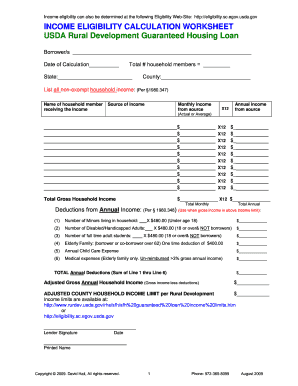

44 usda income calculation worksheet

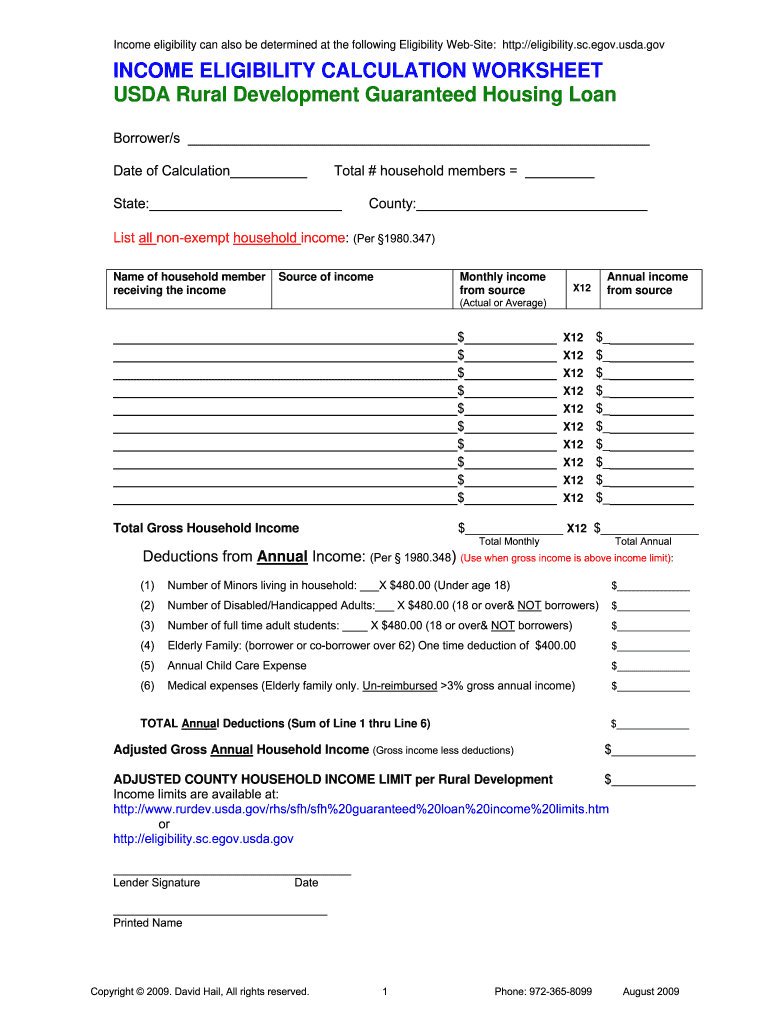

Administration and Forms for NSLP Assistance available in English and Spanish. Please call 877-TEX-MEAL (877-839-6325) for help.. In accordance with federal civil rights law and U.S. Department of Agriculture (USDA) civil rights regulations and policies, this institution is prohibited from discriminating on the basis of race, color, national origin, sex (including gender identity and sexual orientation), disability, age, or ... You are here: Home - USDA Welcome to the USDA Service Center Agencies eForms. eForms allows you to search for and complete forms requesting services from Farm Service Agency (FSA), Natural Conservation Service (NRCS), and Rural Development (RD). There are 2 ways to use the eForms site. You can click the Browse Forms menu option on the left of the page and search for your form. You can …

Emergency Relief Program ERP - Farm Service Agency calculation. The ERP Phase 1 payment calculation for a crop and unit will depend on the type and level of coverage each producer’s loss consistent with the loss procedures . for the type of coverage purchased but using the ERP factor in place of the coverage level. This calculated amount would then be adjusted by subtracting out the net crop

