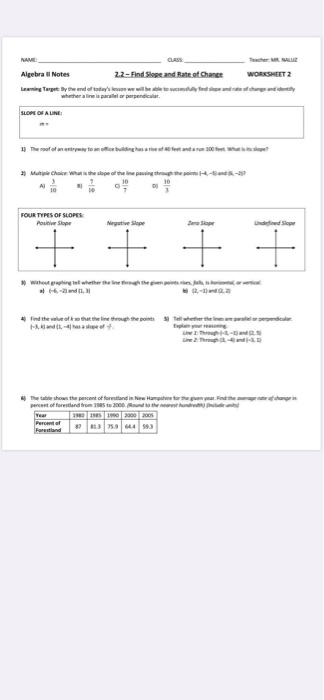

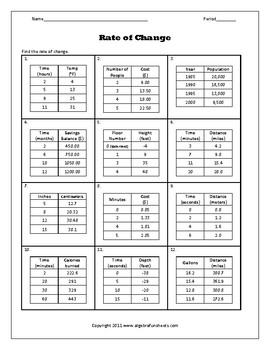

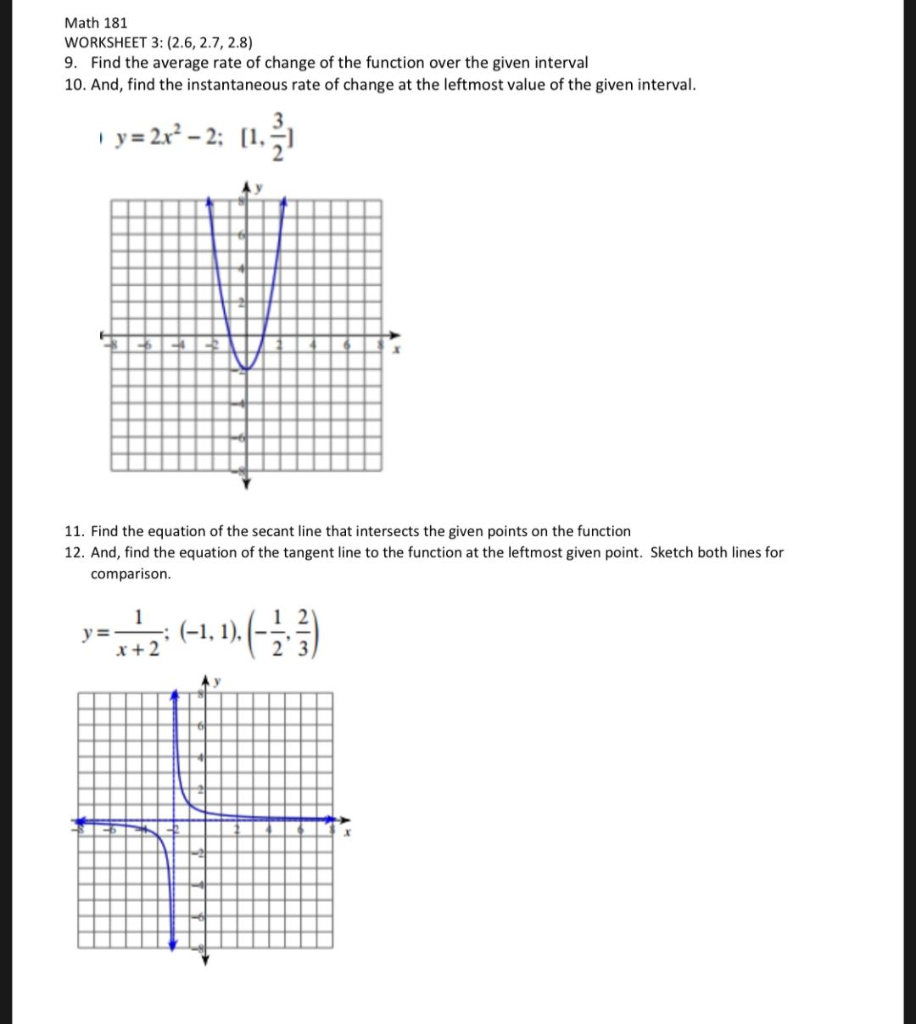

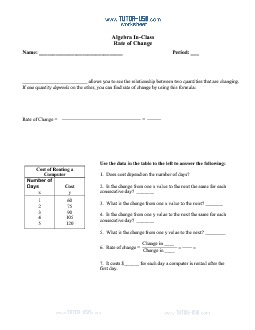

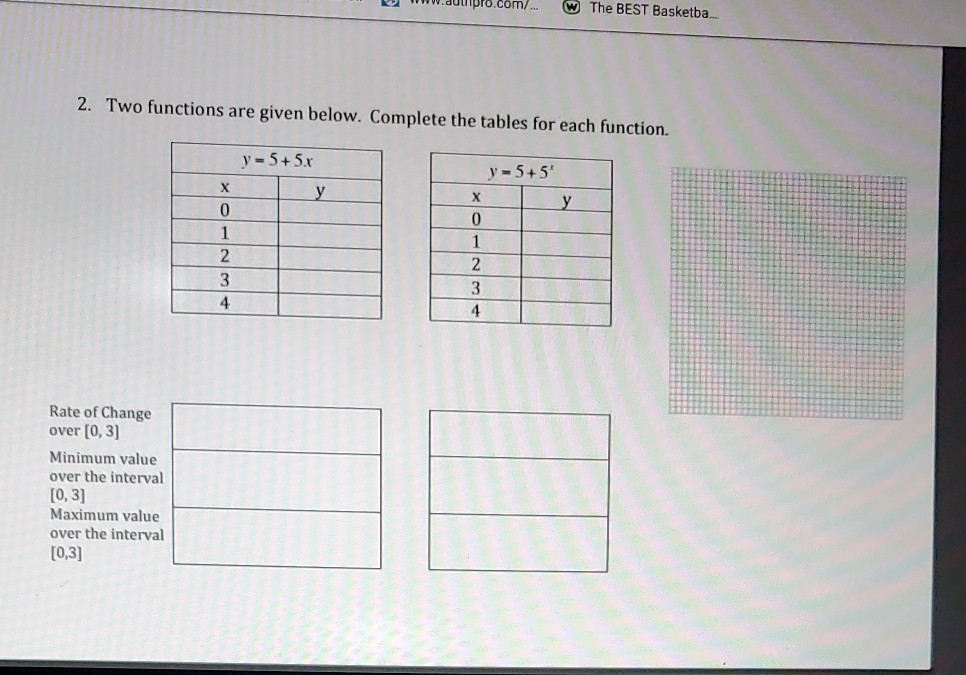

44 rate of change worksheet

Tables Created by BLS - Bureau of Labor Statistics Verkko19.7.2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. Achiever Papers - We help students improve their academic standing VerkkoWe offer free revision as long as the client does not change the instructions that had been previously given. In case a client want to alter the instructions, revision can be done but at a negotiated fee. We give 100% refund for an assignment that we …

› agencies › whdFamilies First Coronavirus Response Act: Questions and ... -DOL Any change to extend the requirement to provide leave under the FFCRA would require an amendment to the statute by Congress. The Consolidated Appropriations Act, 2021, extended employer tax credits for paid sick leave and expanded family and medical leave voluntarily provided to employees until March 31, 2021.

Rate of change worksheet

› pub › irs-pdfand Losses Capital Gains - IRS tax forms change, or worthlessness of small busi-ness investment company (section 1242) stock. 5. Ordinary loss on the sale, ex-change, or worthlessness of small busi-ness (section 1244) stock. 6. Ordinary gain or loss on securi-ties or commodities held in connection with your trading business, if you previ-ously made a mark-to-market election. Healthy Living | livestrong LIVESTRONG.COM offers diet, nutrition and fitness tips for a healthier lifestyle. Achieve your health goals with LIVESTRONG.COM's practical food and fitness tools, expert resources and an engaged community. › pub › irs-pdf2022 Form 1040-ES - IRS tax forms The 2022 Estimated Tax Worksheet, • The Instructions for the 2022 Estimated Tax Worksheet, • The 2022 Tax Rate Schedules, and • Your 2021 tax return and instructions to use as a guide to figuring your income, deductions, and credits (but be sure to consider the items listed under What's New, earlier). Matching estimated tax payments to ...

