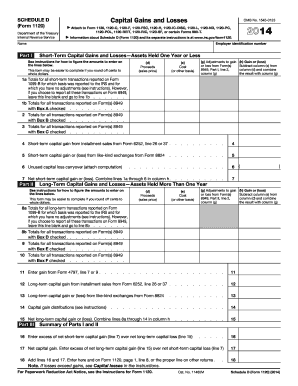

38 schedule d tax worksheet 2014

Publication 936 (2021), Home Mortgage Interest Deduction Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. 2022 Schedule C (Form 1040) - IRS tax forms Schedule SE, line 2. (If you checked the box on line 1, see instructions.) Estates and trusts, enter on . Form 1041, line 3. • If a loss, you . must . go to line 32.} 31. 32 . If you have a loss, check the box that describes your investment in this activity. See instructions. • If you checked 32a, enter the loss on both . Schedule 1 (Form ...

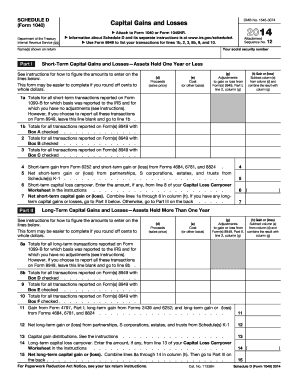

Topic No. 409 Capital Gains and Losses - IRS tax forms Nov 25, 2022 · If your net capital loss is more than this limit, you can carry the loss forward to later years. You may use the Capital Loss Carryover Worksheet found in Publication 550, Investment Income and Expenses or in the Instructions for Schedule D (Form 1040) PDF to figure the amount you can carry forward. Where to Report

Schedule d tax worksheet 2014

Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ... Publication 536 (2021), Net Operating Losses (NOLs) for ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Tax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

Schedule d tax worksheet 2014. 2022 Instructions for Schedule D (2022) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line ... Tax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Publication 536 (2021), Net Operating Losses (NOLs) for ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 505 (2022), Tax Withholding and Estimated Tax Use Worksheet 1-1 if, in 2021, you had a right to a refund of all federal income tax withheld because of no tax liability. Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will ...

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

0 Response to "38 schedule d tax worksheet 2014"

Post a Comment