41 1031 like kind exchange worksheet

IRS 1031 Exchange Worksheet And Vehicle Like Kind ... - Pruneyardinn We constantly attempt to show a picture with high resolution or with perfect images. IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example can be beneficial inspiration for those who seek an image according specific topic, you can find it in this site. Finally all pictures we've been displayed in this site will inspire you all. What Is a 1031 Exchange? Know the Rules - Investopedia Broadly stated, a 1031 exchange (also called a like-kind exchange or a Starker exchange) is a swap of one investment property for another. Most swaps are taxable as sales, although if yours meets ...

Like-Kind Property: What Qualifies and What Doesn't - 1031Gateway Like kind properties are real estate assets that qualify under Section 1031 of the Internal Revenue Code for exchange and for the deferment of capital gains taxes. Like kind properties must be held for business or investment purposes only, not for private use. They do not need to be of similar grade or quality to qualify.

1031 like kind exchange worksheet

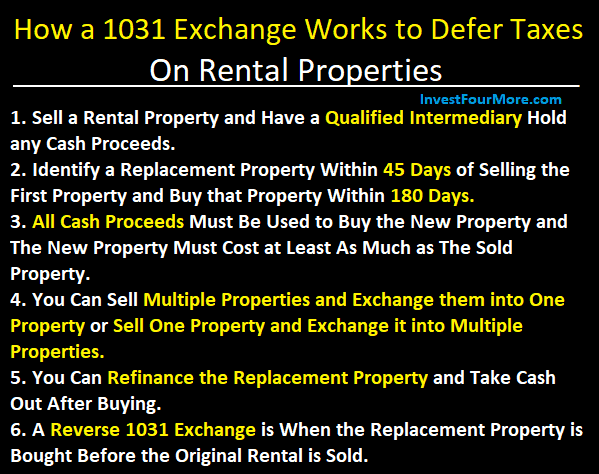

IRC 1031 Like-Kind Exchange Calculator This is known as the exchange period, and there is also an identification period, which is limited to 45 days after closing on the old property. These 45 days of identification are included in the 180-day exchange period. Calculate Your 1031 Deadline Use our 1031 deadline calculator to figure your deadlines. The Improvement Exchange 1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault. 1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain.

