40 2015 qualified dividends and capital gain tax worksheet

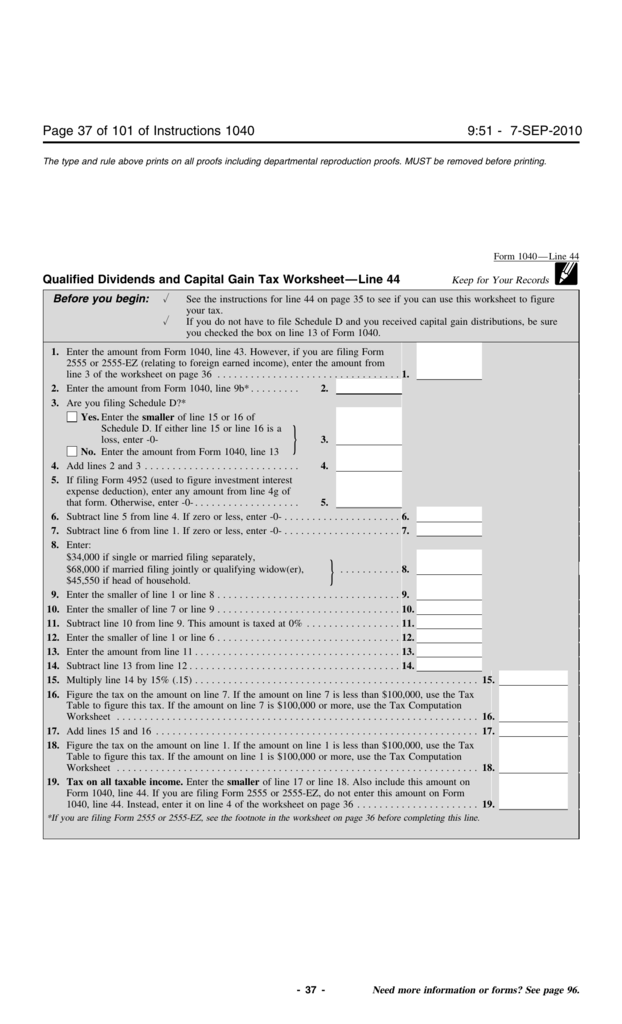

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow How to fill out the Qualified dividends tax worksheetsignNowcom 2015-2019 form on the internet: To start the form, use the Fill & Sign Online button or tick the preview image of the document. The advanced tools of the editor will lead you through the editable PDF template. Enter your official identification and contact details. ACC 330 6-1 Final Project Practice Tax Return Qualified Dividends and ... ISO 9001 2015 Checklist STI Chart SP2019 Premium This is a Premium Document. Some documents on StuDocu are Premium. Upgrade to Premium to unlock it. ACC 330 6-1 Final Project Practice Tax Return Qualified Dividends and Capital Gain Tax Worksheet Finished University Southern New Hampshire University Course Federal Taxation I (ACC330)

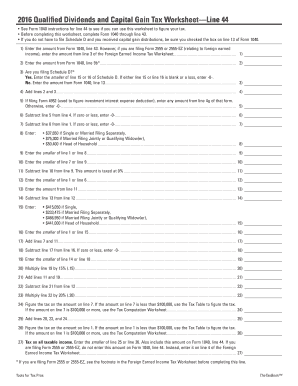

How do I download my Qualified Dividends and Capital Gain Tax Worksheet ... Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040 or 1040-SR, line 3a. You do not have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, line 7.

2015 qualified dividends and capital gain tax worksheet

ACC 330 Final Project Two Qualified Dividends and Capital Gains Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6. What is a Qualified Dividend Worksheet? - Money Inc All about the qualified dividend worksheet. If you have never come across a qualified dividend worksheet, IRS shows how one looks like; its complete name is "Qualified Dividend and Capital Gain Tax Worksheet-Line 11a."In short, it is referred to as Form 1040-Line 11a, and even before you try filing out the many blank spaces, you are supposed to have filled out Form 1040 through line 10. qualified dividends and capital gain tax worksheet 2019 pdf: Fill out ... Edit your qualified dividends and capital gain tax worksheet online Type text, add images, blackout confidential details, add comments, highlights and more. 02. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 03. Share your form with others

