42 1031 exchange calculation worksheet

WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses. HUD-1. Line #. A. Exchange expenses from sale of Old Property. Commissions. $______. 2020 540NR Booklet | FTB.ca.gov - California If your Federal AGI is more than $203,341, subtract line n from the AGI Limitation Worksheet from line 31 of the Form 540NR and enter this amount on line 1 of the worksheet below to calculate your credit. Use the worksheet below to figure this credit using whole dollars only: Subtract line 11 from line 31 on Form 540NR and enter the result here.

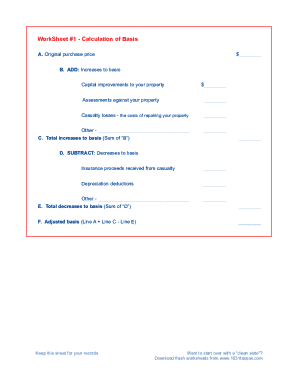

How Do You Calculate Basis for a 1031 Exchange? These calculations are being done on the property being sold, also called the relinquished property. 1.) Add closing costs to the purchase price. + $2,000 = $302,000 Any loan costs are not included in the basis calculation. 2.) Add any capital improvements such as replacing the roof, driveway, or a bathroom renovation.

1031 exchange calculation worksheet

️1031 Exchange Worksheet Excel Free Download| Qstion.co 1031 Exchange Worksheet Excel Master Of This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 replacement property received. (=)$ _____ 4.2 allocation of basis between two or more §1031 replacement properties: Real Estate: 1031 Exchange Examples - SmartAsset You use the total profit from the sale at $400,000 and take out a new loan worth $600,000. With this, you meet the 1031 exchange requirements. Example 4: Partial 1031 Exchange. It's actually possible to sell an investment property and satisfy the 1031 exchange rules without using all of your sale proceeds. This is called a partial exchange. PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #1 - Calculation of Basis WorkSheet #2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #4, 5 & 6 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

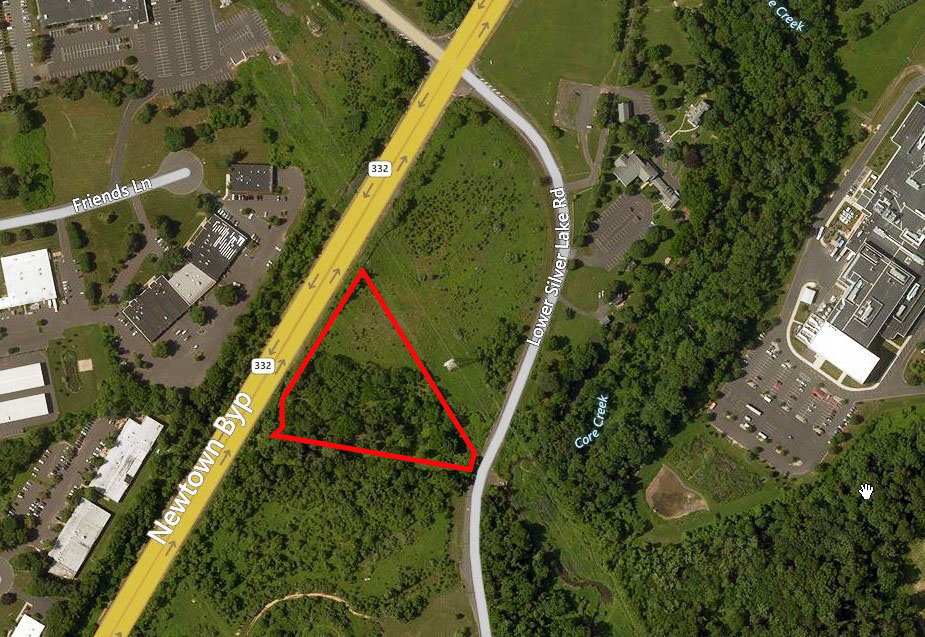

1031 exchange calculation worksheet. 1031 Exchange Calculator - Penn's Grant Realty Corporation We'll be happy to help you with calculating your 1031 Exchange, ... In no way should the completion of this worksheet be construed as tax advice or used in ... 1031 Exchange Calculator - Dinkytown.net Colorful, interactive, simply The Best Financial Calculators! This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received). 1031 Exchange Worksheet - Pruneyardinn Worksheet April 19, 2018 18:23. The 1031 Exchange worksheet is often used in financial and accounting applications, because it allows users to import or export data from one format to another. This can be done on any operating system, including Windows and Macs. There are many different kinds of formats you can work with when you use the worksheet. IRC 1031 Like-Kind Exchange Calculator This calculator will help you to determine how much tax deferment you can realize by performing a 1031 tax exchange instead of a taxable sale. We also offer a 1031 deadline calculator. For your convenience we list current Boydton mortgage rates to help real estate investors estimate monthly loan payments & find local lenders. Calculator Rates