Usda income calculation worksheet

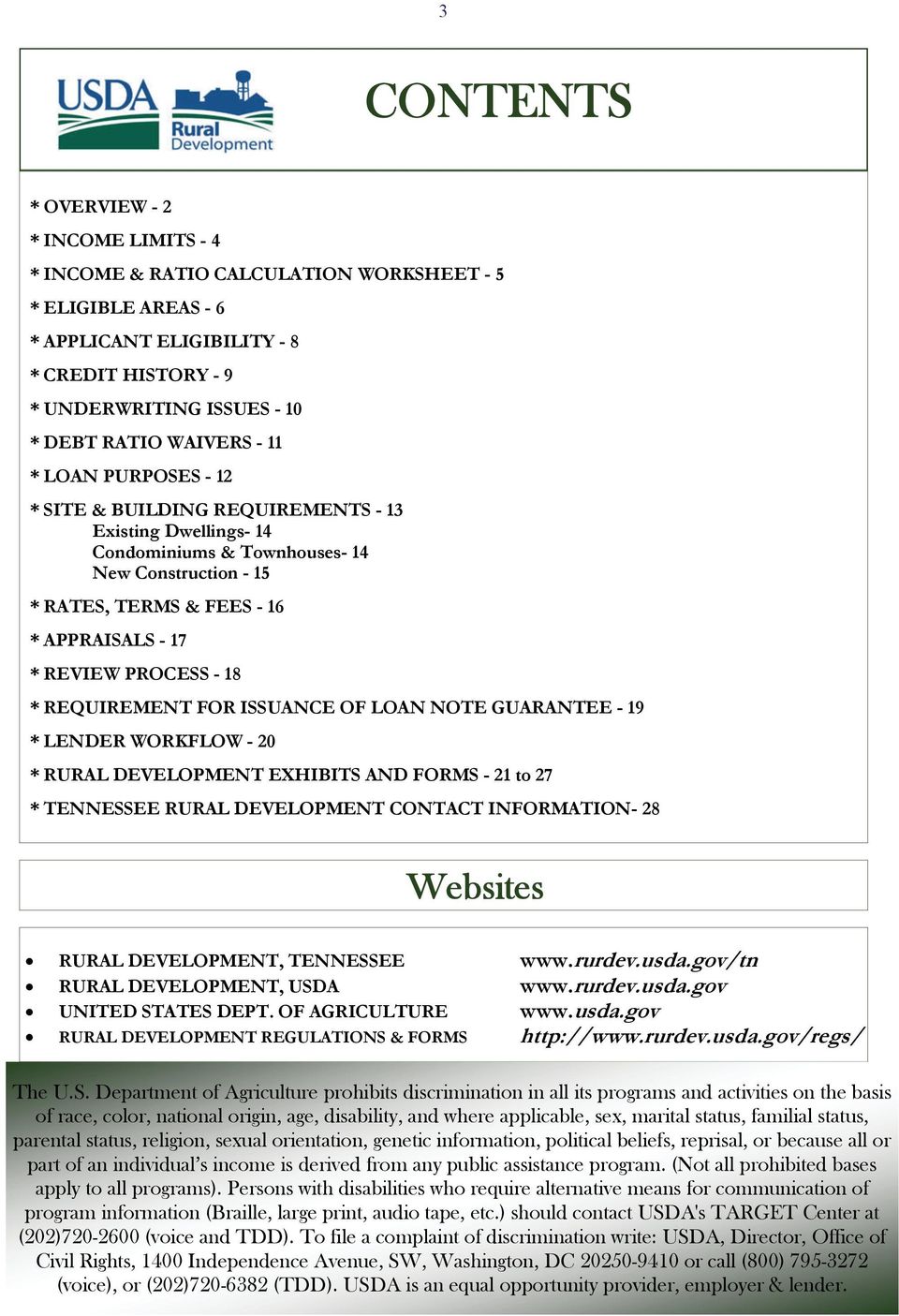

HB‐1‐3555 Chapter 9 Revision Overview - USDA Rural Development Arrive at a logical income calculation based on the documentation that you have been provided. All income calculations are required to be documented on the Income Calculation Worksheet, which is part of a complete Form RD 3555‐21. Attachment 9‐A: THE NEW MATRIX can help! 20 Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; Emergency Relief Program - Farm Service Agency 31.03.2022 · Form AD-2047, Customer Data Worksheet; ... Payment Limitation and Adjusted Gross Income Adjusted Gross Income (AGI) limitations do not apply to ELRP, however the payment limitation for ELRP is determined by the person’s or legal entity’s average adjusted gross farm income (income derived from farming, ranching, and forestry operations). Specifically, a …

Usda income calculation worksheet. Association Forms Update – dotloop support May 27, 2022 · Coronavirus Unpaid Rent Calculation (CAR CURC) & SAMPLE; Coronavirus Unpaid Rent Repayment Agreement (CAR CRRA) Covid-19 Recovery Period Unpaid Rent Calculation (CAR RPURC) COLORADO. Colorado Association Of REALTORS Inc. 4/7/22 Update - Closing Statement (CREC SS60-4-22) 1/1/23 Upcoming New - A ssignment of Lease (CREC AL12-6-22) 1/1/23 10 ... programs, forms, and matrices - CHFA.Colorado Select a program name from the dropdown menu below to find corresponding highlights, matrices, income limits, and forms. ... CHFA Form 707: Lock Worksheet. eCFR :: 7 CFR Part 273 -- Certification of Eligible Households (2) Elderly and disabled persons. Notwithstanding the provisions of paragraph (a) of this section, an otherwise eligible member of a household who is 60 years of age or older and is unable to purchase and prepare meals because he or she suffers from a disability considered permanent under the Social Security Act or a non disease-related, severe, permanent disability may be considered, together ... CHAPTER 9: INCOME ANALYSIS - USDA Rural Development • Income sources that will not be received for the entire ensuing 12 months must continue to be included in annual income unless excluded under 3555.152(b)(5). Examples include, but are not limited to, child support, alimony, maintenance, Social Security, etc. Annual income is the total of all income sources for a 12- month timeframe.