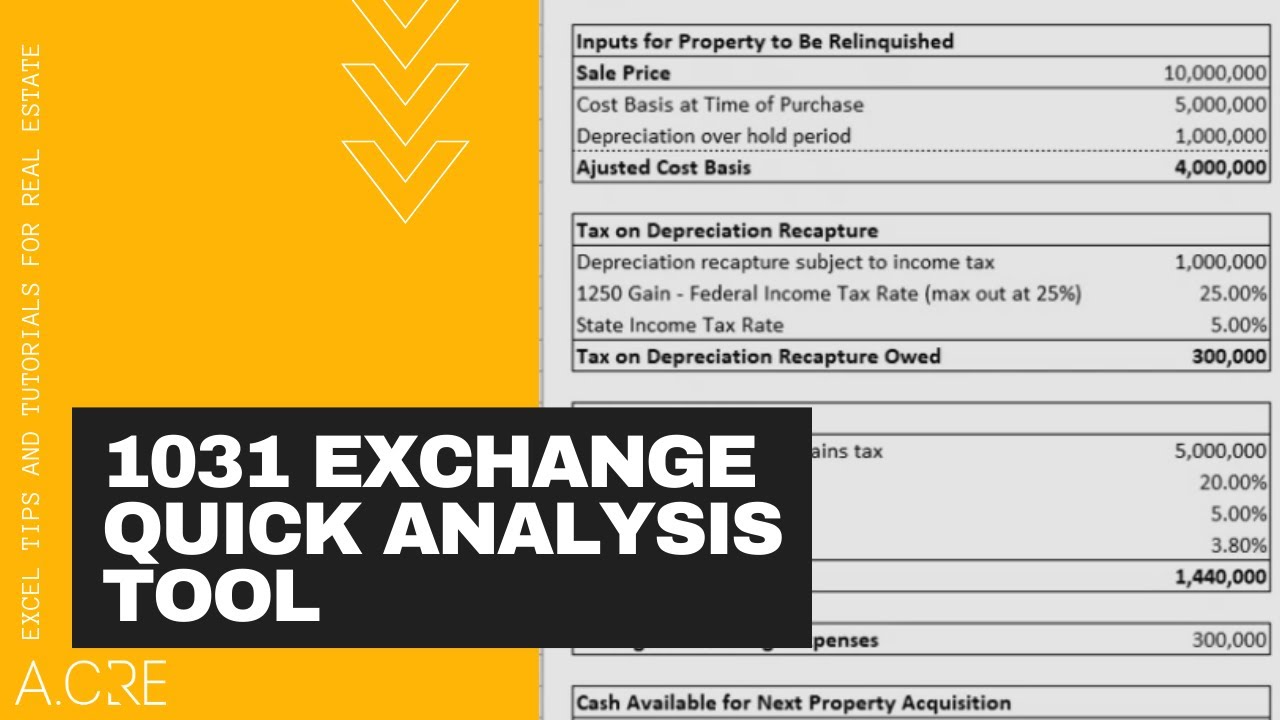

1031 like kind exchange worksheet. Solved: Like-Kind Exchange - Intuit The property I relinquished in the like-kind exchange is being reported in form 4797, "Sale of Business Property". There are two entries for the same property that was relinquished: 2392 Taproot Court 02/01/2010 05/08/2019 0. 34,308. 102,000. -30,831. 2392 Taproot Court Land 02/01/2010 05/08/2019 0. 0, 98,000. -44,636. 1031 Exchange for Dummies: What Investors NEED to Know! 1. Properties must be "like-kind". To qualify for a 1031 exchange, the relinquished property and the replacement property must be "like-kind.". This sounds like they need to be similar in type, but the IRS defines like-kind broadly. In practice, virtually any two types of real estate are like-kind. PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or 1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator

