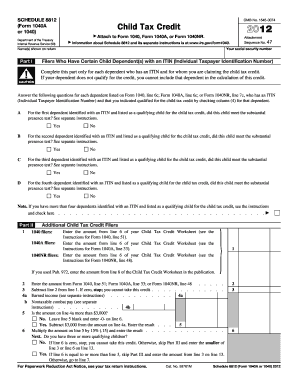

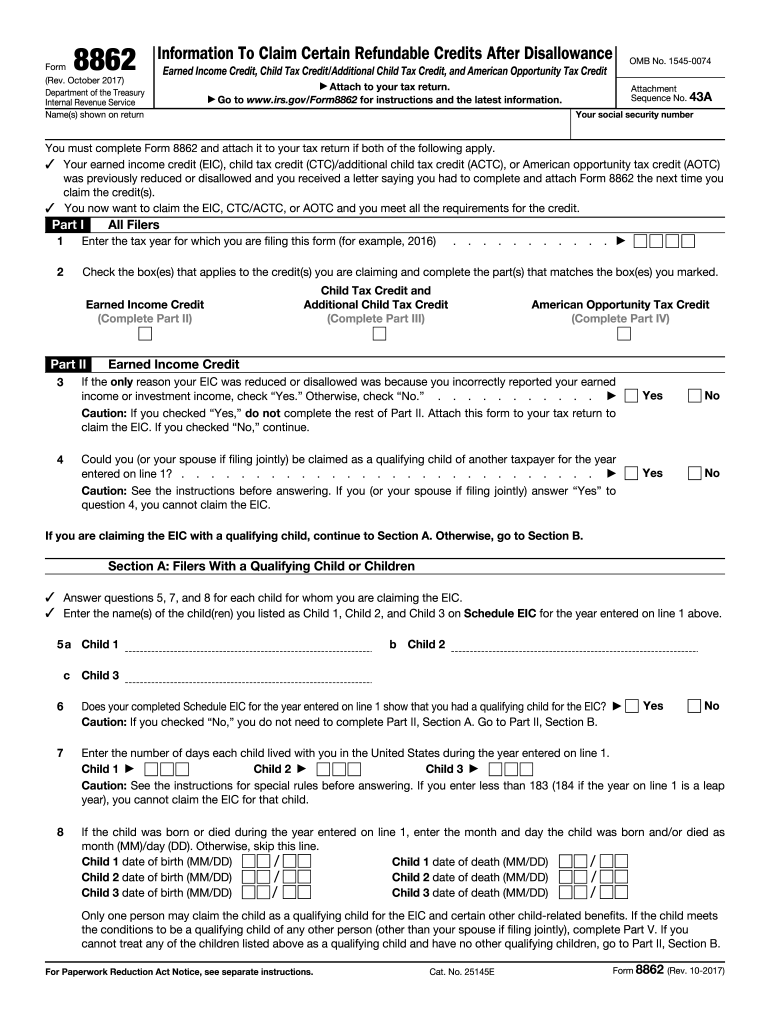

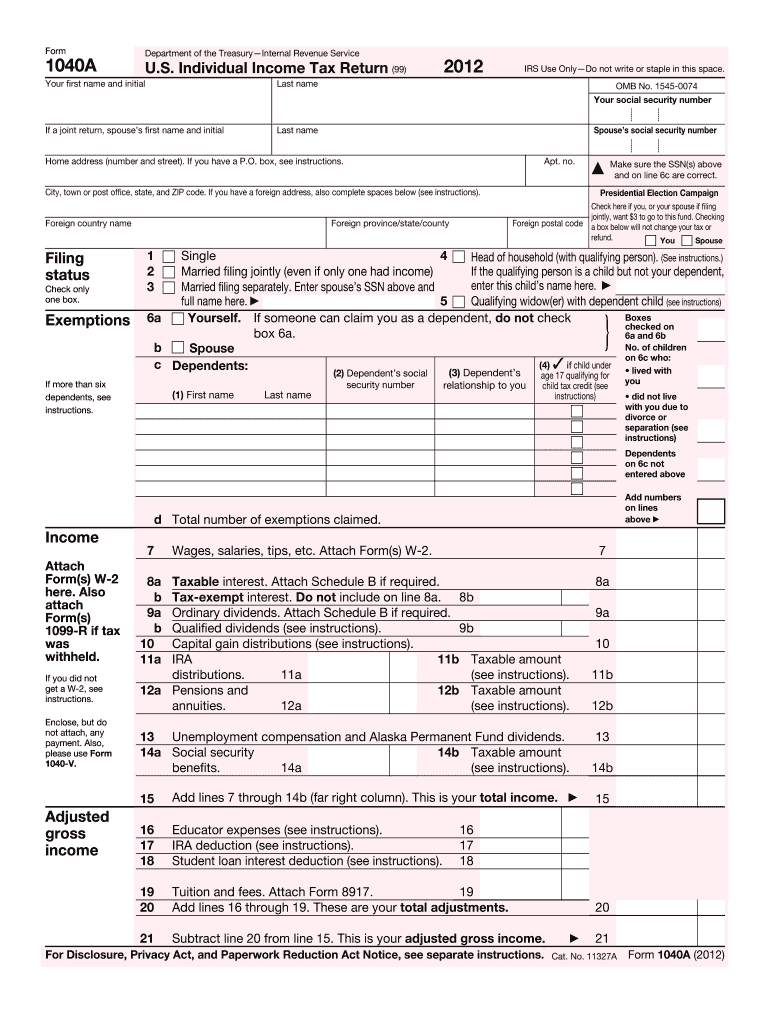

44 2012 child tax credit worksheet

THE 10 BEST Pizza Places in Tuusula (Updated 2022) - Tripadvisor Best Pizza in Tuusula, Uusimaa: Find Tripadvisor traveler reviews of Tuusula Pizza places and search by price, location, and more. Publication 15 (2022), (Circular E), Employer's Tax Guide WebFor tax years beginning after 2015, a qualified small business may elect to claim up to $250,000 of its credit for increasing research activities as a payroll tax credit against the employer share of social security tax. The payroll tax credit election must be made on or before the due date of the originally filed income tax return (including extensions). The …

