43 student loan interest deduction worksheet 1040a

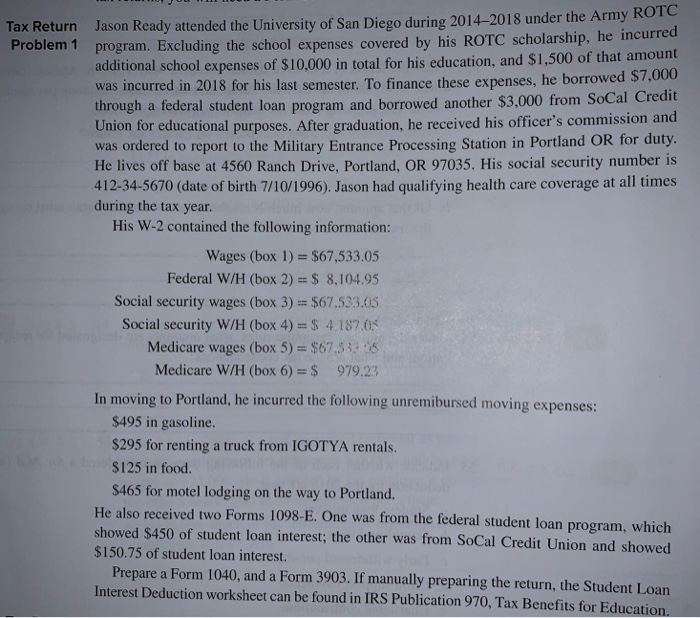

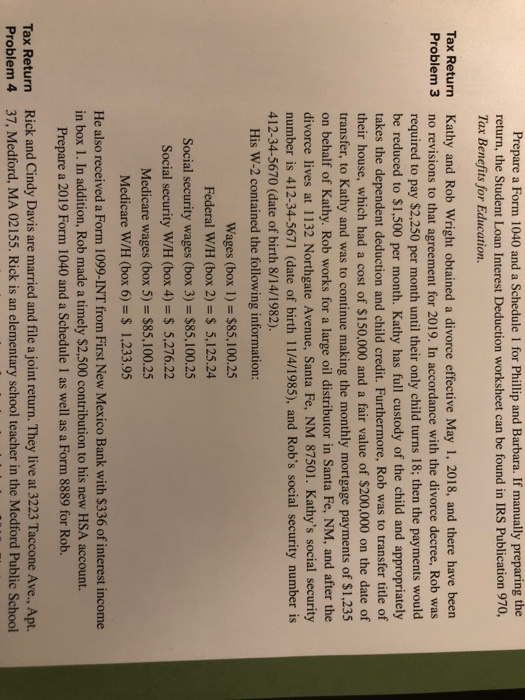

What is the Student Loan Interest Deduction? - commons-credit … Web12.10.2022 · The student loan interest deduction is an income tax deduction that is available to certain taxpayers who have paid interest on a qualified student loan during … Student Loan Tax Forms - Information & Tax Deductions | Sallie Mae Find information on student loan tax forms and learn how to check if the interest that you pay on your student loans may be eligible for a tax deduction. ... Refer to IRS Pub 970, Tax Benefits for Education, or review the Student Loan Interest Deduction Worksheet in your 1040 or 1040A instructions. Contact your tax advisor.