2020 S Corporation Tax Booklet | FTB.ca.gov - California If a tax is shown on this worksheet, enter the amount of excess net passive income from line 8 of the worksheet on Form 100S, Side 2, line 16. For purposes of the built-in gains tax, enter on line 16 the amount from Schedule D (100S), Section A, Part III, line 11. Line 17, Line 18, and Line 19 like kind exchange worksheet: Fill out & sign online - DocHub Edit, sign, and share 1031 exchange worksheet 2019 online. ... exchange worksheet 1031 exchange worksheet 2020 like-kind exchange calculation example 1031 ... 1031 Tool Kit - TM 1031 Exchange Purchase 1031 Exchange Books Suggested Books on 1031 Exchanges Get a Free Property List & Consultation For specific questions about 1031 Exchanges call 1-877-486-1031 or click here to EMail. Informed Decisions Make the Best Investments Thousands of Properties Rated Each Month. Only the Worthiest Investments Make it Into Your Vault. 1031 Exchange Calculation Worksheet - Course Info 1031 Exchange Calculation Worksheet By Hafsa Omar. 1031 exchange calculation worksheet. This is the instructions for completion of form 8824 worksheets searching article. Select the right one from the below list. 1031 exchange calculation worksheet also listed Course in this content.

1031 Exchange Examples: Like-Kind Examples to Study & Learn From You would like to do a 1031 exchange into a $3,975,000 Walgreens in McDonough, Georgia. You exchange your $4,000,000 property for the $3,975,000 7-Eleven and an adjoining lot worth $275,000 for a total value of $4,250,000. This means that there is no boot in the exchange. You qualify for a full tax deferral for the $500,000 capital gain. Publication 523 (2021), Selling Your Home | Internal Revenue ... You acquired the property through a like-kind exchange (1031 exchange), during the past 5 years. See Pub. 544, Sales and Other Dispositions of Assets. You are subject to expatriate tax. For more information about expatriate tax, see chapter 4 of Pub. 519, U.S. Tax Guide for Aliens. The Ultimate Partial 1031 Boot Calculator (Avoid Boot!) You can reinvest $400,000 in a replacement property through a partial 1031 exchange and cash out the remaining $100,000 as boot, which will be taxed. Similarly, boot can help you reduce your debt. If you have $200,000 in mortgage debt on your $750,000 property, you can use a partial 1031 exchange to flip it for a fully paid off $750,000 property. 1031 Exchange Analysis Calculator - Inland Investments IMPORTANT: The projections or other information generated by the 1031 Exchange Analysis Calculator regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. This tool is provided for illustrative purposes only and is not intended to be tax advice nor may it be relied upon as such.

1031 Exchange Calculator - cchwebsites.com This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

1031 exchange calculation worksheet 1031 Exchange Calculation Worksheet - Ivuyteq. 13 Pics about 1031 Exchange Calculation Worksheet - Ivuyteq : 1031 Exchange Worksheet Excel | Universal Network, 1031 Exchange Worksheet Excel | TUTORE.ORG - Master of Documents and also Solved When choosing the sample size needed for an | Chegg.com.

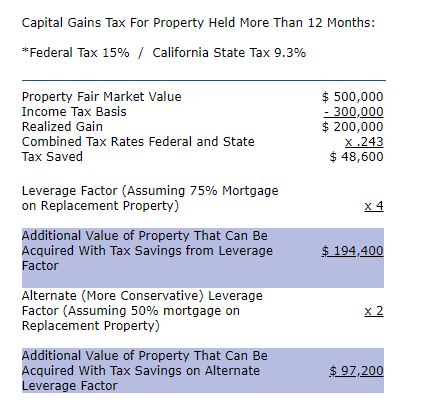

Capital Gains Calculator - 1031 Exchange Experts Equity Advantage Capital Gains Calculator. If the investor does not move forward with an exchange, then the transfer of property is a sale subject to taxation. An investor that holds property longer than 1 year will be taxed at the favorable capital gains tax rate. Otherwise, the sales gain is taxed at the ordinary income rate.

1031 Exchange Calculator | Estimate Tax Savings & Reinvestment the estimated taxes in the 1031 exchange calculator are based on current federal and state rates as well as the following assumptions: (1) the property you are selling is not your primary residence or your vacation home; (2) you have owned the property for at least one year; (3) tax projections are based on the marginal tax rate (highest rate) …