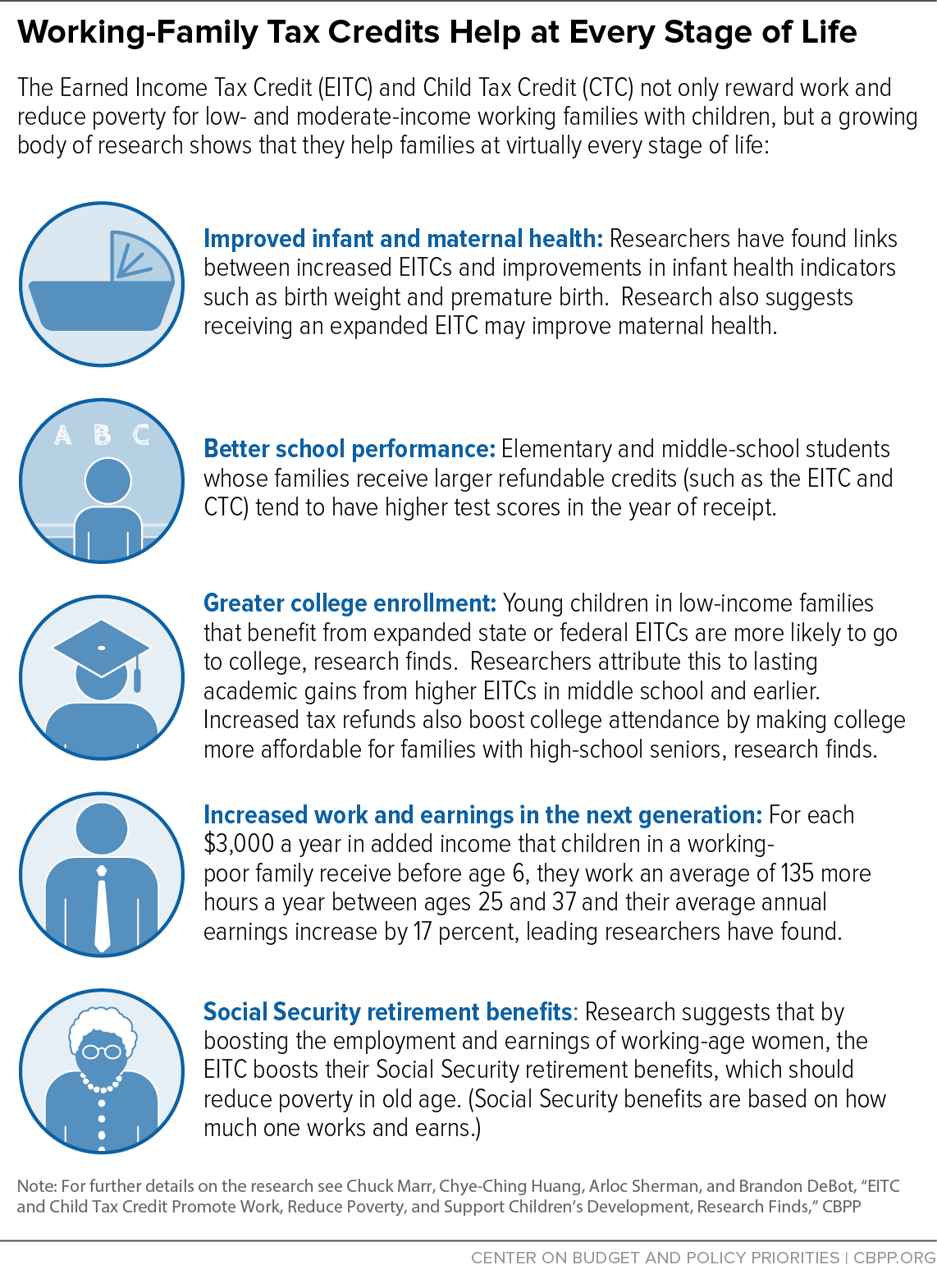

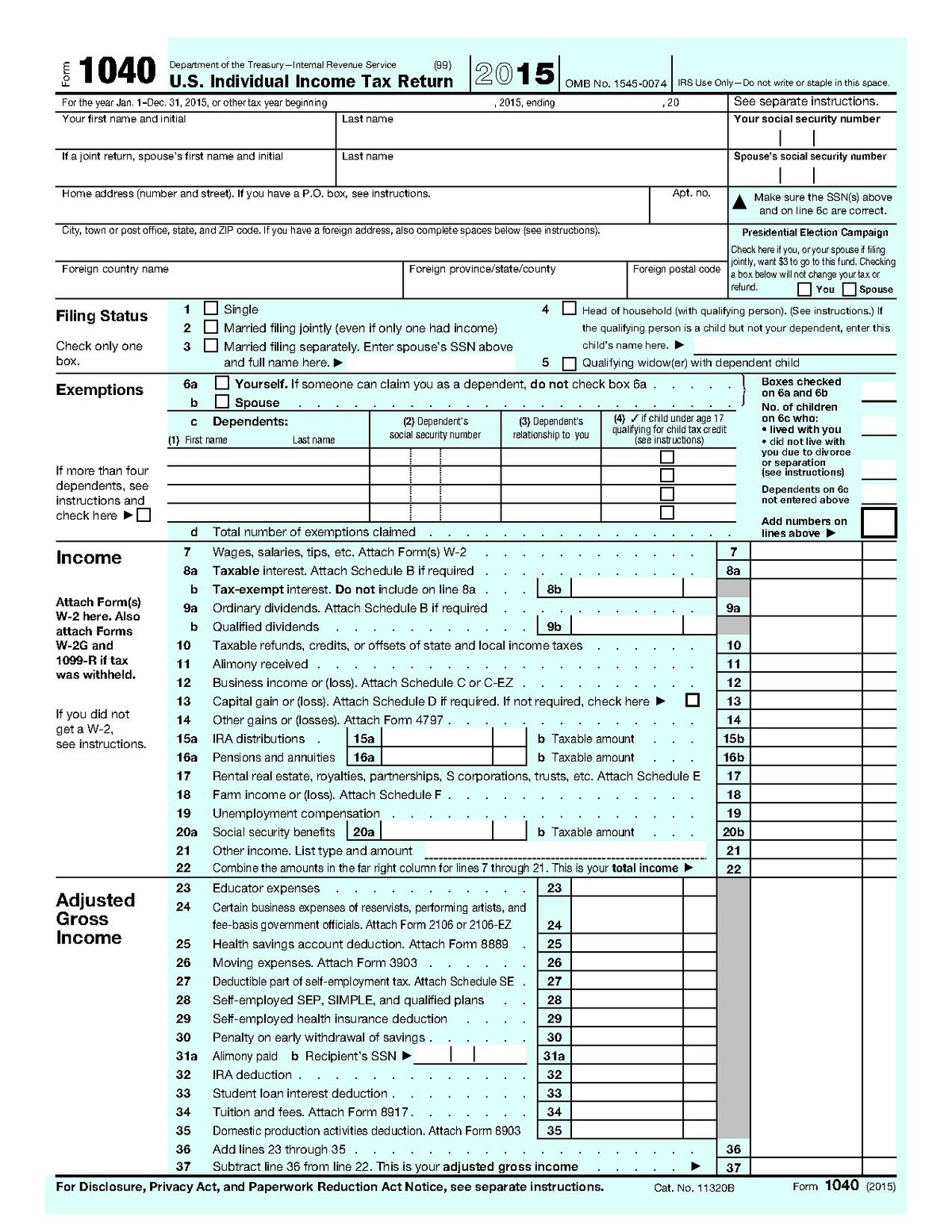

Publication 970 (2021), Tax Benefits for Education | Internal … WebJane has a dependent child, age 10, who is a qualifying child for purposes of receiving the earned income credit (EIC) and the child tax credit. Jane didn't receive any advance child tax credit payments for 2021. Jane's wages are $20,000. Jane withheld no income taxes on these wages and has no other income or adjustments. Jane was awarded a $5,500 …