Rate of change worksheet. 2022 Form 1040-ES VerkkoThe 2022 Estimated Tax Worksheet, • The Instructions for the 2022 Estimated Tax Worksheet, • The 2022 Tax Rate Schedules, and • Your 2021 tax return and instructions to use as a guide to figuring your income, deductions, and credits (but be sure to consider the items listed under What's New, earlier). Matching estimated tax payments to ... › publications › p560Publication 560 (2021), Retirement Plans for Small Business For this reason, you determine the deduction for contributions to your own SEP-IRA indirectly by reducing the contribution rate called for in your plan. To do this, use the Rate Table for Self-Employed or the Rate Worksheet for Self-Employed, whichever is appropriate for your plan's contribution rate, in chapter 5. Publication 505 (2022), Tax Withholding and Estimated Tax Verkko2022 Tax Rate Schedules; Worksheet 2-2.2022 Estimated Tax Worksheet—Line 1 Estimated Taxable Social Security and Railroad Retirement Benefits; ... If you need to change the information later, you must fill out a new form. If you work only part of the year (for example, ... › retirement-center › calculatorsFEGLI Calculator - U.S. Office of Personnel Management Calculate the premiums for the various combinations of coverage, and see how choosing different Options can change the amount of life insurance and the premiums. See how the life insurance carried into retirement will change over time. Instructions. Enter the information below and click on the Calculate button to get a report on those choices.

Families First Coronavirus Response Act: Questions and Answers VerkkoHow do I compute the average regular rate of my employee who is paid a fixed salary each ... to provide FFCRA leave applies from the law’s effective date of April 1, 2020, through December 31, 2020. Any change to extend the requirement to provide leave under the FFCRA would require an amendment to the statute by Congress. The … Teaching Tools | Resources for Teachers from Scholastic VerkkoTeachers Teaching Tools Homepage. Items in this cart only reflect products added from the Teacher store.-+ sourceforge.net › projects › audacityAudacity download | SourceForge.net Jul 14, 2019 · tengo tiempo utilizando audacity al rededor de tres o cuatro años y a mi ver es una aplicación que es fácil de utilizar y a la vez te guía sobre lo que quieres hacer soy aficionado a la música y mi pasatiempo favorito es grabar es como un jovi para mi. Sin fines lucrativos ya que mis grabaciones son personales y como dije es un desestres que tengo he buscado otras aplicaciones y nada ... Canada Mortgage and Housing Corporation | CMHC VerkkoProfessionals. Access CMHC funding, research, knowledge and expertise to help make affordable housing a reality. Explore your options

Simple Healthy Living | livestrong VerkkoLIVESTRONG.COM offers diet, nutrition and fitness tips for a healthier lifestyle. Achieve your health goals with LIVESTRONG.COM's practical food and fitness tools, expert resources and an engaged community. Mortgage Payment Calculator | TD Canada Trust VerkkoWith a variable interest rate mortgage, the interest rate will change when the TD Mortgage Prime Rate changes. This means that the portion of your payment that goes toward the principal may rise or fall over the term of your mortgage, which can result in your amortization period getting longer or shorter. 7th grade constant rate of change worksheet with answers VerkkoID: 1752127 Language: English School subject: Math Grade/level: 9-12 Age: 13-18 Main content: Slope Other contents: Add to my workbooks (12) Download file pdf Embed in my website or blog.. Displaying all worksheets related to - Comparing Constant Rate Of Change.Worksheets are 03, Grades mmaise salt lake city, Hw, 03, Lesson plan, Rates … › pub › irs-pdf2022 Form 1040-ES - IRS tax forms The 2022 Estimated Tax Worksheet, • The Instructions for the 2022 Estimated Tax Worksheet, • The 2022 Tax Rate Schedules, and • Your 2021 tax return and instructions to use as a guide to figuring your income, deductions, and credits (but be sure to consider the items listed under What's New, earlier). Matching estimated tax payments to ...

Healthy Living | livestrong LIVESTRONG.COM offers diet, nutrition and fitness tips for a healthier lifestyle. Achieve your health goals with LIVESTRONG.COM's practical food and fitness tools, expert resources and an engaged community.

› pub › irs-pdfand Losses Capital Gains - IRS tax forms change, or worthlessness of small busi-ness investment company (section 1242) stock. 5. Ordinary loss on the sale, ex-change, or worthlessness of small busi-ness (section 1244) stock. 6. Ordinary gain or loss on securi-ties or commodities held in connection with your trading business, if you previ-ously made a mark-to-market election.

![Rate Of Change (Level 2 Word Problems) Worksheets [PDF] (7 ...](https://bl-cms-bkt.s3.amazonaws.com/prod/Rate_of_change_Level_2_word_problems_Thumbnail_a2a9ed3556.png)

/english/thumb.png)

0 Response to "44 rate of change worksheet"

Post a Comment