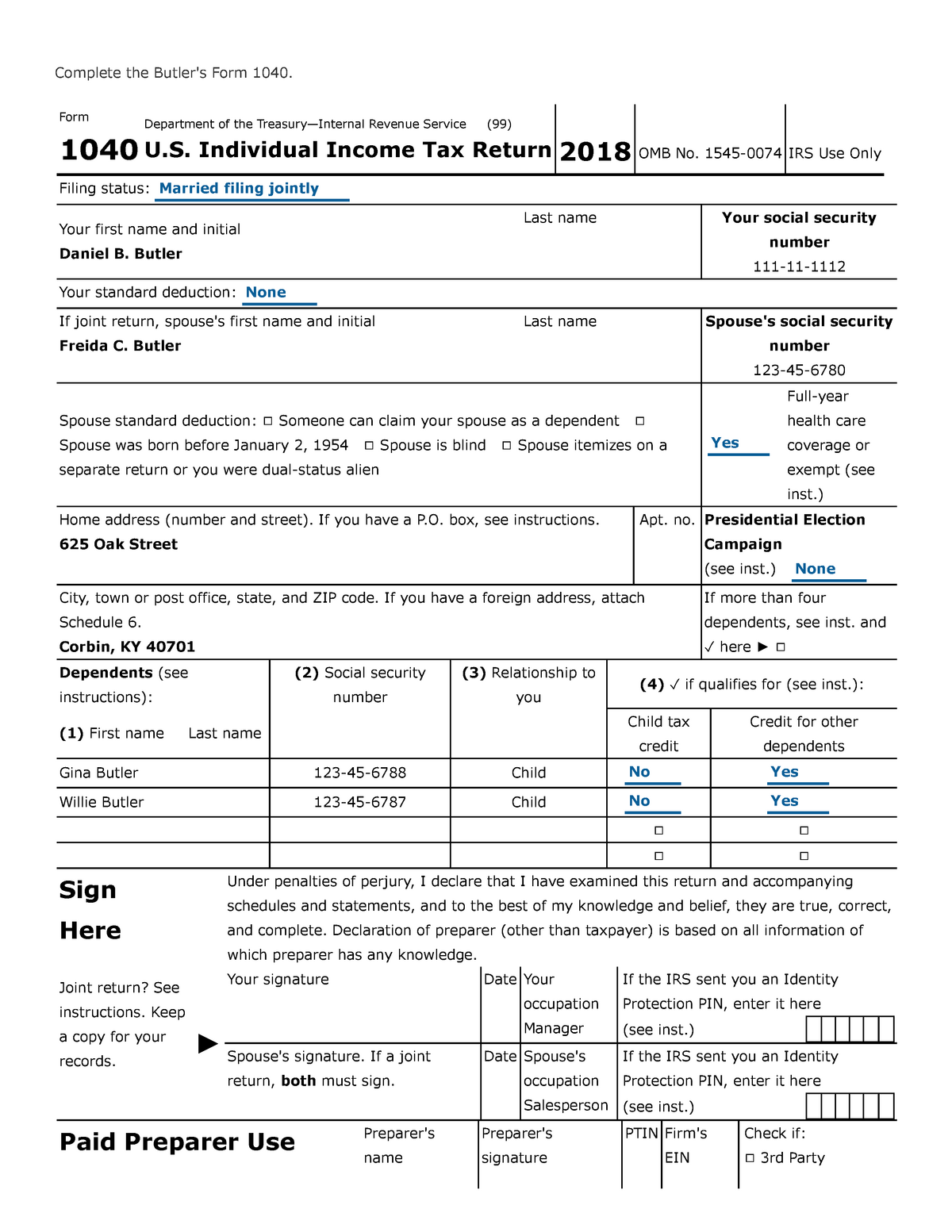

About Form 1040, U.S. Individual Income Tax Return Form 1040, 1040-SR, or 1040-NR, line 3a, Qualified dividends -- 06-APR-2021. Face masks and other personal protective equipment to prevent the spread of COVID-19 are tax deductible. New Exclusion of up to $10,200 of Unemployment Compensation -- 24-MAR-2021.