2012 child tax credit worksheet

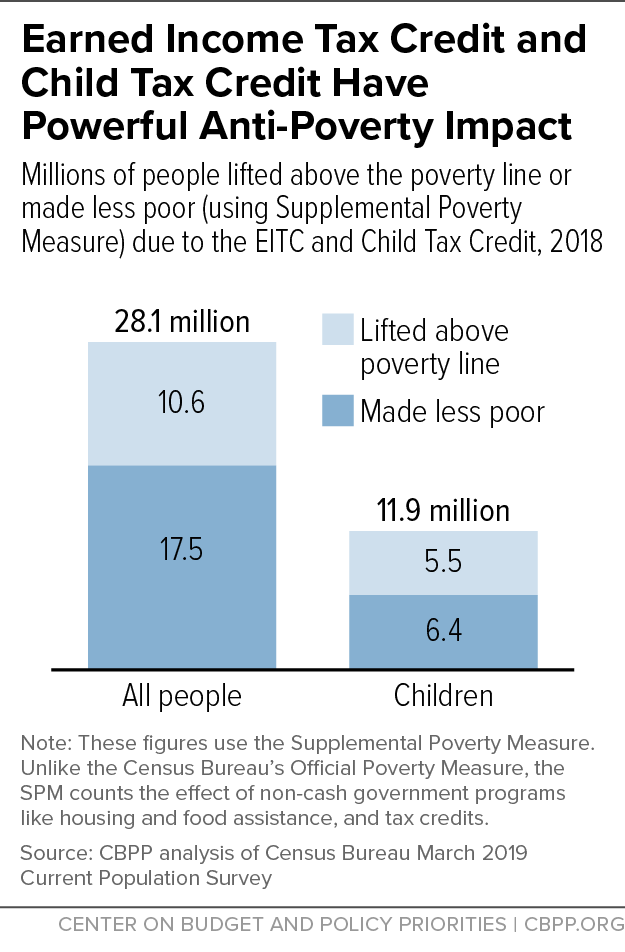

Child Tax Credit Form 8812 Line 5 worksheet - Intuit Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are eligible for the temporarily increased credit of $3,600 for children under 6 and $3,000 for children under 18. Above these income amounts, the credit is reduced by $50 for each $1,000 over these limits. 10++ 2019 Child Tax Credit Worksheet - Worksheets Decoomo Child tax credit and credit for other dependents worksheet figure the amount of any credits you are claiming on schedule 3, lines 1 through 4; View child tax credit worksheet.pdf from busn 6120 at st judes polytechnic college. Source: jncarminat.blogspot.com And families with children often qualify for the largest credits. Child Tax Credit Worksheet - YouTube Child Tax Credit Worksheet 272 views Dec 15, 2019 2 Dislike Share Save The World Of Tax Preparation 1.18K subscribers Subscribe Child Tax Credit Worksheet Show more Passive...