Fannie Mae Income Calculation Worksheet - Fill Online, Printable ... Video instructions and help with filling out and completing fannie mae income calculation worksheet. Instructions and Help about w2 income calculation worksheet excel form . Hi and welcome back to the business career college video series we're doing something a little different in this series of videos I do have a couple of videos where I show excel or word or whatever the … May 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. Center for Nutrition Policy and Promotion (CNPP) - USDA USDA Modernizes the Thrifty Food Plan, Updates SNAP Benefits. News Item. The Thrifty Food Plan Re-Evaluation. Infographics. USDA Food Plans: Cost of Food. Data. Thrifty Food Plan - 2021. Report. USDA Celebrates MyPlate’s Decade of Support for Healthy Habits. News Item. MyPlate/ MiPlato. Technical Assistance & Guidance. Return to top. Home . Data & Research. Grants. … Emergency Relief Program - Farm Service Agency 31.03.2022 · Form AD-2047, Customer Data Worksheet; ... Payment Limitation and Adjusted Gross Income Adjusted Gross Income (AGI) limitations do not apply to ELRP, however the payment limitation for ELRP is determined by the person’s or legal entity’s average adjusted gross farm income (income derived from farming, ranching, and forestry operations). Specifically, a …

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; HB‐1‐3555 Chapter 9 Revision Overview - USDA Rural Development Arrive at a logical income calculation based on the documentation that you have been provided. All income calculations are required to be documented on the Income Calculation Worksheet, which is part of a complete Form RD 3555‐21. Attachment 9‐A: THE NEW MATRIX can help! 20

0 Response to "44 usda income calculation worksheet"

Post a Comment