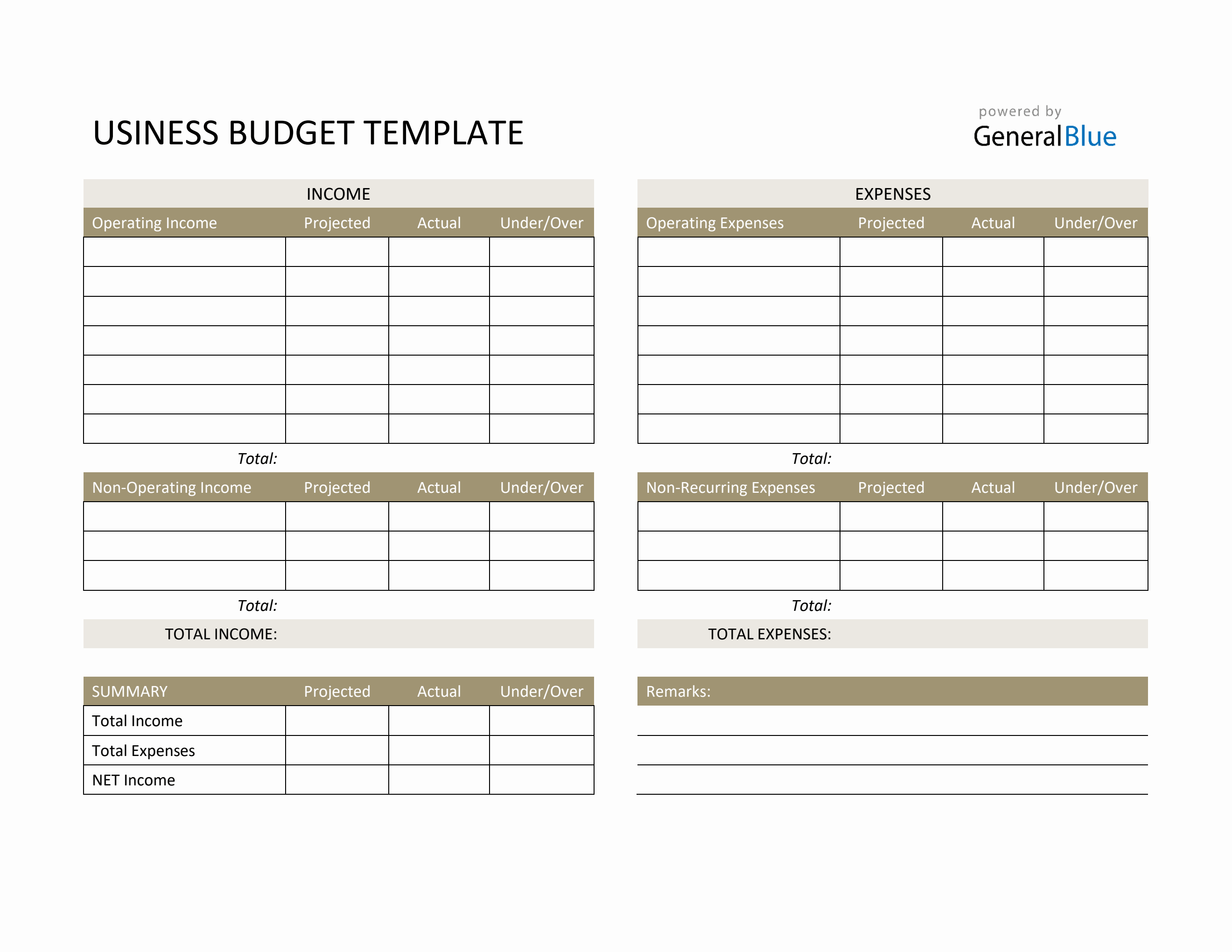

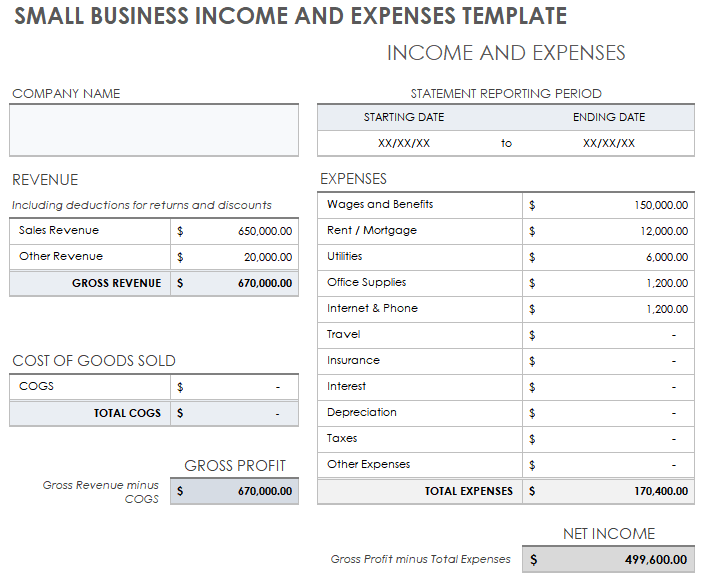

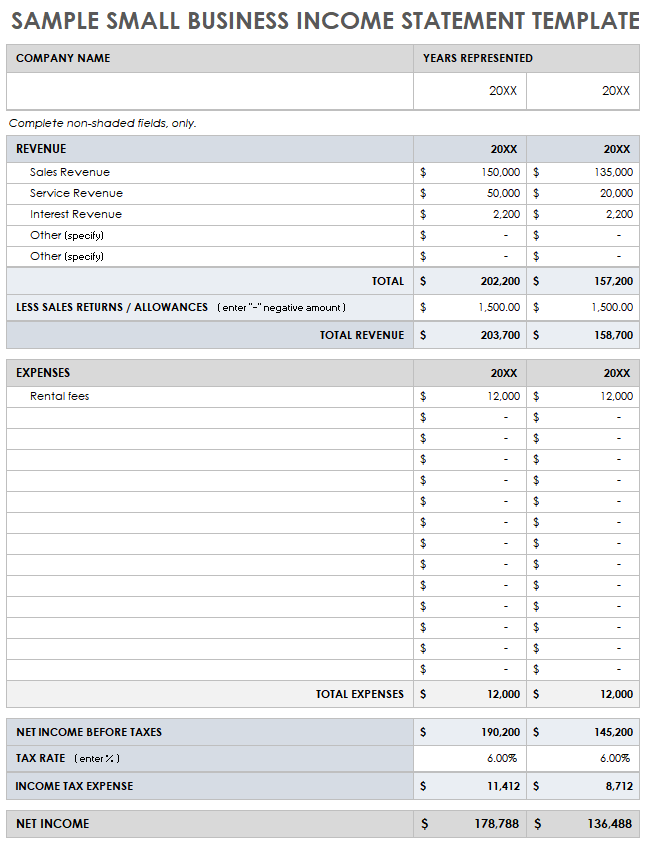

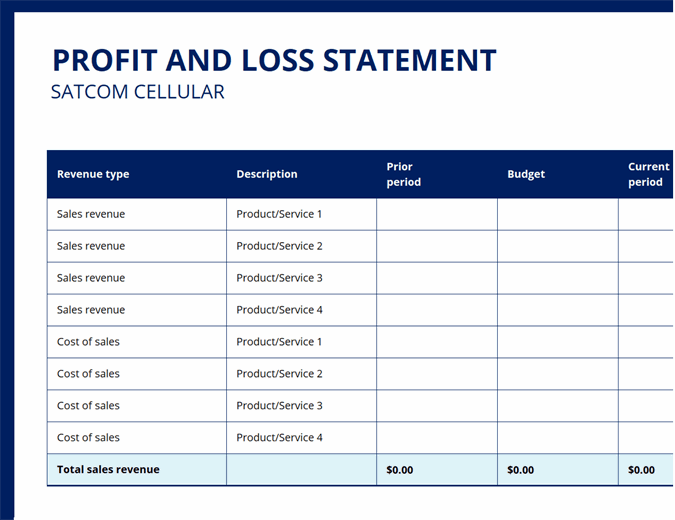

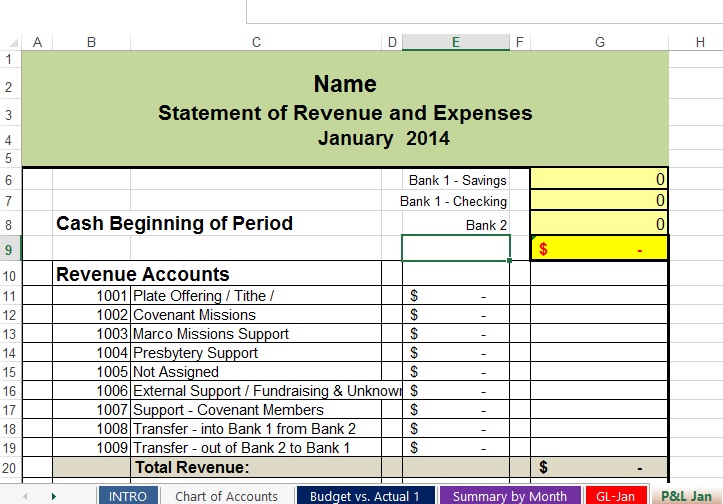

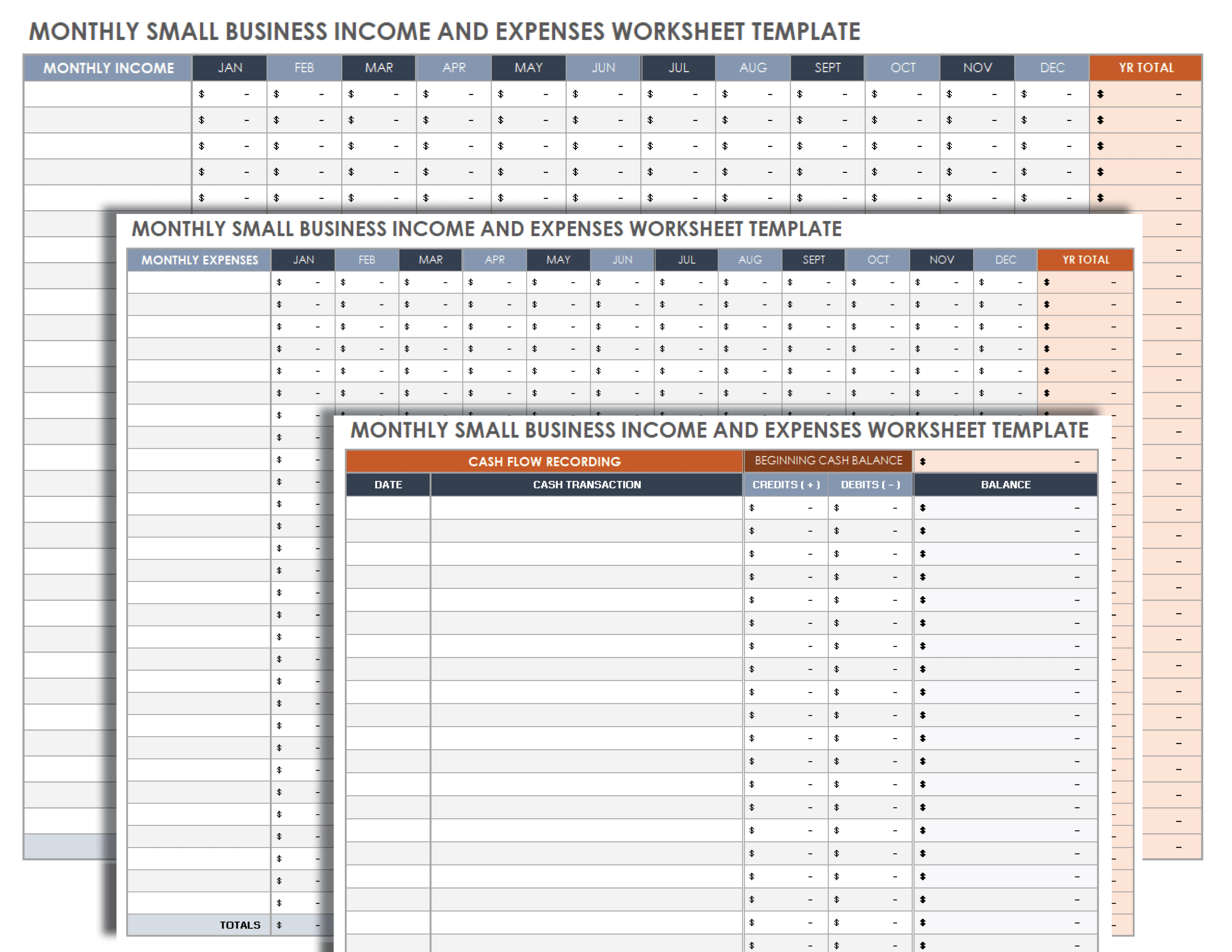

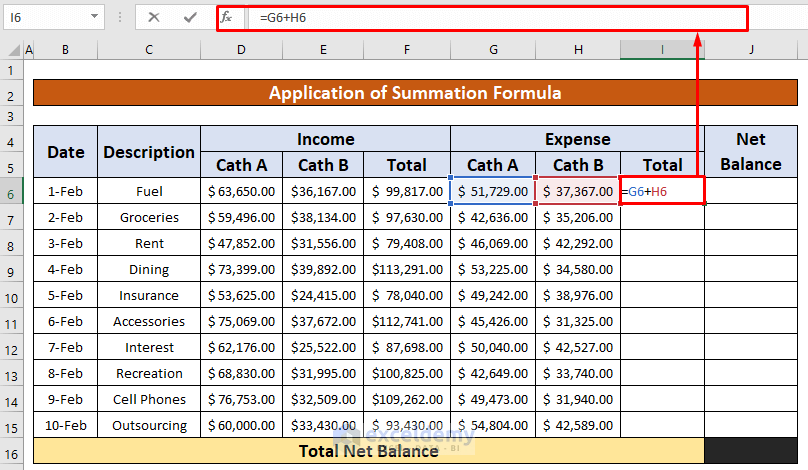

Income Statement Template for Excel - Vertex42.com 11.05.2020 · This income statement template was designed for the small-business owner and contains two example income statements, each on a separate