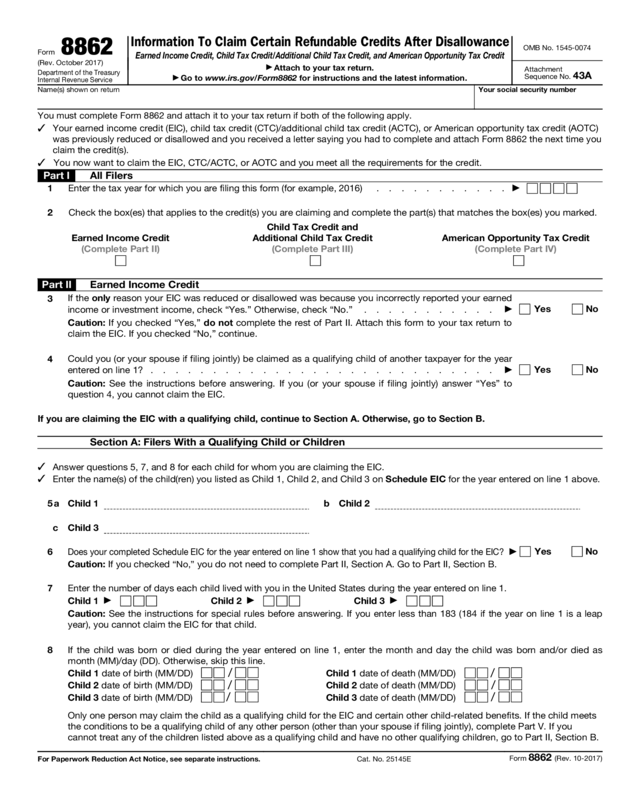

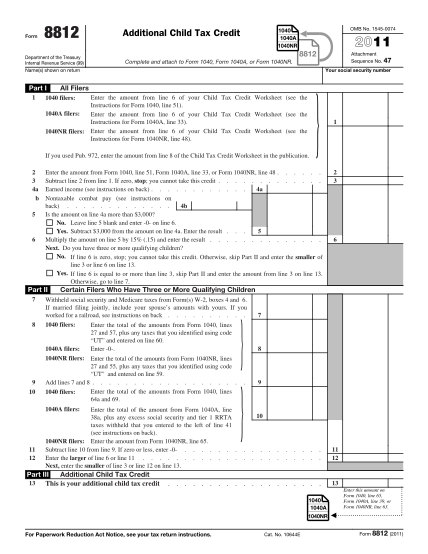

2012 child tax credit worksheet. Time in Pohja, Uusimaa, Finland now Sunrise, sunset, day length and solar time for Pohja. Sunrise: 04:06AM; Sunset: 10:43PM; Day length: 18h 37m; Solar noon: 01:25PM; The current local time in Pohja is 85 minutes ahead of apparent solar time. 2011 Child Tax Credit Worksheet - Printable Maths For Kids Capital Gain Transaction Worksheet Turbotax. Line 51 Child Tax Credit Worksheet. 2011 Child Tax Worksheet. Names shown on return. Get thousands of teacher-crafted activities that sync up with the school year. For more information see Form 8867. Have a qualifying child who was under age 17 on December 31 2011. Enter the amount from line 6 of ... Microsoft says a Sony deal with Activision stops Call of Duty … Web21.10.2022 · A footnote in Microsoft's submission to the UK's Competition and Markets Authority (CMA) has let slip the reason behind Call of Duty's absence from the Xbox Game Pass library: Sony and Adoption Tax Credit 2022 - The North American Council on Adoptable Children They first use $1,200 in child tax credit, then $5,800 in adoption tax credit on their 2022 taxes. They get a refund of the $9,700—the $6,500 they already paid plus $2,800 in refundable additional child tax credit, and can carry over $22,800 for up to five more years. Example 2 — A couple adopted three siblings with special needs.

