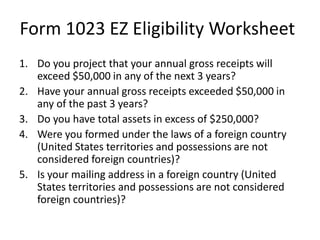

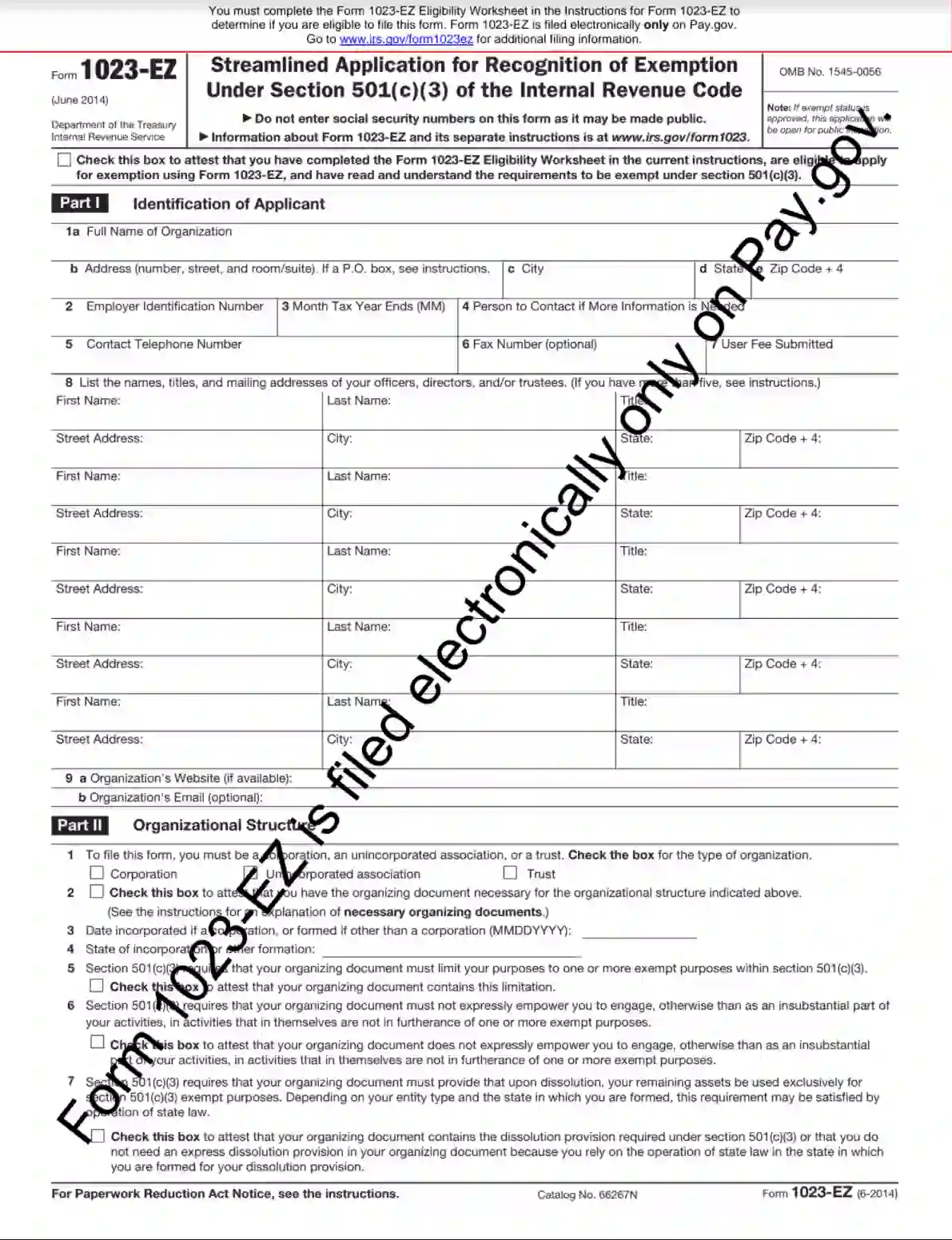

43 form 1023 ez eligibility worksheet

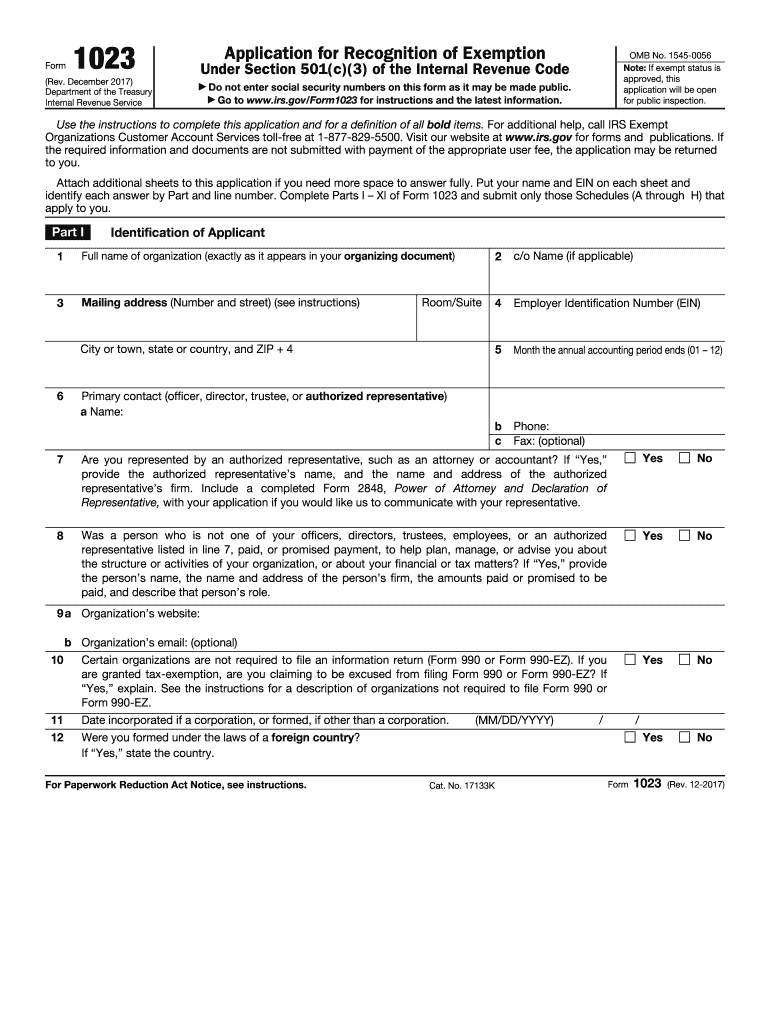

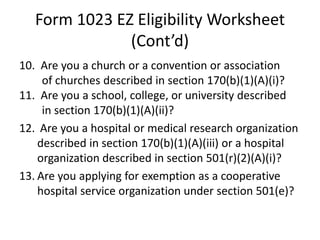

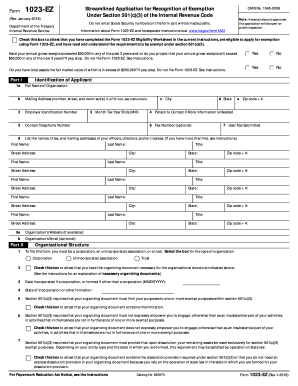

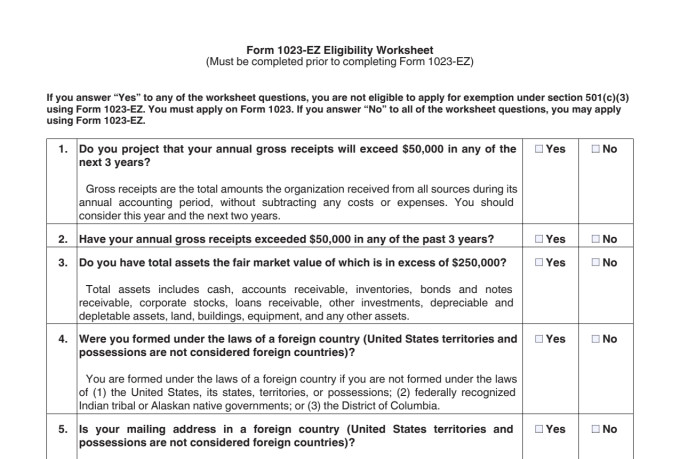

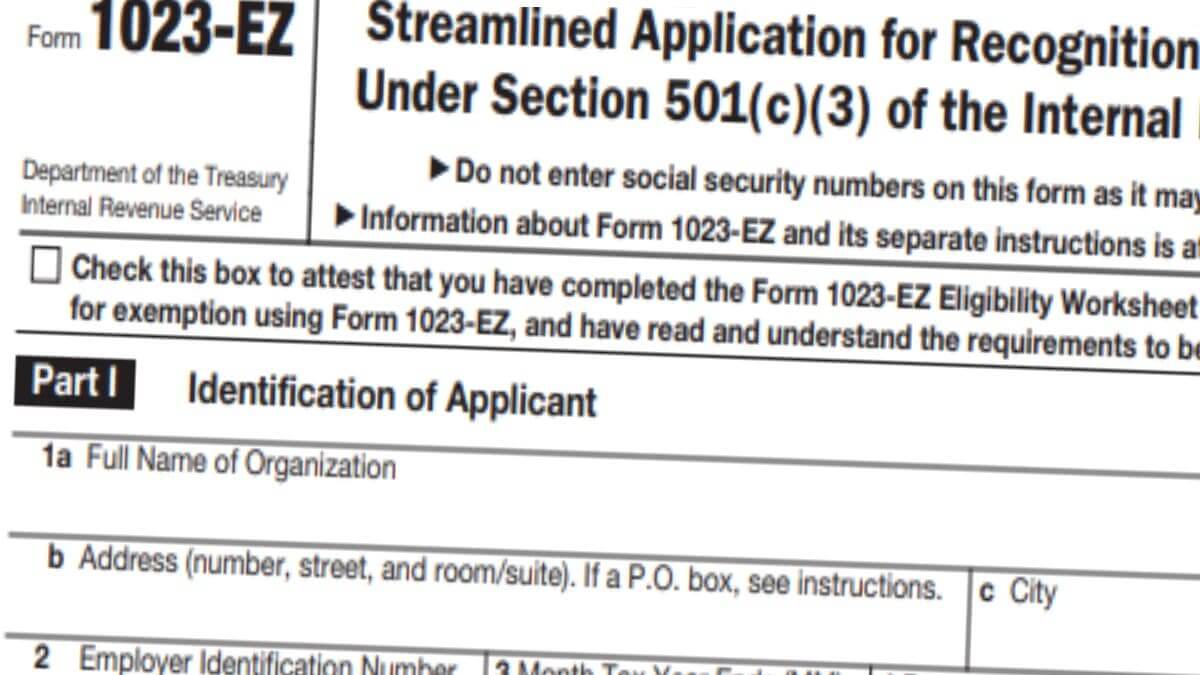

About Form 1023-EZ, Streamlined Application for Recognition of ... To submit Form 1023-EZ, you must: Read the Instructions for Form 1023-EZ and complete its Eligibility Worksheet found at the end of the instructions. (If you are not eligible to file Form 1023-EZ, you can still file Form 1023.) If eligible to file Form 1023-EZ, register for an account on Pay.gov. Enter "1023-EZ" in the search box. Complete the ... Instructions for Form 1023-EZ (01/2018) - IRS tax forms 20/12/2019 · Before completing the Form 1023-EZ, you must complete the Form 1023-EZ Eligibility Worksheet. If you meet the eligibility requirements, you must check the box at the top of Form 1023-EZ to attest that you are eligible to file the form. By checking the box, you are also attesting that you have read and understand the requirements to be exempt ...

