40 like kind exchange worksheet

IA 8824 Like Kind Exchange Worksheet 45-017 | Iowa Department Of Revenue GovConnectIowa Help Report Fraud & Identity Theft Menu IA 8824 Like Kind Exchange Worksheet 45-017 Breadcrumb Home Forms Form IA8824(45017).pdf Tax Type Corporation Income Tax Fiduciary Tax Franchise Income Tax Individual Income Tax Partnership Income Tax Print Stay informed, subscribe to receive updates. Subscribe to Updates Footer menu About 1031 Like Kind Exchange Calculator - Excel Worksheet Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Search This Site. Smart 1031 Exchange Investments. We don't think 1031 exchange investing should be so difficult.

Publication 334 (2021), Tax Guide for Small Business It is the most common type of nontaxable exchange. To be a like-kind exchange, the property traded and the property received must be both (i) real property, and (ii) business or investment property. Report the exchange of like-kind property on Form 8824, Like-Kind Exchanges. For more information about like-kind exchanges, see chapter 1 of Pub. 544.

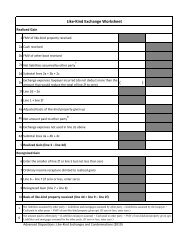

Like kind exchange worksheet

1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn We constantly attempt to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be valuable inspiration for people who seek an image according specific topic, you will find it in this site. Finally all pictures we have been displayed in this site will inspire you all. like kind exchange worksheet: Fill out & sign online | DocHub Adjusting paperwork with our comprehensive and intuitive PDF editor is simple. Follow the instructions below to fill out 1031 exchange worksheet 2019 online quickly and easily: Log in to your account. Log in with your email and password or register a free account to test the product before choosing the subscription. Import a form Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required.

Like kind exchange worksheet. 1031 Exchange Calculator | Calculate Your Capital Gains (As of 7/2019) Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements Microsoft is building an Xbox mobile gaming store to take on … Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games. Form 8824 - Like-Kind Exchange - taxact.com Click + Add Form 8824 to create a new copy of the form or click Edit to edit a form already created (desktop program: click Review instead of Edit). Click Like-Kind Exchange, abd continue with the interview process to enter your information. The amount on Line 25 of Form 8824 is the basis you would use to enter the acquired asset for ... U.S. appeals court says CFPB funding is unconstitutional - Protocol 20.10.2022 · And FTX was huge: The company ran the third-largest crypto exchange after Binance and Coinbase. Like Binance, FTX is not allowed to operate in the U.S. due to regulatory restrictions, though FTX has been in the crypto lobby in Washington. FTX and Binance are also relatively new players in the crypto industry.

Knowledge Base Solution - How do I complete a like-kind exchange in a ... To produce a Form 8824 Like-Kind Exchanges (and section 1043 conflict-of-interest sales) in the system using the automatic sale feature, the following steps are necessary: Note the schedule and entity number of the like-kind exchange. Example: Schedule E entity 1 Go to the Income/Deductions > Rent and Royalty worksheet. Unbanked American households hit record low numbers in 2021 Oct 25, 2022 · Those who have a checking or savings account, but also use financial alternatives like check cashing services are considered underbanked. The underbanked represented 14% of U.S. households, or 18. ... 1031 Exchange Examples | 2022 Like Kind Exchange Example Step 1 Determine Adjusted Basis After several years, Ron and Maggie's adjusted basis in the property may look like this: Step 2 Calculate Realized Gain Ron and Maggie are contemplating selling their property. They believe the property could be sold for $2,850,000. Assuming $50,000 in closing costs, their "realized gain" may look like this: Asset Worksheet for Like-Kind Exchange - Intuit Asset Worksheet for Like-Kind Exchange. I have exchanged a rental property, which had Asset Worksheets (for example) for House, Renovation, Roof, and Land. The new property has Building (27.5 yrs), Site Improvements (15 yrs), and Land. I've got the entries in Schedule E for both the relinquished and replacement properties, as well as the 8824 ...