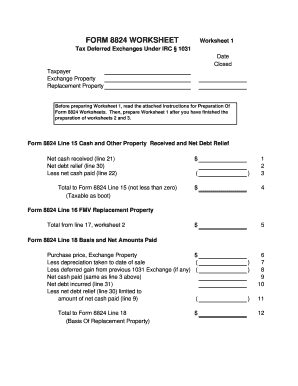

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

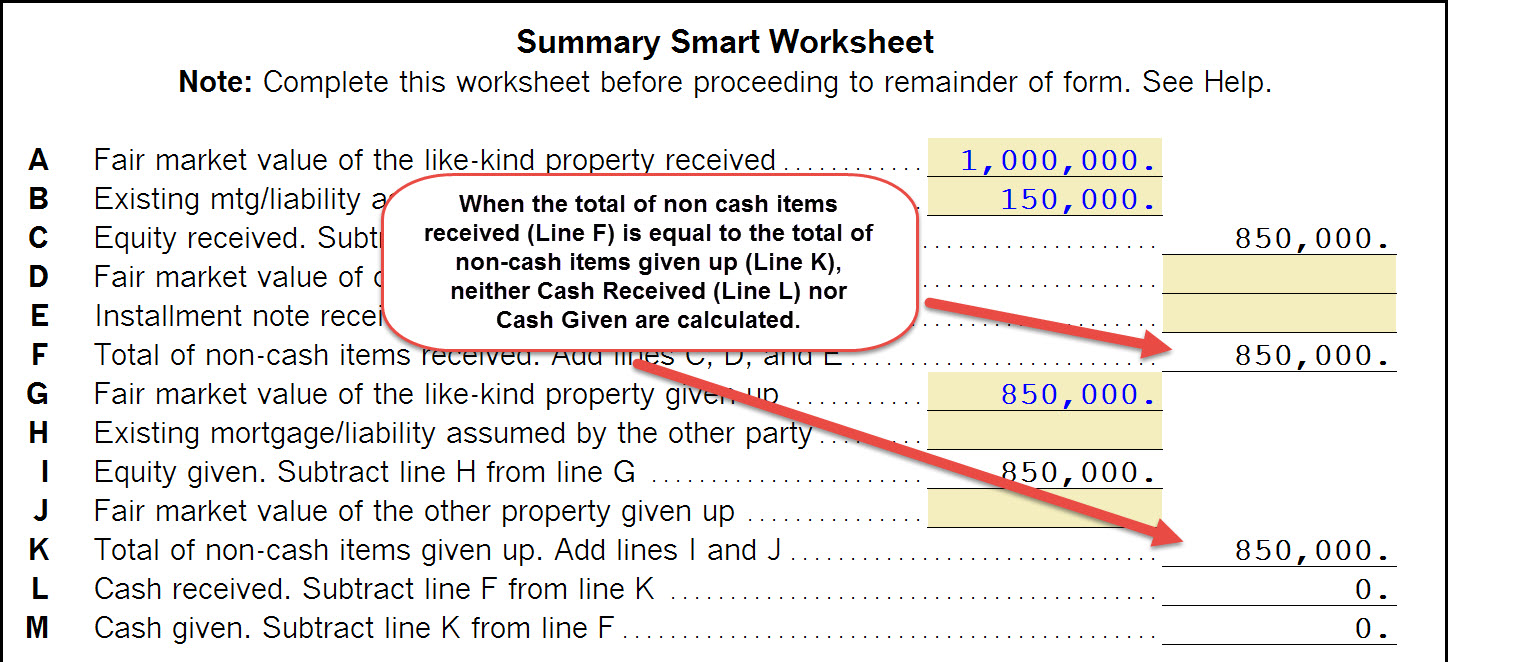

LIKE-KIND EXCHANGE WORKSHEET LIKE-KIND EXCHANGE WORKSHEET. A. Realized Gain. 1. + FMV of all property received. 2. + Total cash received. 3. + Liabilities transferred.

Overwatch 2 reaches 25 million players, tripling Overwatch 1 ... Oct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc

Form 8824 Worksheet - 1031 Corporation Exchange Professionals We have developed the enclosed worksheets for use in calculating the information used to report 1031 Exchanges on Form 8824. We hope that this worksheet ...

1031 Exchange Calculator | Calculate Your Capital Gains (1) To estimate selling costs use 8 to 10% of selling price consider discounts or allowances given by seller. (2) To estimate residential depreciation taken multiply purchase price of property being sold by 3%, times the number of years the property has been rented.

About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

Could Call of Duty doom the Activision Blizzard deal? - Protocol Oct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal.

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

Form 8824 - 1031 Corporation Exchange Professionals We have developed the enclosed worksheets for use in calculating the information used to report 1031 Exchanges on Form 8824 and herein enclose a copy. We hope that this worksheet will help with these reporting issues that present difficulties in reporting 1031 Exchanges.

PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday Allocation of the remaining cost basis to §1031 Replacement Prop erty: 4.1 Enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 Replacement Property received.....(=)$ _____ 4.2 Allocation of basis between two or more §1031 Replacement Properties: a.Identification: _____

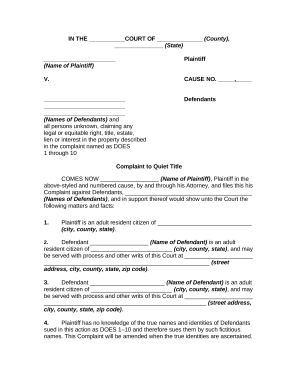

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms type of Section 1031 exchange is a simultaneous swap of one property for another. Deferred exchanges are more complex but allow flexibility. They allow you to dispose of property and subsequently acquire one or more other like-kind replacement properties. To qualify as a Section 1031 exchange, a deferred exchange must be distinguished from the case

Publication 537 (2021), Installment Sales | Internal Revenue ... 2018 Section 453A Calculation: Deferred Tax Liability: 1,827,006 x Applicable Percentage: 64.2857% x Underpayment Rate: 5.00% 2018 Section 453A additional tax: $58,725 2019 Section 453A Calculation: Note is paid off in full, so no deferred tax liability Deferred Tax Liability: 0 x Applicable Percentage: 64.2857% x Underpayment Rate: N/A

Like Kind Exchange Calculator - cchwebsites.com If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. Like Kind Exchange * indicates required. Like kind property given up: Date of Sale:*

1031 Exchange Calculator - The 1031 Investor This 1031 Exchange calculator will estimate the taxable impact of your proposed sale and purchase. To pay no tax when executing a 1031 Exchange, you must purchase at least as much as you sell (Net Sale) AND you must use all of the cash received (Net Cash Received).

What Expenses Are Deductible in a 1031 Exchange? Non-Allowed Exchange Expenses: Real Estate Taxes $ 26,500.00. Loan Payoff $ 455,000.00. Interest Owed $ 9,700.00. Total of Non-Allowed Exchange Expenses: $491,200.00*. * Of the Non-Allowed Exchange Expenses, both the Real Estate Taxes of $ 26,500.00 and the Interest Owed, in the amount of $9,700.00 are allowed as deductions to profit, just not ...

1031 Exchange Worksheet 2019 - Fill Online, Printable, Fillable, Blank Fill 1031 Exchange Worksheet 2019, Edit online. Sign, fax and printable from PC, iPad, ... Comments and Help with 1031 exchange excel spreadsheet download.

1031 Like Kind Exchange Calculator - Excel Worksheet That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet. Calculate the taxes you can defer when selling a property Includes state taxes and depreciation recapture Immediately download the 1031 exchange calculator

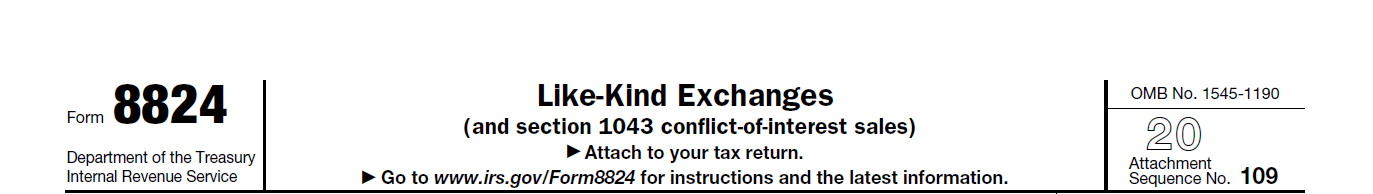

Instructions for Form 8824 (2022) | Internal Revenue Service Include your name and identifying number at the top of each page of the statement. On the summary Form 8824, enter only your name and identifying number, "Summary" on line 1, the total recognized gain from all exchanges on line 23, and the total basis of all like-kind property received on line 25.

1031 Exchange for Dummies: What Investors NEED to Know! 1. Properties must be "like-kind". To qualify for a 1031 exchange, the relinquished property and the replacement property must be "like-kind.". This sounds like they need to be similar in type, but the IRS defines like-kind broadly. In practice, virtually any two types of real estate are like-kind.

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #1 - Calculation of Basis WorkSheet #2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #4, 5 & 6 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

Real Estate: 1031 Exchange Examples - SmartAsset You use the total profit from the sale at $400,000 and take out a new loan worth $600,000. With this, you meet the 1031 exchange requirements. Example 4: Partial 1031 Exchange. It's actually possible to sell an investment property and satisfy the 1031 exchange rules without using all of your sale proceeds. This is called a partial exchange.

️1031 Exchange Worksheet Excel Free Download| Qstion.co 1031 Exchange Worksheet Excel Master Of This 1031 exchange calculator will estimate the taxable impact of your proposed sale and purchase. 4.1 enter the sum of line 1.1 minus lines 2.3 and 3.1 as the cost basis of all §1031 replacement property received. (=)$ _____ 4.2 allocation of basis between two or more §1031 replacement properties:

0 Response to "42 1031 exchange calculation worksheet"

Post a Comment