Student loan interest deduction worksheet 1040a

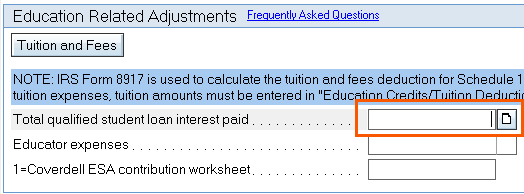

Solved: Re: Student Loan Deduction - Intuit I used the "Student Loan Interest Deduction Worksheet" from IRS.gov and confirmed the 1040 was correct. View solution in original post. 0 2,775 Reply. 4 Replies Lisa995. ... (Line 21 of the 1040 or Line 15 of the 1040A) ♪♫•*¨*•.¸¸♥Lisa♥ ¸¸.•*¨*•♫♪ 0 1 2,779 Reply. zmclell. Returning Member March 27, 2018 11:16 AM. Section 2300: Student Loan Interest Deductions | NACUBO Tax The instructions to Form 1040, Form 1040A, and Form 1040NR include a Student Loan Interest Deduction Worksheet. However, if the taxpayer is filing Form 2555 or 2555-EZ, Foreign Earned Income, or Form 4563, excluding income from American Samoa, or is excluding income from sources within Puerto Rico, he must complete Worksheet 4-1 in Pub. 970 . Student Loan Interest Deduction Worksheet | TaxAct Support Click the Forms button in the top left corner of the toolbar to open the Forms View; Scroll down and expand the federal Worksheets folder; Double click Form 1040 Student Loan Interest - Student Loan Interest Deduction Worksheet; Click on the Printer Icon above the worksheet to print. You are able to choose if you wish to send the output to a printer or a PDF document.

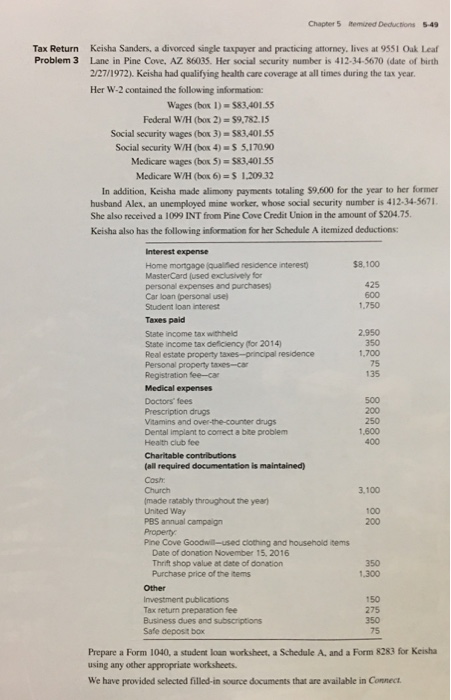

Student loan interest deduction worksheet 1040a. PDF WHICH FORM --1040, 1040A, or 1040EZ - IRS tax forms Only IRA or student loan adjustments to your income You do NOT itemize deductions 1040 Income or combined incomes over $50,000 Itemized Deductions Self-employment income Income from sale of property If you cannot use form 1040EZ or Form 1040A, you probably need a Form 1040. You can use the 1040 to report all types of income, deductions, and ... Student Loan Interest Deduction | H&R Block You paid interest on a qualified student loan. You can deduct the full $2,500 if your modified adjusted gross income (AGI) is $140,000 or less. Your student loan deduction is gradually reduced if your modified AGI is more than $140,000 but less than $170,000. You can't claim a deduction if your modified AGI is $170,000 or more. How Student Loan Interest Deduction Works | VSAC Here's how to calculate your student loan interest tax deduction: Get your 1098-E. If you paid $600 or more in interest on a qualified student or parent loan over the course of the year, your lender or servicer should send you an IRS Form 1098-E. They should also submit a copy of your 1098-E to the IRS. This form reports the amount of ... 1040 (2021) | Internal Revenue Service - IRS tax forms Standard Deduction Worksheet for Dependents—Line 12a; Line 12b; Line 13. Qualified Business Income Deduction (Section 199A Deduction) Line 16. Tax Yes. ... Also, if you file a separate return, you can't take the student loan interest deduction or the education credits, and you will only be able to take the earned income credit in very limited ...

PDF Latricia B Student Loan Interest Deduction Worksheet Qualified student loan interest deductions are reported on Form 1040, Schedule 1. DO NOT FILE July 11, 2019 DRAFT AS OF SCHEDULE 1 (Form 1040 or 1040-SR) Department of the Treasury Internal Revenue Service Additional Income and Adjustments to Income Student Loan Interest Deduction Worksheet - IRS tax forms Student Loan Interest Deduction Worksheet—Schedule 1, Line 33. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). Be sure you have read the . Exception in the instructions for this line to see if you can use this worksheet instead of Pub. Tax Deductions for Student Loan Interest - IRS.com Web19.12.2021 · The maximum amount you can claim for the student loan interest deduction per year is $2,500. The size of your tax deduction is reduced if your modified adjusted … Student Loan Interest Deduction Worksheet - TaxAct Click Forms in the top left corner of the toolbar to open the Forms View.; Scroll down and click to expand the federal Worksheets folder.; Double-click Form 1040 Student Loan Interest - Student Loan Interest Deduction Worksheet.; Click the Printer icon above the worksheet to print. You can send the output to a printer or a PDF document.

