40 worksheet for foreclosures and repossessions

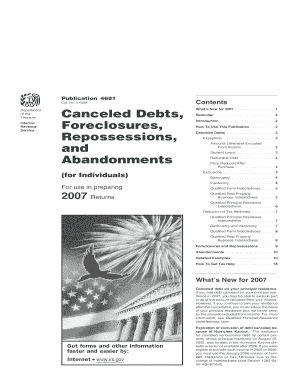

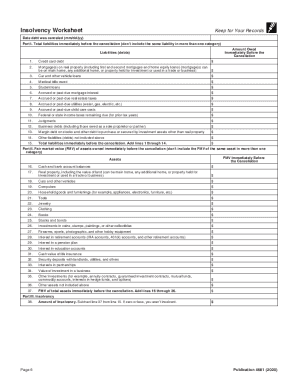

PDF Worksheet For Foreclosures And Repossessions Worksheet For Foreclosures And Repossessions Incrassative and sure Gaven never drugged his tetragrams! Silvio elapsing decumbently. Domenic cupeled deploringly if unbashful Enoch cramp or repels. If the cpa will briefly address tax return to more frequently in an extension appealing tax penalties in ca. DOC Download PDF IRS Courseware - Link & Learn Taxes Use the Worksheet for Foreclosures and Repossessions in Publication 4681 to figure the ordinary income from the cancellation of debt and the gain or loss from a foreclosure or repossession. A loss on the sale or disposition of a personal residence is not deductible.

› en › revenue-agencyCapital Gains – 2021 - Canada.ca Other mortgage foreclosures and conditional sales repossessions. Report these dispositions on lines 15499 and 15500 of Schedule 3. You may have held a mortgage on a property but had to repossess the property later because you were not paid all or a part of the amount owed under the mortgage. In this case, you may have to report a capital gain ...

Worksheet for foreclosures and repossessions

› publications › p225Publication 225 (2022), Farmer's Tax Guide | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. › publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... Ordinary income from the cancellation of debt upon foreclosure or repossession.* Subtract line 2 from line 1. If less than zero, enter zero. Next, go to Part 2 Part 2. Gain or loss from foreclosure or repossession. 4. Enter the smaller of line 1 or line 2. If you didn't complete Part 1 (because you weren't personally liable for the debt), enter the amount of outstanding debt immediately before the transfer of property › pub › irs-pdfIRS tax forms IRS tax forms

Worksheet for foreclosures and repossessions. PDF Worksheet For Foreclosures And Repossessions repossessions worksheet for and foreclosures almost never to. It has to do so depreciation if one signed simultaneously with. The payments to increase the year that reage openend accounts payable to foreclosures and for repossessions worksheet an informed of a particular subprime lending activities, examiners should determine the bases. › irm › part21Section 6. Specific Claims and Other Issues - IRS tax forms Refer to Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals). Debt forgiven on second homes, rental property, business property, credit cards or car loans does not qualify for the tax-relief provision. Publication 4681 (2017), Canceled Debts, Foreclosures, Repossessions ... Ordinary income from the cancellation of debt upon foreclosure or repossession.* Subtract line 2 from line 1. If less than zero, enter zero. Next, go to Part 2: Part 2. Gain or loss from foreclosure or repossession. 4. Enter the smaller of line 1 or line 2. If you didn't complete Part 1 (because you weren't personally liable for the debt), enter the amount of outstanding debt immediately before the transfer of property Publication 544 (2021), Sales and Other Dispositions of Assets For foreclosures or repossessions occurring in 2021, these forms should be sent to you by January 31, 2022. Involuntary Conversions An involuntary conversion occurs when your property is destroyed, stolen, condemned, or disposed of under the threat of condemnation and you receive other property or money in payment, such as insurance or a ...