worksheet tab (see the screenshots).The first is a simple single-step income statement with all revenues and expenses lumped together.. The second worksheet, shown on the right, is a multi-step income …

Simple business income worksheet

› newsroom › tax-cuts-and-jobs-actTax Cuts and Jobs Act, Provision 11011 Section 199A ... A3. S corporations and partnerships are generally not taxable and cannot take the deduction themselves. However, all S corporations and partnerships report each shareholder's or partner's share of QBI items, W-2 wages, UBIA of qualified property, qualified REIT dividends and qualified PTP income, and whether or not a trade or business is a specified service trade or business (SSTB) on a ... › 2012/01/13 › tThe Shockingly Simple Math Behind Early Retirement Jan 13, 2012 · To increase the savings rate to 21%, you could increase your income by $1,265 (holding spending constant) or decrease spending by $1,000 (holding income constant). Now, I understand that as your spending gets lower and lower, it gets harder and harder to trim fat. › publications › p560Publication 560 (2021), Retirement Plans for Small Business SIMPLE IRA and SIMPLE 401(k) Salary reduction contributions: 30 days after the end of the month for which the contributions are to be made. 4 Matching or nonelective contributions: Due date of employer's return (including extensions). Employee contribution: Salary reduction contribution up to $13,500; $16,500 if age 50 or over. Employer ...