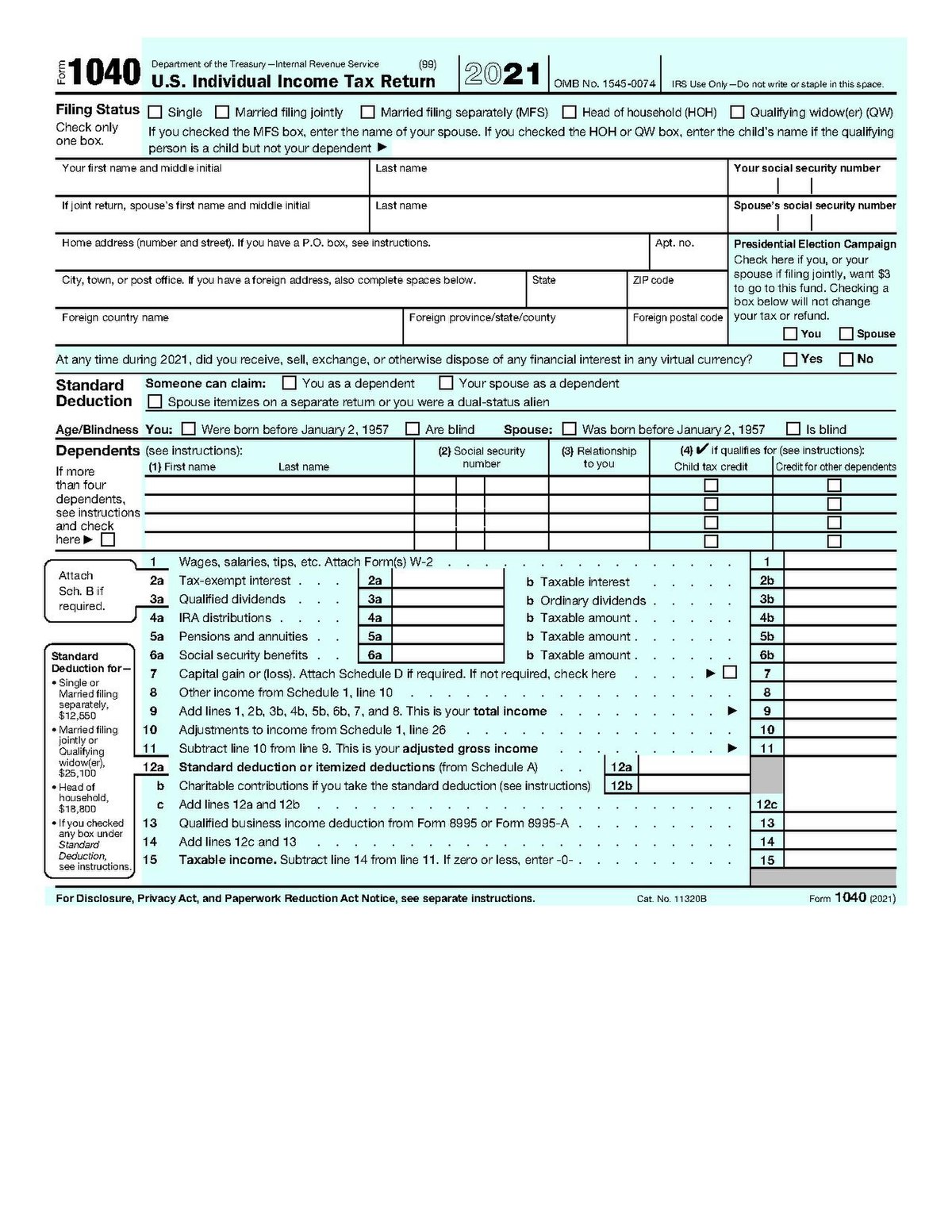

Publication 501 (2021), Dependents, Standard Deduction, and … WebUse the Single column of the Tax Table, or Section A of the Tax Computation Worksheet, ... If you claimed the refundable child tax credit for your son, the IRS will disallow your claim to this credit. If you don't have another qualifying child or dependent, the IRS will also disallow your claim to head of household filing status, the credit for child and dependent … PDF Child Tax Credit 2012 or 1040) Attach to Form 1040, Form 1040A, or Form ... 2012. 47. Name(s) shown on return . Your social security number . Part I Filers Who Have Certain Child Dependent(s) with an ITIN (Individual Taxpayer Identification Number) ... Enter the amount from line 6 of your Child Tax Credit Worksheet (see the Instructions for Form 1040, line 51). 1040A filers: Opportunity Maine – Tax Credit for Student Loans WebFor Bachelors degrees NOT considered to be in STEM (science, technology, engineering or math) fields by Maine Revenue Services, tax credits may offset any individual income taxes you owe the State of Maine (non-refundable). If the tax credit is worth more than what you owe the State of Maine in individual income taxes, you may use the balance over the … Child Tax Credit 2012 - Home - facebook.com Child Tax Credit 2012. 16 likes. With the Child Tax Credit, you may be able to reduce the federal income tax you owe by up to $1,000 for each qualifying... Child Tax Credit 2012 - Home

Publication 523 (2021), Selling Your Home - IRS tax forms WebAdvance child tax credit payments. From July through December 2021, advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. The advance child tax credit payments were early payments of up to 50% of the estimated child tax credit that taxpayers may properly claim on their 2021 returns. PDF Credit Page 1 of 11 8:27 - 14-Jan-2013 Child Tax - IRS tax forms household in 2012, that child meets condition (7) above to be a qualifying child for the child tax credit. Exceptions to time lived with you. A child is consid- ered to have lived with you for more than half of 2012 if the child was born or died in 2012 and your home was this child's home for more than half the time he or she was alive. Child Tax Credit Worksheet Fillable: Fill & Download for Free - CocoDoc Start on editing, signing and sharing your Child Tax Credit Worksheet Fillable online with the help of these easy steps: Click on the Get Form or Get Form Now button on the current page to make your way to the PDF editor. Give it a little time before the Child Tax Credit Worksheet Fillable is loaded. Use the tools in the top toolbar to edit the ... › publications › p970Publication 970 (2021), Tax Benefits for Education | Internal ... She and the college meet all the requirements for the American opportunity credit. Jane has a dependent child, age 10, who is a qualifying child for purposes of receiving the earned income credit (EIC) and the child tax credit. Jane didn't receive any advance child tax credit payments for 2021. Jane's wages are $20,000.