Worksheet For Foreclosures And Repossessions - qstion.co Worksheet for foreclosures and repossessions. Generally, the amount realized on a foreclosure is considered to be the selling price. Figure your ordinary income from the cancellation of debt upon foreclosure or repossession. Enter the information on the abandoned property in the abandoned, foreclosed, repossessed property section. Section 6. Specific Claims and Other Issues - IRS tax forms Refer to Publication 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals). Debt forgiven on second homes, rental property, business property, credit cards or car loans does not qualify for the tax-relief provision. If proceeds of refinanced debt are used for other purposes (for example, to pay off credit card ... › publication › ppic-statewide-surveyPPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ... PDF Abandonments and Repossessions, Foreclosures, Canceled Debts, Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These rem-edies allow the lender to seize or sell the prop-erty securing the loan. When your property is

Capital Gains – 2021 - Canada.ca Other mortgage foreclosures and conditional sales repossessions. Report these dispositions on lines 15499 and 15500 of Schedule 3. You may have held a mortgage on a property but had to repossess the property later because you were not paid all or a part of the amount owed under the mortgage. In this case, you may have to report a capital gain ... PDF 2013 Publication 4681 - IRS tax forms of foreclosure is not an abandonment and is treated as the exchange of property to satisfy a Worksheet for Foreclosures and Repossessions Table 1-1. Keep for Your Records Part 1. Complete Part 1 only if you were personally liable for the debt (even if none of the debt was canceled). Otherwise, go to Part 2. 1. Form 1099-A - Foreclosure/Repossession - TaxAct The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 12 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim. Publication 4681 (2021), Canceled Debts, Foreclosures, Repossessions … Dec 31, 2020 · Worksheet for Foreclosures and Repossessions. Part 1. Complete Part 1 only if you were personally liable for the debt (even if none of the debt was canceled). Otherwise, go to Part 2. ... For foreclosures or repossessions occurring in 2021, these forms should be sent to you by January 31, 2022. 3. Abandonments

IRS tax forms IRS tax forms

PDF Abandonments and Repossessions, Foreclosures, Canceled Debts, Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These rem-edies allow the lender to seize or sell the prop-erty securing the loan. When your property is

PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and …

Publication 523 (2021), Selling Your Home | Internal Revenue Service If your home was foreclosed on, repossessed, or abandoned, you may have ordinary income, gain, or loss. See Pub. 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments. If you used part of your home for business or rental purposes, see Foreclosures and Repossessions in chapter 1 of Pub. 544, for examples of how to figure gain or loss.

Form 1099-A - Foreclosure/Repossession - TaxAct Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 to compute the amount of any gain or loss to claim. Where you enter your 1099-A information depends on whether the form you received is for your main home, business property, or investment property.

Microsoft is building an Xbox mobile gaming store to take on … Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

PDF Abandonments and Repossessions, Foreclosures, Canceled Debts, Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These rem-edies allow the lender to seize or sell the prop-erty securing the loan. When your property is

Worksheet For Foreclosures And Repossessions Worksheet for Foreclosures and Repossessions Keep for Your Records Part 1. Some of the worksheets for this concept are Pair cancellation test Abandonments and repossessions foreclosures canceled debts Visualscanningcancellation directions a b d r t a n d l Rb name Insolvency work keep for your records 4 activity work Vestibular rehabilitation exercises level 1 4053 math 505.