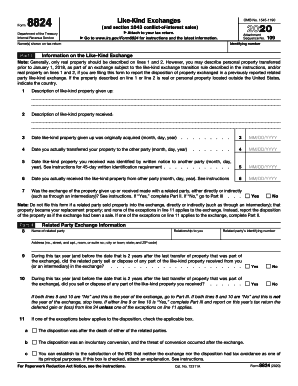

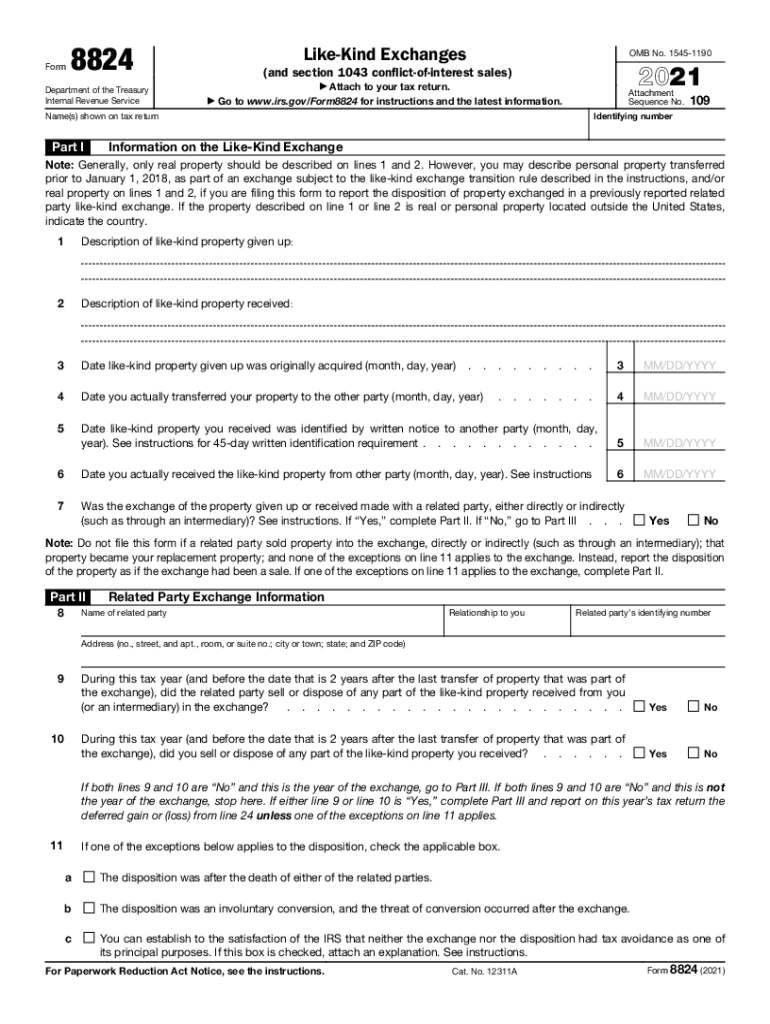

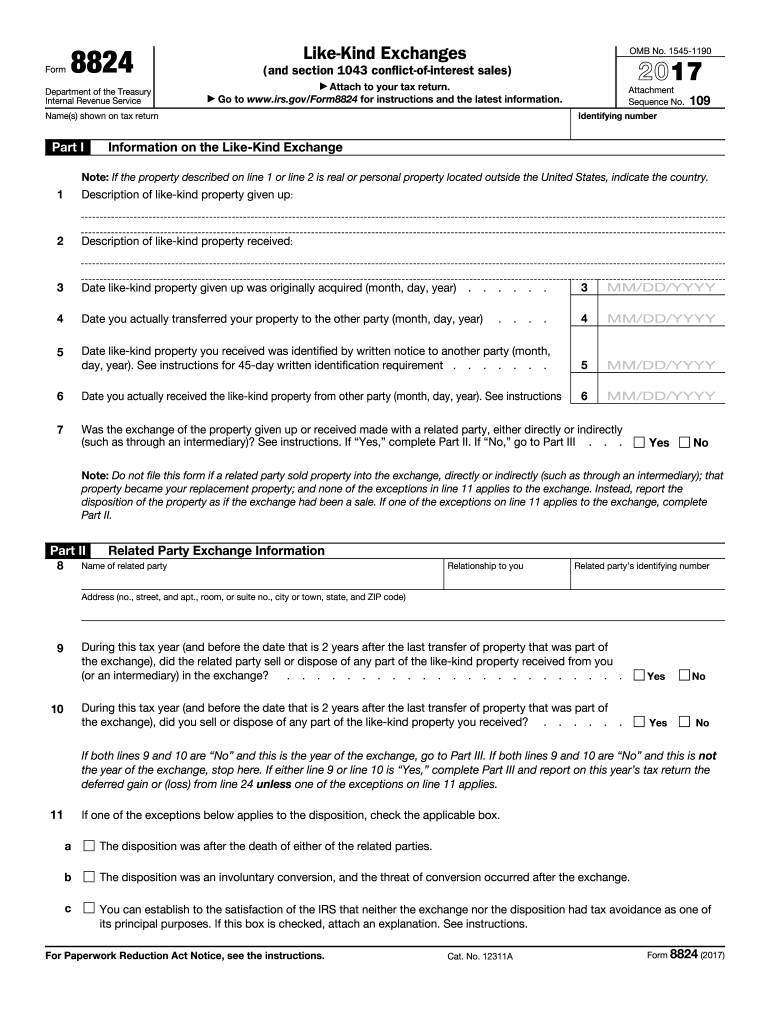

Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required. Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset. Open the Asset Entry Worksheet for the asset being traded ... About Form 8824, Like-Kind Exchanges | Internal Revenue Service About Form 8824, Like-Kind Exchanges Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales.

1031 Exchange: Like-Kind Rules & Basics to Know - NerdWallet What is a 1031 exchange? A 1031 exchange, named after section 1031 of the U.S. Internal Revenue Code, is a way to postpone capital gains tax on the sale of a business or investment... Guide to Like-Kind Exchanges & Taxable Boot Examples | 1031X $430,000 - 1031 proceeds as down payment $20,000 - Closing Costs $145,000 - New Mortgage Loan Here, For the Birds LLC faces $280,000 in capital gains (after closing costs). It will not incur any cash boot because the LLC transferred 100% of net equity from the relinquished property to the replacement property as down payment. PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form ... - 1031 kind properties, cash or other (not like-kind) property. Few real estate exchanges are multi-asset exchanges. See Page 1 of the Instructions for Form 8824 on multi-asset exchanges and reporting of multi-asset exchanges. d. Realized Gain, Recognized Gain and Basis of Like-Kind Property Received. This is the primary purpose of Part III and IRS ... 1031 Exchange Examples | 2022 Like Kind Exchange Example What is a 1031 Exchange? eBook The Ron and Maggie Story Let's take an example couple, Ron and Maggie 1, who purchased a small apartment building in California 10 years ago for $1,500,000. They invested $500,000 of their own money and financed the rest with a $1,000,000 mortgage. Purchase Price Step 1 Determine Adjusted Basis

Accounting for 1031 Like-Kind Exchange - BKPR When you receive boot in a like-kind exchange, you need to record the additional consideration along with the entries above. For instance, you give up property worth $50,000 and for a property worth $40,000 and a cash boot of $10,000. You can record this transaction with the following entry: Debit: Land (new) $40,000 Cash $ 10,000

1031worksheet - Learn more about 1031 Worksheet The net result is that the exchanger can use 100% of the proceeds (equity) from their sale to buy another property and defer the capital gains tax. The property involved in 1031 tax-deferred, like-kind exchange must be held for productive use in a trade or business, income production (rental) or investment purposes. Get 1031 List

Partial 1031 Exchange | 1031 Exchange for Lesser Value Property Buying Down in Value Example: Lila is selling her rental townhouse for $1,000,000 and plans to utilize a 1031 Exchange to defer her taxes. However, she can only locate new property with a sales price of $800,000 that she desires to purchase. The $200,000 not reinvested into like kind property will be taxable.

