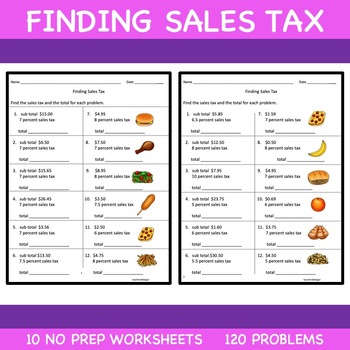

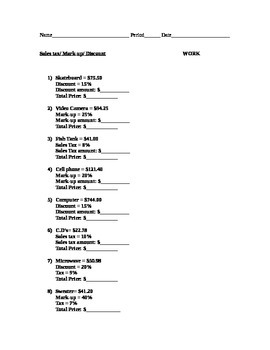

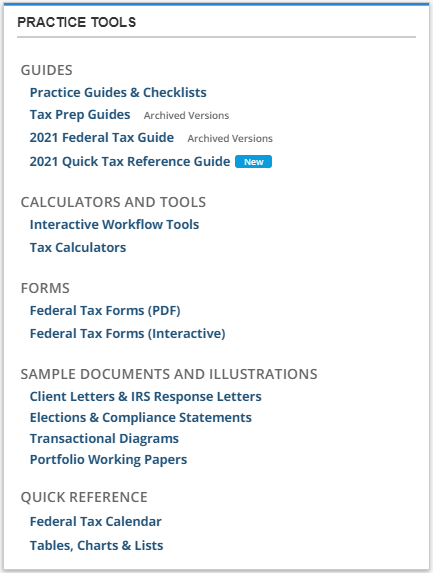

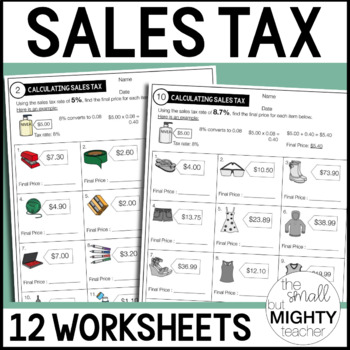

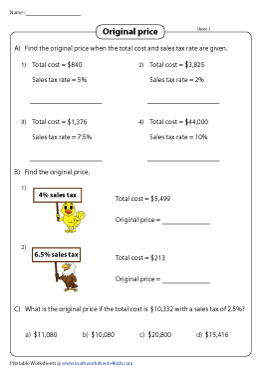

45 calculating sales tax worksheet pdf

› 2022/10/12 › 23400986Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... Self-Employed Individuals Tax Center | Internal Revenue Service Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals PDF, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR.

charitable-worksheet.pdffiller.comDonation Value Guide 2021 Spreadsheet - Fill Online ... The Salvation Army Donation Guide Spreadsheet is helpful in terms of calculating the cash equivalent of the goods donated so that this amount can be reported as a desired tax write-off. The form lists the average prices of all the possible goods and the approximate amount that can be paid for certain items at thrift stores.

Calculating sales tax worksheet pdf

› lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing › self-employed-individuals-tax-centerSelf-Employed Individuals Tax Center | Internal Revenue Service Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals PDF, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR. Frequently Asked Questions About International Individual Tax Matters ... If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555, you must calculate your tax liability using the Foreign Earned Income Tax Worksheet (for Line 16) in the Form 1040 and 1040-SR Instructions or your income tax preparation software.

Calculating sales tax worksheet pdf. Individual Income Tax Forms - 2021 | Maine Revenue Services Schedule PTFC/STFC (PDF) Property Tax Fairness Credit and Sales Tax Fairness Credit: Included: Schedule A (PDF) Adjustments to Tax / Child Care Credit Worksheet: See 1040ME General Instructions: Worksheet for "Other" Tax Credits (PDF) Other Tax Credits Worksheet Worksheet for Form 1040ME, Schedule A, lines 6 and 20: Included: Tax Credit Worksheets Instructions for Form 8949 (2021) | Internal Revenue Service Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return. ... Solely for purposes of calculating a loss on the sale of the stock of a specified 10% ... › instructions › i8949Instructions for Form 8949 (2021) | Internal Revenue Service See the Schedule D instructions for more information about wash sales generally and Pub. 550 for more information on wash sales involving substantially similar stock or securities. If you received a Form 1099-B (or substitute statement) and the amount of nondeductible wash sale loss shown in box 1g is incorrect, enter the correct amount of the ... Fill Online, Printable, Fillable, Blank - pdfFiller The Salvation Army Donation Guide Spreadsheet is helpful in terms of calculating the cash equivalent of the goods donated so that this amount can be reported as a desired tax write-off. The form lists the average prices of all the possible goods and the approximate amount that can be paid for certain items at thrift stores.

PlayStation userbase "significantly larger" than Xbox even if every … Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... www2.illinois.gov › revWelcome to the Illinois Department of Revenue By law, Monday, October 17, 2022, was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate (Public Act 102-0700). No filing extensions are allowed. Processing of rebates and issuance of payments will continue after October 17, until all have been issued by the Illinois Comptroller’s Office. dor.mo.gov › formsForms and Manuals - Missouri Worksheet for Calculating Business Facility Credit, Enterprise Zone Modifications and Enterprise Zone Credit: 12/5/2014: 4357: Other Tobacco Products Tax Exemption Certificate: 5/30/2014: 4374: Application for Registration as a Fleet Vehicle Owner: 2/13/2014: 4379: Request For Information or Audit of Local Sales and Use Tax Records: 4/9/2021: 4379A Welcome to the Illinois Department of Revenue By law, Monday, October 17, 2022, was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate (Public Act 102-0700). No filing extensions are allowed. Processing of rebates and issuance of payments will continue after October 17, until all have been issued by the Illinois Comptroller’s Office.

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing Forms and Manuals - Missouri Worksheet for Calculating Business Facility Credit, Enterprise Zone Modifications and Enterprise Zone Credit: 12/5/2014: 4357: Other Tobacco Products Tax Exemption Certificate: 5/30/2014: 4374: Application for Registration as a Fleet Vehicle Owner: 2/13/2014: 4379: Request For Information or Audit of Local Sales and Use Tax Records: 4/9/2021: 4379A Microsoft takes the gloves off as it battles Sony for its Activision ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ... Frequently Asked Questions About International Individual Tax Matters ... If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555, you must calculate your tax liability using the Foreign Earned Income Tax Worksheet (for Line 16) in the Form 1040 and 1040-SR Instructions or your income tax preparation software.

› self-employed-individuals-tax-centerSelf-Employed Individuals Tax Center | Internal Revenue Service Estimated tax is the method used to pay Social Security and Medicare taxes and income tax, because you do not have an employer withholding these taxes for you. Form 1040-ES, Estimated Tax for Individuals PDF, is used to figure these taxes. Form 1040-ES contains a worksheet that is similar to Form 1040 or 1040-SR.

› lifestyleLifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

0 Response to "45 calculating sales tax worksheet pdf"

Post a Comment