2015 qualified dividends and capital gain tax worksheet. ACC 330 Qualified Dividends and Capital Gain Tax Worksheet finished ... This is the completed Qualified Dividends and Capital Gain Tax Worksheet 2018 form 11a qualified dividends and capital gain tax 11a keep for your records before. 📚 ... ISO 9001 2015 Checklist; STI Chart SP2019; 1040 Internal Revenue Service - Fill Online, Printable ... - pdfFiller Get, Create, Make and Sign 1040 qualified dividends and capital gain tax worksheet 2019 Get Form eSign Fax Email Add Annotation Share 2019 Qualified Dividends And Capital Gains Worksheet is not the form you're looking for? Search for another form here. Comments and Help with depreciation deductible 1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments 2022 Instructions for Schedule D (2022) - IRS tax forms Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment. Also, use Form 8997 to report any capital gains you are deferring by investing in a QOF during the tax year and any QOF investment you disposed of during the tax year. Capital Asset

ACC 330 Final Project Two Qualified Dividends and Capital Gains.pdf ... Qualified Dividends and Capital Gain Tax Worksheet — Line 12a Keep for Your Records Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box ... Qualified Dividends and Capital Gains Worksheet.pdf Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is ... PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 7 is $100,000 or more, use the Tax Computation Worksheet..... 24. 25. Add lines 20, 23, and 24..... 25. 26. Figure the tax on the amount on line 1. If the amount on line 1 is less than $100,000, use ...

Qualified Dividends and Capital Gains Worksheet - StuDocu See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6. Qualified Dividends and Capital Gains Worksheet - StuDocu The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet. PDF and Losses Capital Gains - IRS tax forms To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information.

How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do.

Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gains Worksheet-Completed qualified dividends and capital gain tax 12a keep for your records before you begin: 11. 12. 13. 14. Introducing Ask an Expert 🎉 DismissTry Ask an Expert Ask an Expert Sign inRegister Sign inRegister Home Ask an ExpertNew My Library Courses You don't have any courses yet. Books

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 On average this form takes 7 minutes to complete The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures 2 check-boxes 29 other fields Country of origin: US File type: PDF

Capital Gains Tax Calculation Worksheet - The Balance Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock. There are no other investment purchases or sales. It's simple to match the sale with the purchase. We must organize the data.

PDF Capital Gains and Losses - IRS tax forms 2015. Attachment Sequence No. 12. Name(s) shown on return . Your social security number. ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). ... Qualified Dividends and Capital Gain Tax Worksheet: in the instructions

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow).

'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... This year I DASHED off this quick Excel to CHECK MY MATH on the 'Qualified Dividends And Capital Gain Tax Worksheet'. But, PLEASE check my math on the Excel. It is very, very basic. I had looked around for a spreadsheet like this. SIMPLE. Not complicated. Yes, I looked at 'Excel1040'. It was OVERKILL for my needs.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

Qualified Dividends and Capital Gain Tax Explained — Taxry If you have any questions about qualified dividends and capital gain tax, we have all the answers you need. Let Taxry help. ... The qualified dividends and capital gain tax worksheet can be helpful when you are filing your taxes and you have to pay this tax. Featured. Jun 12, 2022.

Get the free qualified dividends and capital gain tax worksheet 2015 ... The Qualified Dividends and Capital Gain Tax Worksheet is designed to calculate tax on capital gains at a particular rate. Since there is no common tax rate for all income, each income category should be calculated separately. In this worksheet the investors can benefit from the lower capital gains rates.

PDF 2015 Form 6251 - IRS tax forms Enter the amount from line 6 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44, or the amount from line 13 of the Schedule D Tax Worksheet in the instructions for Schedule D (Form 1040), whichever applies (as refigured for the AMT, if necessary) (see instructions). If

qualified dividends and capital gain tax worksheet 2019 pdf: Fill out ... Edit your qualified dividends and capital gain tax worksheet online Type text, add images, blackout confidential details, add comments, highlights and more. 02. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 03. Share your form with others

What is a Qualified Dividend Worksheet? - Money Inc All about the qualified dividend worksheet. If you have never come across a qualified dividend worksheet, IRS shows how one looks like; its complete name is "Qualified Dividend and Capital Gain Tax Worksheet-Line 11a."In short, it is referred to as Form 1040-Line 11a, and even before you try filing out the many blank spaces, you are supposed to have filled out Form 1040 through line 10.

ACC 330 Final Project Two Qualified Dividends and Capital Gains Before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 6.

0 Response to "40 2015 qualified dividends and capital gain tax worksheet"

Post a Comment