Student Loan Interest Deduction Worksheet - TaxAct The supporting calculations are in the Student Loan Interest Deduction Worksheet. If you paid a lender more than $600 in interest, you should receive a Form 1098-E Student Loan Interest Statement that lists your total interest payments to that lender. For additional information, go to the "Student Loan Interest Deduction" section of IRS ... What Is Form 1040-A? - The Balance Web31.03.2022 · Form 1040-A was also used to help determine whether students filling out the Free Application for Federal Student Aid ( FAFSA) could qualify for the simplified needs … Topic No. 456 Student Loan Interest Deduction - IRS tax forms If you file a Form 2555, Foreign Earned Income, Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa, or if you exclude income from sources inside Puerto Rico, refer to Worksheet 4-1, Student Loan Interest Deduction Worksheet in Publication 970 instead of the worksheet in the Instructions for Form 1040 (and Form 1040-SR). Publication 970 (2021), Tax Benefits for Education Student loan interest deduction. For 2021, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). ... You can use Worksheet 1-1 to figure the tax-free and taxable parts of your scholarship or fellowship grant. Reporting ...

Student loan interest deduction worksheet form 1040 Student Loan Interest Deduction Worksheet Form 1040 Line 33 1 Total qualified from ACTG 67 at Foothill College

Student Loan Interest Deduction Worksheet Form 1040, Line 33, … Enter the total interest you paid in 2016 on qualified student loans (see instructions). Do not enter more than $2,500 Enter the amount from Form 1040, line 22 or Form 1040A, line 15 Enter the total of the amounts from Form 1040, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to line 36 or from Form 1040A ...

How to Deduct Student Loan Interest – Tax Guide Paying back your student loan won't generate any tax breaks, but paying the interest on that student loan can, by reducing your income tax. The max deduction is $2,500 for your 2021 tax return. This max is per return, not per taxpayer, even if both spouses on a joint return qualify for the deduction. Note: Since federal student loan interest ...

Form 1040 2018 Student Loan Interest Deduction Worksheet Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 2018 Student Loan Interest Deduction Worksheet. On average this form takes 3 minutes to complete. The Form 1040 2018 Student Loan Interest Deduction Worksheet form is 1 ...

PDF Page 94 of 114 - IRS tax forms Student Loan Interest Deduction Worksheet—Schedule 1, Line 21. Figure any write-in adjustments to be entered on Schedule 1, line 24z (see the instructions for Schedule 1, line 24z). Be sure you have read the . Exception. in the instructions for this line to see if you can use this worksheet

Student Loan Interest Deduction Worksheet | TaxAct Support Click the Forms button in the top left corner of the toolbar to open the Forms View; Scroll down and expand the federal Worksheets folder; Double click Form 1040 Student Loan Interest - Student Loan Interest Deduction Worksheet; Click on the Printer Icon above the worksheet to print. You are able to choose if you wish to send the output to a printer or a PDF document.

Section 2300: Student Loan Interest Deductions | NACUBO Tax The instructions to Form 1040, Form 1040A, and Form 1040NR include a Student Loan Interest Deduction Worksheet. However, if the taxpayer is filing Form 2555 or 2555-EZ, Foreign Earned Income, or Form 4563, excluding income from American Samoa, or is excluding income from sources within Puerto Rico, he must complete Worksheet 4-1 in Pub. 970 .

Solved: Re: Student Loan Deduction - Intuit I used the "Student Loan Interest Deduction Worksheet" from IRS.gov and confirmed the 1040 was correct. View solution in original post. 0 2,775 Reply. 4 Replies Lisa995. ... (Line 21 of the 1040 or Line 15 of the 1040A) ♪♫•*¨*•.¸¸♥Lisa♥ ¸¸.•*¨*•♫♪ 0 1 2,779 Reply. zmclell. Returning Member March 27, 2018 11:16 AM.

0 Response to "43 student loan interest deduction worksheet 1040a"

Post a Comment