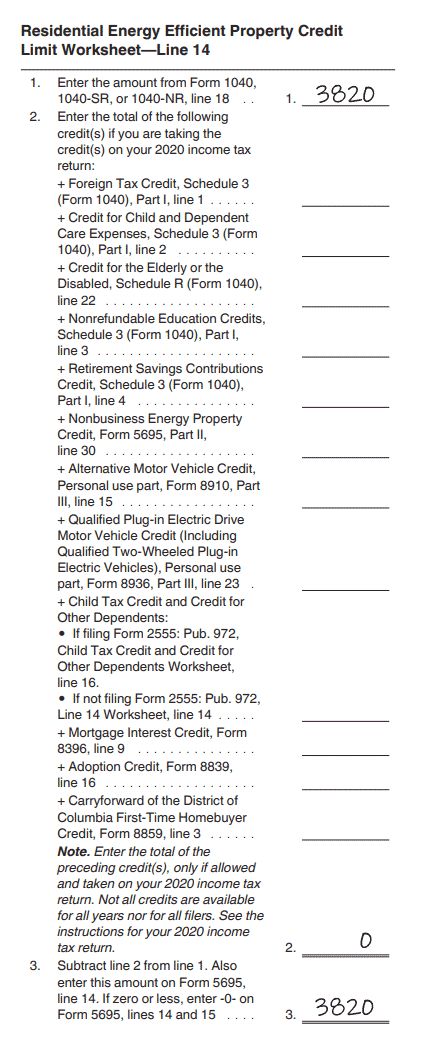

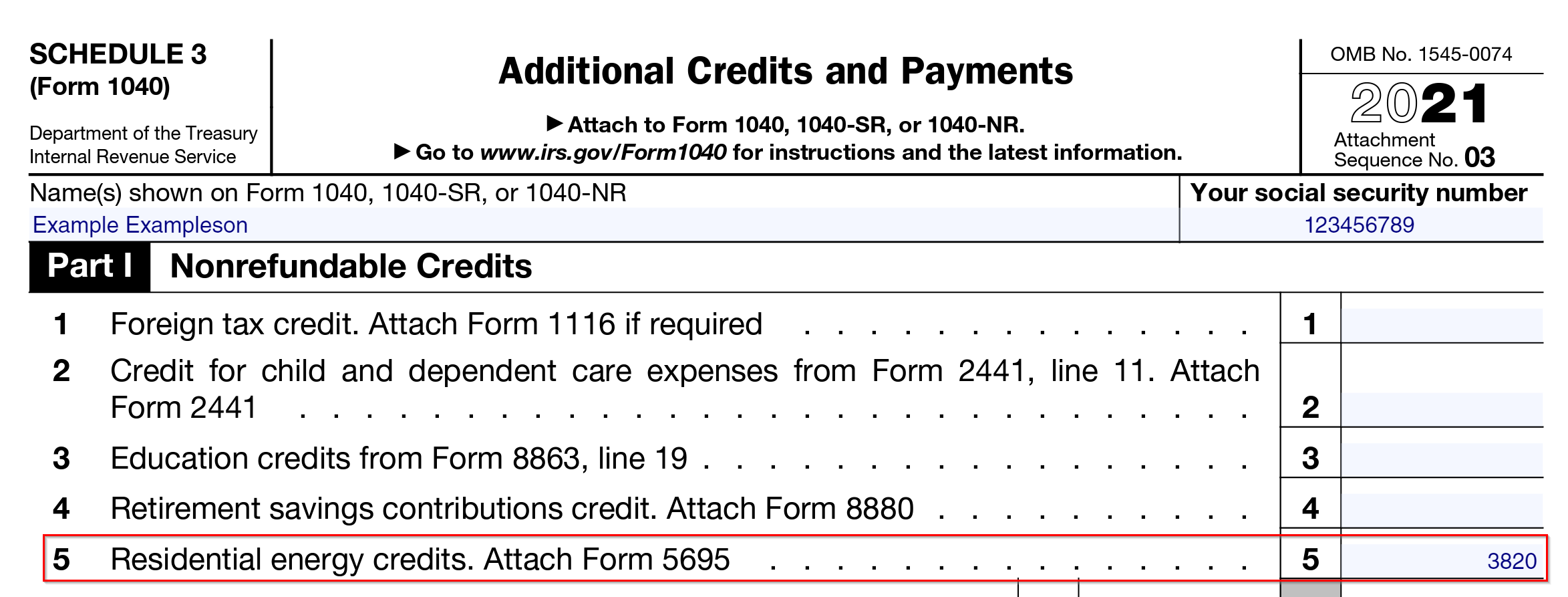

Instructions for Form 5695 (2020) | Internal Revenue Service WebIf you are filing Form 2555, enter the amount, if any, from line 16 of the Child Tax Credit and Credit for Other Dependents Worksheet in Pub. 972. Otherwise, enter the amount from line 14 of the Line 14 Worksheet in Pub. 972. . If you aren't claiming the child tax credit or the credit for other dependents for 2020, you don't need Pub. 972.. Residential Energy …

Child Tax Credit Worksheet.pdf - Child Tax Credit and... Child Tax Credit and Credit for Other Dependents Worksheet Figure the amount of any credits you are claiming on Schedule 3, lines 1 through 4; Form 5695, line 30; Form 8910, line 15; Form 8936, line 23; or Schedule R. Before you begin: 1. Number of qualifying children under 17 with the required social security number: 1 $2,000. Enter the result.