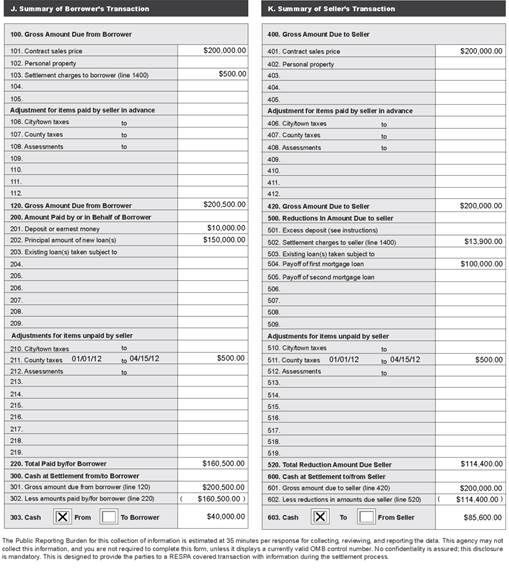

Form 8824: Do it correctly | Michael Lantrip Wrote The Book Form 8824 is the 1031 Exchange tax form. We explain the Instruction for completing it, using real numbers from a real deal, and your HUD-1. ... The name of the form is Form 8824, it's called Like-Kind Exchanges, and you attach it to your Form 1040 if you are an individual. ... FORM 8824 WORKSHEET.

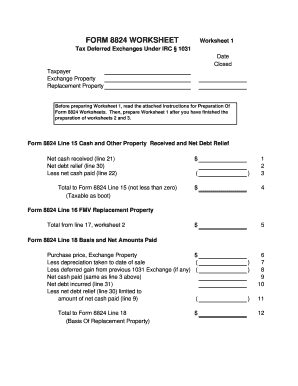

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

1031 Like Kind Exchange Worksheet And Form 8824 ... - Pruneyardinn We hope you can find what you need here. We constantly effort to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be beneficial inspiration for those who seek an image according specific categories, you can find it in this website.

Like-kind exchanges of real property - Journal of Accountancy The taxpayer pays $198,000 less in tax using a Sec. 1031 exchange versus an outright sale, a significant reduction from the $378,870 in tax savings that would accrue from using a like-kind exchange under the current rules; however, the like-kind exchange is still the better option. Use of a like-kind exchange is appropriate in myriad situations.

Replacement Property Basis Worksheet - efirstbank1031.com Replacement Property Basis Worksheet. ... Like-Kind Exchange Replacement Property Analysis of Tax Basis for Depreciation (pdf). Contact Us. Mail: Phone: Fax: Email: 1031 Corporation 1707 N Main St Longmont, CO 80501. 888-367-1031. 303-684-6899. 1031 Team. Resources. 1031 Exchange Manual; 1031 Exchange Manual; Escrow Services; What is a 1031 ...

1031 Exchange Calculator | Calculate Your Capital Gains (As of 7/2019) Example and Explanation of the Like-Kind Exchange Analysis: A rental property has a selling price of $500,000 and will have selling costs of $40,000. The property cost $150,000 when purchased ten years ago. No depreciable improvements have been made. The estimated depreciation taken is $45,000. D. Exchange Reinvestment Requirements

8824 - Like-Kind Exchange - Drake Software A like-kind exchange, also known as a Section 1031 exchange, is a way of trading or exchanging assets and, in many cases, deferring gain on the trade (or exchange). "Like-kind" means that the property you trade must be of the same type as the property you receive. Due to changes to Section 1031 exchanges listed in the Tax Cuts and Jobs Act ...

1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain.

1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault.

IRC 1031 Like-Kind Exchange Calculator This is known as the exchange period, and there is also an identification period, which is limited to 45 days after closing on the old property. These 45 days of identification are included in the 180-day exchange period. Calculate Your 1031 Deadline Use our 1031 deadline calculator to figure your deadlines. The Improvement Exchange

0 Response to "41 1031 like kind exchange worksheet"

Post a Comment