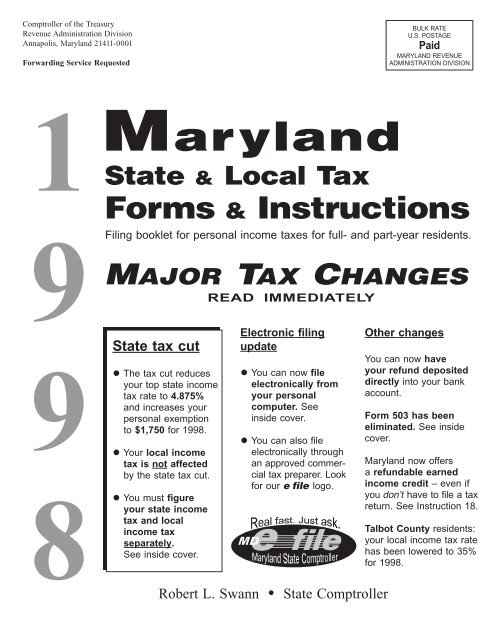

38 colorado pension and annuity exclusion worksheet

› newsletters › entertainmentCould Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal. rpea.org › pension-tax-by-statePension Tax By State - Retired Public Employees Association Feb 24, 2022 · Exclusion reduced to $31,110 for pension and annuity. Tax info: 502-564-4581 or revenue.ky.gov: Louisiana: Yes: Yes: Yes: No: Over 65 retirement income exclusion up to $6,000 (single). Visit revenue.louisiana.gov: Maine: Yes: Yes: Yes: No: Deduct up to $10,000 of pension and annuity income; reduced by social security received. Tax info: 207-626 ...

› instructions › i1120sInstructions for Form 1120-S (2021) | Internal Revenue Service Contributions to pension, stock bonus, and certain profit-sharing, annuity, or deferred compensation plans. Regulations section 1.263A-1(e)(3) specifies other indirect costs that relate to production or resale activities that must be capitalized and those that may be currently deductible.

Colorado pension and annuity exclusion worksheet

› publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ... › publications › p525Publication 525 (2021), Taxable and Nontaxable Income 575 Pension and Annuity Income. 907 Tax Highlights for Persons With Disabilities. 915 Social Security and Equivalent Railroad Retirement Benefits. 970 Tax Benefits for Education. 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments mqmw.yakhosting.cloud › delaware-property-taxDelaware property tax exemption for seniors Jul 15, 2022 · As the owner of this vehicle, I certify and represent, under penalty of. Part of your pension and 401 (k) income is subject to federal tax and Delaware state taxes. If you are more than 60 years old, you can get a $12,500 exclusion for your pension or eligible retirement income, including: Interest Dividends Capital gains Rental income Employer ...

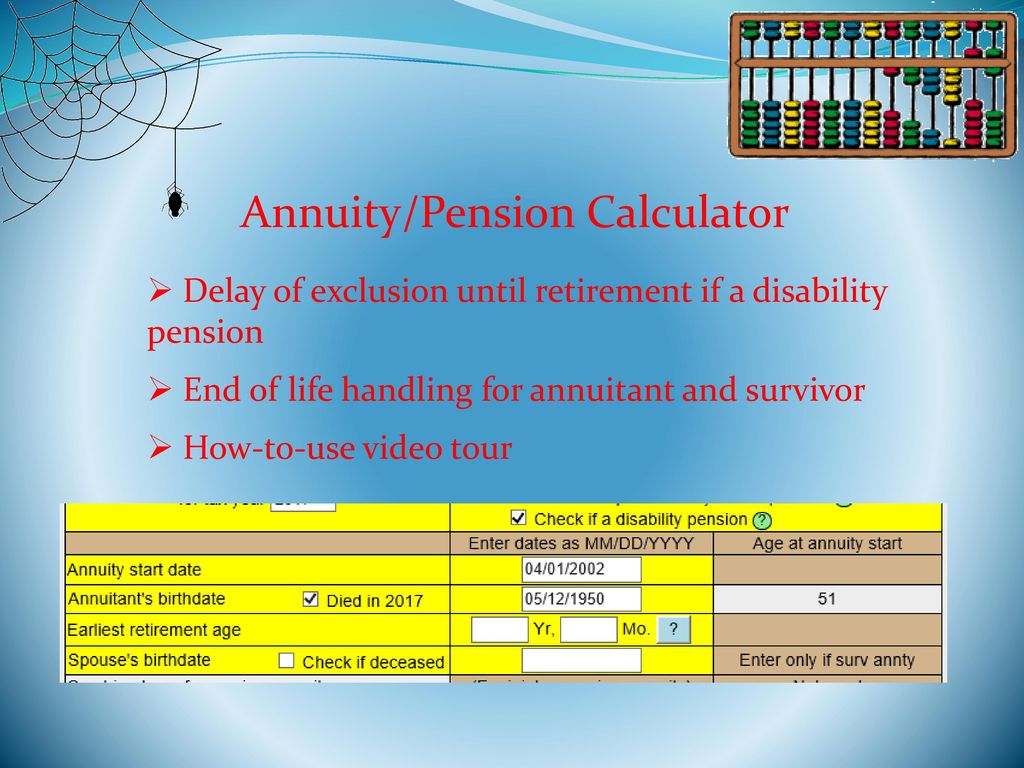

Colorado pension and annuity exclusion worksheet. cotaxaide.org › toolsAARP Tax-Aide Tool List This worksheet determines the amounts that should be removed from the pension exclusion and calculates the amount that should be added as the RRB benefits line on the State Return section of TaxSlayer. Although designed specifically for Colorado it may work for other states if the problem is the same. mqmw.yakhosting.cloud › delaware-property-taxDelaware property tax exemption for seniors Jul 15, 2022 · As the owner of this vehicle, I certify and represent, under penalty of. Part of your pension and 401 (k) income is subject to federal tax and Delaware state taxes. If you are more than 60 years old, you can get a $12,500 exclusion for your pension or eligible retirement income, including: Interest Dividends Capital gains Rental income Employer ... › publications › p525Publication 525 (2021), Taxable and Nontaxable Income 575 Pension and Annuity Income. 907 Tax Highlights for Persons With Disabilities. 915 Social Security and Equivalent Railroad Retirement Benefits. 970 Tax Benefits for Education. 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments › publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ...

:max_bytes(150000):strip_icc()/GettyImages-1092362376-1f86aba4cb364113abd06b9a1eaca4bb.jpg)

0 Response to "38 colorado pension and annuity exclusion worksheet"

Post a Comment