Child Tax Credit Calculator Jointly return: $150,000. The increased child tax credit is reduced by $50 for every $1,000 income above the thresholds. For instance, if you are filing for a single return and your annual income is $77,000, you will only be eligible for $3,500 for each child under 6 years old and $2,900 for each child under 18 years old.

23 Latest Child Tax Credit Worksheets [+Calculators & Froms] child tax credit worksheet 09 (295 KB) When is the Credit Amount Refundable As previously stated in the definition, child tax credit is directly deducted from your taxes and is non-refundable. This means that if your credit is actually larger than what you owe, your tax bill will be brought down to zero and any remaining credit will be gone.

Uudenmaan Asbestikartoitus -asbestikartoitukset ammattitaidolla Asiantuntevaa ja puolueetonta asbesti- ja haitta-ainekartoitusta pääkaupunkiseudun koteihin. Lainmukaiset asbestikartoitukset alk. 169 € sis. ALV:n. Toiminta ...

› publications › p526Publication 526 (2021), Charitable Contributions | Internal ... In return for your payment you receive or expect to receive a state tax credit of 70% of your $1,000 contribution. The amount of your charitable contribution to charity X is reduced by $700 (70% of $1,000). The result is your charitable contribution deduction to charity X can’t exceed $300 ($1,000 donation - $700 state tax credit).

Child Tax Worksheet: Fillable, Printable & Blank PDF Form for Free ... Child Tax Worksheet: Fill & Download for Free GET FORM Download the form How to Edit and draw up Child Tax Worksheet Online Read the following instructions to use CocoDoc to start editing and drawing up your Child Tax Worksheet: First of all, find the "Get Form" button and tap it. Wait until Child Tax Worksheet is loaded.

› oes › currentMay 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

Publication 550 (2021), Investment Income and Expenses - IRS tax … WebComments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Join LiveJournal WebPassword requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

PDF Worksheet—Line 12a Keep for Your Records Draft as of - IRS tax forms 2018 Child Tax Credit and Credit for Other Dependents Worksheet—Line 12a Keep for Your Records 1. To be a qualifying child for the child tax credit, the child must be your dependent, under age 17 at the end of 2018, and meet all the conditions in Steps 1 through 3 under Who Quali es as Your Dependent. Make sure you checked the box in

PDF Child Tax Credit and Credit for Other Dependents Worksheet (2020) To claim the Child Tax Credit the child must have an SSN valid for employment issued before the due date of the 2020 return (including extensions). If a child has an ITIN or ATIN, the taxpayer is eligible for the Credit for Other Dependents. Exceptions to using this worksheet. Use the worksheet in IRS Pub. 972, Child Tax Credit,

May 2021 National Occupational Employment and Wage Estimates Web31.03.2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

Child Tax Credit Amount 2012: Child Tax Credit Worksheet - Blogger Child Tax Credit Amount 2012: Child Tax Credit Worksheet Child Tax Credit Amount 2012 If you have children who are under 17 as of the end of the tax year, you can get $1,000 from the child tax credit on your tax return. Your child must be 17 before December 31 of the year in which you claim them. Child Tax Credit Worksheet

› publications › p501Publication 501 (2021), Dependents, Standard Deduction, and ... If a child is treated as the qualifying child of the noncustodial parent under the rules described earlier for children of divorced or separated parents (or parents who live apart), only the noncustodial parent can claim the child as a dependent and claim the refundable child tax credit, nonrefundable child tax credit, additional child tax ...

› publications › p550Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Free Child Tax Credit Worksheet and Calculator (Excel, Word, PDF) Child tax credit worksheet is a document used to provide a helpful lift to the income of parents or guardians who have dependents or children. The child tax credit received usually based on your income. It is just a tax credit not a deduction on taxes. This tax is directly subtracted from the total amount of taxes you would have to pay.

Child Tax Credit Worksheet - YouTube Child Tax Credit Worksheet 272 views Dec 15, 2019 2 Dislike Share Save The World Of Tax Preparation 1.18K subscribers Subscribe Child Tax Credit Worksheet Show more Passive...

10++ 2019 Child Tax Credit Worksheet - Worksheets Decoomo Child tax credit and credit for other dependents worksheet figure the amount of any credits you are claiming on schedule 3, lines 1 through 4; View child tax credit worksheet.pdf from busn 6120 at st judes polytechnic college. Source: jncarminat.blogspot.com And families with children often qualify for the largest credits.

Child Tax Credit Form 8812 Line 5 worksheet - Intuit Qualifying families with incomes less than $75,000 for single, $112,500 for head of household, or $150,000 for joint returns are eligible for the temporarily increased credit of $3,600 for children under 6 and $3,000 for children under 18. Above these income amounts, the credit is reduced by $50 for each $1,000 over these limits.

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-06.jpg)

0 Response to "44 2012 child tax credit worksheet"

Post a Comment