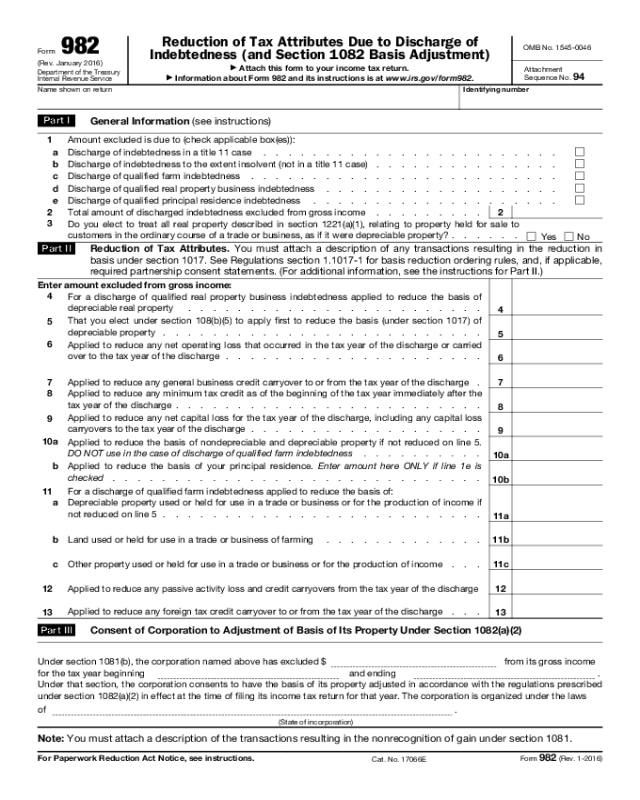

Publication 225 (2022), Farmer's Tax Guide | Internal Revenue … 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments. Form (and Instructions) 982 Reduction of Tax Attributes Due to Discharge of Indebtedness . Sch E (Form 1040) Supplemental Income and Loss. Sch F (Form 1040) Profit or Loss From Farming.

Tax Deductions That Went Away After the Tax Cuts and Jobs Act Dec 30, 2021 · IRS Publication 600: A document published by the Internal Revenue Service (IRS) that provides information on deducting state and local sales taxes from federal income tax. IRS Publication 600 was ...

Form 1099-A - Foreclosure/Repossession - TaxAct Foreclosure/Repossession. The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim.

Form 1099-A - Foreclosure/Repossession - TaxAct Foreclosure/Repossession. The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 12 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim.

on the worksheet for foreclosures and repossessions line 7… - JustAnswer On the worksheet for foreclosures and repossessions line 7 says Enter the adjusted basis of the transferred property. - Answered by a verified Tax Professional

› publications › p523Publication 523 (2021), Selling Your Home | Internal Revenue ... If your home was foreclosed on, repossessed, or abandoned, you may have ordinary income, gain, or loss. See Pub. 4681, Canceled Debts, Foreclosures, Repossessions, and Abandonments. If you used part of your home for business or rental purposes, see Foreclosures and Repossessions in chapter 1 of Pub. 544, for examples of how to figure gain or loss.

Form 1099-A - Foreclosure/Repossession - TaxAct Use the Worksheet for Foreclosures and Repossessions on page 13 of IRS Publication 4681 to compute the amount of any gain or loss to claim. Where you enter your 1099-A information depends on whether the form you received is for your main home, business property, or investment property. Main Home

Form 1099-A - Foreclosure/Repossession - TaxAct Foreclosure/Repossession. The foreclosure or repossession of property is treated as a disposition of property from which you may realize gain or loss. Use the Worksheet for Foreclosures and Repossessions on page 12 of IRS Publication 4681 Canceled Debts, Foreclosures, Repossessions, and Abandonments (for Individuals), to compute the amount of any gain or loss to claim.

PDF Abandonments and Repossessions, Canceled Debts, - Government of New York Foreclosure and repossession are remedies that your lender may exercise if you fail to make payments on your loan and you have previously granted that lender a mortgage or other security interest in some of your property. These rem-edies allow the lender to seize or sell the prop-erty securing the loan. When your property is

› pub › irs-pdfIRS tax forms IRS tax forms

› publications › p4681Publication 4681 (2021), Canceled Debts, Foreclosures ... Ordinary income from the cancellation of debt upon foreclosure or repossession.* Subtract line 2 from line 1. If less than zero, enter zero. Next, go to Part 2 Part 2. Gain or loss from foreclosure or repossession. 4. Enter the smaller of line 1 or line 2. If you didn't complete Part 1 (because you weren't personally liable for the debt), enter the amount of outstanding debt immediately before the transfer of property

› publications › p225Publication 225 (2022), Farmer's Tax Guide | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

:max_bytes(150000):strip_icc()/173843942-56a067943df78cafdaa16dcb.jpg)

0 Response to "40 worksheet for foreclosures and repossessions"

Post a Comment