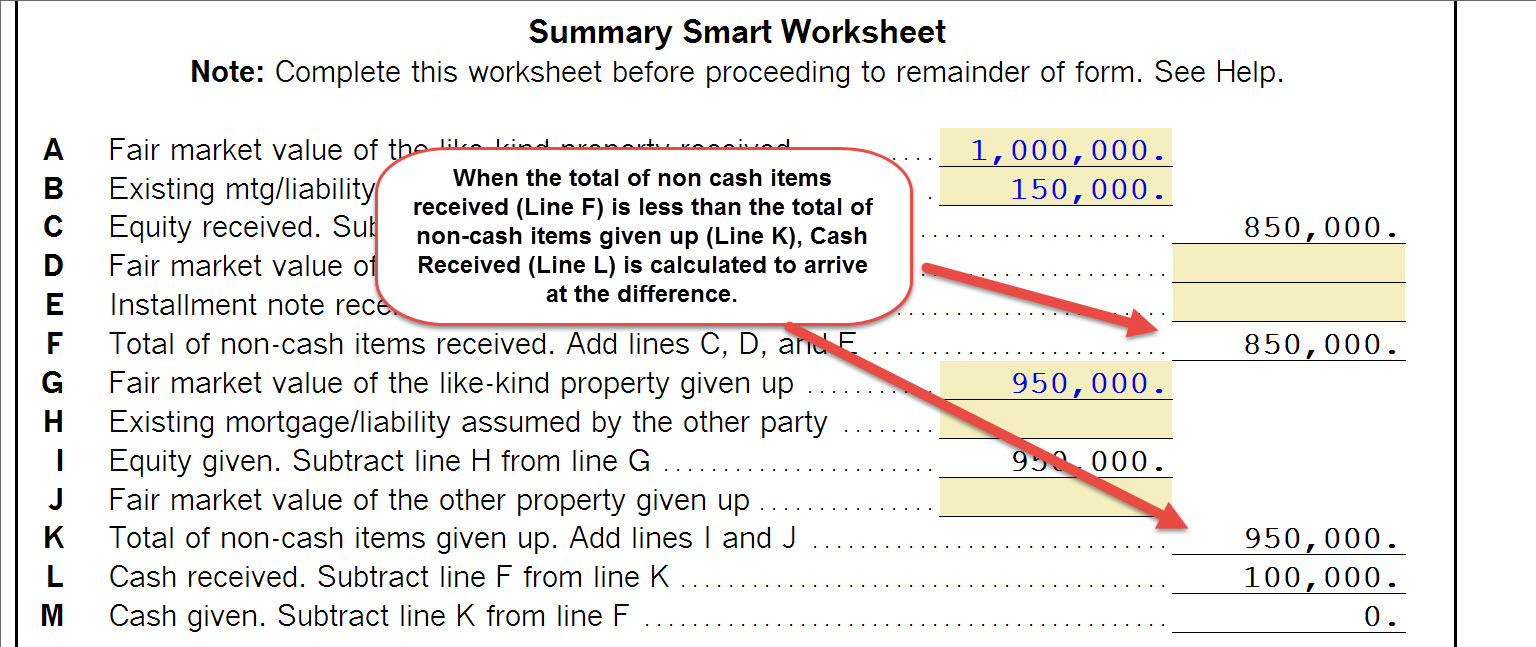

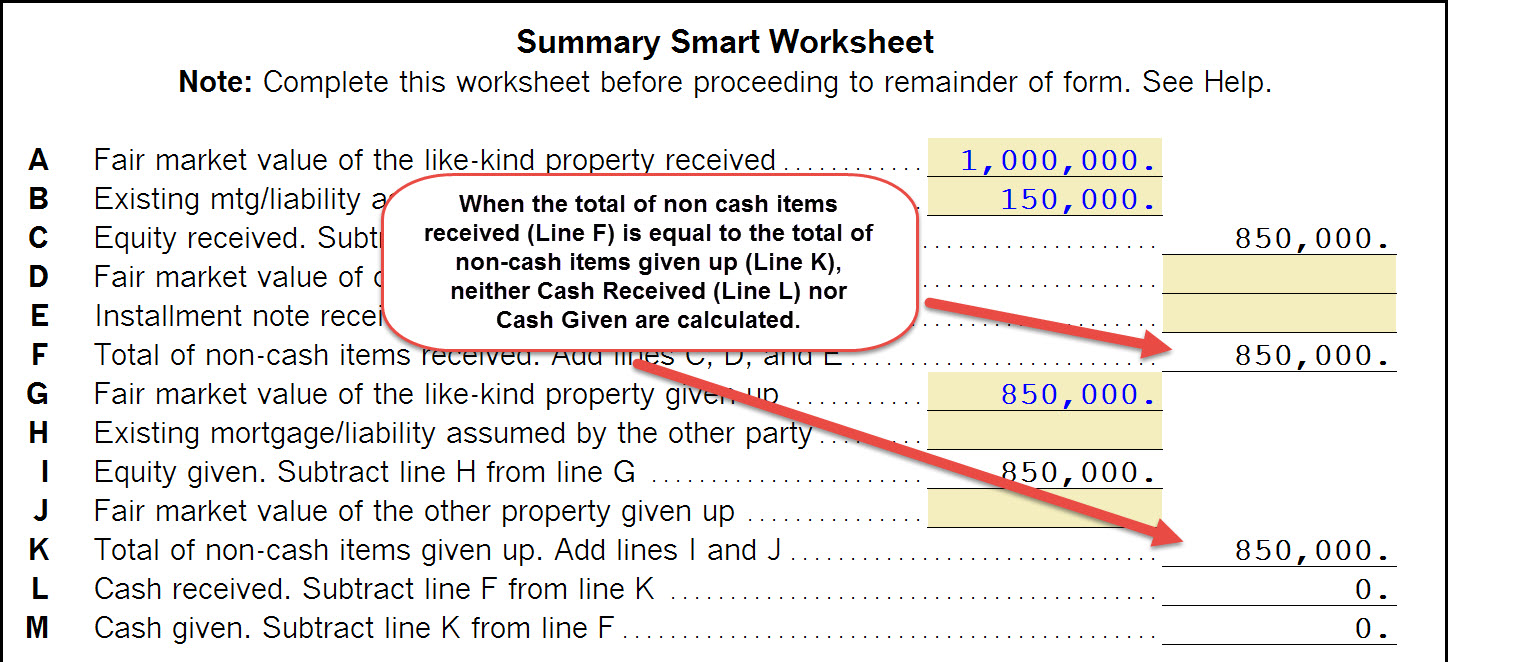

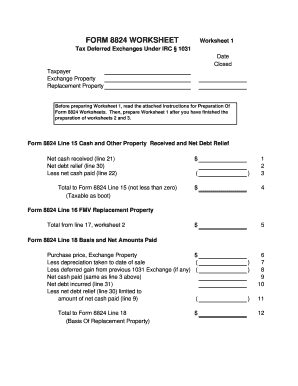

Instructions for Form 8824 (2022) | Internal Revenue Service Form 8824 figures the amount of gain deferred as a result of a like-kind exchange. Use Part III to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Also, use Part III to figure the basis of the like-kind property received. Like-Kind Exchange Worksheet - Thomson Reuters Support Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Qualifying property must be held for use in a trade or business or for investment. PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) Publication 537 (2021), Installment Sales | Internal Revenue Service Like-kind exchanges. Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. See Like-Kind Exchange, later. Photographs of missing children.

Like Kind Exchange Worksheet - The Math Worksheets Like kind exchange worksheet 1031 exchange calculator excel. Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. It was coming from reputable online ...

PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from WorkSheet #7 (Line J) $_____

PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

Microsoft takes the gloves off as it battles Sony for its Activision ... 12.10.2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition.

IRC 1031 Like-Kind Exchange Calculator Like-kind properties are those considered to have similar business or investment uses. Examples are: Trading up from an unimproved property to an improved one Trading up from vacant land to a commercial building Trading up from a single family unit to a small apartment building Time Limits of a Delayed Exchange

Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... 14.10.2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or

About Form 8824, Like-Kind Exchanges | Internal Revenue Service About Form 8824, Like-Kind Exchanges Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales.

Completing a like-kind exchange in the 1040 return 19.7.2022 · A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset. Open the Asset Entry Worksheet for the asset being traded.

Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required.

like kind exchange worksheet: Fill out & sign online | DocHub Adjusting paperwork with our comprehensive and intuitive PDF editor is simple. Follow the instructions below to fill out 1031 exchange worksheet 2019 online quickly and easily: Log in to your account. Log in with your email and password or register a free account to test the product before choosing the subscription. Import a form

1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn We constantly attempt to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be valuable inspiration for people who seek an image according specific topic, you will find it in this site. Finally all pictures we have been displayed in this site will inspire you all.

![2022 Rental Property Analysis Spreadsheet [Free Template]](https://wp-assets.stessa.com/wp-content/uploads/2021/06/13170845/Property_Analysis_Spreadsheet__Stessa_.png)

0 Response to "40 like kind exchange worksheet"

Post a Comment