Simple business income worksheet. proconnect.intuit.com › tax-reform › entityQualified Business Income (QBI) Calculator | 199a Deductions ... This worksheet is designed for Tax Professionals to evaluate the type of legal entity a business should consider, including the application of the Qualified Business Income (QBI) deduction. The best tax strategies may include a combination of business entities to optimize the tax results for the taxpayer. clubthrifty.com › how-to-make-a-budget-in-excelHow to Make a Budget in Excel: Our Simple Step-by-Step Guide Sep 28, 2020 · To calculate the difference between your income and total spending, select the cell where you want the balance to display. Then, input the formula “=SUM(SheetName!Cell-Spending Cell)”. In the example, this is “=SUM(Income!F11-D2)”. This cell will show a negative number if you spent more than your earned. Step 7: Insert a Graph (Optional) › publications › p560Publication 560 (2021), Retirement Plans for Small Business SIMPLE IRA and SIMPLE 401(k) Salary reduction contributions: 30 days after the end of the month for which the contributions are to be made. 4 Matching or nonelective contributions: Due date of employer's return (including extensions). Employee contribution: Salary reduction contribution up to $13,500; $16,500 if age 50 or over. Employer ... › 2012/01/13 › tThe Shockingly Simple Math Behind Early Retirement Jan 13, 2012 · To increase the savings rate to 21%, you could increase your income by $1,265 (holding spending constant) or decrease spending by $1,000 (holding income constant). Now, I understand that as your spending gets lower and lower, it gets harder and harder to trim fat.

› newsroom › tax-cuts-and-jobs-actTax Cuts and Jobs Act, Provision 11011 Section 199A ... A3. S corporations and partnerships are generally not taxable and cannot take the deduction themselves. However, all S corporations and partnerships report each shareholder's or partner's share of QBI items, W-2 wages, UBIA of qualified property, qualified REIT dividends and qualified PTP income, and whether or not a trade or business is a specified service trade or business (SSTB) on a ...