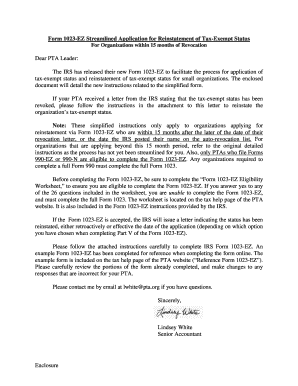

Form 1023-EZ Revisions | Internal Revenue Service - IRS tax forms Oct 05, 2022 · Question 29 on the Form 1023-EZ Eligibility Worksheet now requires that an automatically revoked organization applying for reinstatement must seek the same foundation classification they had at the time of automatic revocation to be eligible to use the Form 1023-EZ. Organizations that are not seeking that same foundation classification must ...

Form 1023 ez eligibility worksheet

Instructions for Form 1023 (01/2020) | Internal Revenue Service Complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you're eligible to file Form 1023-EZ. You can visit IRS.gov/Charities for more information on application requirements. Leaving a group exemption. A subordinate organization under a group exemption can use Form 1023 to leave the group and obtain individual … About Form 1023, Application for Recognition of Exemption … You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ PDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023. Current Revision. To submit Form 1023, you must: Register for an account on Pay.gov. Enter "1023" in the search box and select Form 1023. Complete the … Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons You can find the Form 1023 EZ eligibility worksheet from here. Conclusion. I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal rescue organizations and alike that don’t need big funds. If you are not feeding stray dogs and …

Form 1023 ez eligibility worksheet. Application for Recognition of Exemption Under Section 501(c)(3) You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file that form. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3). You'll have to create a single PDF file (not exceeding 15MB) that you will upload at the end of the application. … Instructions for Form 1023-EZ (Rev. January 2018) - IRS tax forms Form 1023-EZ Eligibility Worksheet. If you answer “Yes” to any of the worksheet questions, you are not eligible to apply for exemption under section 501(c)(3) using Form 1023-EZ. You must apply on Form 1023. If you answer “No” to all of the worksheet questions, you may apply using Form 1023-EZ. Before completing either Form 1023 or Form 1023-EZ, we recommend … Microsoft takes the gloves off as it battles Sony for its Activision ... 12/10/2022 · Microsoft is not pulling its punches with UK regulators. The software giant claims the UK CMA regulator has been listening too much to Sony’s arguments over its Activision Blizzard acquisition. Pay.gov - Streamlined Application for Recognition of Exemption … Note: You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you are eligible to file Form 1023-EZ. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3). See the Instructions for Form 1023-EZ for help in completing this application. The organization …

Unbanked American households hit record low numbers in 2021 25/10/2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ... Form 1023-EZ (1023EZ) Application for 501c3 Pros & Cons You can find the Form 1023 EZ eligibility worksheet from here. Conclusion. I could go on and on, but the honest verdict on the form 1023 EZ is that the only honest organizations that could possibly benefit from this short exemption application form are the very, very, very, small animal rescue organizations and alike that don’t need big funds. If you are not feeding stray dogs and … About Form 1023, Application for Recognition of Exemption … You must complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ PDF to determine if you are eligible to file this form. If you are not eligible to file Form 1023-EZ, you can still file Form 1023. Current Revision. To submit Form 1023, you must: Register for an account on Pay.gov. Enter "1023" in the search box and select Form 1023. Complete the … Instructions for Form 1023 (01/2020) | Internal Revenue Service Complete the Form 1023-EZ Eligibility Worksheet in the Instructions for Form 1023-EZ to determine if you're eligible to file Form 1023-EZ. You can visit IRS.gov/Charities for more information on application requirements. Leaving a group exemption. A subordinate organization under a group exemption can use Form 1023 to leave the group and obtain individual …

0 Response to "43 form 1023 ez eligibility worksheet"

Post a Comment