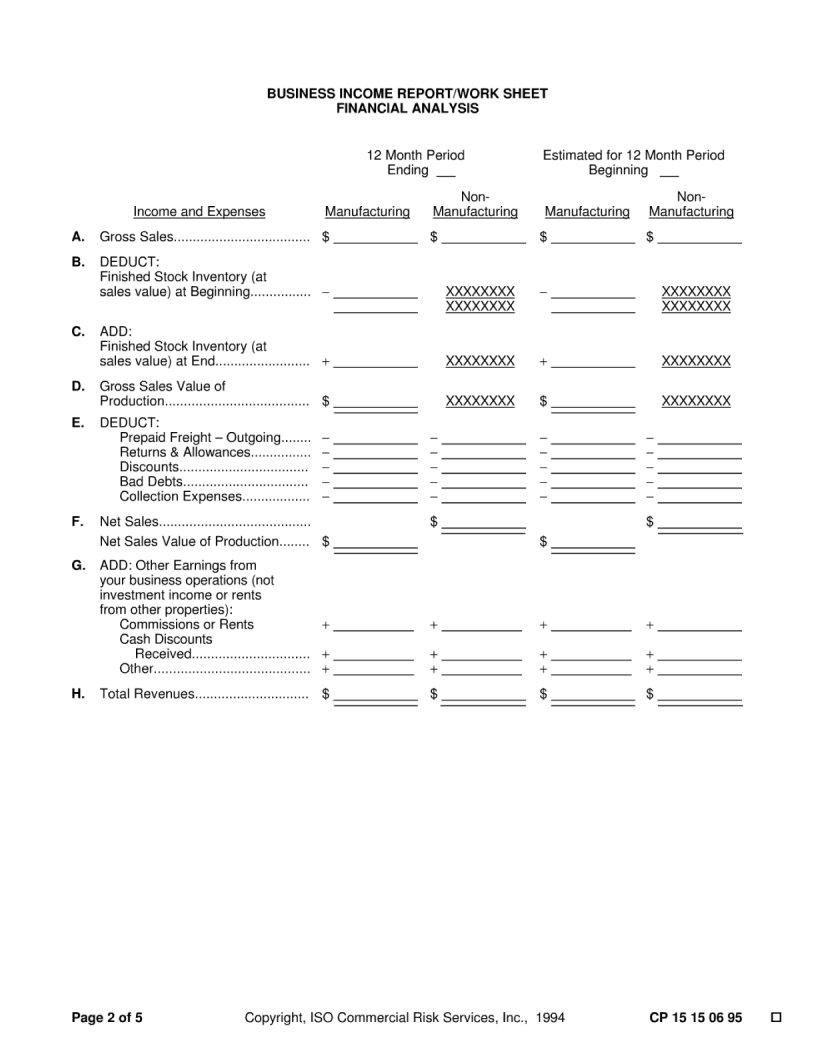

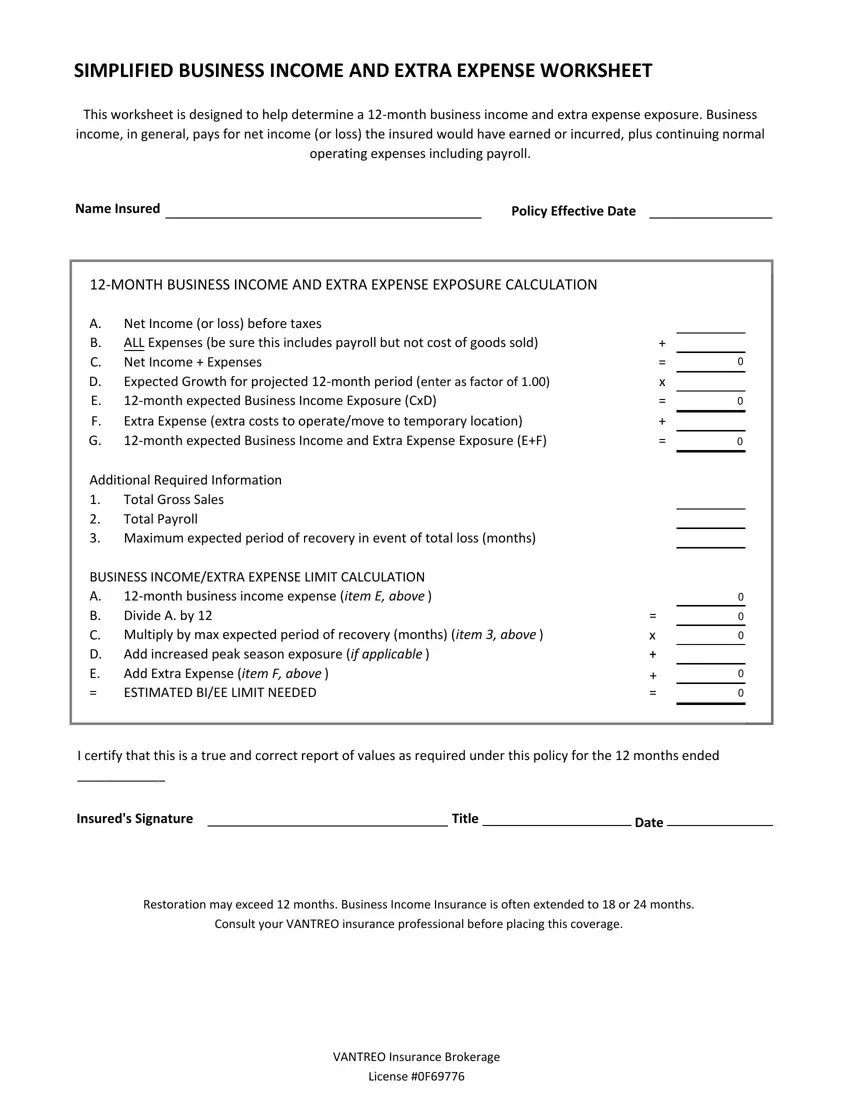

![Business Interruption Insurance Calculation [2 Simple Methods]](https://cdn-acbap.nitrocdn.com/mEpDfFpjnUcMIdkMDwodGakMDqeWdPJo/assets/static/optimized/rev-299fe99/wp-content/uploads/2022/06/2020-05-05-12_44_29-BV-Schedules-Sanderford.xlsx.png)

0 Response to "44 simple business income worksheet"

Post a Comment